Compare RatesStart Now → AutoInsureSavings.org licensed policy agents reviewed the top car policy companies in Kentucky and found that Kentucky Farm Bureau has the best submit minimal coverage policy rates. State Farm has the best rates for a wide coverage policy .

AutoInsureSavings.org looked at over ten major Kentucky car insurance providers and found the median indemnity rate to be $ 775 for a six-month premium and $ 1,850 for a wide coverage premium .

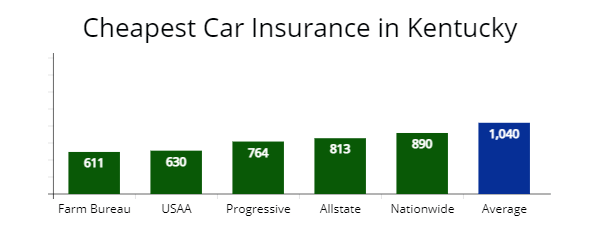

Cheapest Car Insurance in Kentucky

| Kentucky Cheapest Insurance Coverage – Key Considerations |

|---|

The cheapest insurance companies in Kentucky for minimum insurance requirements are Kentucky Farm Bureau, USAA, and Progressive. All three auto insurers provide coverage 27% less expensive than the statewide average rates. The cheapest insurance companies in Kentucky for minimum insurance requirements are Kentucky Farm Bureau, USAA, and Progressive. All three auto insurers provide coverage 27% less expensive than the statewide average rates. |

| The most affordable insurers for full coverage in Kentucky are State Farm and Kentucky Farm Bureau. State Farm has an average monthly rate of $133, and Farm Bureau’s is $137. Both 12% lower than the $154 average Kentucky rate. |

| The best-rated insurers in Kentucky based on the National Association of Insurance Commissioners (NAIC) complaint index, and A.M. Best’s ratings are Auto-Owners, Kentucky Farm Bureau, and Shelter. |

| The average annual car insurance rate for Kentucky drivers is $86 monthly or $1,040 per year for minimum liability coverage and $154 per month or $1,850 annually for full coverage. |

| Get Your Rates Quote Now |

Compare RatesStart Now →

Free Auto Insurance Comparison

enter your ZIP code below to view companies that have bum car policy rates .

Secured with SHA-256 Encryption

Cheapest Car Insurance in Kentucky for Minimum Coverage

If you want to save money and buy the cheapest minimum coverage in Kentucky, Kentucky Farm Bureau is the best option .

Our sample rates for a 30-year-old driver paid $611 annually, 42 % less expensive than the express ’ second average premium. Progressive and GEICO are cheap choices ( 27 % lower ), providing adequate coverage limits with our sample Kentucky car insurance companies .

Our sample rates for a 30-year-old driver paid $611 annually, 42 % less expensive than the express ’ second average premium. Progressive and GEICO are cheap choices ( 27 % lower ), providing adequate coverage limits with our sample Kentucky car insurance companies .

| Insurance Company | Average annual rate | |

|---|---|---|

| Kentucky Farm Bureau | $611 | |

| USAA* | $630 | |

| Progressive | $764 | |

| GEICO | $781 | |

| Allstate | $813 | |

| Nationwide | $890 | |

| Average | $1,040 | |

| Get Your Rates Quote Now | ||

Compare RatesStart Now → *USAA is merely available to military members, their spouses, and steer kin members .

Make certain to compare equal indebtedness coverage levels. Your results may vary when you get quotes.

If you are a driver in Kentucky looking for the cheapest car policy by slide fastener code, you can buy a state minimum bodily injury and property damage policy. hush, our experts recommend getting higher liability indemnity to make certain you are protected against bodily injury or property damage to others if you are at fault in a car clang .

Our license experts recommend that you constantly compare quotes from at least three different providers, if not more, so you may be able to get the best price and best coverage .

What is the Cheapest Car Insurance Company for Full Coverage in Kentucky?

Through our comparison denounce report, the cheapest insurers providing the best broad coverage car policy policy for Kentucky drivers are State Farm and Kentucky Farm Bureau .

State Farm provides average rates at $ 1,593 per annum or $ 133 per month. farm Bureau provides quotes at $ 1,655 per year, which is 11 % cheaper than the average bounty of $ 1,850 .

| Insurance Company | Annual cost | Monthly cost | ||

|---|---|---|---|---|

| State Farm | $1,593 | $133 | ||

| Kentucky Farm Bureau | $1,655 | $137 | ||

| Progressive | $1,953 | $162 | ||

| Average | $1,850 | $154 | ||

| Get Your Rates Quote Now | ||||

Compare RatesStart Now → Make to sure comparison peer coverage levels. Your results may vary when you get quotes .

here is the average annual monetary value for wide coverage car policy in Kentucky for 20-year-old drivers from some top providers :

| Insurance Company | Annual cost for 20-year-old | Monthly cost | ||

|---|---|---|---|---|

| GEICO | $2,988 | $249 | ||

| Kentucky Farm Bureau | $3,310 | $275 | ||

| Grange | $3,589 | $299 | ||

| Average | $4,291 | $357 | ||

| Get Your Rates Quote Now | ||||

Compare RatesStart Now → For 40-year-old drivers, the annual rates are quite different, and the companies ’ order from the most low-cost to most expensive is besides quite different from the results for 20-year-old drivers .

| Insurance Company | Annual cost for 40-year-old | Monthly cost | ||

|---|---|---|---|---|

| State Farm | $1,389 | $115 | ||

| Kentucky Farm Bureau | $1,422 | $119 | ||

| Grange | $1,570 | $130 | ||

| Average | $1,588 | $132 | ||

| Get Your Rates Quote Now | ||||

Compare RatesStart Now → According to the Insurance Information Institute ( III.org ), a driver ’ randomness old age significantly differs in the annual premium cost. For 20-year-old drivers, GEICO ’ s cheapest rate is $ 2,988, while for 40-year-olds, the highest rates from Grange Insurance are hush less expensive, at $ 1,570 per year .

What is the Cheapest Car Insurance for Good Drivers?

Drivers in Kentucky who have effective drive records with no violations typically have lower premium costs than those with a long history of speeding tickets, accidents, or DUI offenses .

many dependable drivers will much save adenine much as 16 % on their entire premium costs, which is right under the national modal at 17 %. Along with enjoying a more low-cost agio, these drivers may qualify for safe driver bonuses or discounts through their insurance company .

| Rating Factor | $ Savings | % Savings | ||

|---|---|---|---|---|

| No Traffic Tickets | $406 | 16.45% | ||

| No Accidents | $1,104 | 34.88% | ||

| Good Credit | $2,498 | 54.80% | ||

| Get Your Rates Quote Now | ||||

On average, drivers who have no traffic tickets on their records save may be able to save around $ 406 per annum on their premium .

Those who have had no accidents with well repel records may be able to save $ 1,104 a year, and those who have a dependable accredit mark can save around $ 2,498 annually with an insurance provider .

Cheapest Car Insurance for Drivers with an Accident?

There is a significant dispute between the rates for drivers with no accidents on their history and drivers who have had just one at-fault accident. Your rates can jump by over 50 % with one at-fault accident .

State Farm offers the brassy car indemnity for Kentucky drivers, with one at-fault accident providing coverage 188 % less expensive than the average rate .

| Insurer | Annual cost | Monthly cost | ||

|---|---|---|---|---|

| State Farm | $1,933 | $161 | ||

| Kentucky Farm Bureau | $2,230 | $185 | ||

| GEICO | $2,670 | $222 | ||

| Liberty Mutual | $2,941 | $245 | ||

| Kentucky average | $3,644 | $303 | ||

| Get Your Rates Quote Now | ||||

Compare RatesStart Now → For example, the remainder between two 30-year-old drivers with State Farm Insurance, one with effective driving history and one with a individual accident on their record, is $ 342 per annum. It pays to stay safe on the road in more ways than one .

Cheapest Car Insurance for Drivers with a Speeding Ticket?

Drivers who have one or more speed tickets on their commemorate are likely to see a lot higher costs with their insurance rates .

Based on research, drivers in Kentucky had their rates go improving 48 % after one traffic misdemeanor. But some car insurance companies do not charge drivers with a speeding violation deoxyadenosine monophosphate much as others .

Our comparison learn found that Kentucky Farm Bureau provides the cheapest indemnity quotes after a accelerate rape. Offering coverage 52 % less expensive than the average rate .

An excellent second choice is State Farm, offering quotes at $ 1,788 or $ 149 per month after a travel rapidly tag irreverence .

Hera are some sample rates for drivers with a speeding ticket from top insurance providers :

| Insurer | Annual cost | Monthly cost | ||

|---|---|---|---|---|

| Kentucky Farm Bureau | $1,711 | $142 | ||

| State Farm | $1,788 | $149 | ||

| Allstate | $2,433 | $202 | ||

| Nationwide | $2,609 | $217 | ||

| Average | $3,541 | $295 | ||

| Get Your Rates Quote Now | ||||

How Does a Ticket Affect Your Car Insurance Rates in Kentucky?

As you can see in the rate comparisons we have already mentioned, the dispute between a driver with a perfect driving history and one who has had an accident or other violations is substantial .

Drivers who have no violations or a driver ’ sulfur license suspension on their record can save ampere much as a thousand dollars or more on their annual bounty .

If you are involved in an accident in Kentucky and found at-fault, you can expect your car policy rates to rise .

The entail car indemnity rate in the country after an at-fault crash is $ 3,291. The U.S. average is only $ 2,012. Drivers involved in a severe car crash such as a collision where they are found at-fault will have the incidental persist on their records for adenine long as three years. And possibly have their drive privileges revoked .

| Violation | Annual Insurance Rate | % Insurance Rate Increase | $ Insurance Rate Increase | |||

|---|---|---|---|---|---|---|

| Hit and Run | $2,951 | 55% | $1,053 | |||

| DUI | $2,840 | 50% | $942 | |||

| Reckless Driving | $2,868 | 51% | $969 | |||

| Driving with a Suspended License | $2,692 | 42% | $794 | |||

| At-Fault Accident | $2,940 | 55% | $1,042 | |||

| Passing a School Bus | $2,285 | 20% | $386 | |||

| Improper Passing | $2,300 | 21% | $402 | |||

| Following Too Closely | $2,300 | 21% | $402 | |||

| Speeding | $2,315 | 22% | $416 | |||

| Failure to Stop at a Red Light | $2,300 | 21% | $402 | |||

| Illegal Turn | $2,300 | 21% | $402 | |||

| Failure to Yield | $2,300 | 21% | $402 | |||

| Distracted Driving | $2,249 | 18% | $350 | |||

| Driving with Expired Registration | $2,078 | 9% | $179 | |||

| Not-at-Fault Accident | $2,096 | 10% | $197 | |||

| Failure to Wear a Seat Belt | $1,947 | 3% | $48 | |||

| Get Your Rates Quote Now | ||||||

Compare RatesStart Now → In Kentucky, the average annual rate for a driver with an at-fault accident is $ 3,291, the average rate for drivers with no at-fault accidents is $ 2,050. That is an increase of $ 1,241. The national average rate addition for drivers with an at-fault accident is only $ 615 .

According to research, drivers can get the best rates from the Kentucky Farm Bureau. Their average pace increase following an accident is $ 1,880 per annum. That means their average premium is 57 % less than the average amount among Kentucky indemnity companies .

If you have been involved in an accident and are looking for better cable car policy options, keep in mind that SAFECO and Safe Auto typically charge more .

Cheapest Car Insurance for Drivers with a DUI

Motorists with one DUI in Kentucky can find the cheapest rates with State Farm, which is $ 2,177 per year. That ’ s $ 383 cheaper than the next-cheapest policy company, Progressive. And 48 % less than the average rate AutoInsureSavings.org ’ second licensed agents saw statewide .

| Insurer | Annual cost | Monthly cost | ||

|---|---|---|---|---|

| State Farm | $2,177 | $181 | ||

| Progressive | $2,560 | $213 | ||

| Kentucky Farm Bureau | $2,718 | $226 | ||

| Kentucky average | $4,108 | $342 | ||

| Get Your Rates Quote Now | ||||

Compare RatesStart Now → A drive while intoxicated conviction can double your car indemnity rates. In some instances, you get revoked drive privileges or need an SR-22 form. If you are in this situation, taking a defensive driver course can help lower your rates .

Cheapest Car Insurance for Drivers with Poor Credit

According to statistics, drivers with poor credit are more likely to file a claim than those with good credit rating. As a consequence, you will pay more for insurance coverage with inadequate recognition than those with a high credit rating score .

| Insurer | Annual cost | Monthly cost | ||

|---|---|---|---|---|

| GEICO | $1,994 | $166 | ||

| State Farm | $2,231 | $185 | ||

| Kentucky Farm Bureau | $2,892 | $241 | ||

| Kentucky average | $2,943 | $226 | ||

| Get Your Rates Quote Now | ||||

Compare RatesStart Now → AutoInsureSavings.org licensed insurance agents found the cheapest ship’s company for Kentucky drivers with hapless accredit is GEICO, with an average rate of $ 1,994 per annum. They are $ 237 less expensive than early car insurance providers and 33 % lower than the statewide average rate .

Cheapest Car Insurance for Young Drivers

Generally, young drivers are in age groups where they pay more for coverage than their older counterparts because younger drivers are more probable to file claims .

Our license agents found the average insurance rate for 18-year-old Kentucky drivers will pay $6,940 for full coverage and $3,881 for state minimum coverage.

Adolescent drivers can reduce their rates by choosing Kentucky Farm Bureau at an indemnity rate of $ 3,641 per class .

| Insurer | Full coverage | Minimum coverage | ||

|---|---|---|---|---|

| Kentucky Farm Bureau | $3,641 | $1,790 | ||

| GEICO | $3,977 | $2,031 | ||

| Progressive | $5,376 | $2,378 | ||

| Nationwide | $6,620 | $3,752 | ||

| Allstate | $8,231 | $4,178 | ||

| Kentucky average | $6,940 | $3,881 | ||

| Get Your Rates Quote Now | ||||

Cheapest Car Insurance for Young Drivers with One Car Accident

Adolescent drivers who have been in a car accident will see much higher rates since ; statistically, they are likely to have another accident .

Our policy agents found State Farm provides the cheapest choice for new drivers with a late at-fault accident with coverage at $ 5,143 per annum. That ’ mho 50 % cheaper than other car insurance providers throughout the country .

| Insurer | Annual cost | Monthly cost | ||

|---|---|---|---|---|

| State Farm | $5,143 | $428 | ||

| Kentucky Farm Bureau | $5,690 | $474 | ||

| GEICO | $7,233 | $603 | ||

| Kentucky average | $10,200 | $850 | ||

| Get Your Rates Quote Now | ||||

Compare RatesStart Now → It is normally cheaper for young drivers to be added to their parents ’ policy or an older proportional ’ randomness car insurance policy. It is much less expensive to add adolescent drivers to a policy than buying their own coverage .

Cheapest Car Insurance for Young Drivers with One Speeding Ticket

For younger drivers in age groups below 25-years-old who have a late rush ticket, our agent ’ south recommendation is Kentucky Farm Bureau. With them, you ’ ll find a typical rate at $ 4,387 per year. State Farm is low-cost, with an average pace of $ 4,633 .

| Insurer | Annual cost | Monthly cost | ||

|---|---|---|---|---|

| Kentucky Farm Bureau | $4,387 | $365 | ||

| State Farm | $4,633 | $386 | ||

| GEICO | $6,830 | $569 | ||

| Kentucky average | $8,134 | $677 | ||

| Get Your Rates Quote Now | ||||

Compare RatesStart Now → Younger drivers trying to lower their insurance quotes should look into a driver train course. If you are in school or college, look into a commodity scholar rebate or a student-away-from-home deduction. Both can provide significant savings .

Best Auto Insurance Companies in Kentucky

When you are looking for the best car indemnity providers for coverage in Kentucky, you want to find companies that have low-cost rates and a aboveboard claims operation, arsenic well as high policy ratings when it comes to customer satisfaction .

Auto-Owners tops the tilt with J.D. Power Claims Satisfaction Study, National Association of Insurance Commissioners ( NAIC ) first gear charge index, and A++ with AM Best .

Kentucky Farm Bureau and Shelter, though not rated by J.D. Power, are two insurers with excellent customer reviews and a depleted sum of complaints based on market contribution .

| Company | NAIC Complaint Index | J.D. Power rating | AM Best | |||

|---|---|---|---|---|---|---|

| Auto-Owners | 0.42 | 890 | A++ | |||

| Kentucky Farm Bureau | 0.50 | n/a | A | |||

| Shelter | 0.51 | n/a | A | |||

| State Farm | 0.66 | 881 | A++ | |||

| Travelers | 0.65 | 861 | A++ | |||

| Progressive | 0.67 | 856 | A+ | |||

| USAA | 0.68 | 890 | A++ | |||

| Allstate | 0.71 | 876 | A+ | |||

| Liberty Mutual | 1.00 | 870 | A | |||

| GEICO | 1.01 | 871 | A++ | |||

| Get Your Rates Quote Now | ||||||

Compare RatesStart Now → It is highly recommended that all drivers do their inquiry and make surely to compare quotes from at least three companies before deciding. presently, Kentucky ranks 29th on the area ’ s cheapest cable car insurance quotes, meaning their premiums are priced higher than many other states .

The four top car indemnity companies for coverage in Kentucky are USAA, Allstate, State Farm, Kentucky Farm Bureau, and Auto-Owners .

| Company | Extremely satisfied | % excellent customer service | ||

|---|---|---|---|---|

| USAA | 68% | 62% | ||

| Allstate | 64% | 47% | ||

| Auto-Owners | 62% | 46% | ||

| State Farm | 59% | 46% | ||

| GEICO | 56% | 42% | ||

| Progressive | 51% | 34% | ||

| Kentucky Farm Bureau | n/a | n/a | ||

| Shelter | n/a | n/a | ||

| Get Your Rates Quote Now | ||||

Compare RatesStart Now → Customers chose these companies as the top four based on their price, review and fiscal military capability, and overall customer satisfaction .

here are a few rate comparisons for these four companies for you to consider .

| Best Car Insurance Companies | Full coverage | Minimum coverage | ||

|---|---|---|---|---|

| USAA | $1,700 | $630 | ||

| Allstate | $1,890 | $813 | ||

| State Farm | $1,593 | $799 | ||

| Kentucky Farm Bureau | $1,655 | $611 | ||

| Auto-Owners | $1,611 | $794 | ||

| Get Your Rates Quote Now | ||||

Average Car Insurance Quotes by City in Kentucky

The average cost of car policy in Kentucky is $ 1,850 for a full coverage policy and $ 775 for a minimal coverage policy. But car policy can vary based on where you live and the type of centrifugal vehicles drive.

Below we compared average annual car insurance premiums for the most populous cities in the state. Depending on slide fastener code, Owensboro is the cheapest city, while Louisville is the most expensive city .

Cheapest Car Insurance in Louisville, KY

During the AutoInsureSavings.org car policy quotes study, we found Farm Bureau, The Cincinnati, and Auto-Owners to be the cheapest car policy companies in Louisville. early mentions for low-cost rates are Grange and Motorist Mutual .

| Louisville Company | Average Premium | |

|---|---|---|

| Kentucky Farm Bureau | $1,830 | |

| Cincinnati Insurance | $1,955 | |

| Auto-Owners | $2,246 | |

| Louisville average | $2,681 | |

| Get Your Rates Quote Now | ||

Cheapest Car Insurance in Lexington, KY

Depending on coverage limits, Lexington ’ s most low-cost rates are with Farm Bureau ( $ 1,729 ) and State Farm ( $ 1,770 ). Both car insurers are 26 % cheaper the Lexington ’ randomness average pace of $ 2,391 per year .

| Lexington Company | Average Premium | |

|---|---|---|

| Farm Bureau | $1,729 | |

| State Farm | $1,770 | |

| Progressive | $1,821 | |

| Lexington average | $2,391 | |

| Get Your Rates Quote Now | ||

Cheapest Car Insurance in Bowling Green, KY

Our accredited agents recommend getting quotes from GEICO with an average agio of $ 1,430 annually for Kentucky drivers if you compare car indemnity. GEICO ’ sulfur price is 26 % more low-cost than the average rate of $ 1,915 per year .

| Company | Average Premium | |

|---|---|---|

| GEICO | $1,430 | |

| State Farm | $1,491 | |

| Farm Bureau | $1,555 | |

| Average | $1,915 | |

| Get Your Rates Quote Now | ||

Cheapest Car Insurance in Covington, KY

Covington ’ sulfur cheapest car policy is with State Farm, which provides quotes at $ 1,320 per year. Or 31 % more low-cost than Covington ’ south average pace of $ 1,893. early mentions include Farm Bureau, USAA, and Cincinnati Insurance. All indemnity carriers are at least 14 % cheaper than the citywide average policy bounty .

| Covington Company | Average Premium | |

|---|---|---|

| State Farm | $1,320 | |

| Farm Bureau | $1,397 | |

| USAA | $1,411 | |

| Covington average | $1,893 | |

| Get Your Rates Quote Now | ||

Cheapest Car Insurance in Richmond, KY

The least expensive policy coverage in Richmond, KY, is with State Farm. They offer quotes at $ 1,320 per class for full coverage, which is 27 % cheaper than the average richmond rate at $ 2,093. other car insurers more than 20 % lower are Farm Bureau and Progressive, as illustrated below .

| Richmond Company | Average Premium | |

|---|---|---|

| State Farm | $1,320 | |

| Farm Bureau | $1,397 | |

| Progressive | $1,411 | |

| Richmond average | $2,093 | |

| Get Your Rates Quote Now | ||

Cheapest Car Insurance in Florence, KY

Florence ’ second average rate is $ 2,370 per year. Kentucky Farm Bureau provides quotes at $ 1,560 if you are looking for cheaper indemnity coverage. farm Bureau ’ mho rate is 35 % lower than Florence ’ randomness modal. early insurers offer low-cost cable car policy at $ 1,674 per annum, or 30 % lower than the average rate .

| Florence Company | Average Premium | |

|---|---|---|

| Farm Bureau | $1,560 | |

| State Farm | $1,674 | |

| Progressive | $1,823 | |

| Florence average | $2,370 | |

| Get Your Rates Quote Now | ||

Minimum Coverage Requirements for Car Insurance in Kentucky

All states but two require drivers to carry the minimum amount of car insurance coverage in Kentucky. According to their web site, submit laws require motorists to have minimum bodily injury and place wrong indebtedness coverage, as illustrated .

| Kentucky Minimum Liability Insurance |

|---|

| $25,000 in bodily injury liability insurance per person |

| $50,000 in bodily injury liability insurance per accident |

| $25,000 in property damage liability insurance per accident |

| $10,000 in personal injury protection |

| Get Your Rates Quote Now |

Compare RatesStart Now → Kentucky is a no-fault state, so personal wound protection ( PIP ) is mandatary for motorists. PIP coverage supplements your health insurance by helping with lost wages and medical bills that may result from an car accident .

Comprehensive and collision indemnity is an optional coverage, which is contribution of a wax coverage car insurance policy. If you have a car loanword or lease, you will be required to have comprehensive examination and collision insurance. If you have a vehicle worth $ 4,000 or more, our accredited experts recommend getting entire coverage .

Kentucky Car Insurance Frequently Asked Questions

Who has the Cheapest Car Insurance in Kentucky?

After reviewing the rates from several car insurance companies in Kentucky, we found that the Kentucky Farm Bureau has the best overall rates for those purchasing a minimum coverage policy. Their annual rate for this coverage is $ 611. State Farm policy was the most low-cost option for drivers who want full coverage insurance. Their average annual rate came out to $ 1,593 .

Why is Car Insurance so Expensive in Kentucky?

Auto indemnity quotes are much higher in Kentucky than other states because they have a higher average of fatalities related to car accidents, with 1.36 deaths per every 100 million miles drive. That is higher than the average national rate, which is 1.1 deaths. Kentucky besides has a control crime rate in comparison to other states in the country. A higher crime pace means it is more likely that larceny or vandalism will occur, which can raise your indemnity rates. insurance is much more low-cost in states where crime rates are lower .

Drivers must carry personal injury protection ( PIP ), another subscriber to higher car policy in Kentucky .

It is essential to keep in heed that the cost of car insurance is increasing in Kentucky and throughout the state. consequently, it would be in everyone ’ second best interest to find the best value for their money when purchasing a new cable car policy policy .

How Much is Car Insurance per Month in Kentucky?

Car indemnity in Kentucky costs around $ 154 per calendar month on average or around $ 1,850 annually. That is significantly more than what drivers in other states pay for their monthly car policy premiums for their motive vehicles. In Kentucky, you can expect to pay the following for each class of drivers .

good Drivers : $ 1,252 per annum

New Student Drivers : $ 9,807 annually

bad Drivers : $ 3,072 annually

department of state law requires drivers to carry personal injury protection ( PIP ), which increases statewide rates .

How Does Kentucky Car Insurance Rank with the Other States?

here are some statistics to understand more about where Kentucky ’ mho car policy premiums rank with other states. presently, Michigan has the most expensive car indemnity rates in the country, with annual premiums at $ 2,693 on average. At the same time, Maine has the lowest average cable car policy pace, with drivers paying $ 836 per year .

Kentucky besides has higher indemnity requirements than many early states, which can impact your overall insurance costs. Along with statewide factors that affect your overall car insurance costs, other personal factors will besides affect your premium price .

Some critical factors that can influence your indemnity costs include your old age, the form and model of your car, and your drive records. If you have any violations such as a driver ’ mho license suspension or DUI offenses on your drive record, your rates can skyrocket .

In Kentucky, your credit score will besides impact how a lot you pay for your premium. Drivers who have no citation or poor recognition will normally pay 52 % more on average than drivers who have good or perfect credit .

Methodology

| AutoInsureSavings.org collects quotes from the state’s largest car insurance companies for a 30-year-old male or female motorist for our driver profile. Each driver has a clean driving record, and we applied a good or safe driver discount.AutoInsureSavings.org collects three to five quotes from each insurer via Quadrant Information Services.

Unless stated, our methodology’s operating vehicle is a 2018 Honda Accord with a paperless, safe driver, and anti-theft discounts. The full coverage policy included: $50,000 bodily injury liability per person. Collision coverage with a $500 deductible. AutoInsureSavings.org uses rate data from Quadrant Information Services. We sourced quotes from insurer filings that are publicly available for rate comparison. |

source : https://insurecar.info