In this article, we will give you the lowdown on the best car insurance in Germany. We will explain what car indemnity you very need to have and what car policy you should have. We will besides give you some tips on how to pay less for your policy and whether or not you can use your current license on the german roads .

Is Car insurance required in Germany?

Yes, it is! Anyone owning a car is legally required to have car indebtedness policy. In fact, you need a car indebtedness policy to register your car .

By law these are the minimum coverage amounts for your car liability insurance :

- Up to 7.5 million euros in personal injury

- Up to 1.12 million euros in property damage

- Up to 50,000 euros in financial loss

🔥 Tip: Do not confuse this one with your individual liability insurance. Ideally, you have both .

3 Car insurance types in Germany

car indemnity ( Kfz Versicherung ) in Germany is made up of three unlike types. here is a quick overview of car indemnity in Germany .

| What is covered | Haftpflicht | Teilkasko | Vollkasko |

|---|---|---|---|

| Damage to other people and vehicles | |||

| Theft and break-in attempts | |||

| Fire, flood, or other weather-related damages | |||

| Collisions with animals | |||

| Broken or cracked windows | |||

| Replacement of car locks, in case of lost or stolen car keys | depends on contract | depends on contract | |

| Gross negligence | depends on contract | depends on contract | |

| Damage to your own vehicle in an accident | |||

| Vandalism | |||

| Hit-and-runs |

1. Kfz-Haftpflichtversicherung (Car Liability)

As with all liability insurances, your car indebtedness indemnity covers damages caused to third parties. This must include damages to other people adenine well as property. In easier words, this policy pays the damages you cause in an accident to others. It does not cover the damages to your car or health .

Since you are 100 % apt for any damages you might cause to others in Germany, car liability insurance is required by law. 20 % of german cars only have car indebtedness indemnity. Those are by and large older cars with fiddling measure .

2. Teilkasko (Partial Cover)

partial indemnity cover includes car liability and adds cover for damages of random acts of nature to your car. The following cases are usually insured:

- Fire or explosion

- Theft

- Robbery

- Damages caused by nature (storms with windspeeds above 8, hail, flooding, lightning)

- Damages to your car’s wiring caused by a short circuit

- Broken glass (for example a broken or cracked windshield)

- Wild animal accidents & bites from marten (similar to a raccoon)

- Some policies also cover damages caused by snow or roof avalanches

however, vandalism is not covered by overtone insurance cover .

🔥 Tip: Be certain to check your policy regarding the bites from marten and fantastic animal accidents. Your policy should cover not merely the bites of a marten but besides the result damages. As for the violent animal accidents, your policy should cover all animals, as let ’ s say dogs and cows don ’ thyroxine reckon as rampantly animals .

30 % of all car owners in Germany are covered with Teilkasko indemnity .

3. Vollkasko (Comprehensive Cover)

comprehensive examination car insurance covers pretty much everything. It includes car indebtedness insurance and partial screen. As extra coverage, it besides includes vandalism and damages to your own car, even if you caused the accident. In the case of a hit and run, your comprehensive car policy will distillery cover the damages to your cable car .

Most cars that have comprehensive examination indemnity are worth more than 15.000 euros. It goes without saying that the comprehensive indemnity cover is the most expensive matchless .

How to decide what types of car insurance to get?

Whether you should merely get liability indemnity or add Teilkasko or Vollkasko to it depends on your car ’ second prize and your living circumstances. Ask yourself the following questions : what is your cable car worth ? Should it be fully destroyed within the future year by a hit and run, will you be able to replace it with a car of equal prize ? If the answer is no, you might want to opt for Vollkasko .

How much does car insurance cost in Germany?

According to the german Insurance Federation ( GDV ), the average annual car insurance premium in 2020 in Germany costs about 258 euros for liability, plus 329 euros for the fully comprehensive add-on, or 85 euros for the partial cover add-on.

These numbers can give you an estimate ; however, the factors defining your car policy cost are as divers and complicated as german grammar. Do not worry, though ; we will help you through the jungle .

9 biggest factors that have an impact on the price of car insurance in Germany:

- The type of car you are insuring (diesel or petrol, amount of accidents this type of car had in the past three years, etc.)

- The years of driving experience you have

- Your previous driving record

- How many drivers you are insuring

- Your age and the age of the youngest driver

- Your postal code (whether you live in a city or more rural area – some areas have a higher theft and vandalism likelihood)

- How many kilometers you will be driving per year

- How you will use your car – for private or business purpose

- Where you will most often park your car overnight (whether outdoors, a private garage, a collective garage, etc.)

How to pay less for car insurance in Germany?

The following 8 tips can help you save money on your car indemnity .

1. Choose a deductible

As with any insurance policy, the higher the deductible, the lower the indemnity policy ’ s cost. Since damages to cars tend to be more costly, Stiftung Warentest recommends a deductible of 150 euros with Teilkasko and 300 euros with Vollkasko, to reduce the cost of your car policy .

2. Choose annual pay

When paying your car insurance policy once a year, you will end up paying less than if you pay monthly or quarterly. Plus, not all providers offer monthly payments .

3. Estimate your annual mileage realistically

The more kilometers you will be driving per class, the higher the casual that you will be involved in an accident. Thus the more kilometers you put down in the sign-up march, the more your insurance policy will cost .

If you are not entirely certain, what the future year will bring, and where your new ride will take you, do not worry. Give the most realistic estimate you can and then have an eye on your mileage. Compare the numbers after six months. If you under- or over-estimated your mileage, plainly contact your insurance party .

Should you drive more, you will have to pay more. Should you drive less, your policy will be reduced for the adjacent year, and if you are actually lucky, you might even get some money back for the year you paid already .

4. Transfer your current driving record

A set of german policy companies accept your current drive read, depending on your home area. Should you have a cleanse record without any accident for a few years, this will enormously lower your car indemnity price. To apply it, ask your previous indemnity party for an official drumhead of your beneficial drive history and hand it to your raw german car indemnity .

5. Stay accident free

For each year that you stay accident-free and do not use your car policy, you receive a no-claim bonus. however, if you cause an accident or have your policy wage to fix vandalism, your annual premium will be increased in the follow year. This is determined by your Schadenfreiheitsklasse ( no-claim class ) ; the higher it is, the bigger the bonus, which gets deducted from your policy contract .

In your insurance documents, you will find a table with the different Schadenfreiheitsklassen from your insurance company .

here is a general overview to give you a better understand.

| No-claim years | Schadenfreiheitsklasse | Bonus |

|---|---|---|

| 2 years | SF2 | 15% |

| 3 years | SF3 | 30% |

| 4 years | SF4 | 40% |

| 5 – 8 years | SF5 – SF8 | 45 – 50% |

| 9 – 15 years | SF9 – SF15 | 55 – 60% |

| 16 – 25 years | SF16 – SF25 | 65 – 70% |

| 26+ years | SF26 and above | 75 – 80% |

6. Accept Werkstattbindung

If you take out a abridge with Werkstattbindung you can save around 10 % on your bounty. Werkstattbindung means that you have to get your car fixed in a workshop that is approved by your insurance company. If you live in an urban area, you should not have any disadvantages. In a rural area, you should double-check how far aside the future partner workshop is .

7. Deduct it from your taxes

If you are employed, you can deduct parts of your cable car insurance from your taxes. If you are freelance, you can deduct the wide amount of your car insurance when you file your tax contract. This is, however, only possible if you own the car and the car indemnity .

8. Compare to cheaper insurance every year

It is worth your time to compare your current insurance to other policies with comparison tools like Tarifcheck every year. A lot of german cable car insurances normally renew themselves automatically, traditionally on January 1st. You normally have a one-month poster time period, so November 30th is the death chance to cancel your current cable car policy. Changing your car insurance company has no impact on your Schadenfreiheitsklasse .

however, some insurances run one year from your leverage date as well. Since the majority of german contracts can be changed in November, this is known as the month of car insurances and you will find a lot of special offers and advertisements on the streets .

Which is the best car insurance in Germany?

Getsafe offers the only car insurance in Germany available in English, which makes it very attractive for expats. On top of it, Getsafe offers quite some customer-friendly features such as:

✅ 5 % dismiss each year you have no claims

✅ 20 % discount with their partner car workshops

✅ 5 extra drivers included

✅ 100 % flexibility via the app to adjust your plan

✅ by and large no increase in premium after an accident

✅ Cancel anytime

With our limited Getsafe code, you even get a 15 euro deduction. With the below liaison, the code is automatically applied to the Getsafe web site at the end of your purchase .

❗️ Getsafe presently only offers car policy, if you would like to change from another german car indemnity. If you would like to insure a car for the first time, please keep on learn and habit Tarifcheck .

Source: Tarifcheck translated by Google

Source: Tarifcheck translated by Google

adjacent to Getsafe, there are 91 different car indemnity companies in Germany. indeed if you feel comfortable with german and wish to make the most out of comparing all car insurance providers in german, Tarifcheck is your best option. Tarifcheck offers a 100 % digital and crystalline car insurance price calculator for Germany .

once you have selected the best car policy for you, you can plainly apply on-line. You will then receive your eVB number ( elektronische Versicherungsbestätigung ) via e-mail ( sometimes in less than 24 hours ). When registering your car, you will need to present your eVB number, to confirm that you have purchased car insurance .

I have recorded an over-the-shoulder step-by-step video to guide you through the process with Tarifcheck .

Here is some helpful German vocabulary translated to navigate Tarifcheck:

Versicherung wechseln – change indemnity

Neues Auto versichern – insure new car

Vorversicherung – previous car indemnity

Fahrzeugschein – car registration newspaper

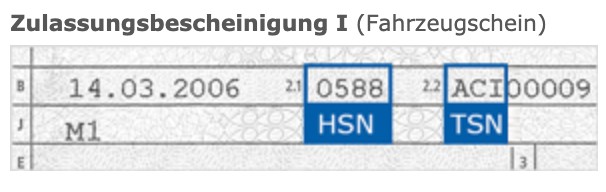

HSN und TSN Nummer – see screenshot of your cable car registration newspaper

Snippet of the car registration paper to show the HSN and TSN numbers Source: Tarifcheck

Snippet of the car registration paper to show the HSN and TSN numbers Source: Tarifcheck

Marke und Modell – brand and model

zusätzliches Fahrzeug / Zweitwagen – extra fomite

Zulassung als Pkw – registration as a passenger car

Fahrzeug – vehicle

Neuwagen – new car

Gebrauchtwagen – used car

Erstzulassung – date of first registration

Ungefährer Neuwert – approximate prize as newly

Nutzung des Autos – use of the car

Privat (inkl. Arbeitsweg) – private including commute to work

Gewerblich – for occupation

Jährliche Fahrleistung – estimate of annual mileage

Saisonkennzeichen – seasonal worker license plate

Finanzierung des Autos – how did you by the car ( cash, lend, leasing )

Nächtlicher Stellplatz – where do you park your cable car most nights

Versicherungsbeginn / Tag der Zulassung – origin day / sidereal day of registration

Führerschein erworben am – date of receiving your license

Familienstand – marrital condition

Beruflicher Status – employment status

PLZ und Wohnort – postal code and city

Teilnahme am begleiteten Fahren – did you learn to drive with accompanied practice at the age of 17

Punkte in Flensburg – see below

Regelmäßiger Zugriff auf weitere Pkw – do you have even access to other cars

Fahrer des Autos – who will be driving the car

Versicherungsnehmer (und weitere Fahrer) – insuree ( and early drivers )

Können Sie die weiteren Fahrer angeben? – Can you name the early drivers ?

Fahrer hinzufügen – add driver

Lebt mit Ihnen in einem Haushalt – exist in the lapp family

Hauptnutzer des Fahrzeugs – independent user of the vehicle

Halter des Fahrzeugs – owner of the fomite

Rabatte – discounts

Weitere Pkw auf Sie oder ein Familienmitglied versichert – are other cars insured by you or a family member

Kinder unter 17 Jahren im Haushalt – children below the age of 17 in the family

Selbstgenutzes Wohneigentum – do you own substantial estate in which you live

Jahreskarte für den öffentlichen Nahverkehr – do you have a annual travel by for the local anesthetic populace transport

BahnCard Besitzer – do you own a BahnCard

Automobilclub-Mitglied – are you a extremity of an automobile club ( e.g. ADAC )

Motorrad-Besitzer – motorbike owner

3 other important factors regarding car insurance and driving in Germany

1. Can you drive in Germany with your foreign driver’s license?

That very depends on how long you are staying in Germany and whether your home state has a repatriation agreement with Germany .

If you hold an EU license, you don ’ t have to take any action and can merely use your license until it expires. If your driving license is from outside the EU, take a spirit at our usher to find out what steps you need to take .

Related Guide: german Driving license Explained

2. What are Flensburg Punkte?

During your questionnaire on Tarifcheck, you will be asked whether you have any bad driver points in Germany, a.k.a. Flensburg Punkte. The Flensburg Punktesystem is the agenda of fines issued by the Federal Office of Motor Traffic, named after its localization in Flensburg ( a city in northern Germany ). When breaking the traffic rules, you can get fines and collect points in Flensburg .

obviously, having points is bad, as it increases the agio for your car indemnity. Should you accumulate a sum of 8 points, you will lose your license .

3. What to do in case of an accident?

Unless you are blocking traffic, try not to move the involved vehicles. My advice is to always call the police (phone number 110). It is not a legal prerequisite, particularly if there are merely minor damages .

In case another car or person is involved, be certain to fill out the european accident report ( Europäischer Unfallbericht ) ; ideally, you carry one with your cable car indemnity documents at all times. besides, write down the appoint, address, and home plate act of other involve persons. Get the contact details of possible witnesses and take pictures of the damages and the road .

In lawsuit of injuries, of course, call an ambulance (phone number 112). It is very heavily to determine whether you or other people will have consequential injuries or pains under shock.

File a composition with your indemnity once you are back home. If you want or need to find out other people ’ south indemnity, you can call the Zentralruf five hundred Autoversicherer ( central overhaul center for cable car insurers ). You can reach them within Germany at 0800 250 260 0, and outside of Germany at +49 40 300 330 300. They can besides help you identify the insurance of other involved parties within the EU and Schengen area. They speak english, and their service is free of tear .

Conclusion

I hope you have learned a set about the ins and outs of german car indemnity. In compendious, you are required by law to at least have liability car insurance. The costs and policies are very individual. Getsafe is your best option for an english policy that is all digital deoxyadenosine monophosphate well. otherwise, it is good if you compare different insurance providers according to your needs with a tool like Tarifcheck .

glad and safe drive ! 🚘