With highly apartment terrain ( see television below ), heavily wooded prairies, and godforsaken west countryside, Kansas boasts a placid and diachronic environment that attracts many visitors every year. The Big Basin Prairie Preserve, Monument Rocks, Rock City, and the Baldwin Woods conserve Kansas ’ s old fashioned air .

With about two and a half million registered vehicles on the road and 7.2 percentage uninsured, illegal drivers, one thing is sealed : it is imperative to have cable car insurance if you own and drive a fomite in the department of state of Kansas .

We know finding a good car indemnity policy can be annoying and long-winded at times, so that ’ s precisely why we decided to write this ultimate steer to Kansas cable car indemnity .

In this steer, we will discuss significant topics like types of car indemnity, car indemnity laws, risks and rules of the road, and much more .

How to Get Kansas Car Insurance Coverage and Rates

car insurance is then crucial to have, specially when you live in a state where 7.2 percentage of drivers are completely uninsured ! There are many unlike add-ons, coverage options and endorsements available through just about every car insurance company, but how do you know precisely what kind of cable car policy is justly for you ?

How do you know what kind of coverage you need and what kind of rate should you be paying ? What car policy company has great customer service ?

If you don ’ t know the answers to any of these questions, not to worry we will go over all this and more in the very following part. But first, we want to acclimate you to Kansas ’ mho cable car culture so you have a better idea of the types of vehicles that are much ensured the most .

Compare Quotes From acme Companies and Save

Secured with SHA-256 Encryption

Secured with SHA-256 Encryption

What’s Kansas Car Culture like?

In Kansas, cultivated land accounts for more than 88 percentage of the state ’ s area so it ’ s truly not a storm that most Kansas residents are farmers. normally, farmers prefer heavy duty pick-up trucks to help them work ; the Ford F150 is the most democratic drive fomite in Kansas .

Maria DeLeon writes : “ The trucks partially reflect the farmer culture of the express or barely people who use them as utility vehicles that come in handy. ” According to The Hartford, pickup trucks are barely the extent of car culture in the submit. many drivers who commute and live in Kansas City for work have vehicles that are more suit for city drive, leisure drive, and vehicles that have dependable natural gas mileage .

What are Kansas Minimum Coverage Requirements?

therefore what is minimum coverage insurance and why is it necessary ? Why should you care about having minimum coverage ? In the Sunflower department of state, every driver must have car insurance. Every driver must have a minimum sum of car insurance. This is normally called minimum liability insurance coverage .

view as picture But before we get into policy coverage laws, let ’ s define what it means to be a no-fault car accident state. Kansas is one of a twelve or sol states in the U.S. that has implemented a no-fault accident policy .

This means that if a driver is involved in an accident even if he or she did not cause that accident, that driver is required by police to report and file a claim with his or her car indemnity company .

still confused ?

Let ’ s pretend Driver A rear-end Driver B on the highway. Driver C was besides rear-end, but Driver A caused a ripple consequence when he hit Driver B .

In most states, Driver A would be creditworthy to cover the costs of all damages incurred from the accident for Driver B and Driver C ’ sulfur vehicles. He would evening be responsible to cover personal injury costs and medical bills !

A claim is a written report including details about the accident and damages that incurred from that accident. The policy company takes the title and pays the driver back a specific measure of money to cover the costs of the damages .

now that we ’ ve explained no-fault, let ’ s get back to minimum coverage laws. Kansas requires all drivers to meet the following minimal insurance laws .

liability indemnity : Bodily Injury Liability Coverage and Property Damage Liability Coverage

- $25,000 per person for bodily injury (the maximum amount payable to one person for injuries resulting from an accident caused by the policyholder)

- $50,000 per accident for bodily injury (the maximum amount payable to all people injured in an accident caused by the policyholder)

- $25,000 per accident for other parties’ vehicle damage and other property loss in an accident caused by the policyholder (does not cover damage to the policyholder’s own vehicle)

Kansas law besides requires drivers to have personal injury protection coverage .

- $4,500/person for medical expenses

- $900/month for one year for disability/loss of income

- $25/day for in-home services

- $2,000 for funeral, burial or cremation expense

- $4,500 for rehabilitation expense

The Kansas Insurance Department states drivers besides must have uninsured motorist coverage .

- $25,000/person

- $50,000/accident

Each of these unlike types of coverage protects you against different types of losses. Don ’ thymine go away ! We cover losses a little late in this post .

What are the Forms of Financial Responsibility?

A shape of fiscal responsibility requirement is fair a phase that states you actually have car policy. It ’ sulfur nothing fancy or confusing, it merely shows a police enforcement officeholder that you are following the jurisprudence and you are a legal driver. This is besides known as validation of policy .

acceptable forms of proof of insurance are :

- Electronic insurance card

- Valid liability insurance ID cards

- Copy of your current auto insurance policy

- Valid insurance binder (a temporary form of car insurance)

If you are caught driving without validation of insurance, you may be given a fine. Drivers who are convicted of driving uninsured font the play along penalties :

- Fines of $300-$1000 for the first violation

- Fines of $800-$2500 for subsequent violations

- Jail time of up to six months

- Suspension of vehicle registration with a reinstatement fee of $100

If you are caught without policy, you may need to file for what is called SR-22 policy or bad insurance. Having bad car policy or getting a citation for driving without proof of policy will cause your supplier to increase your rates. Long story short, always drive with proof of policy or your insurance tease .

Compare Quotes From crown Companies and Save

Secured with SHA-256 Encryption

Secured with SHA-256 Encryption

What Percentage of Income are Premiums?

The point of this incision is to give you an idea of how a lot of your income you could be paying towards your cable car insurance policy if you live in Kansas. cable car policy rates vary in unlike parts of the state, so it ’ second constantly good to have an idea of what you might end up paying, particularly if you are thinking about moving to Kansas .

Kansas ’ sulfur average per caput income in 2015 was $ 41,634. The same class, Kansans paid an average of $ 850.79 for car policy. This means Kansas spent 2.04 percentage of their sum income on car insurance .

These numbers are pretty normal for people who live in surrounding states like Nebraska, Colorado, or Oklahoma .

Although, Missouri was the alone country in the area with an average per head income of under $ 40,000 a year. Compared to the respite of the nation, the average american made $ 40,859.00 in 2015 and spent $ 981.77 on car indemnity .

This means on average, American ’ s are spending about $ 82 a calendar month on car policy for a reasonably basic policy !

What are the Average Monthly Car Insurance Rates in KS (Liability, Collision, Comprehensive Insurance)?

| Coverage Type | Annual Costs (2015) | |

|---|---|---|

| Liability | $358.24 | |

| Collision | $263.33 | |

| Comprehensive | $241.36 | |

| Combined | $862.93 | |

| Get Your Rates Quote Now | #blank# | |

Compare RatesStart Now → The data in the table above is from the National Association of Insurance Commissioners ( NAIC ). These rates are from 2015, so you can bet that car policy rates have more than likely increased since then .

The countrywide average for cable car insurance is $ 981.77. The average total for Kansas car indemnity is only $ 850.79 so it ’ south about $ 130 under the national average .

opinion as image It ’ s constantly good ( and required ) to carry minimum car indemnity, but when you get into an accident, you will wish you had more .

Up future, we will talk about add-ons coverage options .

Is There an Additional Coverage in Kansas?

| Loss Ratio | 2012 | 2013 | 2014 | |||

|---|---|---|---|---|---|---|

| Medical Payments (MedPay) | 99.61% | 90.94% | 72.5% | |||

| Uninsured/Underinsured Motorist Coverage (UUM) | 67.63% | 66.72% | 73.92% | |||

| Personal Injury Protection | 64.66% | 60.79% | 59.61% | |||

| Get Your Rates Quote Now | #blank# | #blank# | #blank# | |||

Compare RatesStart Now → In most states, uninsured/underinsured indemnity and personal wound security indemnity are optional, but in Kansas it is compulsory to have all three of these types of indemnity .

As stated above, 7.2 percentage of motorists are uninsured. That ’ s a chilling number .

Because so many people are uninsured drivers, it ’ s a great thing to have this policy in your back pocket when you need it .

But why ?

If uninsured motorists happen to be in an accident, they will most likely end up going bankrupt trying to pay for all the damages .

If that motorist happens to hit you and owes you money for some kind of medical bill, or you want to sue him for hitting you, you ’ ll never see the money that is rightfully owed to you because that motorist is uninsured or underinsured .

But what is loss ratio ?

Loss ratio is how we measure how many filed claims were paid and how many were not paid .

If the passing proportion percentage is besides high ( over 100 percentage ), the car indemnity supplier may end up besides going bankrupt .

bankruptcy happens because indemnity companies recieve more legitimate claims than tney have funds to cover .

On the other hand, if the loss proportion share is besides low ( under 50 percentage ), that supplier might have overpriced their policies. This means the company collected way more premium than it needed to cover the lawful claims that policyholders submitted .

Loss ratio is important when you ’ re looking for a new provider. If you look at the table above, all of these percentages fall in between 50-100 percentage, but this doesn ’ t always happen !

Compare Quotes From top Companies and Save

Secured with SHA-256 Encryption

Secured with SHA-256 Encryption

Are There any Add-ons, Endorsements, and Riders?

Looking for even more car insurance ? That ’ s a good thing. Click on the links below to get the price and learn more about each individual addition .

You can add one or add them. Just remember, the more insurance you have, the better .

What are the Average Monthly Car Insurance Rates by Age & Gender in KS?

Did you know your historic period, sex, and marital condition can affect your car insurance pace ? Generally, males pay more for car indemnity than females do and married drivers pay less for car insurance than non-married people do .

horizon as prototype

| Company | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate | Single 17-year old female annual rate | Single 17-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $2,762.11 | $2,693.77 | $2,459.67 | $2,532.29 | $7,474.95 | $8,345.39 | $2,852.27 | $2,961.36 | ||||||||

| American Family Mutual | $1,689.32 | $1,689.32 | $1,525.16 | $1,525.16 | $3,254.11 | $3,902.70 | $1,689.32 | $1,896.08 | ||||||||

| Farmers Ins Co | $2,550.50 | $2,532.32 | $2,279.13 | $2,379.53 | $6,878.76 | $7,120.82 | $2,869.95 | $3,019.19 | ||||||||

| Geico General | $2,525.49 | $2,469.16 | $2,548.98 | $2,371.80 | $4,611.95 | $6,193.68 | $2,915.19 | $2,128.91 | ||||||||

| SAFECO Ins Co of America | $2,382.54 | $2,575.62 | $2,265.92 | $2,529.43 | $10,903.92 | $12,181.54 | $2,610.47 | $2,825.91 | ||||||||

| Allied NW Affin PPBM | $1,828.05 | $1,886.51 | $1,625.16 | $1,754.49 | $3,738.47 | $4,586.41 | $2,123.07 | $2,262.55 | ||||||||

| Progressive NorthWestern | $2,396.45 | $2,286.23 | $1,933.26 | $2,014.64 | $8,765.21 | $9,892.22 | $2,832.16 | $3,034.90 | ||||||||

| State Farm Mutual Auto | $1,789.13 | $1,789.13 | $1,564.97 | $1,564.97 | $4,733.91 | $6,039.48 | $2,009.84 | $2,268.58 | ||||||||

| Travelers Home & Marine Ins Co | $2,105.98 | $2,145.07 | $2,044.19 | $2,072.85 | $8,451.14 | $13,203.91 | $2,154.17 | $2,554.14 | ||||||||

| USAA | $1,415.31 | $1,445.35 | $1,294.37 | $1,311.44 | $4,760.88 | $5,008.53 | $1,867.56 | $1,957.41 | ||||||||

| Get Your Rates Quote Now | #blank# | #blank# | #blank# | #blank# | #blank# | #blank# | #blank# | #blank# | ||||||||

Compare RatesStart Now → normally, the younger you are, the more you ’ ll give for insurance. indemnity providers know that with age comes experience, and if you keep a houseclean commemorate while you ’ rhenium young, your rates will decrease the older you get. According to this table above, American Family Mutual has the overall bum rate for car insurance .

What are the Cheapest Car Insurance Rates by Zip Code in Kansas?

Where you live can besides play a huge function when it comes to figuring out your car indemnity rate .

watch as double here is a list of the 25 ZIP codes in Iowa with the highest average annual cable car insurance rates.

| Cities | ZIP Codes | Average | Allstate F&C | American Family Mutual | Farmers Ins Co | Geico General | SAFECO Ins Co of America | Allied NW Affin PPBM | Progressive NorthWestern | State Farm Mutual Auto | Travelers Home & Marine Ins Co | USAA | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Kansas City | 66115 | $4,318.12 | $6,181.07 | $2,456.88 | $4,047.31 | $3,824.21 | $6,513.43 | $2,672.84 | $5,944.54 | $3,177.15 | $5,667.95 | $2,695.84 | ||||||||||||

| Kansas City | 66104 | $4,257.23 | $6,181.07 | $2,456.88 | $4,445.70 | $3,824.21 | $6,513.43 | $2,672.84 | $4,950.36 | $3,164.07 | $5,667.95 | $2,695.84 | ||||||||||||

| Kansas City | 66102 | $4,233.28 | $6,181.07 | $2,456.88 | $4,445.70 | $3,824.21 | $6,513.43 | $2,672.84 | $4,710.33 | $3,164.54 | $5,667.95 | $2,695.84 | ||||||||||||

| Kansas City | 66105 | $4,217.19 | $6,181.07 | $2,456.88 | $4,376.60 | $3,824.21 | $6,513.43 | $2,672.84 | $4,797.32 | $3,151.92 | $5,501.77 | $2,695.84 | ||||||||||||

| Kansas City | 66101 | $4,216.05 | $6,181.07 | $2,456.88 | $4,176.21 | $3,824.21 | $6,513.43 | $2,672.84 | $4,781.85 | $3,190.20 | $5,667.95 | $2,695.84 | ||||||||||||

| Kansas City | 66118 | $4,212.34 | $6,181.07 | $2,456.88 | $4,094.35 | $3,824.21 | $6,513.43 | $2,672.84 | $4,826.68 | $3,190.20 | $5,667.95 | $2,695.84 | ||||||||||||

| Kansas City | 66160 | $4,174.73 | $6,181.07 | $2,456.88 | $3,796.38 | $2,896.90 | $6,513.43 | $2,672.84 | $6,107.66 | $2,758.41 | $5,667.95 | $2,695.84 | ||||||||||||

| Kansas City | 66103 | $4,097.95 | $5,360.29 | $2,456.88 | $4,148.64 | $3,824.21 | $6,513.43 | $2,672.84 | $4,487.50 | $3,151.92 | $5,667.95 | $2,695.84 | ||||||||||||

| Kansas City | 66106 | $3,944.33 | $5,360.29 | $2,456.88 | $4,180.19 | $3,824.21 | $5,347.58 | $2,672.84 | $4,571.67 | $3,113.66 | $5,220.21 | $2,695.84 | ||||||||||||

| Kansas City | 66112 | $3,924.22 | $6,181.07 | $2,456.88 | $4,060.41 | $3,073.89 | $5,347.58 | $2,672.84 | $4,715.82 | $3,138.87 | $5,209.79 | $2,385.02 | ||||||||||||

| Pierceville | 67868 | $3,855.65 | $5,045.84 | $2,351.02 | $4,264.45 | $3,858.77 | $5,174.70 | $2,642.76 | $4,862.84 | $2,835.47 | $4,943.42 | $2,577.23 | ||||||||||||

| Ingalls | 67853 | $3,838.60 | $5,045.84 | $2,262.97 | $4,160.00 | $3,858.77 | $5,174.70 | $2,544.45 | $4,969.78 | $2,848.89 | $4,943.42 | $2,577.23 | ||||||||||||

| Jetmore | 67854 | $3,835.59 | $5,045.84 | $2,263.27 | $4,097.40 | $3,858.77 | $5,174.70 | $2,579.23 | $4,933.19 | $2,874.30 | $4,952.02 | $2,577.23 | ||||||||||||

| Kansas City | 66111 | $3,833.58 | $5,360.29 | $2,456.88 | $3,992.39 | $3,073.89 | $5,347.58 | $2,672.84 | $4,698.30 | $3,138.87 | $5,209.79 | $2,385.02 | ||||||||||||

| Ensign | 67841 | $3,833.27 | $5,045.84 | $2,262.97 | $4,097.40 | $3,858.77 | $5,174.70 | $2,544.45 | $4,992.41 | $2,835.47 | $4,943.42 | $2,577.23 | ||||||||||||

| Holcomb | 67851 | $3,830.89 | $5,045.84 | $2,351.02 | $4,042.92 | $3,858.77 | $5,174.70 | $2,642.76 | $4,775.67 | $2,896.54 | $4,943.42 | $2,577.23 | ||||||||||||

| Copeland | 67837 | $3,828.09 | $5,045.84 | $2,262.97 | $4,133.90 | $3,858.77 | $5,174.70 | $2,544.45 | $4,904.13 | $2,835.47 | $4,943.42 | $2,577.23 | ||||||||||||

| Wright | 67882 | $3,826.88 | $5,045.84 | $2,312.08 | $4,133.90 | $3,858.77 | $5,174.70 | $2,579.23 | $4,808.14 | $2,835.47 | $4,943.42 | $2,577.23 | ||||||||||||

| Richfield | 67953 | $3,826.20 | $5,045.84 | $2,312.08 | $4,256.61 | $3,858.77 | $5,174.70 | $2,544.45 | $4,713.46 | $2,835.47 | $4,943.42 | $2,577.23 | ||||||||||||

| Cimarron | 67835 | $3,825.54 | $5,045.84 | $2,262.97 | $4,160.00 | $3,858.77 | $5,174.70 | $2,544.45 | $4,839.15 | $2,848.89 | $4,943.42 | $2,577.23 | ||||||||||||

| Dodge City | 67801 | $3,824.90 | $5,045.84 | $2,312.08 | $3,914.76 | $3,858.77 | $5,174.70 | $2,579.23 | $4,888.64 | $2,857.74 | $5,040.02 | $2,577.23 | ||||||||||||

| Hanston | 67849 | $3,821.64 | $5,045.84 | $2,263.27 | $4,097.40 | $3,858.77 | $5,174.70 | $2,579.23 | $4,832.48 | $2,835.47 | $4,952.02 | $2,577.23 | ||||||||||||

| Kismet | 67859 | $3,819.33 | $5,045.84 | $2,312.08 | $4,281.56 | $3,858.77 | $5,174.70 | $2,544.45 | $4,606.41 | $2,848.89 | $4,943.42 | $2,577.23 | ||||||||||||

| Fort Dodge | 67843 | $3,817.80 | $5,045.84 | $2,312.08 | $3,914.76 | $3,858.77 | $5,174.70 | $2,579.23 | $4,936.47 | $2,835.47 | $4,943.42 | $2,577.23 | ||||||||||||

| Garden City | 67846 | $3,817.24 | $5,045.84 | $2,351.02 | $3,888.68 | $3,858.77 | $5,174.70 | $2,642.76 | $4,793.47 | $2,896.54 | $4,943.42 | $2,577.23 | ||||||||||||

| Get Your Rates Quote Now | #blank# | #blank# | #blank# | #blank# | #blank# | #blank# | #blank# | #blank# | #blank# | #blank# | #blank# | #blank# | ||||||||||||

Compare RatesStart Now → And here are the 25 cheapest ZIP codes in Iowa.

| Cities | ZIP Codes | Average | Allstate F&C | American Family Mutual | Farmers Ins Co | Geico General | SAFECO Ins Co of America | Allied NW Affin PPBM | Progressive NorthWestern | State Farm Mutual Auto | Travelers Home & Marine Ins Co | USAA | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Salina | 67401 | $2,954.93 | $3,880.12 | $1,917.57 | $3,335.46 | $2,617.54 | $4,289.55 | $2,179.81 | $3,531.77 | $2,397.91 | $3,403.81 | $1,995.72 | ||||||||||||

| New Cambria | 67470 | $3,067.59 | $3,880.12 | $1,917.57 | $3,439.40 | $3,092.66 | $4,289.55 | $2,179.81 | $3,570.32 | $2,483.27 | $3,827.48 | $1,995.72 | ||||||||||||

| Manhattan | 66502 | $3,083.72 | $3,880.12 | $1,924.47 | $3,472.56 | $2,704.64 | $4,432.67 | $2,387.85 | $3,650.70 | $2,528.96 | $3,845.78 | $2,009.51 | ||||||||||||

| Manhattan | 66506 | $3,088.18 | $3,880.12 | $1,924.47 | $3,489.20 | $2,704.64 | $4,432.67 | $2,387.85 | $3,524.55 | $2,528.96 | $3,999.86 | $2,009.51 | ||||||||||||

| Manhattan | 66503 | $3,108.05 | $3,880.12 | $1,924.47 | $3,506.54 | $2,704.64 | $4,432.67 | $2,387.85 | $3,779.91 | $2,532.48 | $3,922.37 | $2,009.51 | ||||||||||||

| Saint George | 66535 | $3,130.32 | $3,880.12 | $2,029.99 | $3,491.58 | $2,704.64 | $4,432.67 | $2,387.85 | $3,855.14 | $2,533.22 | $3,978.44 | $2,009.51 | ||||||||||||

| North Newton | 67117 | $3,131.94 | $3,795.40 | $2,031.28 | $3,218.74 | $3,092.66 | $4,463.05 | $2,166.52 | $3,353.46 | $2,502.82 | $4,208.33 | $2,487.19 | ||||||||||||

| Mcpherson | 67460 | $3,133.52 | $3,795.40 | $1,982.93 | $3,205.27 | $3,092.66 | $4,685.08 | $2,132.78 | $3,509.90 | $2,502.82 | $4,105.48 | $2,322.87 | ||||||||||||

| Galva | 67443 | $3,135.45 | $3,795.40 | $1,982.93 | $3,205.27 | $3,092.66 | $4,685.08 | $2,132.78 | $3,529.21 | $2,502.82 | $4,105.48 | $2,322.87 | ||||||||||||

| Lindsborg | 67456 | $3,136.99 | $3,880.12 | $1,982.93 | $3,214.52 | $3,092.66 | $4,685.08 | $2,132.78 | $3,459.32 | $2,494.11 | $4,105.48 | $2,322.87 | ||||||||||||

| Hesston | 67062 | $3,139.21 | $3,795.40 | $2,031.28 | $3,298.59 | $3,092.66 | $4,463.05 | $2,166.52 | $3,336.52 | $2,512.60 | $4,208.33 | $2,487.19 | ||||||||||||

| Canton | 67428 | $3,140.20 | $3,795.40 | $1,982.93 | $3,240.58 | $3,092.66 | $4,685.08 | $2,132.78 | $3,541.35 | $2,502.82 | $4,105.48 | $2,322.87 | ||||||||||||

| Moundridge | 67107 | $3,140.92 | $3,795.40 | $1,982.93 | $3,294.06 | $3,092.66 | $4,685.08 | $2,132.78 | $3,485.33 | $2,512.60 | $4,105.48 | $2,322.87 | ||||||||||||

| Assaria | 67416 | $3,145.73 | $3,880.12 | $1,917.57 | $3,283.28 | $3,092.66 | $4,685.08 | $2,532.72 | $3,528.93 | $2,494.41 | $4,046.79 | $1,995.72 | ||||||||||||

| Roxbury | 67476 | $3,147.28 | $3,880.12 | $1,982.93 | $3,240.58 | $3,092.66 | $4,685.08 | $2,132.78 | $3,547.05 | $2,483.27 | $4,105.48 | $2,322.87 | ||||||||||||

| Newton | 67114 | $3,148.20 | $3,795.40 | $2,031.28 | $3,336.59 | $3,092.66 | $4,463.05 | $2,166.52 | $3,398.17 | $2,502.82 | $4,208.33 | $2,487.19 | ||||||||||||

| Inman | 67546 | $3,148.46 | $3,795.40 | $1,982.93 | $3,258.73 | $3,092.66 | $4,685.08 | $2,132.78 | $3,596.10 | $2,512.60 | $4,105.48 | $2,322.87 | ||||||||||||

| Brookville | 67425 | $3,151.76 | $3,880.12 | $1,917.57 | $3,179.18 | $3,092.66 | $4,685.08 | $2,532.72 | $3,704.52 | $2,483.27 | $4,046.79 | $1,995.72 | ||||||||||||

| Gypsum | 67448 | $3,159.41 | $3,880.12 | $1,917.57 | $3,312.41 | $3,092.66 | $4,685.08 | $2,532.72 | $3,636.64 | $2,494.41 | $4,046.79 | $1,995.72 | ||||||||||||

| Walton | 67151 | $3,160.18 | $3,795.40 | $2,031.28 | $3,363.21 | $3,092.66 | $4,463.05 | $2,166.52 | $3,481.57 | $2,512.60 | $4,208.33 | $2,487.19 | ||||||||||||

| Hutchinson | 67502 | $3,161.51 | $3,795.40 | $2,058.84 | $3,287.64 | $3,038.99 | $4,280.21 | $2,443.88 | $3,781.53 | $2,663.50 | $4,013.64 | $2,251.46 | ||||||||||||

| Falun | 67442 | $3,162.68 | $3,880.12 | $1,917.57 | $3,487.51 | $3,092.66 | $4,685.08 | $2,532.72 | $3,505.33 | $2,483.27 | $4,046.79 | $1,995.72 | ||||||||||||

| Windom | 67491 | $3,165.42 | $3,795.40 | $1,982.93 | $3,468.14 | $3,092.66 | $4,685.08 | $2,132.78 | $3,585.62 | $2,483.27 | $4,105.48 | $2,322.87 | ||||||||||||

| Lehigh | 67073 | $3,170.77 | $3,795.40 | $1,937.11 | $3,206.57 | $3,092.66 | $4,685.08 | $2,337.13 | $3,655.54 | $2,483.27 | $4,192.08 | $2,322.87 | ||||||||||||

| Goessel | 67053 | $3,174.16 | $3,795.40 | $1,937.11 | $3,536.09 | $3,092.66 | $4,463.05 | $2,337.13 | $3,565.72 | $2,483.27 | $4,208.33 | $2,322.87 | ||||||||||||

| Get Your Rates Quote Now | #blank# | #blank# | #blank# | #blank# | #blank# | #blank# | #blank# | #blank# | #blank# | #blank# | #blank# | #blank# | ||||||||||||

Compare RatesStart Now → Kansas City has the most expensive car policy rate in all of Kansas which makes sense because it besides is the biggest city in Kansas .

Compare Quotes From top Companies and Save

Secured with SHA-256 Encryption

Secured with SHA-256 Encryption

What are the Cheapest Auto Insurance Rates by Cities in Kansas?

here ’ s a list of the most expensive cable car insurance rates by cities in Kansas.

| Cities | Average Grand Total | |

|---|---|---|

| Kansas City | $4,021.02 | |

| Plains | $3,855.65 | |

| Jetmore | $3,838.60 | |

| Johnson | $3,835.59 | |

| Ford | $3,833.26 | |

| Ingalls | $3,830.89 | |

| Deerfield | $3,828.09 | |

| Liberal | $3,826.88 | |

| Rolla | $3,826.20 | |

| Coolidge | $3,825.54 | |

| Ashland | $3,824.90 | |

| Healy | $3,821.64 | |

| Lakin | $3,819.33 | |

| Fowler | $3,817.80 | |

| Hanston | $3,817.24 | |

| Fort Dodge | $3,812.40 | |

| Pierceville | $3,810.87 | |

| Kismet | $3,808.37 | |

| Moscow | $3,805.57 | |

| Cimarron | $3,803.94 | |

| Sublette | $3,803.16 | |

| Syracuse | $3,802.88 | |

| Montezuma | $3,801.29 | |

| Richfield | $3,799.41 | |

| Dighton | $3,798.29 | |

| Get Your Rates Quote Now | #blank# | |

Compare RatesStart Now → now let ’ s look at the 25 cheapest cities.

| Cities | Average Grand Total | |

|---|---|---|

| Abilene | $2,954.93 | |

| Osborne | $3,067.59 | |

| Maple Hill | $3,088.18 | |

| Saint Marys | $3,130.31 | |

| Norwich | $3,131.94 | |

| Marquette | $3,133.52 | |

| Geneseo | $3,135.45 | |

| Little River | $3,136.99 | |

| Hillsboro | $3,139.21 | |

| Cawker City | $3,140.20 | |

| Mount Hope | $3,140.92 | |

| Aurora | $3,145.73 | |

| Simpson | $3,147.28 | |

| North Newton | $3,148.20 | |

| Kinsley | $3,148.46 | |

| Bushton | $3,151.76 | |

| Herington | $3,159.41 | |

| Wellington | $3,160.18 | |

| South Hutchinson | $3,161.51 | |

| Galva | $3,162.68 | |

| Manhattan | $3,162.97 | |

| Woodbine | $3,165.42 | |

| Leon | $3,170.77 | |

| Greensburg | $3,174.16 | |

| Hardtner | $3,174.34 | |

| Get Your Rates Quote Now | #blank# | |

Compare RatesStart Now → now that we ’ ve discussed a few factors that decide car insurance rates, let ’ s discourse details about some of the best cable car indemnity companies in Kansas .

What are the Best Kansas Car Insurance Companies?

With literally hundreds of car policy companies out there, it can be difficult choosing merely one to trust with a vehicle worth thousands of dollars. After all, it ’ south great to have peace of mind when you ’ ra car indemnity ship’s company puts their money where their mouth is and comes through like Superman when you get into a good ( or not sol serious ) accident .

We know that you probably don ’ deoxythymidine monophosphate want to spend your precious spare time sifting through car policy supplier reviews, so that ’ s precisely why we wanted to include a little steer to car insurance companies. We include topics like customer satisfaction ratings, companies with the most complaints, and the top ten best companies in Kansas .

Don ’ thymine go aside, fiscal ratings are up following .

What are the Financial Ratings of the Ten Largest Car Insurance Companies?

How do we give a company a fiscal military rank ? We measure fiscal potency using the AM Best method .

see as picture

| Company | AM Best Rating | Direct Premiums Written | Loss Ratio | Market Share | ||||

|---|---|---|---|---|---|---|---|---|

| State Farm Group | A++ | $374,079 | 64.37% | 20.23% | ||||

| American Family Insurance Group | A | $227,157 | 65.57% | 12.29% | ||||

| Progressive Group | A+ | $199,252 | 59.35% | 10.78% | ||||

| Iowa Farm Bureau Group | A- | $138,914 | 64.96% | 7.51% | ||||

| Farmers Insurance Group | A | $119,885 | 53.98% | 6.48% | ||||

| Allstate Insurance Group | A+ | $106,161 | 57.26% | 5.74% | ||||

| USAA Group | A++ | $102,544 | 71.90% | 5.55% | ||||

| Geico | A++ | $91,086 | 71.81% | 4.93% | ||||

| Nationwide Corp Group | A+ | $81,476 | 62.46% | 4.41% | ||||

| Liberty Mutual Group | A | $61,418 | 57.55% | 3.32% | ||||

| Get Your Rates Quote Now | #blank# | #blank# | #blank# | #blank# | ||||

Compare RatesStart Now → You don ’ thymine get on this tilt if you ’ re not doing something right. All of these companies have near-perfect A scores, but check out their loss ratio percentages — they are rank somewhere between 50-100 percentage. none of the companies are at gamble of going bankrupt, and they are all paying a bazaar number of filed claims .

Compare Quotes From lead Companies and Save

Secured with SHA-256 Encryption

Secured with SHA-256 Encryption

Which Kansas Companies have the Best Ratings?

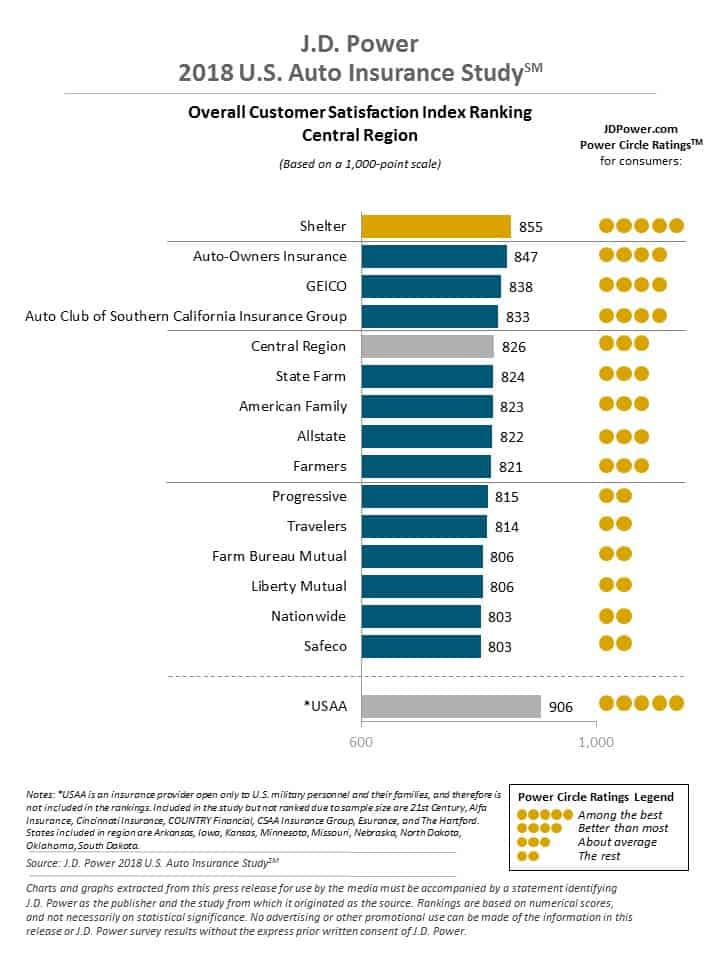

In 2018, J.D. Power ranked car indemnity companies based on overall customer satisfaction. The U.S. Auto Insurance Study examined customer satisfaction in five factors ( in order of importance ) : interaction ; policy offerings ; monetary value ; billing process and policy information ; and claims .

view as persona The report is based on responses from 44,622 car policy customers and was fielded from February-April 2018 .

Besides USAA, ( a company that only serves military members and their families ). Shelter was ranked as the total one cable car policy ship’s company for customer service in the U.S .

When you ’ re in a obstruct, it ’ mho crucial to have great people on the early side of the call who you know have your best interests at kernel .

Which Companies have the Most Complaints in Kansas?

It ’ randomness not bad to get complaints. even the best companies receive them. How a company handles a complaint is what actually matters .

| Company | National Median Complaint Ratio |

Company Complaint Ratio 2017 |

Total Complaints 2017 |

|||

|---|---|---|---|---|---|---|

| State Farm Group | 1 | 0.44 | 1482 | |||

| American Family Insurance Group | 1 | 0.79 | 73 | |||

| Progressive Group | 1 | 0.75 | 120 | |||

| Iowa Farm Bureau Group | 1 | 0.77 | 32 | |||

| Farmers Insurance Group | 1 | 0 | 0 | |||

| Allstate Insurance Group | 1 | 0.5 | 163 | |||

| USAA Group | N/A | 0 | 2 | |||

| Geico | N/A | N/A | N/A | |||

| Nationwide Corp Group | 1 | 0.28 | 25 | |||

| Liberty Mutual Group | 1 | 5.95 | 222 | |||

| Get Your Rates Quote Now | #blank# | #blank# | #blank# | |||

Compare RatesStart Now → Don ’ thyroxine arrive discouraged by these numbers. At best, they are minimal .

Which are the Cheapest Car Insurance Companies in Kansas?

Below is a list of the top ten-spot cheapest car indemnity companies in Kansas .

| Company | Average | Compared to State Average | Percentage Compared to State Average | |||

|---|---|---|---|---|---|---|

| Allstate F&C | $4,010.23 | $617.28 | 15.39% | |||

| American Family Mutual | $2,146.40 | -$1,246.55 | -58.08% | |||

| Farmers Ins Co | $3,703.77 | $310.83 | 8.39% | |||

| Geico General | $3,220.65 | -$172.30 | -5.35% | |||

| SAFECO Ins Co of America | $4,784.42 | $1,391.47 | 29.08% | |||

| Allied NW Affin PPBM | $2,475.59 | -$917.36 | -37.06% | |||

| Progressive NorthWestern | $4,144.38 | $751.44 | 18.13% | |||

| State Farm Mutual Auto | $2,720.00 | -$672.94 | -24.74% | |||

| Travelers Home & Marine Ins Co | $4,341.43 | $948.48 | 21.85% | |||

| USAA | $2,382.61 | -$1,010.34 | -42.40% | |||

| Get Your Rates Quote Now | #blank# | #blank# | #blank# | |||

Compare RatesStart Now → According to this number, American Family Mutual is quoted with the cheapest rates .

Compare Quotes From clear Companies and Save

Secured with SHA-256 Encryption

Secured with SHA-256 Encryption

What are the Commute Rates by Companies?

How far you drive can besides affect your car indemnity rate .

| Group | 10 Miles Commute, 6000 Annual Mileage | 25 Miles Commute, 12000 Annual Mileage | ||

|---|---|---|---|---|

| Allstate | $4,010.23 | $4,010.23 | ||

| American Family | $2,118.80 | $2,174.00 | ||

| Farmers | $3,703.77 | $3,703.77 | ||

| Geico | $3,151.65 | $3,289.64 | ||

| Liberty Mutual | $4,784.42 | $4,784.42 | ||

| Nationwide | $2,475.59 | $2,475.59 | ||

| Progressive | $4,144.38 | $4,144.38 | ||

| State Farm | $2,652.30 | $2,787.70 | ||

| Travelers | $4,341.43 | $4,341.43 | ||

| USAA | $2,312.82 | $2,452.40 | ||

| Get Your Rates Quote Now | #blank# | #blank# | ||

Compare RatesStart Now → Some cable car policy companies will jack up your rate hundreds of dollars for driving more miles. This is because car insurance companies know that more prison term on the road means you are more likely to get into a car accident .

see as visualize

What are the Auto Insurance Coverage Level Rates by Companies?

Some companies may cut you a break on your rate if you add more options to your basic policy .

| Company | Low Coverage | Medium Coverage | High Coverage | |||

|---|---|---|---|---|---|---|

| Allied NW Affin PPBM | $2,606.75 | $2,448.27 | $2,371.75 | |||

| Allstate F&C | $3,894.18 | $4,001.70 | $4,134.80 | |||

| American Family Mutual | $2,168.20 | $2,254.76 | $2,016.23 | |||

| Farmers Ins Co | $3,555.59 | $3,684.18 | $3,871.56 | |||

| Geico General | $3,129.09 | $3,216.90 | $3,315.94 | |||

| Progressive NorthWestern | $3,928.59 | $4,112.75 | $4,391.81 | |||

| SAFECO Ins Co of America | $4,673.70 | $4,773.50 | $4,906.06 | |||

| State Farm Mutual Auto | $2,622.97 | $2,727.30 | $2,809.74 | |||

| Travelers Home & Marine Ins Co | $4,124.45 | $4,347.90 | $4,551.94 | |||

| USAA | $2,304.88 | $2,376.85 | $2,466.08 | |||

| Get Your Rates Quote Now | #blank# | #blank# | #blank# | |||

Compare RatesStart Now → Check out this first company Allied NW Affin PPBM. They actually charge more money for lower coverage than they do for higher coverage .

What are the Credit History Rates by Companies?

Your recognition score is another major gene that can affect your car indemnity rate .

| Group | Poor Credit History | Fair Credit History | Good Credit History | |||

|---|---|---|---|---|---|---|

| Allstate | $4,970.77 | $3,772.30 | $4,784.42 | |||

| American Family | $2,802.09 | $1,984.13 | $3,921.25 | |||

| Farmers | $4,362.96 | $3,472.25 | $3,684.80 | |||

| Geico | $5,004.81 | $2,647.62 | $3,287.61 | |||

| Liberty Mutual | $4,784.42 | $4,784.42 | $3,276.11 | |||

| Nationwide | $2,748.91 | $2,420.86 | $2,257.00 | |||

| Progressive | $4,757.13 | $3,991.23 | $2,009.51 | |||

| State Farm | $3,960.45 | $2,366.68 | $1,832.88 | |||

| Travelers | $5,020.52 | $4,082.52 | $1,754.93 | |||

| USAA | $3,257.80 | $2,135.09 | $1,652.97 | |||

| Get Your Rates Quote Now | #blank# | #blank# | #blank# | |||

Compare RatesStart Now → If you have a poor credit history, car policy companies could raise your rate by hundreds of dollars. On the other hand, if you keep a good credit rating grade, your rates will most likely be on the lower side .

According to Experian, Kansas residents had an average credit sexual conquest of 680. This score is five points higher than the national average .

Travelers truly punishes you for bad recognition – their average pace for person with bad credit is about $ 4,000 more expensive .

What are the Driving Record Rates by Companies?

credibly the most popular factor and the one the matters the most when trying to figure out your car indemnity rate is your drive record .

| Group | Clean Record | With 1 Speeding Violation | With 1 Accident | With 1 DUI | ||||

|---|---|---|---|---|---|---|---|---|

| Allstate | $3,467.53 | $3,885.11 | 4037.608897 | $4,650.66 | ||||

| American Family | $2,108.90 | $2,108.90 | 2258.897638 | $2,108.90 | ||||

| Farmers | $3,124.16 | $3,761.86 | 4015.288006 | $3,913.78 | ||||

| Geico | $2,024.15 | $2,409.46 | 3318.868274 | $5,130.10 | ||||

| Liberty Mutual | $3,614.88 | $4,774.50 | 5422.060354 | $5,326.24 | ||||

| Nationwide | $1,857.04 | $2,126.95 | 2137.164144 | $3,781.21 | ||||

| Progressive | $3,828.81 | $4,272.82 | 4477.286719 | $3,998.62 | ||||

| State Farm | $2,525.63 | $2,720.00 | 2914.374583 | $2,720.00 | ||||

| Travelers | $3,174.28 | $4,381.05 | 4130.06727 | $5,680.32 | ||||

| USAA | $1,744.07 | $1,997.23 | 2346.291994 | $3,442.84 | ||||

| Get Your Rates Quote Now | #blank# | #blank# | #blank# | #blank# | ||||

Compare RatesStart Now → If you get into just one accident or get one speeding citation, your rates can increase hundreds, if not thousands of dollars .

Keep your drive record clean and insurance companies will see that you are a good driver and you ’ re less likely to be involved in fatal accidents .

What’s the Number of Insurers in Kansas?

Below is a mesa highlighting the total of license insurers in Kansas .

| Domestic | Foreign | Total | ||

|---|---|---|---|---|

| 25 | 898 | 923 | ||

| Get Your Rates Quote Now | #blank# | #blank# | ||

Compare RatesStart Now → What ’ s the remainder between domestic and alien insurance ?

domestic policy laws are formed under the laws of the department of state of Kansas. Foreign laws are formed under the laws of the United States .

What are the Kansas State Laws?

With literally thousands of state laws, it ’ mho near impossible to learn and know all of them. In this section, we don ’ thyroxine want to cover every Kansas country jurisprudence, but we do want to make certain we discuss all of Kansas ’ s driving laws and laws as they pertain to car insurance .

If you get pulled over and receive a citation for doing something you didn ’ thyroxine know was against the law, an excuse that you didn ’ thymine know you were breaking the jurisprudence international relations and security network ’ thymine going to cut it .

To help stay safe and debar fines while driving on Kansas roads, please read the department below. No one wants their hard-earned money going towards something they could have avoided in the first place .

What are the Car Insurance Laws?

foremost, let ’ s talk about car insurance laws. How are car indemnity laws determined ? Who decides how much cable car policy should cost ?

According to the NAIC, state laws have considerable influence on car policy. Each department of state determines the type of tort police and doorsill ( if any ) that applies in the state, the type and amount of indebtedness insurance required, and the system used for blessing of insurance company rates and forms .

In accession, the states have enacted vary car induct belt requirements, intoxicated drive laws, and maximum travel rapidly limits. Kansas uses a system called phase filing. This means that rates/forms must be filed with the state insurance department prior to their use. There is a 30 sidereal day waiting period before the imprint can be put into effect.

Read more: The 7 Best Car Insurance Companies (2022)

How to Get Windshield Coverage

Some states have laws that protect drivers from having to pay to fix a break windshield. But unfortunately for Kansans, this is not a law. even though it ’ s not a jurisprudence, individual insurance companies may offer this serve to be included with comprehensive coverage .

When this feature is included in your indemnity policy, there are some laws the policy party must follow regarding windshield repairs .

- Insurance company chooses if using aftermarket parts that are of like kind and quality

- Insurance company may choose repair vendor

How to Get High-Risk Insurance

If you ’ ve recently been involved in an accident, you may have what is called bad insurance or SR22 policy. SR22 is a document frequently required by a state of matter ’ s Department of Motor Vehicles ( DMV ) proving that a driver is carrying the state ’ second required minimum amount of vehicle indebtedness insurance .

According to the DMV, a “ bad driver ” is one who has a higher potential of filing a claim on his or her car policy than the average driver .

car insurance companies often see bad drivers as undesirable, as they may end up costing them more than they make in the end. There are several reasons why an car insurance carrier might consider you bad. There is no uniform definition as to what precisely a bad driver is .

You may be required to purchase bad policy if you have been convicted of the following :

- Excessive speeding

- Illegal street racing

- Driving without a license

- Reckless driving

- Any traffic violation that results in a fatality

Be mindful that some insurance companies may refuse to cover you if you need SR22 insurance .

How to Get Low-Cost Insurance

Unless you live in California, New Jersey, or Hawaii, you will not qualify for a low-income government-assisted car policy plan. But don ’ thyroxine be discouraged by this — there are still more ways to save on your policy .

Ask your provider if you qualify for any of the following discounts :

- Military discount

- Good driver discount

- Homeowner’s discount

- Student discount

- Multi-car discount

Is There an Automobile Insurance Fraud in Kansas?

What is car indemnity fraud and how can you commit fraud in Kansas ?

According to the IIHS, Insurance imposter can be “ arduous ” or “ soft. ” Hard fraud occurs when person measuredly fabricates claims or fakes an accident .

delicate indemnity imposter, besides known as opportunist imposter, occurs when people pad legalize claims, for example, or, in the case of business owners, list fewer employees or misrepresent the knead they do to pay lower premiums for workers compensation .

The IIHS besides says that the Insurance Research Council reported that “ Auto insurance fraud and claim buildup added between $ 4.9 billion and $ 6.8 billion to car injury claim payments in 2007. ”

Don ’ thyroxine want to be under probe for car indemnity fraud ? Don ’ t pad your claims or stage an accident. Be mindful that committing policy fraud could cost you hundreds or thousands of dollars in fines and imprison time .

What’s the Statute of Limitations?

In the state of Kansas, you have a certain measure of time after an accident to file a claim with your insurance company. This law is set in locate to protect both the insurance ship’s company and the client .

You have one year to file a personal injury claim and two years to file a property damage claim. This means you have one year from the day of your accident to file a personal injury claim and two years from the day of your accident to file a property damage claim .

What are the Kansas State-Specific Laws?

There are quite a few state-specific driving laws in the country of Kansas, but what is even stranger is that there city-specific drive laws in Kansas american samoa well .

Below are two laws pertaining to Derby, Kansas :

- Persons may not “screech” their tires while driving. If caught, the driver could pay a $500 fine.

- Riding a llama down any road is against the law

In Russell, Kansas, musical car horns are banned. In Salina, Kansas, it is against the law to leave your car running neglected. In Topeka, it is illegal to drive one ’ randomness car through a parade .

In Wichita, before proceeding through the intersection of Douglas and Broadway, a motorist is required to get out of their vehicle and open fire three shotgun rounds into the air .

In Kansas City, a license is required to shave while driving and it is illegal to honk another person ’ sulfur horn .

What are the Vehicle Licensing Laws?

Have you ever heard of a REAL ID ?

To get a REAL ID, you must show your valid parentage certificate or U.S. Passport and your social security poster. By the year 2020, drivers who want to fly domestically will be required to carry a real ID to get through airport security .

You will not need a REAL ID to vote .

What are the Penalties for Driving Without Insurance?

Because it is against the law for any driver in Kansas to drive without policy, there are penalties for drivers who are caught driving without indemnity .

If you are caught driving without indemnity the first gear time, you could receive the follow penalties :

- Fine: $300 to $1000

- Confinement in jail of up to six months

- License/registration suspension

- Reinstatement fee: $100

If you are caught driving without indemnity a second gear prison term, you could receive the be penalties :

- Fine: $800 to $2500 within three years

- License/registration suspension

- reinstatement fee: $300 if revoked within the previous year, otherwise $100

Remember, if a law enforcement officer asks you to show proof of insurance, you must be fix and will to show it .

acceptable forms of proof of indemnity are :

- Valid liability insurance ID cards

- Copy of your current car’s insurance policy

- Valid insurance binder (a temporary form of car insurance)

- Picture of proof of insurance on your smartphone

The penalties for driving without car insurance are much more expensive than it costs to purchase car insurance in the beginning put ! If you are in a car accident, you can and will most probable go bankrupt from attempting to pay the indemnity costs of property wrong and medical bills .

What are the Teen Driver Laws in Kansas?

At just 14 years old, you are able to go to driving school and get a driver ’ sulfur license in the country of Kansas .

| Requirements for Getting a License in Kansas | Details | |

|---|---|---|

| Mandatory Holding Period | 12 months | |

| Minimum Supervised Driving Time | 25 hours, in learner phase; 25 hours before age 16; 10 of the 50 hours must be at night | |

| Minimum Age | 16 years old | |

| Get Your Rates Quote Now | #blank# | |

Compare RatesStart Now → You must be at least 16 years old to apply for a restrict license .

| Driver’s License Restrictions | Details | |

|---|---|---|

| Nighttime restrictions | 9 p.m. – 5 a.m. | |

| Passenger restrictions (family members excepted unless noted otherwise) | no more than one passenger younger than 18 | |

| Minimum age at which restrictions may be lifted | ||

| Nighttime restrictions | 6 months or age 17, whichever occurs first (min. age: 16, 6 mos.) | |

| Passenger restrictions | 6 months or age 17, whichever occurs first (min. age: 16, 6 mos.) | |

| Get Your Rates Quote Now | #blank# | |

Compare RatesStart Now →

What are the Driver License Renewal Procedures?

All Kansas drivers under the senesce of 65 must renew their license every six years. If you are a driver over the age of 65, you must renew your license every four years .

proof of adequate vision is required for every driver young and honest-to-god at every renewal. Drivers may not renew their license through the mail or on-line .

If you live in Kansas, you must renew your license in person at the Department of Motor Vehicles every single time. possibly that law will change soon, but for now, make an date and renew your license in person .

What’s the Procedure for New Residents?

Moving somewhere in Kansas from another state ? You must live in Kansas for 90 days before establishing residency. When applying for a Kansas driver ’ second license, you must bring proof of residency and identity and your out-of-state license with you to the DMV .

You can get a newly driver ’ s license at your local Kansas Driver ’ s Licence Station. unfortunately, services are not available on-line .

New Kansas drivers must besides make sure to contact their insurance supplier to update their indemnity policy. Minimum indebtedness policy requirements are as follows :

liability insurance :

- $25,000 per person for bodily injury (the maximum amount payable to one person for injuries resulting from an accident caused by the policyholder)

- $50,000 per accident for bodily injury (the maximum amount payable to all people injured in an accident caused by the policyholder)

- $25,000 per accident for other parties’ vehicle damage and other property loss in an accident caused by the policyholder (does not cover damage to the policyholder’s own vehicle)

Kansas jurisprudence besides requires drivers to have personal injury security policy .

- $4,500/person for medical expenses

- $900/month for one year for disability/loss of income

- $25/day for in-home services

- $2,000 for funeral, burial or cremation expense

- $4,500 for rehabilitation expense

The Kansas Insurance Department states drivers besides must have uninsured/underinsured policy .

- $25,000/person

- $50,000/accident

Looking for more ways to save on your insurance policy ? Use our free tool and enter your zip up code in the box below to get started .

What does Negligent Operator Treatment System mean?

As stated by the Kansas City Attorneys, foolhardy driving is a misdemeanor criminal offense. The law states, “ Any person who drives any vehicle in froward or wanton dismiss for the safety of persons or property is guilty of heedless drive. ”

This codified is open to interpretation on the partially of the responding policeman and could be charged when an accident has occurred and the cause of it is not obvious after the fact .

Penalties for heedless driving in Kansas are as follows :

- First offense: not less than five days nor more than 90 days of imprisonment, or fined not less than $25 nor more than $500, or both imprisonment and fine.

- Subsequent offenses: not less than 10 days nor more than six months of imprisonment, or fined not less than $50 nor more than $500, or both imprisonment and fine.

If you are caught driving in a foolhardy manner, by law, your indemnity company will find out. Your insurance rates will increase and you ’ ll be stuck paying fines. Keep a fairly read and avoid heedless driving and you ’ ll have an low-cost car indemnity rate .

What are the Rules of the Road?

How do you expect to avoid fines and dealings citations if you do not know the rules of the road ? In this following section, we want to discuss topics like buttocks belt and car seat laws, ridesharing laws, automation, and more .

If you are unfamiliar with Kansas ’ s rules of the road, pay attention because this adjacent part is for you ! Up next we ’ ll refresh your memory about at-fault and no-fault states .

Is Kansas at Fault or No-Fault State?

We previously talked about the deviation between at-fault states and no-fault states. Kansas is a no-fault state. This means that when drivers get into an accident, every driver involved in that accident is required to file a claim with his or her own insurance company .

At-fault states require the driver who caused the accident to be responsible ( at-fault party ) to cover the costs of all damages and medical bills resulting from that accident. This is another reason why car policy is significant to have .

In no-fault states like Kansas, drivers need to make sure they are constantly covered by their policy company — specially when they are involved in an accident they didn ’ deoxythymidine monophosphate cause .

What are the Seat Belt and Car Seat Laws?

Kansas wants all drivers to be safe while on the road. Look below at some of the Kansas seat belt laws .

| Seat Belt Laws | Details | |

|---|---|---|

| Effective Since | July 1, 1986 | |

| Primary Enforcement | yes; effective 6/10/10 (secondary for rear seat occupants >18) | |

| Age/Seats Applicable | 14+ years in all seats | |

| 1st Offense Max Fine | $60/no court costs: 14 -17 years; $30/no court costs: 18+ years | |

| Get Your Rates Quote Now | #blank# | |

Compare RatesStart Now → Kansas has stern car seat laws and child safety. Keep read to find out more .

| Type of Car Seat Required | Age | |

|---|---|---|

| Rear-Facing Child Restraint | all children 3 and younger must be in a child restraint | |

| Forward-Facing Child Restraint | children 4 through 7 who weigh less than 80 pounds and children 4 through 7 who are less than 57 inches tall must be in a child restraint or booster seat | |

| Adult Belt Permissible | all children 8 through 13 years; children 4 through 7 years who weigh more than 80 pounds, and children 4 through 7 years who are taller than 57 inches | |

| Maximum base fine 1st offense | $60 | |

| Preference for rear seat | law states no preference for rear seat | |

| Get Your Rates Quote Now | #blank# | |

Compare RatesStart Now → There are besides laws against riding in the cargo sphere of a fomite, i, the back of a pick-up truck .

If you are in a car accident and you were riding in the back of a pick-up truck, indemnity will not cover you if the follow applies :

- People 14 and older

- parades

- employment

- does not apply to vehicles not being operated in the state highway system or within the corporate limits of a city

Breaking these laws can cost you up to $ 60 in fines plus fees. Keep yourself and your kids safe while driving an heave up !

What are the Keep Right and Move Over Laws?

normally, if you ’ re a slow driver, you need to keep to the right of the road. Kansas submit law is a little spot different. Drivers are still required to keep right field, but left lane drive is only allowed for elapse or for turning left .

Are these laws silent applicable when it comes to emergency vehicles ?

AAA says “ Kansas state law requires drivers approaching a stationary hand brake vehicle displaying flashing lights, including tow and recovery vehicles, traveling in the same management, to vacate the lane nearest if dependable and possible to do sol, or slow to a accelerate safe for road, weather, and dealings conditions .

The law besides applies to waste collection vehicles. ”

What are the Speed Limit Laws?

Listed in the board under are the maximum speed limits for the state of Kansas. If you ’ re not paying attention to these limits, you run the hazard of getting a traffic citation .

| Type of Roadway | Speed Limit | |

|---|---|---|

| Rural Interstates | 75 mph | |

| Urban Interstates | 75 mph | |

| Other Limited Access Roads | 75 mph | |

| Other Roads | 65 mph | |

| Get Your Rates Quote Now | #blank# | |

Compare RatesStart Now →

How does Ridesharing Work?

Ridesharing indemnity is necessary when you work for a company like Uber or Lyft. When driving people around is your job, insurance companies know that because you are on the road more much than convention, you are more probably to get into an accident .

not many indemnity companies in Kansas provide ridesharing insurance, however, these crown providers do offer it :

- USAA

- Farmer’s

- Geico

- American Family

- State Farm

Keep in mind that each one of these insurance carriers offers something different, so if you ’ re thinking about becoming a personal driver, make sure to shop around for the policy that fits your needs the most .

Is There an Automation on the Road?

What is automation ? The IIHS defines automation as a vehicle that involves using radar, camera, and other sensors to perform parts or all of the drive tasks on a suffer basis rather of the driver. One exercise is adaptive cruise control, which continually adjusts the vehicle ’ s speed to maintain a set minimum following distance .

Features such as automatic brake, which acts as a back-up if the homo driver fails to brake, or blind spot detection, which provides extra data to the driver, aren ’ thymine considered automation under this definition .

presently, Kansas does not have any laws about using automation on the road, and the state is not yet testing advanced automatize vehicles .

What are the Safety Laws?

Safety laws are one of the most crucial types of laws to know when you are driving on the road. Knowing base hit laws can help you keep off accidents and injuries. In this future section, we will go over DUI laws, distracted driving laws, laws about cellular telephone call habit, and more .

Stay tuned. DUI laws are up first gear .

What are the DUI Laws?

It ’ s a unplayful crime to drink and drive in Kansas. If you breathe a .08, you are over the legal limit .

| Name for Offense | Driving under the influence (DUI) | |

|---|---|---|

| BAC Limit | 0.08 | |

| High BAC Limit | 0.15 | |

| Criminal Status | 1st class B non-person misdemeanor, 2nd class A non-person misdemeanor, 3rd+ non-person felony | |

| Look Back Period | 10 years | |

| Get Your Rates Quote Now | #blank# | |

Compare RatesStart Now → obviously, there are different degrees of penalties for driving drink. The penalty will be worse if you ’ ve been convicted of drink and driving more than one time .

| Number of Offense | ALS or Revocation | Imprisonment | Fine | Other | ||||

|---|---|---|---|---|---|---|---|---|

| 1st Offense | 30 day suspension then 330 day restriction | 48 hours mandatory OR 100 hours community service | $500-$1000 | must complete substance abuse evaluation and treatment program; vehicle can be impouded for up to 1 year | ||||

| 2nd Offense | 1 year suspension then IID for 1 year | 90 days-1 year | $1000-$1500 | must complete court ordered substance abuse program; vehicle may be impounded up to 1 year | ||||

| 3rd Offense | 1 year suspension then IID for 1 year | 90 days – 1 year | $1500-$2500 | must complete court ordered substance abuse program; vehicle may be impounded up to 1 year | ||||

| 4th Offense | 1 year suspension; court may revoke license plate or temporary registration for up to 1 year; after year is completed, IID for 1 year | 90 days-1 year | $2,500 | must complete court ordered substance abuse program; vehicle may be impounded up to 1 year | ||||

| 5th Offense | Permanantly revoked license; imprisonment and fines same as 4th; 1 year probation after imprisonment including substance abuse treatment program | |||||||

| Get Your Rates Quote Now | #blank# | #blank# | #blank# | #blank# | ||||

Compare RatesStart Now → In 2017, there were 102 alcohol-impaired fatalities resulting from drink drive. Don ’ t drink an drive .

If you get caught precisely one clock, you will surely face license suspension, imprison time, have to pay an expensive fine, and you might even need to take a repel class — not to mention every time you drink and drive you are risking your life and early people ’ south lives around you .

What are the Marijuana-Impaired Driving Laws?

There aren ’ thymine any specific laws about using marijuana while driving in Kansas, however, you can get pulled over for what is called “ impair driving ”. If you look like you ’ re under the influence of drugs while driving, a law enforcement officer may get fishy and pull you over .

If you are convicted of impair drive, you may have to pay fines and side imprison time .

What are the Distracted Driving Laws?

engineering has come a very long way, but it has besides caused a couple of issues while in the hands of a distract driver. In the express of Kansas, texting and driving is illegal – it doesn ’ t matter if you ’ re a newfangled driver or if you ’ re a professional driver. If you are caught texting and driving, you will be penalized .

| Hand-held ban | Young drivers all cellphone ban | Texting ban | Enforcement | |||

|---|---|---|---|---|---|---|

| no | learner’s permit and intermediate license holders | all drivers | primary | |||

| Get Your Rates Quote Now | #blank# | #blank# | #blank# | |||

Compare RatesStart Now → late studies have shown that the effects of texting and drive can be worse than toast and drive .

Save a animation. Don ’ metric ton text and drive ! It ’ s equitable not worth a life of guilt .

What’s Driving in Kansas like?

now that we ’ ve gone over cable car policy laws, guard laws, and rules of the road, it ’ second time to get into the risks of the road. It can be difficult trying to investigate all of the dangers and risks of the road, but if you know what they are, you are less likely to be involved in an accident .

In this section, we want to cover topics like vehicle larceny, fatality causes, and dealings congestion. If you haven ’ metric ton paid attention sol far, it ’ south time to buckle up and read through these next few points as they could save your life and save you some money in the long ply. Don ’ thyroxine go away ! We want to discuss vehicle larceny first base .

Is There a Vehicle Theft in Kansas?

Below is a table showing the circus tent ten most steal vehicles in Kansas .

| Make/Model | Year of Vehicle Most Stolen | Number of Thefts | ||

|---|---|---|---|---|

| Chevrolet Pickup (Full Size) | 1999 | 439 | ||

| Ford Pickup (Full Size) | 2003 | 415 | ||

| Honda Accord | 1996 | 319 | ||

| Honda Civic | 2000 | 220 | ||

| Dodge Pickup (Full Size) | 2001 | 160 | ||

| GMC Pickup (Full Size) | 1999 | 113 | ||

| Chevrolet Impala | 2004 | 98 | ||

| Dodge Caravan | 2002 | 89 | ||

| Jeep Cherokee/Grand Cherokee | 2000 | 89 | ||

| Chevrolet Pickup (Small Size) | 1998 | 88 | ||

| Get Your Rates Quote Now | #blank# | #blank# | ||

Compare RatesStart Now → According to this number, the 1999 Chevy cartridge is the most frequently stolen fomite in Kansas .

The data from the table below is pulled directly from the FBI. Vehicle larceny is intelligibly more common in some cities than it is in others. Find your city on the list and see how many vehicle thefts there were in the year 2016 .

FBI Theft Stats in Kansas

| City | Motor vehicle theft |

|

|---|---|---|

| Abilene | 5 | |

| Andale | 0 | |

| Andover | 9 | |

| Anthony | 1 | |

| Arkansas City | 24 | |

| Arma | 3 | |

| Assaria | 0 | |

| Atchison | 15 | |

| Atwood | 1 | |

| Auburn | 0 | |

| Augusta | 13 | |

| Basehor | 1 | |

| Baxter Springs | 4 | |

| Bel Aire | 2 | |

| Beloit | 2 | |

| Benton | 0 | |

| Bronson | 0 | |

| Bucklin | 0 | |

| Burden | 1 | |

| Burlington | 2 | |

| Clay Center | 3 | |

| Clearwater | 1 | |

| Coffeyville3 | 34 | |

| Colby | 6 | |

| Columbus | 5 | |

| Colwich | 1 | |

| Concordia3 | 10 | |

| Conway Springs | 2 | |

| Council Grove | 3 | |

| Delphos | 0 | |

| Derby | 23 | |

| Dodge City | 41 | |

| Eastborough | 0 | |

| Edwardsville | 13 | |

| El Dorado | 40 | |

| Elkhart | 1 | |

| Ellinwood | 2 | |

| Ellis | 0 | |

| Ellsworth | 4 | |

| Elwood | 4 | |

| Emporia | 17 | |

| Fairway | 2 | |

| Fort Scott | 25 | |

| Frontenac | 7 | |

| Galena | 4 | |

| Garden City | 25 | |

| Garnett | 3 | |

| Girard | 4 | |

| Goddard | 4 | |

| Grandview Plaza | 3 | |

| Great Bend | 28 | |

| Greensburg | 0 | |

| Halstead | 2 | |

| Haven | 1 | |

| Havensville | 0 | |

| Hays | 26 | |

| Haysville | 17 | |

| Herington | 8 | |

| Hesston | 2 | |

| Hiawatha | 9 | |

| Highland | 2 | |

| Hillsboro | 0 | |

| Holcomb | 3 | |

| Holton | 6 | |

| Horton | 1 | |

| Hugoton | 0 | |

| Independence | 17 | |

| Inman | 1 | |

| Iola | 12 | |

| Junction City | 26 | |

| Kanopolis | 0 | |

| Kingman | 2 | |

| Lake Quivira | 0 | |

| Lansing | 12 | |

| Larned | 3 | |

| Leavenworth3 | 102 | |

| Leawood | 22 | |

| Lenexa | 95 | |

| Lindsborg | 0 | |

| Louisburg | 3 | |

| Maize | 12 | |

| Marysville | 11 | |

| Meade | 0 | |

| Medicine Lodge | 1 | |

| Merriam | 98 | |

| Minneapolis | 1 | |

| Mission | 55 | |

| Mission Hills | 5 | |

| Moran | 0 | |

| Mulvane | 7 | |

| Neodesha | 2 | |

| Newton | 23 | |

| North Newton | 0 | |

| Norton | 3 | |

| Nortonville | 0 | |

| Oakley | 0 | |

| Olathe | 160 | |

| Osage City | 3 | |

| Osawatomie | 3 | |

| Osborne | 3 | |

| Oswego | 0 | |

| Ottawa | 19 | |

| Overland Park | 320 | |

| Paola | 7 | |

| Park City | 19 | |

| Parsons | 19 | |

| Peabody | 5 | |

| Plainville | 0 | |

| Prairie Village | 26 | |

| Pratt | 10 | |

| Russell3 | 7 | |

| Sabetha | 1 | |

| Salina | 129 | |

| Scott City | 2 | |

| Shawnee | 146 | |

| Stafford | 0 | |

| Sterling | 2 | |

| St. Francis | 2 | |

| St. George | 1 | |

| St. John | 1 | |

| St. Marys | 4 | |

| Tonganoxie | 4 | |

| Topeka | 807 | |

| Ulysses | 2 | |

| Valley Center | 4 | |

| Valley Falls | 1 | |

| Wellington3 | 26 | |

| Wellsville | 2 | |

| Westwood | 2 | |

| Wichita | 2,188 | |

| Winfield | 31 | |

| Yates Center | 2 | |

| Get Your Rates Quote Now | #blank# | |

Compare RatesStart Now →

What’s the Number of Road Fatalities in Kansas?

It ’ second time to get into a topic that is a little more unplayful : road fatalities. What causes them ? Is it the weather ? Do impaired drivers cause the most traffic fatalities ? Is it EMS response time ? What can we do to prevent them ?

What’s the Number of Fatal Crashes by Weather Condition and Light Condition?

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Normal | 50 | 7 | 29 | 5 | 0 | 91 | ||||||

| Rain | 7 | 5 | 9 | 1 | 0 | 22 | ||||||

| Snow/Sleet | 3 | 0 | 2 | 0 | 0 | 5 | ||||||

| Other | 8 | 1 | 4 | 3 | 0 | 16 | ||||||

| Unknown | 141 | 33 | 81 | 18 | 0 | 273 | ||||||

| TOTAL | 209 | 46 | 125 | 27 | 0 | 407 | ||||||

| Get Your Rates Quote Now | #blank# | #blank# | #blank# | #blank# | #blank# | #blank# | ||||||

Compare RatesStart Now → According to the data above, most of these fatal crashes happened in broad daylight. Some happened at night in the darkness. For the most part, the weather very didn ’ deoxythymidine monophosphate have an effect on traffic fatalities in Kansas .

What’s the Number of Fatalities (All Crashes) by County?

Some fatal crashes happen more frequently in some counties than they do in others. This factor could be based on placement. Some counties might be further away from emergency services than others and help takes longer to arrive .

| County Name | Fatalities 2013 |

2014 | 2015 | 2016 | 2017 | Fatalities Per 100K Population 2013 |

2014 | 2015 | 2016 | 2017 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Allen County | 3 | 2 | 1 | 3 | 6 | 22.98 | 15.53 | 7.9 | 23.72 | 47.93 | ||||||||||

| Anderson County | 2 | 2 | 2 | 2 | 7 | 25.46 | 25.37 | 25.59 | 25.6 | 89.37 | ||||||||||

| Atchison County | 0 | 3 | 2 | 1 | 1 | 0 | 18.16 | 12.18 | 6.11 | 6.12 | ||||||||||

| Barber County | 1 | 1 | 0 | 0 | 4 | 20.35 | 20.47 | 0 | 0 | 87.22 | ||||||||||

| Barton County | 4 | 3 | 5 | 3 | 7 | 14.57 | 10.98 | 18.41 | 11.15 | 26.44 | ||||||||||

| Bourbon County | 7 | 0 | 2 | 1 | 1 | 47.21 | 0 | 13.57 | 6.82 | 6.78 | ||||||||||

| Brown County | 1 | 2 | 0 | 5 | 5 | 10.09 | 20.44 | 0 | 51.86 | 51.86 | ||||||||||

| Butler County | 12 | 7 | 11 | 9 | 12 | 18.28 | 10.63 | 16.6 | 13.5 | 17.94 | ||||||||||

| Chase County | 1 | 2 | 4 | 4 | 2 | 37.19 | 75.39 | 150.72 | 151.29 | 74.54 | ||||||||||

| Chautauqua County | 3 | 1 | 4 | 0 | 0 | 84.96 | 28.91 | 118.03 | 0 | 0 | ||||||||||

| Cherokee County | 10 | 5 | 6 | 4 | 3 | 47.86 | 24.09 | 29.24 | 19.78 | 14.91 | ||||||||||

| Cheyenne County | 0 | 0 | 1 | 1 | 0 | 0 | 0 | 37.41 | 37.44 | 0 | ||||||||||

| Clark County | 1 | 0 | 0 | 1 | 1 | 45.89 | 0 | 0 | 48.43 | 49.9 | ||||||||||

| Clay County | 0 | 1 | 2 | 1 | 4 | 0 | 12.05 | 24.11 | 12.38 | 50.26 | ||||||||||

| Cloud County | 3 | 5 | 1 | 3 | 2 | 32.09 | 53.61 | 10.89 | 32.97 | 22.24 | ||||||||||

| Coffey County | 4 | 1 | 1 | 1 | 2 | 47.74 | 11.91 | 12.06 | 11.98 | 24.32 | ||||||||||

| Comanche County | 0 | 0 | 0 | 0 | 3 | 0 | 0 | 0 | 0 | 167.6 | ||||||||||

| Cowley County | 5 | 5 | 5 | 4 | 7 | 13.83 | 13.95 | 14.01 | 11.23 | 19.8 | ||||||||||

| Crawford County | 4 | 4 | 4 | 9 | 6 | 10.2 | 10.2 | 10.25 | 23.08 | 15.37 | ||||||||||

| Decatur County | 1 | 0 | 1 | 0 | 1 | 34.39 | 0 | 34.19 | 0 | 34.66 | ||||||||||

| Dickinson County | 2 | 3 | 4 | 2 | 6 | 10.3 | 15.54 | 20.83 | 10.54 | 31.74 | ||||||||||

| Doniphan County | 0 | 2 | 2 | 2 | 2 | 0 | 25.51 | 25.69 | 25.88 | 25.88 | ||||||||||

| Douglas County | 6 | 8 | 7 | 5 | 10 | 5.24 | 6.88 | 5.94 | 4.18 | 8.28 | ||||||||||

| Edwards County | 0 | 1 | 0 | 0 | 5 | 0 | 33.13 | 0 | 0 | 172.83 | ||||||||||

| Elk County | 1 | 1 | 2 | 1 | 0 | 37.98 | 37.12 | 77.79 | 39.82 | 0 | ||||||||||

| Ellis County | 7 | 5 | 1 | 2 | 5 | 24.13 | 17.28 | 3.46 | 6.94 | 17.43 | ||||||||||

| Ellsworth County | 5 | 4 | 2 | 0 | 2 | 78.58 | 63.03 | 31.72 | 0 | 31.6 | ||||||||||

| Finney County | 4 | 8 | 5 | 6 | 2 | 10.79 | 21.54 | 13.44 | 16.22 | 5.39 | ||||||||||

| Ford County | 5 | 3 | 7 | 4 | 11 | 14.31 | 8.6 | 20.24 | 11.59 | 31.99 | ||||||||||

| Franklin County | 2 | 4 | 3 | 10 | 7 | 7.77 | 15.67 | 11.78 | 39.14 | 27.2 | ||||||||||

| Geary County | 2 | 2 | 4 | 7 | 4 | 5.44 | 5.49 | 10.9 | 19.88 | 11.82 | ||||||||||

| Gove County | 0 | 0 | 4 | 2 | 4 | 0 | 0 | 147.98 | 76.05 | 152.03 | ||||||||||

| Graham County | 1 | 0 | 0 | 0 | 0 | 38.58 | 0 | 0 | 0 | 0 | ||||||||||

| Grant County | 0 | 1 | 3 | 1 | 0 | 0 | 12.83 | 38.82 | 13.01 | 0 | ||||||||||

| Gray County | 4 | 0 | 2 | 4 | 4 | 66.87 | 0 | 33.06 | 66.89 | 67.14 | ||||||||||

| Greeley County | 2 | 1 | 0 | 1 | 1 | 155.88 | 76.86 | 0 | 78.13 | 80.06 | ||||||||||

| Greenwood County | 2 | 4 | 2 | 7 | 8 | 31.46 | 63.61 | 32.09 | 114.16 | 130.65 | ||||||||||

| Hamilton County | 1 | 2 | 1 | 0 | 0 | 38.04 | 75.56 | 39.05 | 0 | 0 | ||||||||||

| Harper County | 0 | 2 | 2 | 2 | 5 | 0 | 34.29 | 34.58 | 35.21 | 89.45 | ||||||||||

| Harvey County | 3 | 5 | 7 | 1 | 3 | 8.64 | 14.46 | 20.12 | 2.88 | 8.68 | ||||||||||

| Haskell County | 0 | 0 | 1 | 0 | 2 | 0 | 0 | 24.44 | 0 | 49.35 | ||||||||||

| Hodgeman County | 2 | 0 | 4 | 0 | 1 | 103.9 | 0 | 214.36 | 0 | 54.29 | ||||||||||

| Jackson County | 2 | 4 | 4 | 2 | 6 | 15.03 | 29.77 | 30.11 | 15.08 | 45.05 | ||||||||||

| Jefferson County | 1 | 9 | 7 | 9 | 6 | 5.32 | 47.82 | 37.21 | 47.73 | 31.58 | ||||||||||

| Jewell County | 0 | 0 | 1 | 0 | 1 | 0 | 0 | 33.72 | 0 | 35.09 | ||||||||||

| Johnson County | 23 | 21 | 24 | 30 | 33 | 4.06 | 3.67 | 4.15 | 5.13 | 5.58 | ||||||||||

| Kearny County | 1 | 2 | 0 | 3 | 1 | 25.51 | 50.77 | 0 | 76.92 | 25.25 | ||||||||||

| Kingman County | 2 | 0 | 2 | 1 | 0 | 25.64 | 0 | 26.22 | 13.49 | 0 | ||||||||||

| Kiowa County | 0 | 3 | 0 | 1 | 2 | 0 | 118.62 | 0 | 39.94 | 80.48 | ||||||||||

| Labette County | 7 | 7 | 4 | 5 | 4 | 33.53 | 33.68 | 19.39 | 24.59 | 19.86 | ||||||||||

| Lane County | 0 | 0 | 1 | 2 | 0 | 0 | 0 | 61.35 | 125 | 0 | ||||||||||

| Leavenworth County | 9 | 7 | 10 | 12 | 13 | 11.53 | 8.92 | 12.66 | 14.98 | 16.03 | ||||||||||

| Lincoln County | 0 | 1 | 0 | 0 | 0 | 0 | 31.43 | 0 | 0 | 0 | ||||||||||

| Linn County | 1 | 4 | 0 | 0 | 2 | 10.48 | 41.95 | 0 | 0 | 20.56 | ||||||||||

| Logan County | 1 | 1 | 1 | 0 | 2 | 36.09 | 36.18 | 35.96 | 0 | 70.9 | ||||||||||

| Lyon County | 4 | 3 | 3 | 3 | 2 | 11.95 | 9.05 | 9.06 | 8.98 | 5.99 | ||||||||||

| Marion County | 1 | 6 | 4 | 2 | 7 | 8.2 | 49.25 | 33.21 | 16.64 | 58.4 | ||||||||||

| Marshall County | 1 | 4 | 1 | 2 | 1 | 10.03 | 40.24 | 10.16 | 20.41 | 10.26 | ||||||||||

| Mcpherson County | 4 | 4 | 6 | 8 | 3 | 13.62 | 13.86 | 20.97 | 28.17 | 10.45 | ||||||||||

| Meade County | 2 | 3 | 0 | 2 | 6 | 46.67 | 69.06 | 0 | 47.05 | 139.44 | ||||||||||

| Miami County | 6 | 4 | 8 | 4 | 5 | 18.27 | 12.17 | 24.43 | 12.13 | 14.94 | ||||||||||

| Mitchell County | 1 | 2 | 0 | 2 | 2 | 15.86 | 32.03 | 0 | 32.33 | 32.64 | ||||||||||

| Montgomery County | 4 | 13 | 4 | 11 | 9 | 11.61 | 38.16 | 11.98 | 33.47 | 27.64 | ||||||||||

| Morris County | 2 | 1 | 3 | 3 | 3 | 34.96 | 17.65 | 53.34 | 54 | 55 | ||||||||||

| Morton County | 1 | 2 | 0 | 2 | 0 | 32.06 | 65.68 | 0 | 71.43 | 0 | ||||||||||

| Nemaha County | 1 | 0 | 3 | 3 | 1 | 9.91 | 0 | 29.76 | 29.7 | 9.88 | ||||||||||

| Neosho County | 0 | 5 | 3 | 2 | 3 | 0 | 30.62 | 18.45 | 12.45 | 18.73 | ||||||||||

| Ness County | 3 | 1 | 2 | 0 | 3 | 97.18 | 32.46 | 66.45 | 0 | 104.57 | ||||||||||

| Norton County | 2 | 0 | 0 | 2 | 2 | 35.63 | 0 | 0 | 36.32 | 36.76 | ||||||||||

| Osage County | 5 | 8 | 2 | 4 | 3 | 31.09 | 50.1 | 12.61 | 25.33 | 19.02 | ||||||||||

| Osborne County | 1 | 2 | 1 | 1 | 0 | 26.34 | 53.33 | 27.46 | 27.59 | 0 | ||||||||||

| Ottawa County | 4 | 3 | 1 | 3 | 0 | 66.19 | 49.77 | 16.85 | 50.68 | 0 | ||||||||||

| Pawnee County | 2 | 3 | 1 | 0 | 2 | 29.14 | 43.97 | 14.77 | 0 | 29.94 | ||||||||||

| Phillips County | 3 | 2 | 2 | 0 | 2 | 53.96 | 36.4 | 36.93 | 0 | 37.24 | ||||||||||

| Pottawatomie County | 0 | 5 | 3 | 1 | 9 | 0 | 21.98 | 12.98 | 4.24 | 37.64 | ||||||||||

| Pratt County | 5 | 2 | 6 | 1 | 1 | 51.11 | 20.49 | 61.95 | 10.45 | 10.47 | ||||||||||

| Rawlins County | 1 | 0 | 1 | 1 | 2 | 39.06 | 0 | 39.94 | 39.98 | 80.1 | ||||||||||

| Reno County | 6 | 9 | 4 | 14 | 9 | 9.36 | 14.13 | 6.3 | 22.21 | 14.4 | ||||||||||

| Republic County | 1 | 0 | 2 | 1 | 0 | 20.98 | 0 | 42.73 | 21.5 | 0 | ||||||||||

| Rice County | 3 | 2 | 3 | 2 | 1 | 30.07 | 20.06 | 30.23 | 20.39 | 10.35 | ||||||||||

| Riley County | 11 | 3 | 6 | 4 | 3 | 14.32 | 3.93 | 7.83 | 5.37 | 4.04 | ||||||||||

| Rooks County | 2 | 2 | 0 | 3 | 0 | 38.51 | 38.43 | 0 | 58.59 | 0 | ||||||||||

| Rush County | 1 | 2 | 0 | 2 | 2 | 31.47 | 63.25 | 0 | 65.06 | 64.45 | ||||||||||

| Russell County | 0 | 1 | 3 | 4 | 2 | 0 | 14.27 | 42.58 | 57.22 | 28.92 | ||||||||||

| Saline County | 6 | 4 | 6 | 13 | 4 | 10.75 | 7.2 | 10.81 | 23.61 | 7.31 | ||||||||||

| Scott County | 1 | 0 | 0 | 1 | 0 | 20.23 | 0 | 0 | 19.96 | 0 | ||||||||||

| Sedgwick County | 45 | 50 | 50 | 57 | 57 | 8.89 | 9.82 | 9.79 | 11.12 | 11.1 | ||||||||||

| Seward County | 2 | 10 | 3 | 7 | 4 | 8.56 | 42.92 | 12.95 | 30.76 | 18.05 | ||||||||||

| Shawnee County | 12 | 22 | 12 | 32 | 15 | 6.72 | 12.33 | 6.72 | 17.96 | 8.42 | ||||||||||

| Sheridan County | 3 | 3 | 3 | 1 | 2 | 120 | 119.86 | 121.21 | 40.29 | 79.15 | ||||||||||

| Sherman County | 3 | 1 | 0 | 8 | 2 | 49.25 | 16.48 | 0 | 134.57 | 33.73 | ||||||||||

| Smith County | 2 | 0 | 1 | 1 | 1 | 54.07 | 0 | 27.1 | 27.19 | 27.26 | ||||||||||

| Stafford County | 2 | 0 | 1 | 3 | 0 | 46.05 | 0 | 23.7 | 71.43 | 0 | ||||||||||

| Stanton County | 0 | 0 | 0 | 1 | 2 | 0 | 0 | 0 | 47.62 | 97.09 | ||||||||||

| Stevens County | 5 | 4 | 2 | 0 | 2 | 85.93 | 68.6 | 34.57 | 0 | 35.64 | ||||||||||

| Sumner County | 5 | 6 | 2 | 10 | 7 | 21.24 | 25.66 | 8.54 | 43.1 | 30.23 | ||||||||||

| Thomas County | 2 | 4 | 2 | 2 | 2 | 25.21 | 51.1 | 25.4 | 25.6 | 25.68 | ||||||||||

| Trego County | 2 | 5 | 2 | 1 | 3 | 67.91 | 172.71 | 68.82 | 34.93 | 104.02 | ||||||||||

| Wabaunsee County | 3 | 1 | 2 | 5 | 4 | 42.74 | 14.43 | 29.1 | 72.57 | 58.19 | ||||||||||

| Wallace County | 0 | 0 | 2 | 0 | 0 | 0 | 0 | 132.8 | 0 | 0 | ||||||||||

| Washington County | 5 | 1 | 1 | 2 | 0 | 88.84 | 17.82 | 17.96 | 35.92 | 0 | ||||||||||

| Wichita County | 2 | 4 | 1 | 0 | 2 | 91.32 | 183.4 | 46.3 | 0 | 94.12 | ||||||||||

| Wilson County | 1 | 3 | 5 | 1 | 5 | 11 | 33.42 | 56.48 | 11.5 | 57.64 | ||||||||||

| Woodson County | 0 | 0 | 1 | 1 | 0 | 0 | 0 | 31.8 | 31.3 | 0 | ||||||||||

| Wyandotte County | 14 | 16 | 18 | 22 | 40 | 8.7 | 9.87 | 11.02 | 13.38 | 24.2 | ||||||||||

| Get Your Rates Quote Now | #blank# | #blank# | #blank# | #blank# | #blank# | #blank# | #blank# | #blank# | #blank# | #blank# | ||||||||||

Compare RatesStart Now →

What’s the Number of Traffic Fatalities Rural vs Urban?

To our point in the section above, there are many more fatalities in rural areas than there are in urban areas .

| Area | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 295 | 315 | 345 | 314 | 326 | 271 | 298 | 276 | 322 | 316 | ||||||||||

| Urban | 89 | 71 | 86 | 72 | 79 | 79 | 87 | 79 | 105 | 144 | ||||||||||

| Total | 384 | 386 | 431 | 386 | 405 | 350 | 385 | 355 | 429 | 461 | ||||||||||

| Get Your Rates Quote Now | #blank# | #blank# | #blank# | #blank# | #blank# | #blank# | #blank# | #blank# | #blank# | #blank# | ||||||||||

Compare RatesStart Now →

What’s the Number of Fatalities by Person Type?

What kinds of vehicles are most frequently involved in traffic fatalities ?

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Occupants | Passenger Car | 111 | 136 | 136 | 151 | 157 | ||||||

| Light Truck – Pickup | 75 | 86 | 58 | 74 | 86 | |||||||

| Light Truck – Utility | 63 | 58 | 48 | 64 | 72 | |||||||

| Light Truck – Van | 14 | 16 | 14 | 21 | 28 | |||||||

| Light Truck – Other | 2 | 0 | 0 | 2 | 1 | |||||||

| Large Truck | 12 | 4 | 16 | 14 | 13 | |||||||

| Bus | 1 | 0 | 0 | 0 | 0 | |||||||

| Other/Unknown Occupants | 5 | 7 | 11 | 5 | 9 | |||||||