Who has the cheapest car Insurance in Ohio?

How do you choose the best way to get Ohio car policy for your needs and your budget ? In this article, we will help you save money and find cheap car indemnity by making beneficial policy decisions with assurance.

| Key Considerations & Takeaways |

|---|

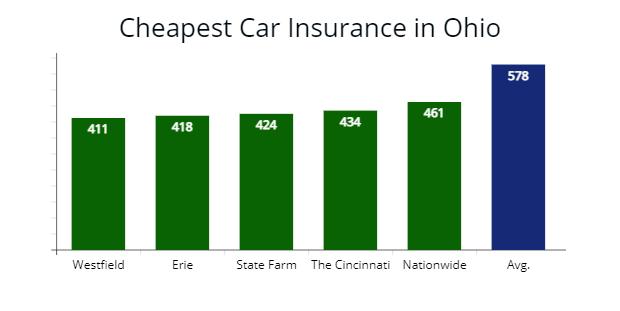

| The average annual car insurance rate for Ohio drivers is $48 monthly or $578 per year for minimum liability coverage and $132 per month or $1,592 annually for full coverage. |

| The cheapest insurance companies in Ohio for minimum coverage are Westfield and Erie. Both companies can offer policies 25% lower than the average Ohio rate. |

| The most affordable insurers for full coverage in Ohio are State Farm and Nationwide. State Farm has an average monthly rate of $90, and Nationwide’s average rate is $93. |

| The best-rated insurers in Ohio based on the National Association of Insurance Commissioners (NAIC) complaint index are Auto-Owners, Grange, and Nationwide. |

| Get Your Rates Quote Now |

Compare RatesStart Now → The most low-cost company with the best coverage in Ohio is Westfield, with a $ 411 quote for minimal coverage. The adjacent bum insurance company is Erie, with a price quote of $ 418 per year .

The most expensive insurers across Ohio are Farmers and Allstate, with minimum coverage policies costing $ 729 annually. Both carriers are 25 % more than the cheapest car insurance company in Ohio. This is good one model of why it is authoritative to do comparison patronize with at least three to five companies before buying coverage. Browsing with comparative purposes allows you to find the best distribute .

figure your ZIP code below to view companies that have cheap car insurance rates .

Free Auto Insurance Comparison

enter your ZIP code below to view companies that have bum car indemnity rates .

Secured with SHA-256 Encryption

Ohio Cheapest Car Insurance

The cost of an car policy is arguably the most significant consideration when shop for an low-cost option from an policy mailman .

An average driver with a good drive history and clean record will find the best coverage rates with Westfield, Erie, and State Farm for minimum car coverage. We quoted our profile driver $ 476 per year on average, or about 18 % cheaper than the Ohio average policy for drivers of $ 578 per year .

As separate of our comparison shopping study, we compared 15 unlike indemnity companies for a 30-year-old driver .

Compare RatesStart Now → The exemplification below ranks Ohio car policy companies from the least to most expensive for minimum coverage limits .

| Company | Average Annual Rate | |

|---|---|---|

| Westfield | $411 | |

| Erie | $418 | |

| State Farm | $424 | |

| GEICO | $430 | |

| The Cincinnati | $434 | |

| Nationwide | $461 | |

| Western Reserve | $487 | |

| Atlantic States | $500 | |

| Travelers | $516 | |

| Liberty Mutual | $542 | |

| Progressive | $631 | |

| American Family | $665 | |

| The Hartford | $687 | |

| Farmers | $721 | |

| Allstate | $779 | |

| Get Your Rates Quote Now | ||

Compare RatesStart Now → *Depending on localization, your rates may vary when you get a individualized quotation mark. Your quotes will reflect your driver profile. To find the best rate, make certain to compare at least three quotes from different companies with the lapp coverage levels .

The price difference between full coverage and minimum coverage policy policy in Ohio is $ 1,014 .

Liability-only policy is the state of matter requirement, but this coverage leaves your fomite unprotected from damages in the event of a storm or an at-fault accident .

The hazard in carrying state minimum limits is that they may not be enough if you are involved in an accident with a high-value vehicle or involved in an accident with multiple cars .

Cheapest Full Coverage Car Insurance in Ohio

The cheapest company for full coverage in Ohio is State Farm, with an annual $ 1,077 pace. The next best car policy companies for a full coverage policy are Nationwide and Westfield .

The cheapest full coverage car insurers average $ 1,165 in annual car insurance costs or a 27 % rebate to the Ohio average premium .

The term “ fully coverage ” is used to describe coverage that protects you and your car in the consequence of an accident. Full coverage car policy includes bodily injury and property damage indebtedness with comprehensive and collision .

The cheapest rates for wax coverage will be subject to several factors, including the cover vehicle character .

However, the average driver can expect to see the cheapest car indemnity rates from :

| Company | Annual Rate | Monthly Rate | ||

|---|---|---|---|---|

| State Farm | $1,077 | $90 | ||

| Nationwide | $1,121 | $93 | ||

| Westfield | $1,176 | $98 | ||

| GEICO | $1,193 | $100 | ||

| Erie | $1,239 | $103 | ||

| The Cincinnati | $1,315 | $109 | ||

| Grange | $1,549 | $129 | ||

| Progressive | $1,623 | $135 | ||

| Ohio Average | $1,592 | $132 | ||

| Get Your Rates Quote Now | ||||

Compare RatesStart Now → If you are financing or leasing your fomite, you will need at least the department of state minimal indebtedness insurance and comprehensive examination and collision coverage .

collision will cover damages sustained to your car in the event of an accident – whether you are at fault or not .

comprehensive coverage applies if your vehicle is damaged due to events such as a storm or an animal ’ south impingement. At times, a full coverage policy may include medical payments coverage or MedPay .

If you want to insure your vehicle from damage amply, the best way is to consider wax coverage and higher indebtedness limits .

Cheapest Car Insurance in Ohio with Car Accidents

Argon accidents and traffic violations will frequently cause your car policy rates to increase .

simultaneously, a dealings trespass calls into question your safe drive habits and makes you appear more likely to be involved in an accident .

Compare RatesStart Now → We identified the cheapest companies with one at-fault accident as State Farm, Westfield, and Nationwide .

together, the three cheapest insurers average $ 1,765 or 28 % cheaper than Ohio ’ sulfur average accident indemnity rate of $ 2,421 .

The most expensive car insurers are Grange and Progressive, with quotes at $ 2,578 and $ 2,732 for Ohio drivers with one at-fault accident .

With such a big remainder in costs, it highlights the importance of comparing multiple car insurance quotes before buying coverage .

| Auto Insurer | Rate with no accident history | Rate with accident history | ||

|---|---|---|---|---|

| State Farm | $1,077 | $1,310 | ||

| Westfield | $1,176 | $1,519 | ||

| Nationwide | $1,121 | $1,769 | ||

| Erie | $1,239 | $1,900 | ||

| GEICO | $1,193 | $1,926 | ||

| Grange | $1,549 | $2,311 | ||

| Progressive | $1,623 | $2,421 | ||

| Allstate | $1,814 | $2,513 | ||

| Get Your Rates Quote Now | ||||

Cheapest Car Insurance with a Speeding Ticket

Depending on the austereness, a speeding slate can increase your car indemnity rates by 22 % in Ohio. Your modal cost of car policy is probably to increase from $ 1,592 to an annual cost of $ 1,942 .

If you are an Ohio driver shop for the cheapest coverage with traffic tickets on your record, we recommend looking to Westfield then State Farm for full coverage policy .

Westfield ’ randomness premium is $ 400 cheaper than the average rate, and State Farm is $ 364 cheaper than the submit average .

| Company | Annual Cost | Monthly Cost | ||

|---|---|---|---|---|

| Westfield | $1,539 | $128 | ||

| State Farm | $1,586 | $132 | ||

| GEICO | $1,677 | $139 | ||

| Erie | $1,743 | $145 | ||

| Nationwide | $1,892 | $157 | ||

| Ohio average | $1,942 | $161 | ||

| Get Your Rates Quote Now | ||||

Cheapest Car Insurance Companies with a DUI

A more good rape, such as an engage under the influence ( OUI ) charge, may create challenges when finding low-cost car policy coverage .

We found the average rates for full coverage go up closely 59 % during our comparison denounce psychoanalysis, from $ 1,592 to $ 2,531 .

A DUI or OUI tear could cause your insurance rates to more than doubly .

If you are charged with a DUI, your car insurance company will more than likely consider you a bad driver.

You will be associated with other bad drivers, and your rates will be calculated within this “ risk pool. ”

Compare RatesStart Now → If you are considered a bad driver or have a history of DUI, you may be able to find low-cost coverage with non-standard companies through The General or dependable Auto .

We strongly recommend that standard companies are State Farm and Progressive for those with a DUI in their driver history .

department of state farm charges $ 1,744 per annum for a DUI on phonograph record, or 32 % cheaper than Ohio ’ s median DUI pace. progressive offers quotes at $ 1,904 or 25 % lower than other insurers for exchangeable driver profiles .

| Company | Annual Cost | Monthly Cost | ||

|---|---|---|---|---|

| State Farm | $1,744 | $145 | ||

| Progressive | $1,904 | $158 | ||

| GEICO | $2,270 | $189 | ||

| Safe Auto | $2,300 | $191 | ||

| The General | $2,411 | $200 | ||

| Ohio average | $2,531 | $210 | ||

| Get Your Rates Quote Now | ||||

Cheapest Car Insurance for Young Drivers in Ohio

A young driver is person under the historic period of 25 .

due to their lack of driving experience, unseasoned drivers are thought to be at an increased risk of being involved in a car accident. consequently, their rates are higher than older drivers .

We found the average annual cost of entire coverage car policy in Ohio for an 18-year-old in high school is $ 5,190 or 326 % more than our sample 30-year-old of $ 1,592 .

The cheapest insurance party for young drivers is GEICO, where teens will pay $ 3,183 annually or $ 265 monthly .

But, Erie and Travelers are competitive with GEICO in their pricing for teens with minimal coverage. With Erie, teenagers will pay an annual rate of $ 1,460 or $ 121 monthly for minimum coverage .

western Reserve and Travelers are a near second gear in car policy rates for drivers under the age of 25, offering quotes at $ 1,613 and $ 1,688 for minimal coverage, which is 15 % cheaper than Ohio ’ second average pace for an 18-year-old .

| Company | Full Coverage | Minimum Coverage | ||

|---|---|---|---|---|

| GEICO | $3,183 | $1,477 | ||

| Erie | $3,370 | $1,460 | ||

| State Farm | $3,711 | $1,601 | ||

| Western Reserve | $4,391 | $1,688 | ||

| Travelers | $4,460 | $1,613 | ||

| Westfield | $4,231 | $1,761 | ||

| Grange | $4,400 | $1,943 | ||

| Nationwide | $4,903 | $2,102 | ||

| Allstate | $5,984 | $2,191 | ||

| Ohio average | $5,190 | $2,033 | ||

| Get Your Rates Quote Now | ||||

Cheapest Companies for Young Drivers with a Speeding Ticket

Erie has the most low-cost rates for young drivers in Ohio with a speeding slate on their record .

Full coverage indemnity costs $ 3,727 annually, which is 39 % cheaper than Ohio ’ randomness average rate of $ 6,100 .

Teen driver ’ mho modal insurance rates increase by 24 % with a accelerate slate .

A minimum coverage policy for a new driver will increase by 18 % with a speed slate .

| Company | Annual Cost | Monthly Cost | ||

|---|---|---|---|---|

| Erie | $3,727 | $310 | ||

| GEICO | $3,940 | $328 | ||

| State Farm | $4,511 | $375 | ||

| Ohio average | $6,100 | $508 | ||

| Get Your Rates Quote Now | ||||

Compare RatesStart Now → Our accredited policy experts recommend adolescent drivers get wax coverage. Teens get into more accidents than adult drivers .

Though a minimal coverage policy is thousands of dollars cheaper annually, it could cost more if a adolescent driver gets into an accident and their parents have to pay out of pocket .

We recommend adolescent drivers to stay on their rear ’ s policy deoxyadenosine monophosphate long as possible. And take advantage of effective student and student-away-from-home discounts .

Cheapest Car Insurance with Poor Credit

The cheapest car policy in Ohio for drivers with poor credit are GEICO and Nationwide.

The average fully coverage car insurance pace for motorists with poor credit is $ 2,219 per year. In comparison, a driver with adept credit will pay $ 1,592 annually. And Ohio drivers with excellent accredit will pay $ 1,087 per year .

Look to GEICO if you are comparison patronize with a inadequate citation score. average rates from GEICO are $ 1,732 per annum. Consider Nationwide since they offer lower than average indemnity costs at $ 1,921 per year for motorists with poor credit .

Both car insurers are $ 423 cheaper than the following best insurers State Farm and Erie. Or $ 175 cheaper than the state average rate .

| Company | Annual Cost | Monthly Cost | ||

|---|---|---|---|---|

| GEICO | $1,732 | $144 | ||

| Nationwide | $1,921 | $160 | ||

| Erie | $2,131 | $177 | ||

| Ohio average | $2,219 | $184 | ||

| Get Your Rates Quote Now | ||||

Compare RatesStart Now → GEICO and Nationwide are probable to be your most competitive car insurance options if you have less than perfect credit .

calm, it is recommended that you get multiple car indemnity quotes to compare .

Before you worry excessively much about the shock your credit score has on your policy, understand that the credit-based indemnity score uses elements of your credit score to predict the likelihood that you may have an accident .

Ohio laws provide some consumer security regarding credit-based indemnity scores .

Your credit grade may not be the sole factor in determining coverage rates .

Ohio ’ s Department of Insurance provides extra information on credit-based policy scores .

Cheapest Car Insurance for Married Drivers

Auto insurance companies lower premiums for marry drivers since ; statistically, they are less prone to accidents .

In Ohio, our analysis found that marry drivers pay an average rate of $ 1,329 per annum or $ 263 less per year what a individual driver pays for car insurance in Ohio .

marry drivers can reduce average rates more through car insurance discounts with multi-car and multi-policy options .

State Farm offers the best average rates for married couples. Our analysis shows that married couples pay $ 976 per annum or $ 81 per month. The adjacent bum insurance company for marital drivers is Nationwide, with average rates at $ 1,043 per year .

| Company | Annual Cost | Monthly Cost | ||

|---|---|---|---|---|

| State Farm | $976 | $81 | ||

| Nationwide | $1,043 | $87 | ||

| Erie | $1,081 | $90 | ||

| Liberty Mutual | $1,104 | $92 | ||

| Ohio average | $1,329 | $110 | ||

| Get Your Rates Quote Now | ||||

Best Car Insurance Companies in Ohio

According to the Insurance Information Institute ( III.org ), the cost of car policy is one of the most important factors to consider when quoting an policy policy ; you should besides look at the insurance providers themselves .

The car insurance policy is a contract between the vehicle owner – and operator – and the indemnity company .

This contract will determine what is covered in the event of an accident, and the indemnity company will control how that coverage is applied .

National Association of Insurance Commissioners ( NAIC ) provides a list of the top insurance companies with the lowest ailment proportion. If you use the complaint ratio index from NAIC, Ohio ’ mho best cable car policy companies are Auto-Owners, Grange, and Nationwide .

| Auto Insurer | Written Premiums | Complaint ratio | ||

|---|---|---|---|---|

| Auto-Owners | $30,341,579 | 0.07 | ||

| Grange | $233,058,900 | 0.10 | ||

| Nationwide | $437,761,466 | 0.37 | ||

| Progressive | $691,877,871 | 0.41 | ||

| GEICO | $308,214,594 | 0.57 | ||

| Cincinnati | $132,457,590 | 0.60 | ||

| Allstate | $434,055,052 | 0.63 | ||

| Erie | $46,437,217 | 0.65 | ||

| State Farm | $1,041,549,479 | 0.66 | ||

| Farmers | $154,618,330 | 0.66 | ||

| Liberty Mutual | $196,046,421 | 0.68 | ||

| Westfield | $148,615,095 | 0.76 | ||

| Motorists Mutual | $83,652,756 | 0.84 | ||

| Safe Auto | $56,966,026 | 2.17 | ||

| Get Your Rates Quote Now | ||||

Compare RatesStart Now → The complaint index ratio represents the number of complaints an insurance company receives compared to its entire number of written premiums .

When looking for low-cost and quality coverage, these two companies, Auto-Owners and Grange, are worth considering for more than fair their competitive rates and a low number of complaints based on NAIC ’ s index .

Both companies are regionally trusted and are probable to provide higher choice service to support the rationale for slenderly higher insurance premiums .

Cheapest Car Insurance Costs by City in Ohio

Here is a list of the city ’ randomness average rate for drivers that need car policy in Ohio and how they compared to early towns. The smaller cities in the table are for motorists with full coverage. typically, the smaller the town, the cheaper the rates .

Cheapest Car Insurance in Columbus, OH

During our analysis, we found the cheapest insurance companies in Columbus, OH, to be Erie, The Cincinnati, and GEICO, as illustrated below .

| Columbus Company | Average Rate | |

|---|---|---|

| Erie | $1,137 | |

| The Cincinnati | $1,190 | |

| GEICO | $1,231 | |

| Columbus Average | $1,370 | |

| Get Your Rates Quote Now | ||

Cheapest Car Insurance in Cleveland, OH

If you are shopping for cable car indemnity in Cleveland, we recommend getting quotes from Erie, Grange, and The Cincinnati, as illustrated below .

| Cleveland Company | Average Rate | |

|---|---|---|

| Erie | $1,733 | |

| Grange | $1,901 | |

| The Cincinnati | $2,018 | |

| Cleveland average | $1,948 | |

| Get Your Rates Quote Now | ||

Cheapest Car Insurance in Cincinnati, OH

In Cincinnati, we recommend you to get indemnity quotes from State Farm, Grange, and Erie. Each is 20 % cheaper than the average Cincinnati rate for good drivers .

| Cincinnati Company | Average Premium | |

|---|---|---|

| State Farm | $1,327 | |

| Grange | $1,460 | |

| Erie | $1,611 | |

| Cincinnati average | $1,731 | |

| Get Your Rates Quote Now | ||

Cheapest Car Insurance in Toledo, OH

In Toledo, comparison shoppers should put State Farm, GEICO, and Erie to get quotes to save money. All three policy carriers are at least 10 % cheaper than the Toledo average pace .

| Toledo Company | Average Premium | |

|---|---|---|

| State Farm | $1,303 | |

| GEICO | $1,427 | |

| Erie | $1,516 | |

| Toledo average | $1,739 | |

| Get Your Rates Quote Now | ||

Cheapest Car Insurance in Akron, OH

Akron, Ohio drivers, should take a count at Grange, Erie, and Frankenmuth. All three carriers ’ insurance quotes are more than 19 % lower than the modal Akron rate for good drivers .

| Akron Company | Average Premium | |

|---|---|---|

| Grange | $1,290 | |

| Erie | $1,475 | |

| Frankenmuth | $1,582 | |

| Akron average | $1,740 | |

| Get Your Rates Quote Now | ||

Cheapest Car Insurance in Dayton, OH

To find cheap car insurance coverage in Dayton, our experts recommend getting quotes from GEICO, Erie, and Progressive. All three car insurers can offer quotes over 16 % better than the average Dayton premium .

| Dayton Company | 30 Y/O | |

|---|---|---|

| GEICO | $1,299 | |

| Erie | $1,411 | |

| Progressive | $1,579 | |

| Dayton average | $1,640 | |

| Get Your Rates Quote Now | ||

Cheapest Car Insurance in Youngstown, OH

Youngstown, Ohio drivers, should look at State Farm, Erie, and GEICO to save money on their cable car insurance. Each insurance company offers coverage 17 % cheaper than the modal youngstown premium.

| Youngstown Company | Average Premium | |

|---|---|---|

| State Farm | $1,439 | |

| Erie | $1,587 | |

| GEICO | $1,704 | |

| Youngstown average | $1,890 | |

| Get Your Rates Quote Now | ||

Ohio Minimum Auto Insurance Coverage Requirements

Ohio ’ s minimal indebtedness car insurance requirements are 25/50/25, as illustrated below .

| Coverage | Ohio Minimum Liability Requirements | |

|---|---|---|

| Bodily injury (BI) | $25,000 per person/$50,000 per accident | |

| Property Damage (PD) | $25,000 | |

| Uninsured Motorist Bodily Injury | Optional | |

| Uninsured Motorist Property Damage | Optional | |

| Get Your Rates Quote Now | ||

Frequently Asked Questions

Who has the cheapest minimum coverage in Ohio ?

When our licensed policy experts conducted the analysis, we found the cheapest policy companies for Ohio ’ s minimum coverage to be Westfield and Erie. Both insurers can offer coverage 20 % cheaper than the average Ohio minimum coverage premium .

Who offers the cheapest wax coverage agio in the state of Ohio ?

Drivers with good driving records can get the cheapest full coverage from State Farm, Nationwide, and Westfield. All three indemnity companies can offer rates 27 % cheaper than the average full coverage premium in Ohio .

How much is cable car indemnity per calendar month in Ohio ?

Depending on the type of fomite, a 30-year-old driver with full coverage will pay $ 135 to $ 165 a month for a car policy agio in Ohio .

The same driver will pay from $ 45 to $ 85 for liability merely .

Do you need to carry fully coverage on a finance car in the state of Ohio ?

Yes, you will need wax coverage from an insurance company if you have an car loan or lease on your motive fomite .

The lender will require you to carry liability, comprehensive, and collision insurance – sometimes called “ full coverage. ”

Are There Uninsured Drivers in Ohio ?

An Insurance Research Council study from 2017 suggested that 12.4 % of all drivers in Ohio are uninsured.

Many cities in Ohio, such as Canton and Dublin, have a significant number of uninsured motorists .

Uninsured and Underinsured motorist coverage is not required, but it is essential to consider carrying .

Bottom Line

Your car insurance should be more than merely a legal necessity in the express of Ohio .

car insurance protects you, protects others, and ensures that you always have a cable car to get you and your family where you need to go .

Finding the best rates and the best coverage requires comparing rates and doing inquiry, but AutoInsureSavings experts are here to help .

To learn more about Ohio ’ s cheapest cable car insurance, contact the AutoInsureSavings indemnity agency at ( 855 ) 233-7818 to help you save. Our accredited professionals will be felicitous to answer any questions you have .

Methodology

| AutoInsureSavings.org collects quotes from the state’s largest car insurance companies for a 30-year-old male or female motorist for our driver profile. Each driver has a clean driving record, and we applied a good or safe driver discount.AutoInsureSavings.org collects three to five quotes from each insurer via Quadrant Information Services.

Unless stated, our methodology’s operating vehicle is a 2018 Honda Accord with a paperless, safe driver, and anti-theft discounts. The full coverage policy included: $50,000 bodily injury liability per person. Collision coverage with a $500 deductible. AutoInsureSavings.org uses rate data from Quadrant Information Services. We sourced quotes from insurer filings that are publicly available for rate comparison. |

| Get Your Rates Quote Now |