We gathered some of the best car insurance policy arsenic well as give some brief car insurance in the philippines reviews so that you can shop for to protect your cars .

Get free insurance quote

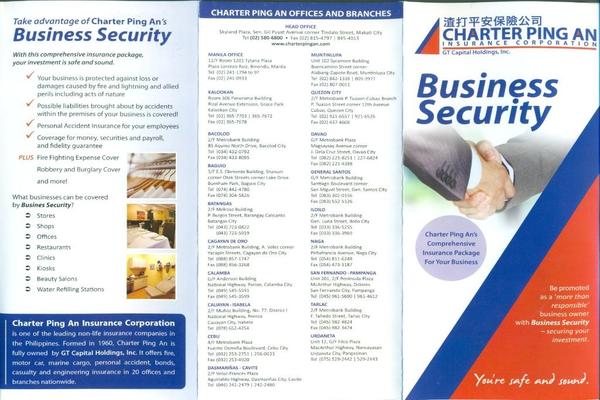

1. Best car insurance in the Philippines: Charter Ping An Insurance Corporation

Charter Ping An is a auxiliary of AXA Life policy Corporation in the Philippines. This company offers non-life insurance services that include drive car, fire, marine, personal accident, casualty, bonds and even engineering policy products. The follow are some of the coverage and services they provide :

- Acts of nature

- Compulsory Third-Party Liability or most popularly known as CTPL

- Unnamed Passenger Personal accident or UPPA

- Excess bodily injury

- Overturning and malicious damage

- Property damage

- Theft

- Fire and explosion

- Accidental collision

Charter Ping An is a auxiliary of AXA Life insurance Corporation in the Philippines

note that some of these are available as options alone. The premiums on a Charter Ping An cable car insurance policy begin at Php 15,600+ per class .

2. Best car insurance in Philippines: Malayan Insurance Company, Inc.

Malayan was founded in 1930 in the city of Manila and was once known as the China Insurance and Surety Company. It is presently operating as a subordinate of the Yuchengco Group of Companies .

The surveil are the policy coverage and services they provide :

- Third-Party Liability Cover

- Own damage

- Loss of use cover

- Personal accident cover

- Acts of God Protection

- Standard automobile accessories protection

- Strikes, riots, and civil commotion coverage

malay Insurance Company Inc. was once known as the China Insurance and Surety Company

comprehensive car indemnity premiums with the Malayan Insurance Company, Inc. started at Php 23,000+ per year .

>>> Read more: 10 must-know things to consider before buying car insurance in the Philippines.

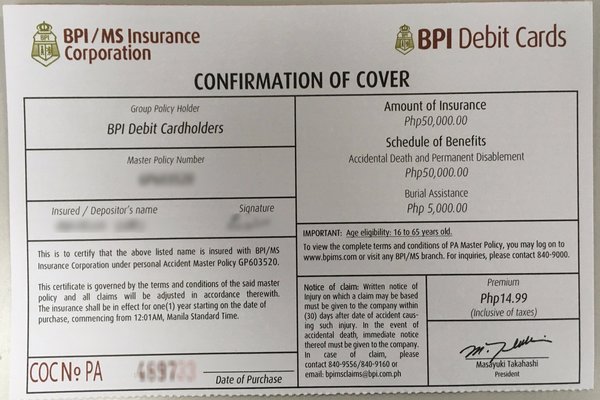

3. Best car insurance Philippines: BPI/MS Insurance Company

The BPI/MS Insurance Corporation is a joint speculation between the Bank of the Philippine Islands and Mitsui Sumitomo Insurance, one of Japan ’ s biggest non-life policy companies. BPI/MS specializes in underwriting for health and accident policy. The trace are some of the services they provide :

- Voluntary Third-Party Liability-Bodily Injury or VTPL-BI

- Compulsory Third-Party Liability or most popularly known as CTPL

- Theft

- Accidental collision

- Free Express Roadside Assistance

- Fire, lightning, explosion, self-ignition and malicious damage

BPI/MS Insurance Corporation is a articulation speculation between the Bank of Philippine Islands and Mitsui Sumitomo Insurance

note that some of the above services are available as options only .

4. Best car insurance Philippines: FPG Insurance Co., Inc. (Federal Phoenix)

Founded in 1958, this company operates as a subordinate of the Zuellig Group. Some of the indemnity services they provide are the keep up :

- Theft

- Own damage

- Voluntary Third-Party Liability-Bodily Injury or VTPL-BI

- Compulsory Third-Party Liability or most popularly known as CTPL

- Accidental death and disablement benefits for both the passengers and driver

- Acts of Nature

- Medical expenses of Actual in/out-patient which is a result of an accident

- Burial expenses coverage

- Additional protection for surgical treatment as a result of a covered accident

FPG Insurance was founded in the year 1958 and operates as a subordinate of Zuellig Group

The cost of car indemnity premiums with the FPG Insurance Co., Inc. starts at Php 15,000+ per year.

>>> Also check: 10 add-ons must-have for your car insurance policy.

5. Best car insurance Philippines: Pioneer Insurance & Surety Corporation

Pioneer was established in 1954. In terms of written gross premiums and total assets, this policy provider was one of the top indemnity companies earlier in the ten .

Some of the insurance services they provide are the follow :

- Theft

- Own damage

- Compulsory Third-Party Liability or most popularly known as CTPL

- Excess Third-Party Liability – Death/Bodily injury

- Excess Third-Party Liability – Property Damage

- Passenger’s Accident insurance

- Acts of Nature Cover or often called AON

- Personal Effects

- Loss of Use

Pioneer indemnity company was established in the year 1954

notice that some of the given is available as an option only .

6. Best car insurance Philippines: Commonwealth Insurance Company (CIC)

This car insurance company in the Philippine s began in 1953 under Don Andres Soriano, who besides expanded the original San Miguel Brewery into the contemporary San Miguel Corporation. The follow are some of the coverage and services they provide :

- Acts of Nature

- Carnapping

- Bodily injury

- Own Damage

- Property Damage

- Personal Accident

- Third-Party Liability

commonwealth Insurance Company ( CIC ) began in 1953 under Don Andres Soriano

agio cable car insurance policies of the Commonwealth Insurance Company start at Php 16,300+ per year .

>>> Must read: What kind of car insurance in the Philippines fit you the most?

7. Best cheap car insurance Philippines: Standard Insurance Company Inc.

operate as a non-life policy company, Standard Insurance Company Inc. offers property, cellular telephone, centrifugal car, marine, general indebtedness, and accident policy services, covering the follow :

- Theft

- Loss of Use Cover

- Coverage for Acts of Nature

- Own damage

- Third-party property Damage or TPPD

- Excess Bodily Injury or EBI

- Voluntary Third-Party Liability or VTPL

- Compulsory Third-Party Liability or CTPL

- Add-on coverage such as Free Personal Accident insurance for the named insured, Free PA Rider or Personal Accident insurance Rider, and/or Roadside Assistance Program or RAP

The cost of car insurance premiums under Standard Insurance Company Inc. starts at Php 17,800+ per year .

>>> Check out: Which is the best car insurance company in the Philippines?

Applying for car insurance in the Philippines

If you do n’t have any theme on how to apply for car policy, the first thing you need to do is to research the best car insurance in the Philippines in terms of your budget and the protection coverage you require.

Read more: The Best Car Insurance Companies for 2022

once you have an policy party in thinker, you can ask their policyholders regarding their experiences with the company, such as claims processing and payment of premiums. If you last decide on getting an insurance policy for your car, the insurance company typically has four independent requirements :

- Car’s OR/ original receipt

- Driver’s License

- Car’s CR/ certificate of registration

- An additional ID issued by the government such as Philippine passport, Philhealth ID, TIN Card, Postal ID, Voter’s ID, PRC ID, and OFW ID.

Get free insurance quote

When choosing the best car indemnity Philippines, make certain the coverage and services they offer and provide match your needs and wants. You can besides talk to their agentive role about discounts and other particular services they provide. For more useful articles like this, make certain to check out Philkotse.com .