Compare RatesStart Now → AutoInsureSavings.org licensed indemnity agents reviewed the cheapest car insurance companies in Nevada and found Progressive ( $614 per year ) has the cheapest rates for minimum liability coverage .

Progressive ( $1,513 annually ) offers the cheapest indemnity in Nevada for drivers with thoroughly drive records who need full coverage .

Affordable Nevada Car Insurance Rates

Comparing a car insurance quote from at least three to five indemnity carriers is the best way to make sure you find the best deals to save money monthly .

| Cheapest Car Insurance in Nevada – Key Takeaways |

|---|

The cheapest Nevada car insurance options are: The cheapest Nevada car insurance options are:

Cheapest for minimum coverage: Progressive |

Compare RatesStart Now → This guidebook will take a closer front at car policy providers and coverage options available to Nevada drivers and help oneself you determine which one is best for your individual needs .

Free Auto Insurance Comparison

embark your ZIP code below to view companies that have brassy car policy rates .

Secured with SHA-256 Encryption

Cheapest Car Insurance in Nevada for Minimum Coverage?

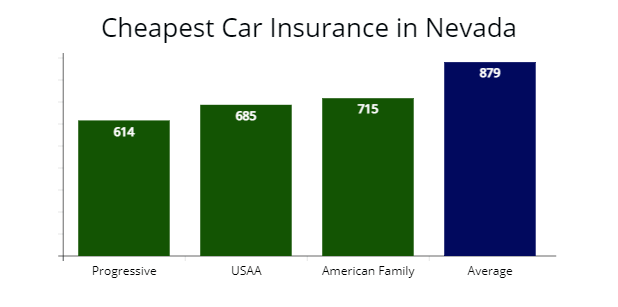

Our late research found the cheapest car insurance company in Nevada for minimum liability indemnity requirements is Progressive, which provided our agents a $614 insurance rate for our sample driver .

The average quote is $ 879 per year, and Progressive ’ south rate at $614 per year is 31% cheaper, making them the best choice for Nevada drivers needing minimum liability policy .

| Insurer | Average annual rate |

|---|---|

| Progressive | $614 |

| USAA | $685 |

| American Family | $715 |

| State Farm | $727 |

| Safeco | $858 |

| Allstate | $1,061 |

| GEICO | $1,150 |

| Farmers | $1,212 |

| Average in Nevada | $879 |

Compare RatesStart Now → *USAA is for modify military members, their spouses, and direct family members. Rates may vary depending on driver profiles .

military members, their spouses, or family members qualify for cheaper car indemnity through USAA. Buying minimum coverage insurance requirements at $685 annually through USAA is 23 % less expensive than the state average $ 879 rate .

Cheapest Full Coverage Car Insurance in Nevada

If you are matter to in having extra coverage options in Nevada while you are on the road, the cheapest full coverage rates are with Progressive at $1,513 annually or $126 per month .

Quotes from this car policy carrier are 30 % less expensive than Nevada ’ second average of $ 2,140 .

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $1,513 | $126 |

| American Family | $1,680 | $140 |

| State Farm | $1,823 | $151 |

| Nevada average | $2,140 | $178 |

Compare RatesStart Now → *Your rates may vary when you get quotes .

Full coverage car indemnity in Nevada costs more than double the measure that minimum coverage policy costs .

While many drivers may instantaneously turn away from taking out wide coverage due to the higher car indemnity rates, others appreciate the peace of mind and reassurance they receive by having collision and comprehensive coverage along with their liability coverage .

Compare RatesStart Now → Our agents recommend fully coverage indemnity in The Silver State to protect your vehicle and the other drivers. Collision coverage pays for damage to your vehicle no matter who is at fault. And comprehensive examination policy pays for non-collision wrong, such as from hitting a dealings sign or a fallen tree branch .

Cheapest Car Insurance With a Speeding Ticket in Nevada

The best coverage rate for drivers with one speeding violation in Nevada is American Family (AmFam), which offered us a quotation mark at $1,710 annually or $142 per month for full coverage. The modal cost of policy for Nevadans with a speed ticket is $ 2,616, but American Family is $ 906 cheaper .

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| American Family | $1,710 | $142 |

| Progressive | $1,772 | $147 |

| State Farm | $1,916 | $159 |

| Nevada average | $2,616 | $218 |

Compare RatesStart Now → traffic tickets will cause your car insurance rates to increase careless of coverage levels. In Nevada, most drivers expect rate increases by 19 % on average for traffic violations .

Cheapest Car Insurance in Nevada With a Car Accident

In Nevada, drivers with one at-fault accident on their force record should consider State Farm, the cheapest indemnity company, which provided our policy agents with a quote at $2,147 annually or $178 per month .

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $2,147 | $178 |

| Progressive | $2,359 | $196 |

| Liberty Mutual | $2,911 | $242 |

| Nevada average | $3,169 | $264 |

Compare RatesStart Now → In Nevada, the average cost of car policy after being involved in an accident is $ 3,169 per year or $ 264 per month. State Farm ’ randomness pace for those with a car accident is 33 % cheaper than average .

Your next cheap option is Progressive, with a $2,359 rate or $ 810 less than modal .

One at-fault accident on your drive record in Nevada, you can expect your car insurance rates to go up by 43 % over three years .

Cheapest Car Insurance With a DUI in Nevada

Nevada ’ s policy supplier to check out is Progressive for drivers with a DUI during our agent ’ s research. progressive ’ randomness quote of $2,511 per year or $209 per month is 37 % less expensive than average and $ 433 less than the adjacent best option GEICO Insurance .

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $2,511 | $209 |

| GEICO | $2,944 | $245 |

| American Family | $3,558 | $296 |

| Nevada average | $3,960 | $330 |

Compare RatesStart Now → In Nevada, drivers caught driving under the influence are expected to pay cable car insurance premiums 49 % more than drivers who have clean drive records .

Compare RatesStart Now → According to Nevada ’ s Department of Motor Vehicles ( DMV ), after a DUI, Nevada drivers must attend a MADD Victim Impact Panel, a state-approved alcohol awareness program, participate in community military service, and an ordering from a Judge to install an ignition interlock device ( BAIID ) in their drive vehicle for three to six months .

Cheapest Car Insurance For Drivers with Poor Credit in Nevada

According to our analysis, the Nevadan insurance company offering the best rates with poor people recognition is State Farm .

state Farm ’ sulfur quote of $2,033 per year is 25 % less expensive than the $ 2,681 average premium .

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $2,033 | $169 |

| GEICO | $2,250 | $187 |

| American Family | $2,717 | $226 |

| Nevada average | $2,681 | $223 |

Compare RatesStart Now → evening if you are a thoroughly driver in Nevada, your accredit report and mark can increase cable car indemnity rates by 32 %. That ’ s because many companies look at a person ’ s ability to pay off their debts or credit cards to reflect their ability to make their monthly car policy payments .

Cheapest Car Insurance for Young Drivers in Nevada

Our analysis found that Safeco Insurance is the cheapest policy ship’s company for young drivers in Nevada looking for fully coverage policy . Our indemnity agents received a rate of $4,547 annually from Safeco, which is 37 % more low-cost than Nevada ’ s submit average pace .

adolescent drivers looking for low-cost minimum coverage in Nevada should consider State Farm ( $ 1,915 ) and American Family ( $ 1,956 ). Both car insurers are 35 % cheaper than the average $ 3,009 Nevada car insurance rate .

| Auto Insurer | Full coverage | Minimum coverage |

|---|---|---|

| Safeco | $4,547 | $2,235 |

| State Farm | $4,724 | $1,915 |

| USAA | $4,815 | $2,178 |

| American Family | $5,449 | $1,956 |

| GEICO | $5,933 | $2,747 |

| Progressive | $6,248 | $3,164 |

| Farmers | $7,280 | $4,230 |

| Allstate | $8,157 | $4,277 |

| Liberty Mutual | $8,827 | $4,515 |

| Nevada average | $7,118 | $3,009 |

Compare RatesStart Now → *USAA is for modify military members, their spouses, and direct family members. Your indemnity rates may vary based on the driver ’ mho profile .

Our agents recommend a adolescent driver in Nevada carry entire coverage insurance and be added to an adult or parent ’ south policy to save the most money. Adding high school or college students to their rear ’ randomness policy is $ 1,400 in annual savings and up to 30 % if they qualify for a good scholar discount .

Cheapest Car Insurance for Young Drivers with a Speeding Ticket

young or adolescent drivers in Nevada who have a speed trespass will find low-cost insurance rates with Safeco, which provided us a quote at $384 per month or 44 % less expensive than the submit median rate .

State Farm proved low-cost Nevada indemnity with a $435 monthly rate for full coverage for similar driver profiles .

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Safeco | $4,611 | $384 |

| State Farm | $5,230 | $435 |

| GEICO | $6,274 | $522 |

| Nevada average | $8,125 | $677 |

Cheapest Car Insurance for Young Drivers with an Auto Accident

Young Nevadans with an at-fault accident can avoid meaning rate increases by getting indemnity coverage from Safeco Insurance with a quote at $421 per month or 45 % cheaper .

The following best coverage choice is State Farm, quoted at a $493 monthly rate or 35 % less expensive than a distinctive rate for a adolescent driver with a car accident in their driver history .

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Safeco | $5,055 | $421 |

| State Farm | $5,918 | $493 |

| GEICO | $6,671 | $555 |

| Nevada average | $9,046 | $753 |

Best Car Insurance Companies in Nevada

AutoInsureSavings.org agent ’ s surveil of car policy carriers in Nevada found American Family ( AmFam ) performed the best overall customer overhaul and JD Power claims satisfaction. other best car policy options based on customer service are Progressive and State Farm.

We studied data to help you find the best coverage choices and insurance decisions during our analysis of Nevada ’ south best car insurers. The datum we use is from the National Association of Insurance Commissioners ( NAIC ), J.D. Power ’ s customer satisfaction survey, and AM Best fiscal potency ratings .

| Insurer | NAIC Complaint Index | J.D. Power claims satisfaction score | AM Best Financial Strength Rating |

|---|---|---|---|

| American Family | 0.46 | 862 | A |

| Allstate | 0.63 | 876 | A+ |

| State Farm | 0.66 | 881 | A++ |

| Progressive | 0.67 | 856 | A+ |

| USAA | 0.68 | 890 | A++ |

| Farmers | 0.74 | 872 | A |

| Liberty Mutual | 0.85 | 877 | A |

| GEICO | 1.02 | 871 | A++ |

Compare RatesStart Now → *NAIC ailment index, the lower, the better, JD Power ’ sulfur claims atonement learn, the higher, the better, AM Best Ratings, A+ is “ excellent, ” and A++ is “ superior ” fiscal intensity .

American Family ( 0.46 ) and Allstate Insurance ( 0.63 ) perform best with NAIC ’ s complaint index. Both scored less than the national average of 1.00 with lower than average complaints based on their commercialize share .

Compare RatesStart Now → Deciding on the best car insurance company in Nevada is not a simple tax. That is because the gamble factors that make one car policy company the best for one driver may make them the worst option for another. Finding the best car insurance rates for you will depend on many factors like your age, your driving history, where you live, and your fomite ’ s make or model, to name a few .

A holocene indemnity sketch from ValuePenguin reached alike results for Nevada car indemnity carriers .

| Company | % respondents extremely satisfied with recent claim | % respondents rated customer service as excellent |

|---|---|---|

| American Family | 86% | 50% |

| USAA | 78% | 62% |

| Progressive | 74% | 34% |

| State Farm | 73% | 46% |

| Allstate | 72% | 47% |

| Farmers Insurance | 71% | 38% |

| GEICO | 64% | 42% |

| Liberty Mutual | 44% | 32% |

Average Car Insurance Costs by City in Nevada

Auto insurers use your energy code to calculate your insurance rate, a well as many other hazard factors such as marital condition, credit mark, type of vehicle, and driving history. Your rates can vary by $ 447 or more, depending on your travel rapidly code in Nevada .

AutoInsureSavings.org licensed policy agents analyzed cities with the cheapest indemnity coverage in Nevada .

Cheapest Car Insurance in Las Vegas, NV

Las Vega ’ sulfur cheap indemnity is with Progressive, which provided our agents a $1,739 annual quote or $ 144 per month with a $ 500 deductible for comprehensive and collision policy .

progressive ’ s rate is 29 % less expensive than the $ 2,427 Las Vegas average rate .

| Las Vegas Company | Average Premium |

|---|---|

| Progressive | $1,739 |

| State Farm | $1,860 |

| Safeco | $2,033 |

| Las Vegas average | $2,427 |

Cheap Auto Insurance in Henderson, NV

Henderson ’ s least expensive car indemnity is with GEICO, which offered us a $1,694 rate for our sample distribution 30-year-old driver with full coverage. GEICO ’ south quote is 30 % cheaper than Henderson ’ s modal rates of $ 2,390 per year .

| Henderson Company | Average Premium |

|---|---|

| GEICO | $1,694 |

| State Farm | $1,746 |

| Progressive | $1,827 |

| Henderson average | $2,390 |

Cheapest Auto Insurance in Reno, NV

In Reno, cheaper insurance coverage can be found with American Family, which offered our agents a $1,613 quote for a full coverage policy. american Family ’ south rate is 34 % less expensive than Reno ’ randomness average of $ 2,412 per year .

| Reno Company | Average Premium |

|---|---|

| American Family | $1,613 |

| GEICO | $1,756 |

| Progressive | $1,906 |

| Reno average | $2,412 |

Cheapest Auto Insurance in North Las Vegas, NV

low-cost insurance coverage in North Las Vegas is with Progressive providing the best pace at $1,739 annually for a broad coverage policy. progressive ’ s $ 144 a calendar month pace is 29 % less expensive than modal for North Las Vegas residents .

| North Las Vegas Company | Average Premium |

|---|---|

| Progressive | $1,739 |

| State Farm | $1,860 |

| Safeco | $2,033 |

| North Las Vegas average | $2,427 |

Cheap Auto Insurance in Paradise, NV

Drivers in Paradise can get cheaper policy with State Farm, which provided our license agents a $1,470 per year rate for a broad coverage policy with $ 100,000 in indebtedness insurance. State Farm ’ sulfur quote is 33 % less expensive than the average $ 2,173 annually rate in Paradise, Nevada .

| Paradise Company | Average Premium |

|---|---|

| State Farm | $1,470 |

| AmFam | $1,515 |

| Safeco | $1,648 |

| Paradise average | $2,173 |

Cheapest Car Insurance in Spring Valley, NV

The most low-cost rates our agents found in Spring Valley is Progressive, with a $1,397 per year rate for a policy with collision and comprehensive coverage. progressive ’ sulfur quotation is 37% less expensive than Spring Valley ’ randomness average rate of $ 2,206 per class .

| Spring Valley Company | Average Premium |

|---|---|

| Progressive | $1,397 |

| Safeco | $1,532 |

| AmFam | $1,623 |

| Spring Valley average | $2,206 |

Cheap Auto Insurance in Sunrise Manor, NV

Sunrise Manor drivers can find bum cable car insurance that offers a wax coverage policy policy with Progressive, which offered us a $1,420 annual rate for our sample distribution 30-year-old driver. progressive ’ south car insurance rate is $ 769 less per year than Sunrise Manor ’ south average of $ 2,189 per class .

| Sunrise Manor Company | Average Premium |

|---|---|

| Progressive | $1,420 |

| Safeco | $1,642 |

| GEICO | $1,761 |

| Sunrise Manor average | $2,189 |

Minimum Auto Insurance Requirements in Nevada

Nevada vehicle registration requires all drivers to carry a minimum amount of indebtedness coverage in their cable car policy policies. The indemnity requirements can provide bodily injury liability and property damage indebtedness coverage sustained to other people or centrifugal vehicles, which are :

| Liability | Minimum coverage |

|---|---|

| Bodily injury liability | $25,000 per person and $50,000 per accident |

| Property damage Liability | $20,000 per accident |

Frequently Asked Questions

Who has the Cheapest Car Insurance in Nevada?

We found the top car insurance companies that offer the lowest Nevada drivers ’ average rates are Progressive at $ 51 per calendar month, USAA at $ 57 per calendar month, and american english Family at $ 60 a calendar month for a state of matter minimal coverage policy for a 30-year-old with uninfected driving history .

How Much is Car Insurance in Nevada per Month?

On average, drivers pay around $ 74 per month for state minimal coverage in Nevada and $ 178 per calendar month for entire coverage indemnity. Based on our research, Progressive Insurance ( $ 1,513 per year ) is one of the submit ’ s most low-cost car insurance companies. Most drivers ’ average annual rate is around $ 879 per year for state minimums and $ 2,140 per annum, including comprehensive and collision coverage .

How Much Is Full Coverage Car Insurance in Nevada?

On average, most drivers in Nevada pay for full coverage indemnity is $ 178 per calendar month or $ 2,140 per year. Nevada ’ s top policy companies that offer the lowest rate for drivers matter to in wide coverage car indemnity policies include Progressive, American Family, and State Farm. All three insurers provide car insurance quotes 16 % lower than average, depending on your driver profile .

How do I Save on Car Insurance in Nevada?

There are many things drivers can do to help save money on their car indemnity rates in Nevada. First, you will need to compare quotes from multiple insurance providers to find the right party that offers the demand level of coverage in Nevada you need at the most low-cost price.

Another thing drivers can do to help them save more on their car indemnity rates is ask their car insurance provider about a money-saving driver dismiss they may be eligible for. many companies offer cable car insurance discounts for drivers who have multiple coverage policies with them or drivers who have no prior accidents or violations on their force records. Consider Usage-Based car insurance, such a Progressive ’ randomness Snapshot platform. You can get long-run savings of 20 to 30 %, depending on your safe drive habits .

To learn more and find the best car policy options in Nevada, contact the experts at AutoInsureSavings.org. Our license policy professionals will be happy to answer any questions you have.

MethodologyAutoInsureSavings.org comparison shop sketch used a full-coverage car policy for a 30-year-old driving a 2018 Honda Accord with the follow coverage limits :

| Coverage type | Study limits | |

|---|---|---|

| Bodily liability | $50,000 per person/$100,000 per accident | |

| Property damage | $25,000 per accident | |

| Personal injury protection | $10,000 | |

| Uninsured motorist bodily injury & underinsured motorist bodily injury | $50,000 per person/$100,000 per accident | |

| Comprehensive and collision | $500 deductible | |

| Get Your Rates Quote Now | ||

Compare RatesStart Now → We used indemnity rates for drivers with accident histories, credit scores, and marital status for early rate analyses. We used indemnity rate data from Quadrant Information Services, which are publicly available for comparative purposes only. Your car indemnity rates may vary when you get quotes.