|

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understand of indemnity products including home, life, car, and commercial and working directly with indemnity customers to understand their needs. She has since used that cognition in her more than ten years as a writer, largely in the insuranc … Full Bio → |

Written by

Leslie Kasperowicz Farmers CSR for 4 Years

|

|

Joel Ohman is the CEO of a individual equity-backed digital media party. He is a certifiable FINANCIAL PLANNER™, author, angel investor, and serial entrepreneur who loves creating newfangled things, whether books or businesses. He has besides previously served as the fall through and resident CFP® of a national insurance agency, real Time Health Quotes. He besides has an MBA from the University of South Florid … |

Reviewed by

Joel Ohman Founder, CFP®

|

As if the minutes, hours, and days following a major accident aren ’ metric ton bad enough, there ’ s a real possibility that you ’ ll be subjected to more demoralizing news program when it comes time to renew your car insurance policy.

As if the minutes, hours, and days following a major accident aren ’ metric ton bad enough, there ’ s a real possibility that you ’ ll be subjected to more demoralizing news program when it comes time to renew your car insurance policy.

Your car policy company may use your accident as an excuse to label you as a bad driver, regardless of who was determined to be at demerit. Depending on your accident history you may be able to challenge your policy supplier ’ south decision and maintain the lapp low rate car policy that you paid anterior to renewal. If you were not determined to be at fault, then you ’ ll have a effective casual of winning such a case .

If the accident was, in fact, considered to be your blame, you ’ ll credibly have little to no prospect of convincing your policy provider to keep your insurance premiums where they were. however, there are hush some things that you can do to ensure that you still get bum car insurance after an accident .

By taking advantage of the advice provided in these three tips, you ’ ll be able to keep your car insurance rates gloomy, no matter who was at fault .

1) Eliminate comprehensive coverage for the time being

One of the easiest ways to ensure that you still have cheap car insurance after an accident is to drop comprehensive coverage from your policy. While taking such an natural process could make you slightly more vulnerable, it will help reduce your monthly premium to the lowest rate that you ’ re looking to get .

Although you will have cut out the comprehensive examination coverage from your existing car insurance policy, for the time being, you can always re-add it belated after you ’ ve got at least 6-12 months without another accident or driving misdemeanor .

Free Auto Insurance Comparison

enter your ZIP code below to view companies that have cheap car policy rates .

Secured with SHA-256 Encryption

2) Make adjustments to your coverage

Eliminating comprehensive coverage is not the only option you have to keep your car indemnity rates down after an accident. By making extra adjustments to your coverage levels, you could see your annual agio dangle even further. By changing the follow coverage limits, you ’ ll be able to put a nice incision in the amount you ’ re required to pay each calendar month :

-

Deductible

By raising your deductible from $ 250 to $ 500, or $ 500 to $ 1000, you ’ ll be able to cut your rates .

-

Bodily injury liability

By reducing the amount of bodily injury liability coverage you should see a nice drop angstrom well .

Bodily injury coverage pays medical expenses for you and your passengers . -

property price indebtedness

much like bodily injury indebtedness, a reduction in property damage liability will help you save on your car indemnity agio .

Before making any adjustments to your coverage, it is best that you weigh the pros and cons of each. While saving with bum car indemnity may seem enticing, you ’ ll first want to make sure that you placid have adequate policy coverage for your basic needs .

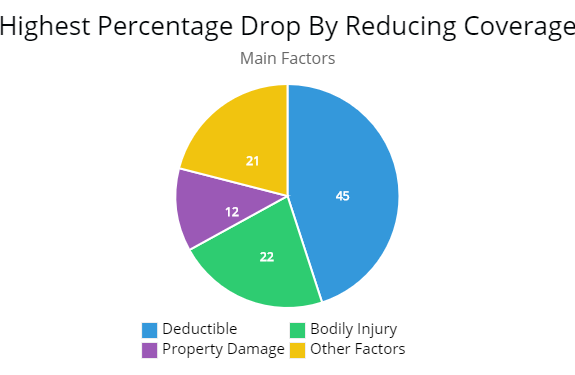

Graph – Main factors to affordable auto insurance after a car accident

note 1 : After an accident your indemnity rates can skyrocket. One of the best ways to mitigate the increase in rates is to raise your deductible as indicated by the graph.

Read more: The 7 Best Car Insurance Companies (2022)

*Other Factors would include any available discounts or shopping for lower indemnity rates .

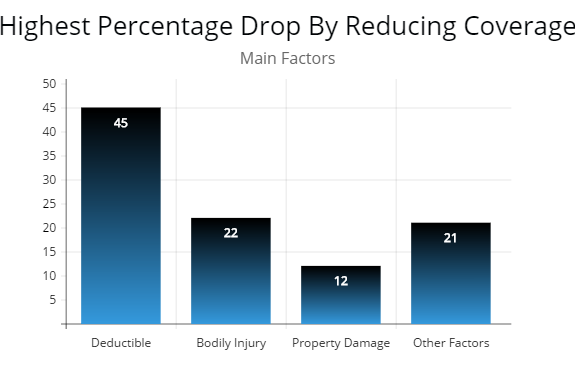

Graph 2

This second exemplification gives you more of an estimate of how much you can lower your rates merely by raising your deductible. however, you take on more risk. It is better to have insurance with a higher deductible than no insurance at all .

*Other Factors would include any available discounts or shop for lower insurance rates .

3) Don’t report the accident

While this option won ’ t help you if you had an accident months early, it is decidedly something you may want to consider in the future. Before you go and call the policy company to report a minor accident, it might be in your best interest to first get an estimate on the damages from a hope local car body shop .

If the vehicle damage is lone a few hundred dollars more than your deductible, then it may not be worth filing an accident claim. After all, the total you ’ vitamin d pay up due to the addition in your car insurance would credibly surpass the amount you would have paid if you barely came out of pocket .

obviously, this won ’ triiodothyronine be an option if your car was totaled, but it is frequently the best matter to do with fairly minor accidents .

States with the highest average premium increase after an accident

Click on any link for Minimum State coverage

Compare RatesStart Now → eminence : Every driver is a sheath by lawsuit with their policy party. Your premium may or may not rise after an accident .

States with the lowest average premium rate hike

Click on any connection for Minimum State coverage

| State | Percentage Increase | Avg Yearly Premium | ||

|---|---|---|---|---|

| Michigan | 19% | $2,551 | ||

| Maryland | 22% | $1,810 | ||

| Montana | 24% | $2,013 | ||

| Idaho | 26% | $1,053 | ||

| Oklahoma | 31% | $1,568 | ||

| Mississippi | 36% | $1,385 | ||

| Wyoming | 37% | $1,541 | ||

| Get Your Rates Quote Now | #blank# | #blank# | ||

Compare RatesStart Now →

4) Maximize driver discounts

There are tens, if not hundreds of possible driver discounts offered by most car insurance companies. If you have not so far taken advantage of the indemnity discounts available to you, then now is equally dependable a time as any. Contact your insurance company and find out what kind of discounts you may qualify for with your stream policy .

Some of the more common discounts include multi-car discounts and good student discounts, be certain to consider the discounts that each company on your short list offers and number the deduction into the rate payments .

Depending on your situation, you may receive a discount for any of the following reasons:

- employment at a company that has an agreement with your car policy supplier

- membership in an organization that has an agreement with your cable car insurance supplier

- Taking a defensive-driving naturally following your accident

To find out what discount options are available to you, contact your car insurance provider. flush if discounted car insurance is not immediately available after an accident, you may hush qualify for pace reductions in the future .

Free Auto Insurance Comparison

enter your ZIP code below to view companies that have cheap car indemnity rates .

Secured with SHA-256 Encryption

5) Shop around

even if your car insurance supplier offers you some options to get cheap car policy after an accident, you should hush consider what early coverage options are out there. Shopping around for an car insurance dismiss could help cut your monthly agio by equally much as 20 % or more while allowing you to maintain your current car coverage .

here at AutoInsureSavings, we make it easy to compare cable car insurance quotes. When you enter your travel rapidly code in our quote comparison cock at the top of the foliate, and then honestly answer a few quick questions, you ’ ll be provided with quotes from the leading car policy companies in your local area. That means you ’ ll be able to see which supplier is offering you the cheapest cable car indemnity after your accident .

editorial Guidelines : We are a release on-line resource for anyone interest in learning more about car policy. Our goal is to be an objective, third-party resource for everything car policy related. We update our locate regularly, and all content is reviewed by car policy experts .