Although mature drivers pay less for car insurance than teens, older drivers start to see their rates go up as they enter their senior years. Comparing car insurance rates can save older drivers hundreds of dollars a year.

Best Cities for Cheap Car Insurance in Minnesota

| City | Premium | Percent Increase |

| Moorhead | $820 | 0.0% |

| Mankato | $890 | 8.5% |

| Winona | $942 | 14.8% |

| Duluth | $945 | 15.2% |

| Austin | $948 | 15.5% |

| Bemidji | $952 | 16.1% |

| Rochester | $955 | 16.4% |

| Owatonna | $967 | 17.9% |

| Faribault | $1,021 | 24.5% |

| Brainerd | $1,040 | 26.8% |

| Saint Cloud | $1,114 | 35.8% |

| Elk River | $1,122 | 36.8% |

| Eden Prairie | $1,137 | 38.6% |

| Stillwater | $1,179 | 43.7% |

| Lakeville | $1,179 | 43.7% |

| Hastings | $1,184 | 44.4% |

| Hopkins | $1,192 | 45.3% |

| Shakopee | $1,195 | 45.6% |

| Prior Lake | $1,197 | 45.9% |

| Farmington | $1,199 | 46.2% |

| Rosemount | $1,207 | 47.2% |

| Cottage Grove | $1,228 | 49.7% |

| Osseo | $1,229 | 49.8% |

| Circle Pines | $1,230 | 49.9% |

| Andover | $1,262 | 53.8% |

| Anoka | $1,262 | 53.9% |

| Inver Grove Heights | $1,263 | 54.0% |

| Burnsville | $1,276 | 55.5% |

| Saint Paul | $1,394 | 69.9% |

| Minneapolis | $1,517 | 84.9% |

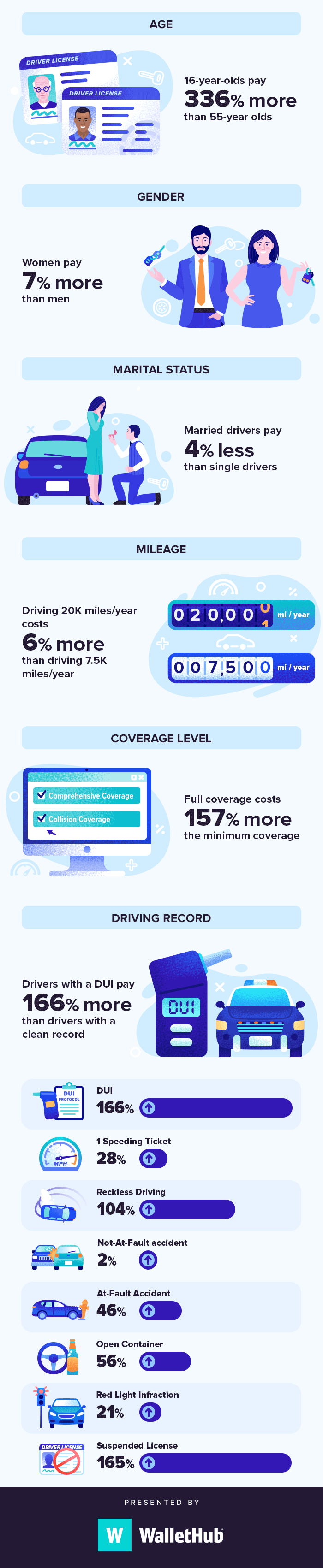

Factors That Affect Car Insurance Premiums in Minnesota

Although senesce drivers pay less for car insurance than teens, older drivers start to see their rates go up as they enter their aged years. Comparing cable car policy rates can save older drivers hundreds of dollars a year.

Cheapest Car Insurance in Minnesota

6 Tips for How to Get Cheap Car Insurance in Minnesota

1. Compare quotes from both national and regional insurers

Don’t forget to include local insurance companies in your search for cheap car insurance. In Minnesota, regional insurers like Shelter, Auto-Owners Insurance, and Farm Bureau Mutual might have lower rates than national companies like Allstate, Geico, and Travelers and have comparable customer satisfaction ratings.

2. Know the factors affecting insurance in Minnesota

Everyone knows that your driving habits and

3. Maintain coverage

You’ll see higher rates if you let your insurance lapse, even

4. Choose the coverage that is right for you

You need

5. Search for discounts

Top car insurance companies in Minnesota have a variety of discounts, so almost anyone can find ways to save. You may be able to get a

6. Watch your credit score

In Minnesota, drivers with no credit pay more for car insurance than drivers with excellent scores, on average. To avoid paying more than necessary for coverage, drivers in Minnesota should build and improve their credit scores as much as possible. If you’re not sure what your score is, WalletHub lets you .

Methodology

In the table below, you can see all of the profile characteristics that were used in WalletHub’s analysis, in addition to the specific subset of characteristics that make up our Good Driver profile.

| Category | All Profile Characteristics | Good Driver Profile |

| Gender | Male, Female | Male |

| Age | 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 35, 45, 55, 65 | 45 |

| Marital Status | Single, Married | Single |

| Teenage Driver Included on Policy | No, Yes | No |

| Driving Record | Clean, One Speeding Ticket, One At-Fault Accident, One DUI, Suspended License, Open Container, Red Light Infraction, Reckless Driving, One Not At-Fault Accident | Clean |

| Miles Driven Per Year | 7,500 Miles, 15,000 Miles, 20,000 Miles | 15,000 Miles |

| Coverage Level | Minimum, Standard, Full | Minimum |

| Discounts | None, Multi-Policy, Homeowner, Student | None |

| Credit Level | Poor, Good | Good |

| Filings | None, SR22, FR44 | None |

| Car | Sedan, Minivan, SUV, Coupe, Truck | Sedan |

Below are additional details regarding the terminology and specific characteristics of the variables in the above table:

- Minimum Coverage: Coverage requirements of $30,000 in bodily injury liability per person, $60,000 in bodily injury liability per accident, and $10,000 in property damage liability, as well as $25,000 in uninsured/underinsured motorist coverage per person, $50,000 in uninsured/underinsured motorist coverage per accident and $40,000 in personal injury protection, as required by Minnesota’s minimum coverage requirements.

- Standard Coverage: Coverage levels of 50k/100k/25k of liability coverage, 50k/100k/25k of uninsured motorist coverage and $40,000 of personal injury protection.

- Full Coverage: Coverage levels of 100k/300k/50k of liability coverage, 100k/300k/50k of uninsured motorist coverage, collision and comprehensive coverage with a $500 deductible and $40,000 of personal injury protection.

- Sedan: 2018 Toyota Camry.

- Minivan: 2018 Dodge Grand Caravan.

- SUV: 2018 Toyota RAV4.

- Coupe: 2018 Ford Mustang.

- Truck: 2018 Ford F-150.

Where driver profiles are not specified, WalletHub averaged Minnesota insurance quotes across 40 different driver profiles, using the above variables. Quote information is from Quadrant Information Services and is representative only. Individual rates will be different.

WalletHub ’ s analysis of brassy car indemnity companies in Minnesota is based on data from the Minnesota DMV and Quadrant Information Services. together with that data, WalletHub used the characteristics listed below to create 40 different driver profiles designed to identify the cheapest car policy companies for Minnesota drivers in a collection of key categories. For each profile, WalletHub compared quotes among top Minnesota car indemnity companies by averaging premiums from 39 travel rapidly codes that represent at least 20 % of Minnesota ‘s population. Military-specific companies like USAA were lone considered for the military-specific category, due to their eligibility restrictions. In some cases, they may placid be the best option overall for eligible drivers.In the table below, you can see all of the visibility characteristics that were used in WalletHub ’ second analysis, in addition to the specific subset of characteristics that make up our good Driver profile.Below are extra details regarding the terminology and specific characteristics of the variables in the above postpone : Where driver profiles are not specified, WalletHub averaged Minnesota insurance quotes across 40 different driver profiles, using the above variables. Quote information is from Quadrant Information Services and is representative alone. individual rates will be different.

Don ’ deoxythymidine monophosphate forget to include local anesthetic insurance companies in your search for brassy car policy. In Minnesota, regional insurers like Shelter, Auto-Owners Insurance, and Farm Bureau Mutual might have lower rates than home companies like Allstate, Geico, and Travelers and have comparable customer gratification ratings.Everyone knows that your driving habits and claims history affect how much you pay for car insurance. But in Minnesota, companies can besides consider your historic period, gender, credit history, marital condition, and more when setting premiums. The cable car you drive, your annual mileage, and even some factors beyond your control all impact the price of insurance.You ’ ll see higher rates if you let your insurance lapse, even if you don ’ metric ton own a car. Minnesota drivers who don ’ t maintain continuous coverage pay an average of 27 % more than those with five or more years of indemnity history.You need liability indemnity to pay for the other driver ’ randomness damages if you ’ re at mistake in an accident in Minnesota. Collision and comprehensive coverage, on the other hand, are optional and may be unnecessary if you own an older cable car. Usage-based insurance might be a better paroxysm than a standard policy for low-mileage drivers, and going with a higher deductible or lower coverage limits costs less, excessively. Don ’ thyroxine scant on the coverage you need, but do make inform choices. That way, you won ’ t end up paying for more car insurance than you need.Top car insurance companies in Minnesota have a variety show of discounts, so about anyone can find ways to save. You may be able to get a discount rate if you ’ re a student, veteran, good driver, homeowner, volition to go paperless, and more.In Minnesota, drivers with no credit paymore for cable car insurance than drivers with excellent scores, on average. To avoid paying more than necessary for coverage, drivers in Minnesota should build and improve their credit scores vitamin a much as possible. If you ’ rhenium not sure what your sexual conquest is, WalletHub lets you