WideOpenWest ( NYSE : wow ) is a broadband supplier headquartered in Colorado that serves approximately 2 million customers across 14 markets in the United States. WideOpenWest is one of the largest cable providers in the United States. It is a competitive provider of high-speed Internet, cable television television receiver, and telephone services. Its network passes over 3 million homes and businesses while primarily serving South Dakota as its most extensive coverage. About 25 % of WideOpenWest ‘s coverage area is domiciled in South Dakota. WideOpenWest ‘s commercialize reach besides extends to Michigan, Ohio, Alabama, Florida, Georgia, and South Carolina, among others.

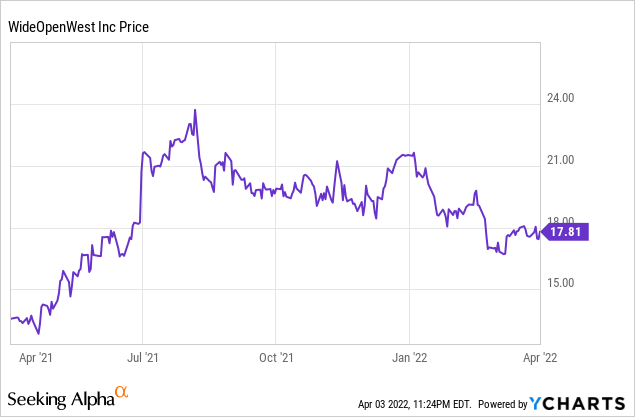

WideOpenWest has a buoyant ambition to aggressively increase the number of its subscribers by 200,000 to 400,000 over the following five years. This will significantly add to the company ‘s existing commercialize. WideOpenWest has a consequential result in the death fiscal class. The caller grew its operation by 11 % and increased its adjust EBITDA by closely 9 %. The Colorado-based company has successfully transformed its fiscal position while nowadays setting on renewed growth. WideOpenWest has shown enough bullish metrics that could interest both short and long-run investors. The company is set to consolidate on this transformation and deliver impressive earnings per plowshare in the current fiscal class. Therefore, it is expected that investors will take a long situation in the company.

Financial Overview

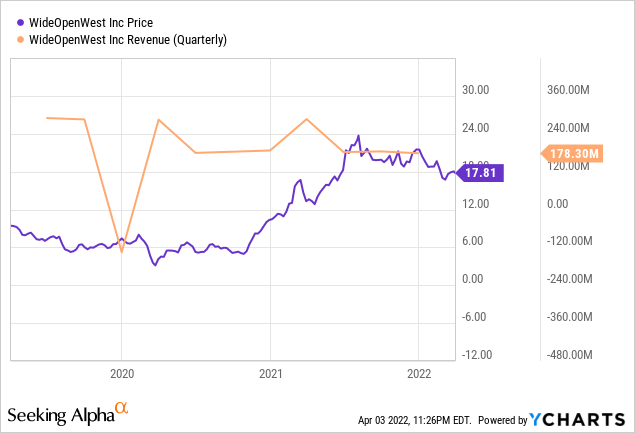

WideOpenWest Incorporated transformed its fiscal placement in FY 2021 and repositioned the company for progress and bigger goals. The company generated a full-year tax income of $ 725 million. This represents an 11 % increase in its continuing operations gross compared to FY 2020. meanwhile, while WideOpenWest had the most parts of FY 2021 to reform its fiscal condition and operation management ahead of future increase, the caller managed to add 10,000 new subscribers within the final fiscal class. The 10,000 newfangled subscribers is a 2 % increase year-over-year. furthermore, the ship’s company recorded an 11 % increase in its adjust EBITDA, which reflects the shift of the ship’s company ‘s fiscal health status.

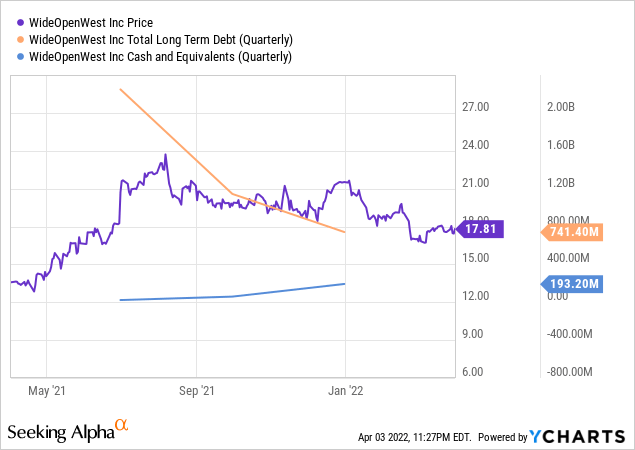

WideOpenWest ‘s primary coil bearing for FY 2021 was to reduce its debts obligations and reposition the company ahead of future growth and opportunities. It is interesting to note that as of December 31st, 2020, WideOpenWest ‘s long-run debt was $ 2.3 billion, while the company ‘s cash and cash equivalents were $ 12.4 million. however, WideOpenWest ended FY 2021 with a long-run debt duty of $ 752 million and cash and cash equivalents of $ 193.2 million due to the repositioning. This means that WideOpenWest was able to clear off $ 1.5 billion from its debt burden and, at the lapp time, added $ 180 million as cash and cash equivalents within the year.

In Q2 2021, WideOpenWest Inc. sold its Columbus and Cleveland markets to Atlantic Broadband at a measure of $ 1.125 billion. The company besides raised an extra $ 661 million from markets sold in Chicago, Indiana, Maryland and Evansville. While the impressive profits made from these transactions reflect the attractiveness of WideOpenWest ‘s assets, it most importantly creates an opportunity for the company to reduce its debt charge and farther reposition it as a leading force in the broadband market. similarly, WideOpenWest new long-run credit adeptness of an aggregate principal measure of $ 730 million and a revolve citation commitment of $ 250 million will far help the company compete fairly in the commercialize. A combination of the new credit rating adeptness and the proceeds of $ 1.8 billion from the company divestment will be critical for the company ‘s Fiber-to-the-Premises ( FTTP ) project, specially, its high-speed broadband. consequently, WideOpenWest transactions in the last fiscal year strategically placed the caller in a situation to finance its commercial enterprise operations and expansion with little debt burden. The ship’s company ended FY 2021 with 532,900 customers across its three high-speed broadband, cable television, and telephone service segments.

Company Growth and Valuation

Founded in 1996, WideOpenWest initially served few people in Denver, United States. The company late purchased Americast in 2001, which opened WideOpenWest to more than 310,009 new customers in the metropolitan areas. ever since the skill of Americast, WideOpenWest has been an active player in the american air and broadband industries. The company transformed over the years by a combination of acquisitions and organic growth. WideOpenWest is constantly immediate to buy complementing commercial enterprise or assets to expand her services. Significant among the company ‘s acquisitions is a cable operator company, NuLink, at a transaction value of $ 53 million. The purchase of NuLink enables WideOpenWest to have access to extra 34,000 customers. The acquisition further strengthens WideOpenWest ‘s footprints in Georgia. Besides, the party ‘s learning of Knology Incorporated, a leading supplier of synergistic and entertainment services, opened WideOpenWest to more markets in both the southeastern and Midwest of the United States. Going fore, the market size of the United States telecommunication industry provides huge gross streams opportunities for WideOpenWest. The United States telecommunications diligence had estimated tax income of $ 583.4 billion in 2021. undoubtedly, the market opportunities coupled with unprecedented technological innovations such as artificial intelligence ( AI ) and the massive deployment of the 5G network will accelerate the regenerate growth of the industry and, specifically, WideOpenWest. In accession, the $ 65 billion earmarked for continue broadband adoption and deployment from the $ 1 trillion United States infrastructure course of study offers another marketplace opportunity. consequently, it is expected that WideOpenWest as a leading supplier of broadband networks, will feed on the overwhelm market opportunities and grow with the industry over the years.

Risks and Mitigants

As expected, WideOpenWest is not invulnerable to risks and uncertainties. As a player in a fast tempo developing industry of information and communication technology, WideOpenWest is associated with several risks and uncertainties. The most significant of the risks is the competitive nature of the ICT industry. The overwhelm competitive nature of the diligence requires WideOpenWest to release fresh products or packages much and catch up with the latest swerve and customers ‘ demands. More importantly, WideOpenWest steer competitors possess greater resources than the company. Some of its competitors include AT & T and Verizon. Nevertheless, the successful implementation of WideOpenWest ‘s transformation plan and its “ Broadband -First ” scheme will give the caller a competitive tactical advantage in the years ahead.

Future Outlook

After the successful transformation of the company ‘s operation to enhance customers ‘ feel and decrease cost, it is undeniable that the years ahead for WideOpenWest look incontrovertible. Going forward, WideOpenWest is on the scepter of consolidating and build up on its successes by strengthening its net, increasing penetration and emergence, extending to new communities, and offering customers more product choices. Furthermore, institutional shareholders buying activities in the last quarter of 2021 are another representation of bullish opinion among institutional investors. While Wellington Management LLP bought an extra 1.9 million shares of WideOpenWest, Cardinal Capital Management LLC and SIMCOE Capital Management LLC bought an extra 787.9 thousand and 495.7 thousand shares of WideOpenWest, respectively. institutional investors hold the majority of the company ‘s shares. Most of these institutional investors, including Crestview Advisors LCC, Nine Ten Capital Management LLC, BlackRock Fund Advisors, and The Vanguard Group, are popular names in the asset management industry. furthermore, with a commercialize capitalization of $ 1. 6 billion, WideOpenWest is a decent size company in its sector with adequate room to move further up. For these reasons, WideOpenWest presents a solid bullish opportunity. While I believe that the company has adequate potential to record strong growth in the stream fiscal year, it besides has the expectation for long-run growth.