Best Cheap Car Insurance in Oregon

Carrying indemnity in the department of state of Oregon is mandated by country law. however, who provides your coverage and anything above the liability insurance requirements are a matter of choice .

| Cheapest Car Insurance in Oregon – Key Takeaways |

|---|

The cheapest Oregon car insurance options are: The cheapest Oregon car insurance options are:

Cheapest for minimum coverage: Progressive |

| Get Your Rates Quote Now |

Compare RatesStart Now → Keep reading to answer your indemnity questions. Learn how to save money with Oregon car policy companies in assorted age groups, and how to find the best car indemnity coverage for the most low-cost cost through comparison shop .

Free Auto Insurance Comparison

figure your ZIP code below to view companies that have cheap car policy rates .

Secured with SHA-256 Encryption

Cheapest Car Insurance in Oregon for Minimum Coverage

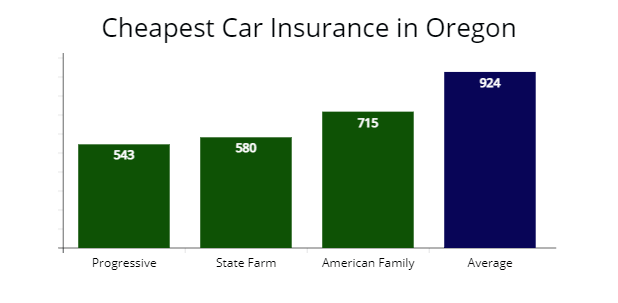

Our agents found that Progressive offers the cheapest minimal coverage car indemnity for Oregon drivers with a estimable drive record at $543 per year, which is 24 % less expensive than the average cost for minimum liability from early cable car indemnity companies in Oregon at $ 924 per class .

Compare RatesStart Now → enter your zip code code above to compare the cheapest options for an car indemnity quote from the best car insurers to help you save money .

| Auto Insurer | Average Annual Rate | |

|---|---|---|

| Progressive | $543 | |

| State Farm | $580 | |

| USAA | $624 | |

| American Family | $715 | |

| Country Financial | $753 | |

| Wawanesa | $795 | |

| GEICO | $876 | |

| Allstate | $978 | |

| Farmers | $1,031 | |

| Nationwide | $1,154 | |

| Get Your Rates Quote Now | ||

Compare RatesStart Now → *USAA is for qualify military members, their spouses, and steer family members. Auto insurance rates vary depending on driver profiles .

We found the most expensive policy providers for minimal coverage during our pace analysis are Farmers and Nationwide, with an modal quote of $ 1,031 and $ 1,154 per year.

Compare RatesStart Now → The cheapest car insurance in the state of Oregon is based on several factors. First, you must determine if you want wax coverage or the department of state minimum coverage. then, you must factor in your vehicle data, historic period, and driving history .

minimum coverage is a liability-only policy policy with bodily injury and property damage liability indemnity and uninsured motorist bodily wound, including personal injury security .

Cheapest Insurance for Full Coverage in Oregon

State Farm offers brassy insurance rates in Oregon at $1,217 per year or $101 per month for broad coverage, 35 % cheaper than Oregon state average rates .

The next best is Progressive, which offers full moon coverage indemnity rates at $ 1,465 per year or 21 % cheaper than average rates .

| Insurer | Annual Cost | Monthly Cost | ||

|---|---|---|---|---|

| State Farm | $1,217 | $101 | ||

| Progressive | $1,465 | $122 | ||

| American Family | $1,576 | $131 | ||

| Oregon average | $1,847 | $153 | ||

| Get Your Rates Quote Now | ||||

Compare RatesStart Now → *Your rates may vary when you get a quote .

Oregon ’ south average premium for full coverage insurance is $ 1,847 per class or $ 153 per month .

Full coverage policies include comprehensive examination and collision, which reimburse property damage to your vehicle from car accidents, vandalism, or thefts .

AutoInsureSavings.org licensed policy agents to recommend drivers in Oregon with newer model vehicles to buy a full coverage car indemnity policy .

Cheapest Auto Insurance in Oregon With Speeding Tickets

Our accredited agents found American Family Insurance company offers the brassy rates for Oregon drivers with accelerate tickets at $1,678 per year or a $ 139 monthly rate. american Family ’ randomness pace is 27 % less expensive than Oregon ’ s average rates of $ 2,268 per year .

| Insurer | Annual Cost | Monthly Cost | ||

|---|---|---|---|---|

| American Family | $1,678 | $139 | ||

| Progressive | $1,723 | $143 | ||

| State Farm | $1,850 | $154 | ||

| Oregon average | $2,268 | $189 | ||

| Get Your Rates Quote Now | ||||

Compare RatesStart Now → The average cable car indemnity bounty for an Oregon driver with a speed misdemeanor is $ 2,258, or $ 421 more for car insurance than a clean record driver .

A minor rush irreverence stays on Oregon drive records for two years. During those two years, the cost of car insurance can increase by 19 %, according to the Oregon Driver & Motor Vehicle Services .

Cheapest Insurance in Oregon For Drivers with an Accident

Country Financial offers the best rate for drivers with a late at-fault accident in Oregon, with car indemnity premiums at $1,934 per year. That is $ 1,051 per class less than the median amount drivers pay ( $ 2,985 ) for car insurance coverage in Oregon .

| Insurer | Annual Cost | Monthly Cost | ||

|---|---|---|---|---|

| Country Financial | $1,934 | $161 | ||

| State Farm | $2,051 | $170 | ||

| Wawanesa | $2,374 | $197 | ||

| Oregon average | $2,985 | $248 | ||

| Get Your Rates Quote Now | ||||

Compare RatesStart Now → The least expensive policy coverage exists for people with clean drive records. Oregon car insurance carriers will cover people with an accident. Oregon ’ south median rates for a person with a car accident on their drive record would be $ 2,985 per class, over $ 1,138 more than the modal premium for full coverage .

Cheapest Auto Insurance in Oregon for Drivers with a DUI

Progressive offers the cheapest car indemnity rates for drivers in Oregon with a DUI in their drive history at $1,862 per year. The average rate for drivers with a DUI in Oregon is $ 2,860, and Progressive offers savings of $ 998 per year .

| Insurer | Annual Cost | Monthly Cost | ||

|---|---|---|---|---|

| Progressive | $1,862 | $155 | ||

| State Farm | $2,127 | $177 | ||

| Oregon Mutual | $2,561 | $213 | ||

| Oregon average | $2,860 | $238 | ||

| Get Your Rates Quote Now | ||||

Compare RatesStart Now → According to the Oregon Health Authority, DUI offenders in Oregon will have driving privileges suspended for one year, a want ignition mesh device ( IID ) installed in their motive fomite for one year, with the necessitate defensive repel run, and 80 hours of community military service. A drink drive violation in Oregon can raise your car policy premiums by 36 % per year for 24 months .

Cheapest Car Insurance in Oregon for Drivers With Poor Credit

State Farm offers the least expensive policy premiums for Oregon drivers with a poor credit score. State Farm provides a savings of over $772 per year or 31 % less expensive, with an indemnity premium of $ 1,798 per year for wax coverage .

Progressive is the second gear bum car indemnity choice for a poor credit grudge at $ 1,954 per year or 24 % cheaper than modal Oregon hapless credit rates .

| Insurer | Annual Cost | Monthly Cost | ||

|---|---|---|---|---|

| State Farm | $1,798 | $149 | ||

| Progressive | $1,954 | $162 | ||

| Nationwide | $2,231 | $185 | ||

| Oregon average | $2,570 | $214 | ||

| Get Your Rates Quote Now | ||||

Compare RatesStart Now → We found drivers with a regretful credit grade pay 29 % more for coverage in Oregon than those with good credit scores during our rate analysis. Make sure to pay your credit cards, student loans, and bills on time to find the best rates with Oregon cable car insurance. And keep an eye on your credit report .

Cheapest Car Insurance in Oregon for Young Drivers

Younger drivers shopping for car indemnity can find cheap rates in Oregon with GEICO, who provided our agents with a $3,165 per year quote for entire coverage. GEICO ’ s rate is 43 % cheaper than Oregon ’ s average young driver rate of $ 5,521 per year .

adolescent drivers can find the cheapest indemnity for minimum coverage in Oregon with Country Financial, which provided us with a $1,714 per year rate for an 18-year-old driver .

| Insurer | Full Coverage | Minimum Coverage | ||

|---|---|---|---|---|

| GEICO | $3,165 | $1,890 | ||

| USAA | $3,378 | $1,587 | ||

| Country Financial | $3,481 | $1,714 | ||

| State Farm | $3,765 | $1,765 | ||

| Farmers | $4,438 | $2,087 | ||

| Nationwide | $5,176 | $2,548 | ||

| Progressive | $6,328 | $1,976 | ||

| American Family | $6,646 | $3,148 | ||

| Liberty Mutual | $7,894 | $3,033 | ||

| Oregon average | $5,521 | $2,353 | ||

| Get Your Rates Quote Now | ||||

Compare RatesStart Now → *USAA is for qualify military members, their spouses, and conduct family members. Coverage rates may vary depending on driver profiles .

A adolescent driver who recently received their driver ’ south license or has been driving for less than five years is a bad driver .

Compare RatesStart Now → They tend to get more traffic tickets and have more accidents. The price to insure an Oregon driver under 21 is importantly higher than insuring a driver over 30 with a clean driving record .

Cheapest Insurance for Young Drivers with Speeding Tickets

young or adolescent drivers in Oregon should compare car policy quotes with Nationwide Insurance caller with a speeding slate in their drive history. Nationwide provided our agents a quote at $ 5,176 per year or $431 per month .

Nationwide ’ sulfur coverage rates are 17 % less expensive than median rates for young Oregon drivers .

| Insurer | Annual Cost | Monthly Cost | ||

|---|---|---|---|---|

| Nationwide | $5,176 | $431 | ||

| GEICO | $5,241 | $436 | ||

| Country Financial | $5,573 | $464 | ||

| Oregon average | $6,137 | $511 | ||

| Get Your Rates Quote Now | ||||

Cheapest Car Insurance for Young Drivers in Oregon with an Accident

According to our license agentive role ’ randomness rate analysis, younger drivers with an at-fault accident can find the cheapest cable car policy quotes with Nationwide, with an average cost of $ 5,176 per year or $431 per month .

Nationwide ’ s indemnity pace is 39 % less expensive than Oregon ’ s $ 8,431 average rates for younger drivers with an at-fault accident .

| Insurer | Annual Cost | Monthly Cost | ||

|---|---|---|---|---|

| Nationwide | $5,176 | $431 | ||

| Country Financial | $5,208 | $434 | ||

| GEICO | $5,987 | $498 | ||

| Oregon average | $8,431 | $702 | ||

| Get Your Rates Quote Now | ||||

Best Auto Insurance Companies in Oregon

If we use the NAIC charge index, J.D. Powers claims atonement study, and the average price for express minimum and full coverage, American Family ( AmFam ) and Country Financial are the best cable car insurance companies in Oregon .

sometimes getting the most low-cost indemnity company for the average driver international relations and security network ’ t the best for quality customer avail for Oregon drivers. Depending on your assets and position, you may need to compare insurance companies with higher than average customer service and satisfaction standards .

| Auto Insurer | % respondents satisfied with recent claim | % respondents rated customer service as excellent | ||

|---|---|---|---|---|

| American Family | 86% | 50% | ||

| Liberty Mutual | 82% | 40% | ||

| USAA | 78% | 62% | ||

| Progressive | 74% | 34% | ||

| State Farm | 73% | 46% | ||

| Allstate | 72% | 47% | ||

| Farmers Insurance | 71% | 38% | ||

| GEICO | 64% | 42% | ||

| Get Your Rates Quote Now | ||||

Compare RatesStart Now → According to ValuePenguin, AmFam received the highest customer satisfaction ratings for Oregon car insurance. AmFam besides received the highest satisfaction ratings from its customers for both claims atonement and an NAIC ailment index of 0.55, well below the national average of 1.00 .

Compare RatesStart Now → If we take the National Association of Insurance Commissioners ( NAIC ) complaint index, J.D. Power claims atonement seduce, and A.M. Best fiscal intensity ratings, the results are exchangeable .

| Company | NAIC complaint index | J.D. Power Claims Satisfaction | AM Best Rating | |||

|---|---|---|---|---|---|---|

| PEMCO | 0.04 | n/a | B++ | |||

| Country Financial | 0.19 | 863 | A+ | |||

| Farmers | 0.51 | 872 | A | |||

| American Family | 0.55 | 861 | A++ | |||

| Progressive | 0.59 | 856 | A+ | |||

| Allstate | 0.63 | 876 | A+ | |||

| State Farm | 0.66 | 881 | A++ | |||

| USAA | 0.68 | 890 | A++ | |||

| Liberty Mutual | 0.92 | 870 | A | |||

| GEICO | 1.02 | 871 | A++ | |||

| Get Your Rates Quote Now | ||||||

Compare RatesStart Now → Country Financial ( 0.19 ), Farmers Insurance ( 0.51 ), and AmFam ( 0.55 ) are the best car insurance companies with excellent fiscal intensity, have a ailment proportion below the national average of 1.00 which means all three car policy companies have fewer complaints relative to their marketplace share .

Average Car Insurance Costs by City in Oregon

An policy company will use your zip up code and many factors to determine your Oregon car insurance costs, american samoa well as your credit score, marital condition, type of motor vehicle, and past drive history. If you live in Oregon ’ s more urban areas, there is a higher luck of car larceny or being in an car accident. policy companies will increase rates to account for such risk, which can pose an return for what you will pay for in the overall cost of car indemnity .

Cheapest Car Insurance in Portland, OR

Drivers in Portland can find the most low-cost coverage with Country Financial with a $1,532 per year rate for our 30-year-old sample driver. A $ 1,532 quote from Country Financial is 30 % cheaper than Portland, Oregon ’ second average car policy rates .

| Portland Company | Average Premium | |

|---|---|---|

| Country Financial | $1,532 | |

| State Farm | $1,651 | |

| Progressive | $1,680 | |

| Portland average | $2,186 | |

| Get Your Rates Quote Now | ||

Cheapest Car Insurance in Salem, OR

State Farm offers cheap policy for drivers in Salem who provided our license agents a quotation at $1,388 per year or a $ 115 monthly pace. State Farm ’ sulfur rate is 31 % less expensive than average rates in Salem, Oregon .

| Salem Company | Average Premium | |

|---|---|---|

| State Farm | $1,388 | |

| Progressive | $1,475 | |

| Travelers | $1,734 | |

| Salem average | $2,007 | |

| Get Your Rates Quote Now | ||

Cheapest Car Insurance in Eugene, OR

Eugene drivers can find cheap policy with Progressive, who offered us a quote at $1,416 per year or a $ 117 monthly rate with $ 500 deductibles for comprehensive examination and collision indemnity. Progressive ’ s policy quotation is 32 % cheaper than Eugene ’ mho average rates at $ 2,075 per year .

| Eugene Company | Average Premium | |

|---|---|---|

| Progressive | $1,414 | |

| Country Financial | $1,529 | |

| Travelers | $1,811 | |

| Eugene average | $2,075 | |

| Get Your Rates Quote Now | ||

Compare RatesStart Now →

Cheapest Car Insurance in Gresham, OR

Progressive Insurance offers cheaper car indemnity for drivers in Gresham with a effective driving record with quotes at $1,436 per year and 30 % less expensive than average rates in Gresham .

| Gresham Company | Average Premium | |

|---|---|---|

| Progressive | $1,436 | |

| Country Financial | $1,538 | |

| State Farm | $1,571 | |

| Gresham average | $2,042 | |

| Get Your Rates Quote Now | ||

Cheapest Auto Insurance in Hillsboro, OR

AutoInsureSavings.org licensed agents found that Hillsboro ’ sulfur cheapest indemnity rate is with State Farm, who provided us a quote at $1,327 per year for full coverage or 33 % lower than average rates for drivers in Hillsboro, Oregon .

| Hillsboro Company | Average Premium | |

|---|---|---|

| State Farm | $1,327 | |

| American Family | $1,400 | |

| Country Financial | $1,526 | |

| Hillsboro average | $1,964 | |

| Get Your Rates Quote Now | ||

Cheapest Auto Insurance in Beaverton, OR

Country Financial offers cheaper cable car indemnity for drivers in Beaverton, Oregon, with a quotation at $1,314 per year or a $ 109 monthly rate for a entire coverage cable car policy policy, which is 30 % less expensive than the average rates in Beaverton .

| Beaverton Company | Average Premium | |

|---|---|---|

| Country Financial | $1,314 | |

| American Family | $1,375 | |

| GEICO | $1,651 | |

| Beaverton average | $1,855 | |

| Get Your Rates Quote Now | ||

Compare RatesStart Now →

Average Cost of Insurance for All Cities in Oregon

Compare RatesStart Now →

Minimum Car Insurance Requirements in Oregon

Drivers in Oregon must carry the submit minimal car insurance requirements for vehicle registration. State police mandates drivers have at least $ 25,000 per person and up to $ 50,000 per accident of bodily injury liability coverage. They besides require at least $ 25,000 per accident of property damage liability coverage .

| Liability insurance | State minimum requirements | |

|---|---|---|

| Bodily injury liability | $25,000 per person / $50,000 per accident | |

| Property damage liability | $20,000 per accident | |

| Uninsured/Underinsured motorist bodily injury insurance | $25,000 per person / $50,000 per accident | |

| Personal injury protection (PIP) | $15,000 | |

| Get Your Rates Quote Now | ||

Compare RatesStart Now → Oregon is a no-fault state, so drivers must carry personal wound protective covering in their car insurance premiums along with uninsured motorist bodily injury coverage .

AutoInsureSavings.org licensed agents recommend buying coverage with higher indebtedness limits with comprehensive and collision coverage in Oregon for the modal driver with multiple assets, such as houses or multiple vehicles .

According to the Insurance Information Institute ( III.org ), we recommend higher uninsured motorist coverage limits since Oregon ’ south uninsured motorist rate is 10.2 % .

Oregon Car Insurance FAQs

Who has the cheapest car insurance in Oregon?

We found the top car indemnity companies that offer the lowest oregon driver ’ south average rates are Progressive at $ 543 per year, State Farm at $ 580 per year, and american Family at $ 715 per year for a state minimal car policy policy for a 30-year-old with uninfected driving history .

How much is car insurance in Oregon per month?

On average, drivers pay around $ 77 per month for state minimum coverage in Oregon and $ 153 per calendar month for broad coverage indemnity. Based on our research, State Farm, at $ 1,217 per year, is one of the state of matter ’ s most low-cost car insurance companies. Most driver ’ s average annual rate is around $ 924 per year for state of matter minimums and $ 1,847 per year, including comprehensive and collision coverage .

How much is full coverage car insurance in Oregon?

On average, most drivers in Oregon yield for full coverage policy is $ 153 per calendar month or $ 1,847 per year. Oregon ’ s clear insurance companies that offer the lowest rate for drivers interested in wide coverage car indemnity policies include State Farm and Progressive. Both insurers provide car indemnity quotes 21 % lower than average rates, depending on your driver profile .

How do I save on car insurance in Oregon?

There are many things drivers can do to help save money on their car indemnity rates in Oregon. First, you will need to compare quotes from multiple policy providers to find the right insurance party that offers the claim charge of coverage in Oregon you need at the most low-cost price .

Another thing drivers in Oregon can do to help them save more on their car indemnity rates is to ask their car indemnity supplier about a money-saving driver rebate they may be eligible for. many companies offer car insurance discounts for drivers who have multiple coverage policies with them or drivers who have no prior accidents or violations on their drive records. Consider Usage-Based car policy, such as american Family ’ south KnowYourDrive Program. You can get long-run savings up to 20 %, depending on your safe drive habits and driver demeanor .

To learn more about finding the best rates and car insurance options in Oregon, contact the experts at AutoInsureSavings.org. Our license professionals will be happy to answer any questions you have .

Methodology

AutoInsureSavings.org comparison shopping study used a full-coverage car policy for a 30-year-old driving a 2018 Honda Accord in Oregon with the following coverage limits :

| Coverage type | Study limits |

|---|---|

| Bodily liability | $50,000 per person/$100,000 per accident |

| Property damage | $25,000 per accident |

| Personal injury protection | $10,000 |

| Uninsured motorist bodily injury & underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

Compare RatesStart Now → We used car indemnity rates for drivers in Oregon with accident histories, credit scores, and marital status for early rate analyses. We used policy rate data from Quadrant Information Services, which are publicly available for comparative purposes only. Your car policy rates will vary when you get quotes .