Cost to insure used cars

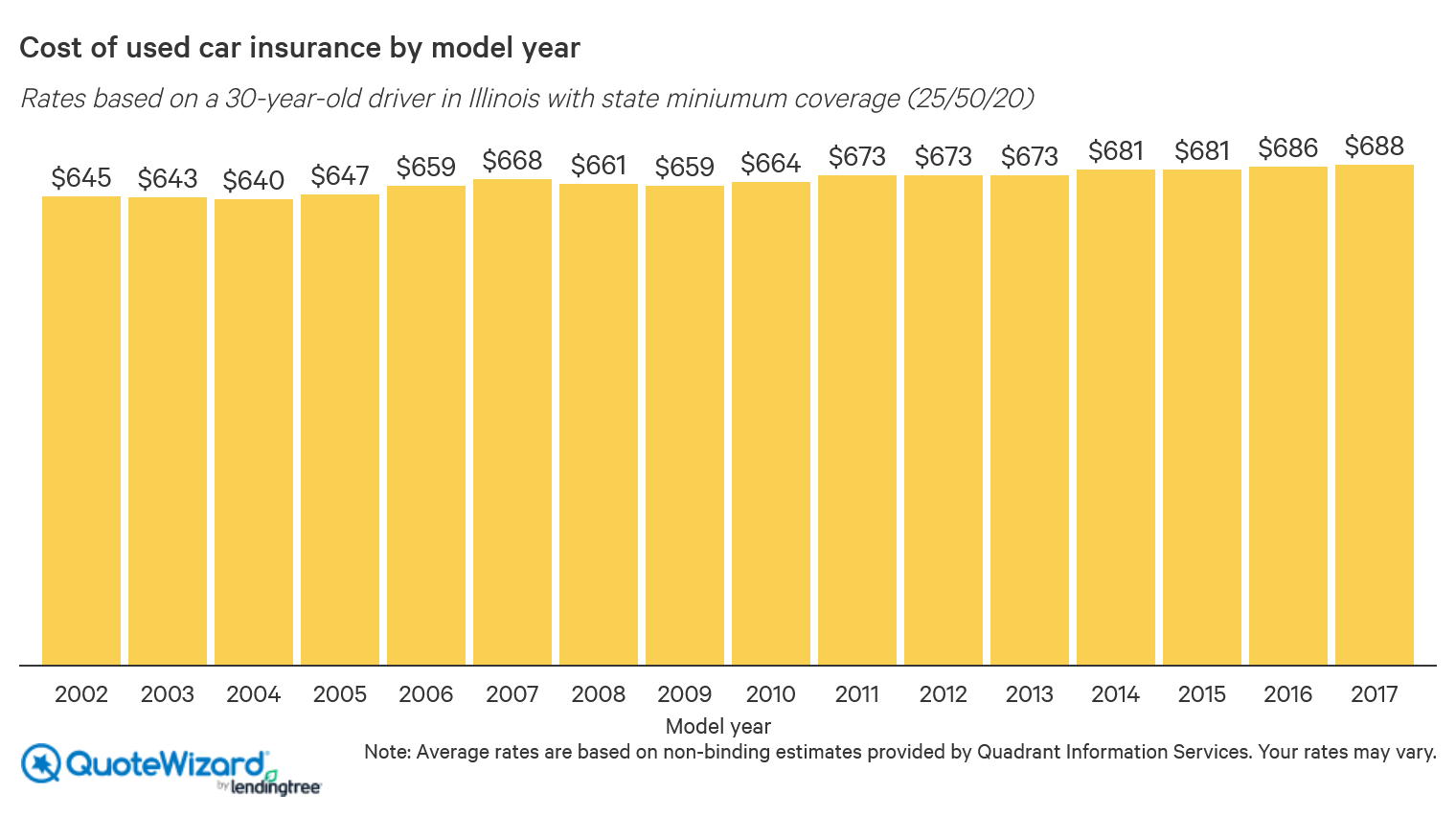

To find the cost of indemnity for use cars, we looked at three popular second-hand vehicles : Toyota Camry, Nissan Altima and Honda Accord, from model years 2002 to 2017. For minimum coverage, we found that rates do not vary substantially by model year, but increase slightly for more holocene years .

so, while insurance is generally cheaper for older used cars, assuming you have minimum coverage, it is not cheaper by much. Your policy prices are going to vary based on the car you buy, the model year, your driving backdrop, where you live and more.

Don ’ t assume that buying an older car is constantly cheaper, though. New cars have improved base hit and security features, which can lower your policy rates. The alone way to know for indisputable how cheap your insurance rates would be is by getting a few quotes .

Get the cheapest rates for your used car.

Cheapest used cars to insure

We analyzed data for more than 375 vehicles to find the cheapest secondhand vehicles to insure, from model years 2006 to 2014. These were the cheapest vehicles we found for exploited car indemnity :

| Car | Average yearly cost to insure |

|---|---|

| 2008 BMW 328i | $539 |

| 2006 Mercedes CLK350 | $542 |

| 2006 Volkswagen New Beetle | $566 |

| 2006 Chevrolet Uplander | $567 |

| 2006 Volkswagen Passat | $567 |

| 2006 Nissan Quest | $567 |

| 2006 Honda Odyssey | $572 |

| 2006 Toyota Sienna | $578 |

| 2011 Chevrolet Camaro | $591 |

| 2010 Volkswagen Routan | $594 |

| 2007 Chevrolet Uplander | $594 |

| 2006 Volkswagen Golf | $608 |

| Note: Average rates are based on non-binding estimates provided by Quadrant Information Services. Your rates may vary. | |

There is no individual bum car to insure — these are average rates to help you ballpark. As you can see, there are many makes and models where you can find cheap insurance, from sedans, to sports cars, to minivans. As cars historic period, substitute parts can become cheaper. This could make older cars cheaper to insure, but not always .

Insurance when buying a used car

You do not need insurance to buy a car, but you need indemnity to drive away with it. This is true whether you buy from a private seller or a dealer. That means time is key : you don ’ thymine want to buy policy before you ’ re sure the car is yours, but you need indemnity by the time you ’ re ready to drive it home .

Although you don ’ t need indemnity ahead of time to buy a practice car, we recommend considering the cost of indemnity as separate of the buying process. Auto policy is one of the largest recurring expenses of owning a car, and its cost varies depending on the vehicle. Doing some legwork ahead of time means you won ’ t be surprised belated .

We recommend reaching out to a few companies for quotes ahead of time. many companies let you start a quote and refund to it by and by, meaning ampere soon as you know your cable car purchase is going to happen, you can go back to your quote and purchase the best policy for you .

How much insurance to buy for a used car

Knowing how much coverage to purchase for your fomite is a catchy wonder. car policy companies should give you some flexibility in how much policy you buy, and you should purchase enough to protect your assets.

Read more: Best car insurance companies for 2022

Minimum coverage for used cars

Every submit ( except New Hampshire ) has state-minimum liability coverage limits. These can be relatively low, ranging from $ 20,000 to $ 100,000 for bodily injury liability, and from $ 10,000 to $ 25,000 for property damage liability. You ’ ll have to have at least the minimum necessity in your state .

That may sound like a batch of coverage, but bodily wound and property damage liability can add up quickly. If you are found apt for more damage than you are covered for, expenses can be recovered from your early assets. therefore, it ’ randomness frequently a good theme to have more policy than your state of matter minimum .

We recommend having a total of $500,000 of liability coverage, or a 100/300/100 policy. That means $ 100,000 of bodily injury liability protection per person, $ 300,000 bodily injury liability full and $ 100,000 of property damage liability .

Full coverage for used cars

Your vehicle is an asset, so you might want to consider adding full moon coverage to your insurance policy, depending on how much the car is worth. A entire coverage cable car policy policy typically includes indebtedness, comprehensive and collision coverages. A common rule of thumb is that if the cost of full coverage per year is 10% or higher of your car’s value, you can drop full coverage .

For case, if your car is worth $ 5,000, but fully coverage costs more than $ 500 a year, you should drop it. additionally, if your deductible is conclusion to your car ‘s respect, full coverage credibly is n’t deserving it .

State-minimum coverage normally does not include auspices for your vehicle. That means if it is damaged in an accident, you may have to pay for repairs out of pocket. therefore, if your use car has significant prize, we recommend adding some sum of collision or comprehensive coverage .

Summing up

Buying a use cable car saves you money on your vehicle, but not necessarily on policy. Older cars by and large have cheaper car indemnity rates, but because there are sol many factors that decide rates, this is n’t always the character. once your vehicle depreciates adequate, it may be time to drop full coverage on it.

Most states have a command minimum indebtedness coverage sum, but you ‘ll credibly want to increase it — $ 500,000 of liability protection is a full place to start for many people .

Methodology

Our calculations are based on Illinois minimum coverage for vehicles in the Chicago metro area. To find the cheapest use cars to insure, we considered 376 individual vehicles and rates from four boastfully companies : Allstate, GEICO, Progressive and State Farm. The same companies were used to determine average rates by model year .

QuoteWizard.com LLC has made every feat to ensure that the data on this site is correct, but we can not guarantee that it is free of inaccuracies, errors, or omissions. All capacity and services provided on or through this web site are provided “ as is ” and “ as available ” for use. QuoteWizard.com LLC makes no representations or warranties of any kind, express or implied, as to the operation of this locate or to the data, subject, materials, or products included on this locate. You expressly agree that your manipulation of this web site is at your sole risk .