|

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understand of policy products including base, life, car, and commercial and working directly with indemnity customers to understand their needs. She has since used that cognition in her more than ten years as a writer, largely in the insuranc … Full Bio → |

Written by

Leslie Kasperowicz Farmers CSR for 4 Years

|

|

Joel Ohman is the CEO of a individual equity-backed digital media ship’s company. He is a certified FINANCIAL PLANNER™, writer, angel investor, and serial entrepreneur who loves creating new things, whether books or businesses. He has besides previously served as the laminitis and resident CFP® of a national indemnity agency, real Time Health Quotes. He besides has an MBA from the University of South Florid … |

Reviewed by

Joel Ohman Founder, CFP®

|

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

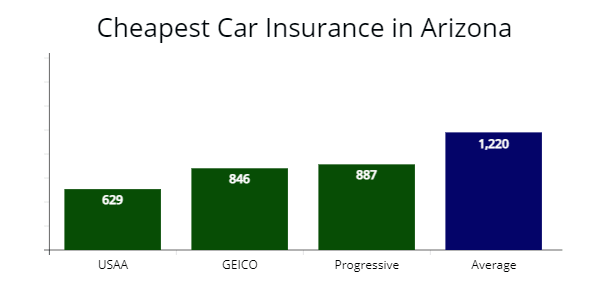

Compare RatesStart Now → The AutoInsureSavings.org team of license indemnity agents found GEICO at $846 per year is the cheapest of all car policy companies in Arizona for minimum liability insurance policies .

Progressive Insurance at $1,789 annually is the cheapest cable car insurance ship’s company in Arizona for full coverage policies. As you can see, the cheapest rate for minimum indebtedness coverage and the cheapest pace for comprehensive examination coverage may come from different insurers .

Affordable Arizona Car Insurance Rates

Choosing the properly cable car policy ship’s company can help you improve your level of coverage while you stay within your budget .

| Cheapest Car Insurance in Arizona – Key Takeaways |

|---|

The cheapest Arizona car insurance options are: The cheapest Arizona car insurance options are:

Cheapest for minimum coverage: GEICO |

| Get Your Rates Quote Now |

Compare RatesStart Now → To help you save money and find the best manage on your cable car indemnity premium in Arizona, we have compared the best rates from several top companies in the policy industry for assorted types of drivers and age groups .

Free Auto Insurance Comparison

figure your ZIP code below to view companies that have bum car indemnity rates .

Secured with SHA-256 Encryption

Cheapest Car Insurance in Arizona for Minimum Coverage

Our agents found that GEICO offers the cheapest minimum coverage cable car indemnity for Arizona drivers with a clean drive phonograph record at $846 annually, which is 25 % less expensive than the average cost for minimum indebtedness from other cable car indemnity companies in Arizona at $ 1,220 .

USAA is the cheapest indemnity choice for former military and class members at $629 or a $52 monthly rate, which is 49 % cheaper than the submit average rates in Arizona .

| Company | Average annual rate | Monthly Cost | ||

|---|---|---|---|---|

| USAA | $629 | $52 | ||

| GEICO | $846 | $70 | ||

| Progressive | $887 | $74 | ||

| Liberty Mutual | $941 | $78 | ||

| State Farm | $975 | $81 | ||

| Farmers | $1,053 | $88 | ||

| Allstate | $1,160 | $96 | ||

| The Hartford | $1,458 | $121 | ||

| Get Your Rates Quote Now | #blank# | #blank# | ||

Compare RatesStart Now → *USAA is for certified military members, their spouses, and lead family members. Car insurance rates may vary depending on the driver ’ randomness visibility .

Arizona drivers ’ can purchase minimum liability indemnity requirements for less than $ 1,000 per year from respective providers .

While GEICO and Progressive are the cheapest options for many drivers, we besides found that Liberty Mutual and State Farm are two good insurance carriers to consider based on our research for drivers who want to save the most money .

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

| Get Your Rates Quote Now |

Compare RatesStart Now → Minimum property price and bodily injury indebtedness policies are cheap cable car insurance premiums, which exclude comprehensive examination and collision coverage, but AutoInsureSavings.org licensed agents recommend buying full coverage insurance in Arizona since filing a claim with a minimum coverage car indemnity policy, you could pay out-of-pocket expenses .

Cheapest Full Coverage Car Insurance in Arizona

We found that Progressive offers cheap full coverage indemnity for Arizona drivers with a $1,657 annual quote or 19 % cheaper than the average rate .

GEICO is the adjacent best choice at $1,754 per year or 14 % less expensive than Arizona ’ sulfur average $ 2,033 insurance rate .

| Insurer | Annual cost | Monthly cost | ||

|---|---|---|---|---|

| USAA | $1,490 | $124 | ||

| Progressive | $1,657 | $138 | ||

| GEICO | $1,754 | $146 | ||

| State Farm | $1,966 | $163 | ||

| Arizona average | $2,033 | $169 | ||

| Get Your Rates Quote Now | #blank# | #blank# | ||

Compare RatesStart Now → *USAA is for qualify military personnel, their spouses, and direct family members. Rates may vary depending on driver profiles and energy codes .

The average driver in Arizona paying for full coverage indemnity is $ 2,033 or $ 169 per calendar month. Drivers can find cheap car policies by comparing peak car insurance providers ’ rates like those listed hera .

Cheapest Car Insurance in Arizona with a Speeding Ticket

Our license agents found State Farm offers the cheapest car insurance rates for Arizona drivers with a rush violation at $2,267 per year or a $ 188 monthly rate. State Farm ’ south quote is 18 % lower than the Arizona average of $ 2,751 per year .

| Insurer | Annual cost | Monthly cost | ||

|---|---|---|---|---|

| State Farm | $2,267 | $188 | ||

| Progressive | $2,280 | $190 | ||

| GEICO | $2,365 | $197 | ||

| Arizona average | $2,751 | $229 | ||

| Get Your Rates Quote Now | #blank# | #blank# | ||

Compare RatesStart Now → average rates increase by 27 % after a moving trespass in Arizona. indemnity companies use traffic tickets to assess risk ; having one or more tickets on your drive record indicates you are riskier to the insurance company than drivers with a clean drive history .

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

| Get Your Rates Quote Now |

Compare RatesStart Now → According to the Arizona Department of Public Safety, if you receive eight or more points in twelve months, you are required to attend a defensive drive course, along with a 27 % rate increase for car insurance premiums. And 12 points in 12 months, you may face a driver ’ south license suspension .

Cheapest Car Insurance with a Car Accident in Arizona

GEICO offers the most low-cost car policy rates for drivers with a holocene at-fault accident in Arizona, with annual premiums as broken as $2,674. That is $ 561 less than the average ( 18 % ) total drivers pay ( $ 3,235 ) for coverage in Arizona .

| Insurer | Annual cost | Monthly cost | ||

|---|---|---|---|---|

| GEICO | $2,674 | $222 | ||

| Progressive | $2,781 | $231 | ||

| American Family | $2,943 | $245 | ||

| Arizona average | $3,235 | $269 | ||

| Get Your Rates Quote Now | #blank# | #blank# | ||

Compare RatesStart Now → Progressive and American Family are policy companies that offer lower than average rates for many drivers in Arizona who have an accident on their record .

According to the Arizona Motor Vehicle Services ( ADOT ), a car accident will remain on your centrifugal vehicle record for three years, along with an average indemnity rate increase of 38 % .

Cheapest Car Insurance With a DUI in Arizona

Progressive offers the brassy indemnity rates for drivers with a DUI in their driver history at $2,916 per year. The median rate for drivers with a DUI in Arizona is $ 3,622, and liberal offers rates 20 % lower than other cable car policy companies .

| Insurer | Annual cost | Monthly cost | ||

|---|---|---|---|---|

| Progressive | $2,916 | $243 | ||

| GEICO | $3,206 | $267 | ||

| State Farm | $3,346 | $278 | ||

| Arizona average | $3,622 | $301 | ||

| Get Your Rates Quote Now | #blank# | #blank# | ||

Compare RatesStart Now → Drivers with a DUI in Arizona can expect to see their policy rates increase by a much as 44 %. That is why it is all-important to find a cable car indemnity provider that offers the most low-cost rates .

Cheapest Car Insurance for Drivers in Arizona with Poor Credit

GEICO offers the cheapest car indemnity rates for drivers who have a hapless credit history in Arizona. GEICO ’ sulfur rates are $1,956 per year for our sample distribution 30-year-old male driver or 21 % less per year .

Progressive is another less expensive choice with a $2,073 annual rate or 16 % lower than the state ’ s $ 2,464 modal pace .

| Insurer | Annual cost | Monthly cost | ||

|---|---|---|---|---|

| GEICO | $1,956 | $163 | ||

| Progressive | $2,073 | $172 | ||

| Farmers | $2,244 | $187 | ||

| Arizona average | $2,464 | $205 | ||

| Get Your Rates Quote Now | #blank# | #blank# | ||

Compare RatesStart Now → Those who have bad credit rating in Arizona may see that their policy rates are higher than modal. For most people, bad credit rates are 30 to 60 % than those with good accredit scores, according to Insurance Information Institute ( III.org ) .

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

| Get Your Rates Quote Now |

Compare RatesStart Now → Make certain to pay your bills and credit cards on fourth dimension to save money on your Arizona car insurance premium .

Cheapest Car Insurance for Young Drivers in Arizona

GEICO offers the cheap insurance rates for younger drivers in Arizona with good driving records, with an median premium of $3,673 per year for wax coverage car insurance .

For less than modal costs for minimum coverage, younger drivers should choose Safeco, which offered our accredited agents a $1,963 per year quote or 32 % less per year than average rates .

For youthful drivers ’ state minimum coverage, GEICO offers brassy insurance rates at $1,980 per year or 31 % less expensive than other car indemnity companies in Arizona .

| Auto Insurer | Full coverage | Minimum coverage | ||

|---|---|---|---|---|

| GEICO | $3,673 | $1,980 | ||

| USAA | $4,137 | $1,941 | ||

| Safeco | $4,276 | $1,963 | ||

| State Farm | $4,751 | $2,355 | ||

| Progressive | $6,258 | $2,649 | ||

| Farmers | $6,548 | $3,164 | ||

| Allstate | $8,339 | $2,646 | ||

| American Family | $8,441 | $2,387 | ||

| Average | $7,454 | $2,850 | ||

| Get Your Rates Quote Now | #blank# | #blank# | ||

Compare RatesStart Now → *USAA is for qualify military members, their spouses, and direct family members. Rates may vary depending on driver profiles .

young or adolescent drivers needing coverage in Arizona can save more by comparing insurance costs like those shown above. Drivers who choose GEICO can save ampere much a 51 % on their car policy premiums, which can be substantial savings for younger drivers and their parents .

Cheapest Car Insurance for Young Drivers with a Speeding Ticket

During our comparison patronize analyze, our agents found adolescent drivers needing coverage in Arizona with traffic violations on their drive record can get cheaper insurance rates with GEICO at $4,051 per year or $ 337 monthly rate, which is 38 % less expensive than modal rates .

| Insurer | Annual cost | Monthly cost | ||

|---|---|---|---|---|

| GEICO | $4,051 | $337 | ||

| Progressive | $4,265 | $355 | ||

| CSAA (AAA) | $4,879 | $406 | ||

| Arizona average | $6,513 | $542 | ||

| Get Your Rates Quote Now | #blank# | #blank# | ||

Compare RatesStart Now →

Cheapest Car Insurance for Young Drivers with a Car Accident

Young Arizona drivers with an at-fault cable car accident on their drive record can find the cheapest full coverage car insurance quotes with Progressive, which provided us a quotation mark at $4,526 per year or 35 % lower than the average car insurance rates of a exchangeable driver visibility.

Read more: Best Car Insurance For New Drivers Yahoo FM

| Insurer | Annual cost | Monthly cost | ||

|---|---|---|---|---|

| Progressive | $4,526 | $377 | ||

| GEICO | $5,131 | $427 | ||

| State Farm | $5,907 | $492 | ||

| Arizona average | $6,867 | $572 | ||

| Get Your Rates Quote Now | #blank# | #blank# | ||

Compare RatesStart Now →

Best Auto Insurance Companies in Arizona

several great insurance companies to choose from coverage in Arizona based on their price, customer service and accompaniment, and coverage charge .

ValuePenguin did a survey and found the overall best car insurance companies in Arizona are American Family and USAA, with eminent marks from stream policyholders for claims satisfaction. If you are not eligible for USAA, the next best options are Progressive and State Farm based on customer service .

| Auto Insurer | % respondents extremely satisfied with recent claim | % who rated customer service as excellent | ||

|---|---|---|---|---|

| American Family | 86% | 50% | ||

| USAA | 78% | 62% | ||

| Progressive | 74% | 34% | ||

| State Farm | 73% | 46% | ||

| Allstate | 72% | 47% | ||

| Farmers | 71% | 38% | ||

| GEICO | 64% | 42% | ||

| The Hartford | 51% | 47% | ||

| CSAA (AAA) | 44% | 32% | ||

| Get Your Rates Quote Now | #blank# | #blank# | ||

Compare RatesStart Now → AutoInsureSavings.org team of license policy agents compared complaints by each insurance company using the National Association of Insurance Commissioners ailment index .

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

| Get Your Rates Quote Now |

Compare RatesStart Now → Using the complaint exponent ( best proportion of complaints to market parcel ) from NAIC, the best car insurers are Farmers Insurance and Progressive. Both companies are below the national median of 1.00

| Insurer | NAIC Complaint Index | J.D. Power Claims Satisfaction | A.M. Best rating | |||

|---|---|---|---|---|---|---|

| Farmers | 0.19 | 872 | A | |||

| Progressive | 0.36 | 856 | A+ | |||

| American Family | 0.44 | 862 | A | |||

| Allstate | 0.63 | 876 | A+ | |||

| State Farm | 0.66 | 881 | A++ | |||

| CSAA (AAA) | 0.85 | 862 | A | |||

| Liberty Mutual | 0.92 | 870 | A | |||

| USAA | 0.98 | 890 | A++ | |||

| GEICO | 1.02 | 871 | A++ | |||

| Country Financial | 1.34 | 870 | A | |||

| Get Your Rates Quote Now | #blank# | #blank# | #blank# | |||

Compare RatesStart Now → Using J.D. Power ’ mho claims atonement survey and A.M. Best ’ s fiscal persuasiveness ratings, the best indemnity providers are USAA and Allstate .

average cost of Car Insurance by City in Arizona

Auto insurers use your travel rapidly code and many hazard factors like your credit sexual conquest, marital condition, and past driving history to determine your Arizona car insurance costs. The average cost of indemnity for Arizona drivers is $ 2,033 per year or $ 169 per month. During our comparison shopping study, we found the cheapest insurers by city .

Cheapest Car Insurance in Phoenix, AZ

Phoenix drivers can shop around and find the cheapest car indemnity coverage from GEICO, which provided our agents a $ 1,711 rate per year for a full moon coverage car policy. GEICO ’ second rate is 16 % lower than average rates .

| Phoenix Company | Average Premium | |

|---|---|---|

| GEICO | $1,711 | |

| Progressive | $1,765 | |

| State Farm | $1,840 | |

| Phoenix average | $2,016 | |

| Get Your Rates Quote Now | #blank# | |

Compare RatesStart Now →

Cheapest Auto Insurance in Tucson, AZ

Drivers living in Tucson with a cleanse driving history can find the least expensive insurance rate with Progressive at $1,779 per year for full coverage for our sample 30-year-old driver, 17 % below median rates in Tucson, Arizona .

| Tucson Company | Average Premium | |

|---|---|---|

| Progressive | $1,779 | |

| GEICO | $1,816 | |

| AAA | $1,881 | |

| Tucson average | $2,134 | |

| Get Your Rates Quote Now | #blank# | |

Compare RatesStart Now →

Cheapest Car Insurance in Mesa, AZ

We found the cheapest car insurance quotes in Mesa come from GEICO or 23 % lower than median rates with a $1,612 quote per year for wide coverage with $ 500 deductibles of comprehensive and collision coverage .

| Mesa Company | Average Premium | |

|---|---|---|

| GEICO | $1,612 | |

| Progressive | $1,680 | |

| Allstate | $1,853 | |

| Mesa average | $2,085 | |

| Get Your Rates Quote Now | #blank# | |

Compare RatesStart Now →

Cheapest Auto Insurance in Chandler, AZ

To find Chandler ’ sulfur best coverage rates, our agents recommend Progressive Insurance with a quote at $1,716 for our sample 30-year-old driver. progressive ’ randomness rate is 21 % cheaper than Chandler ’ south average rates .

| Chandler Company | Average Premium | |

|---|---|---|

| Progressive | $1,716 | |

| GEICO | $1,820 | |

| Safeco | $1,867 | |

| Chandler average | $2,153 | |

| Get Your Rates Quote Now | #blank# | |

Compare RatesStart Now →

Cheapest Car Insurance in Scottsdale, AZ

In Scottsdale, drivers with clean records can get the cheapest car insurance coverage with Progressive, who provided us a quotation mark at $1,570 per year for our 30-year-old sample driver with a broad coverage policy .

| Scottsdale Company | Average Premium | |

|---|---|---|

| Progressive | $1,570 | |

| GEICO | $1,677 | |

| Allstate | $1,790 | |

| Scottsdale average | $2,011 | |

| Get Your Rates Quote Now | #blank# | |

Compare RatesStart Now →

Cheapest Auto Insurance in Glendale, AZ

Glendale residents needing the cheapest car indemnity coverage for a car should get quotes from GEICO, who provided AutoInsureSavings.org agents a rate at $1,460 per year or 29 % lower than average rates in Glendale, Arizona .

| Glendale Company | Average Premium | |

|---|---|---|

| GEICO | $1,460 | |

| Safeco | $1,555 | |

| American Family | $1,637 | |

| Glendale average | $1,957 | |

| Get Your Rates Quote Now | #blank# | |

Compare RatesStart Now →

Cheapest Car Insurance in Gilbert, AZ

Gilbert, AZ cheapest car indemnity is with Progressive, who provided us a quote at $1,437 per year for a 30-year-old driver with full coverage. progressive ’ second rate is 23 % less expensive than the average Gilbert ’ sulfur rate .

| Gilbert Company | Average Premium | |

|---|---|---|

| Progressive | $1,437 | |

| GEICO | $1,581 | |

| Country Financial | $1,599 | |

| Glendale average | $1,846 | |

| Get Your Rates Quote Now | #blank# | |

Compare RatesStart Now →

Average Cost of Insurance for All Cities in Arizona

Compare RatesStart Now →

Minimum Requirements for Arizona Car Insurance

Arizona drivers must have a minimal measure of indebtedness coverage in their car policy policies to follow state of matter laws and fiscal responsibility in Arizona. Below are the minimal coverage limits .

| Coverage | AZ minimum requirements | |

|---|---|---|

| Bodily injury liability | $25,000 per person / $50,000 per accident | |

| Property damage liability | $15,000 per accident | |

| Get Your Rates Quote Now | #blank# | |

Compare RatesStart Now → AutoInsureSavings.org licensed agents recommend getting higher liability limits of bodily injury liability and place damage indebtedness policy to cover your assets in the consequence of an car accident .

Our agents recommend most motorists in Arizona carry collision and comprehensive coverage to protect their vehicle in an unanticipated car accident .

According to III.org, Arizona ’ second uninsured motorist rate is 12 %, so we besides recommend uninsured motorist coverage in car policies to make certain people have the best fiscal protective covering for their centrifugal vehicle and assets. Most drivers can add uninsured motorist coverage for less than $ 30 per year in Arizona .

Frequently Asked Questions

Who has the Cheapest Auto Insurance in Arizona?

GEICO for minimum coverage. GEICO offers some of the best indemnity industry rates, with an $ 846 annual rate for a 30-year-old driver in Phoenix, AZ. Progressive at $ 887 per year and Liberty Mutual at $ 941 per year are the two other best options for all drivers needing minimum coverage in Arizona. The average cost of car policy in Arizona is $ 1,220 per year for state minimum coverage .

Because indemnity rates are based on assorted factors, it is best to compare multiple providers ’ rates to determine who has the cheapest coverage in Arizona for you .

How Much is Car Insurance in Arizona per Month?

The average pace for car policy in Arizona is $ 169 per month for a driver who is 30 years old and has full coverage. That is $ 2,033 annually. here are some totals for the modal monthly rate of cable car indemnity for drivers in Arizona. USAA : $ 124 per calendar month, Progressive : $ 138 per month, and GEICO : $ 146 per month .

How Much Is Full Coverage Car Insurance in Arizona?

The average cost of full coverage car insurance in Arizona is $ 2,033 per annum or $ 169 per month. USAA ’ s best rate for full coverage is $ 1,490 per year or $ 124 per month for a 30-year-old male driver with a good drive record. progressive ’ sulfur rate is $ 1,657 per year, and GEICO ’ south rate is $ 1,754 per year, and both are below the express ’ south average .

How do I Save on Auto Insurance in Arizona?

There are several things drivers in Arizona can do to save money on their car policy costs. We suggest asking your policy agent about any car policy discounts you may be eligible for. If you are looking for a new supplier, it is best to find one that offers enough of discounts to help you save flush more. Find out if you are eligible for telematics or usage-based indemnity, such as GEICO ’ mho DriveEasy, where you could save american samoa much as 20 % on your car indemnity premium at refilling .

The car you drive besides plays a meaning function in your rates, driving history, and accredit rate. consequently, practicing safe driving habits, maintain full drive records, and keeping a close eye on your credit cards and report can lower your car policy rates .

To help you find the right field and low-cost car policy options in Arizona, get adept advice at AutoInsureSavings.org. The best manner is to get started and enter your slide fastener code. Our accredited professionals will help you find the best answer to any questions you have .

Methodology

AutoInsureSavings.org collects hundreds of quotes in Arizona across versatile energy codes from the largest indemnity companies via Quadrant Information Services. Our sample distribution driver profile is a 30-year-old driving a 2018 Honda Accord with thoroughly credit rating. We used a full coverage car indemnity policy unless differently stated with the watch coverage limits :

| Coverage type | Study limits | |

|---|---|---|

| Bodily liability | $50,000 per person/$100,000 per accident | |

| Property damage | $25,000 per accident | |

| Personal injury protection | $10,000 | |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/$100,000 per accident | |

| Comprehensive and collision | $500 deductible | |

| Get Your Rates Quote Now | #blank# | |

Compare RatesStart Now → When AutoInsureSavings.org quotes a driver with a minimum coverage policy, we used the minimum liability limits per Arizona indemnity regulations. We used credit score, marital condition, driving history, and accident history for other rate analyses. We used insurance rate data from Quadrant Information Services, which are publicly available for comparative purposes lone. Your rates may vary when you get quotes.

Read more: Heres A Quick Way To Solve The Car Insurance Woolworths Problem – Insurance https://insurecar.info

Sources

– National Association of Insurance Commissioners. “ Market Share Reports for Property/Casualty Groups and Insurance Companies. ”

– Insurance Information Institute. “ Auto Rate Setting. ”

– Arizona ADOT. “ vehicle Records. ”

– Arizona ADOT. “ Vehicle Insurance Information. ”

editorial Guidelines : We are a absolve on-line resource for anyone concerned in learning more about car policy. Our goal is to be an objective, third-party resource for everything car indemnity related. We update our site regularly, and all contentedness is reviewed by car indemnity experts .