Buy Cheap Car Insurance in Oklahoma

GEICO offers the bum car policy in Oklahoma, according to a QuoteWizard view of companies that write car policies in the Sooner State .

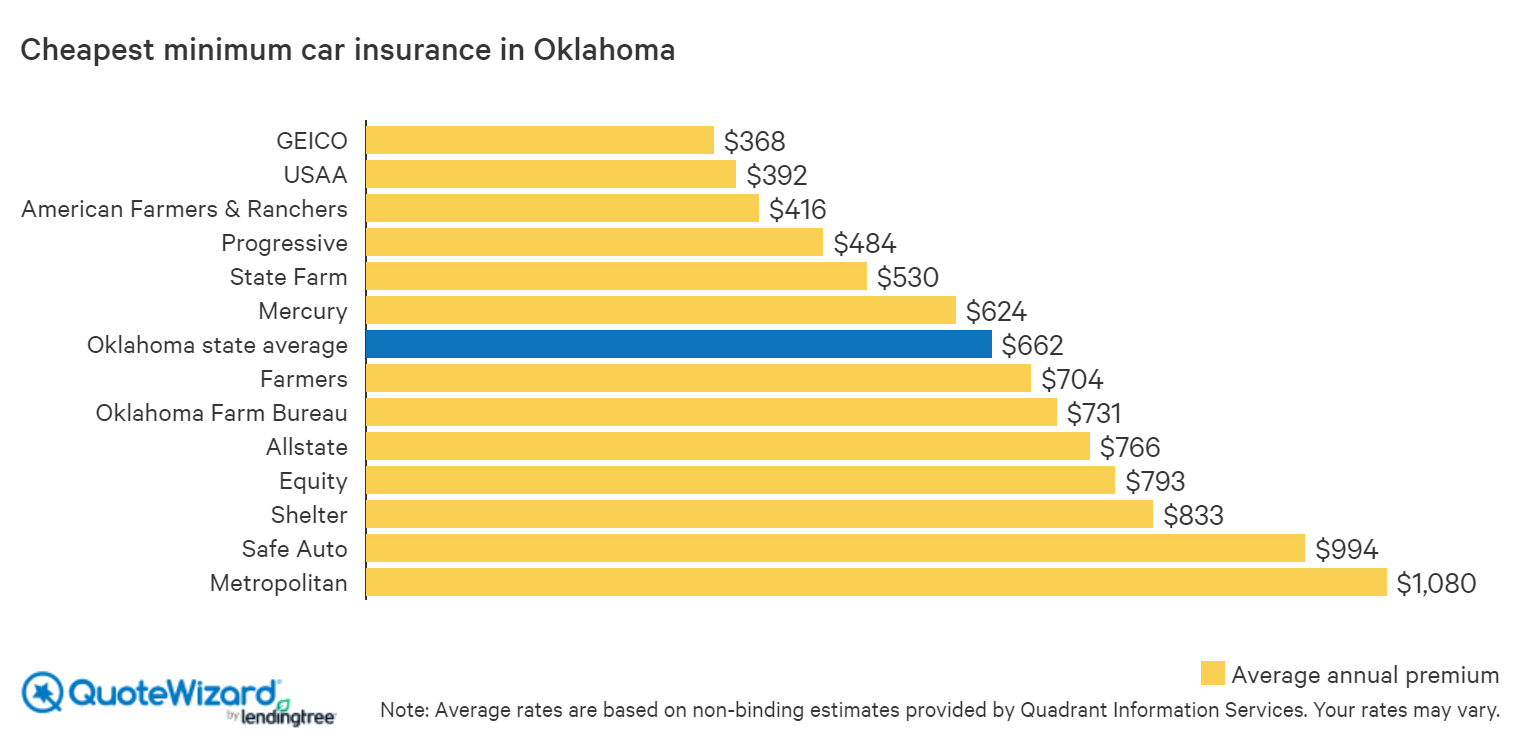

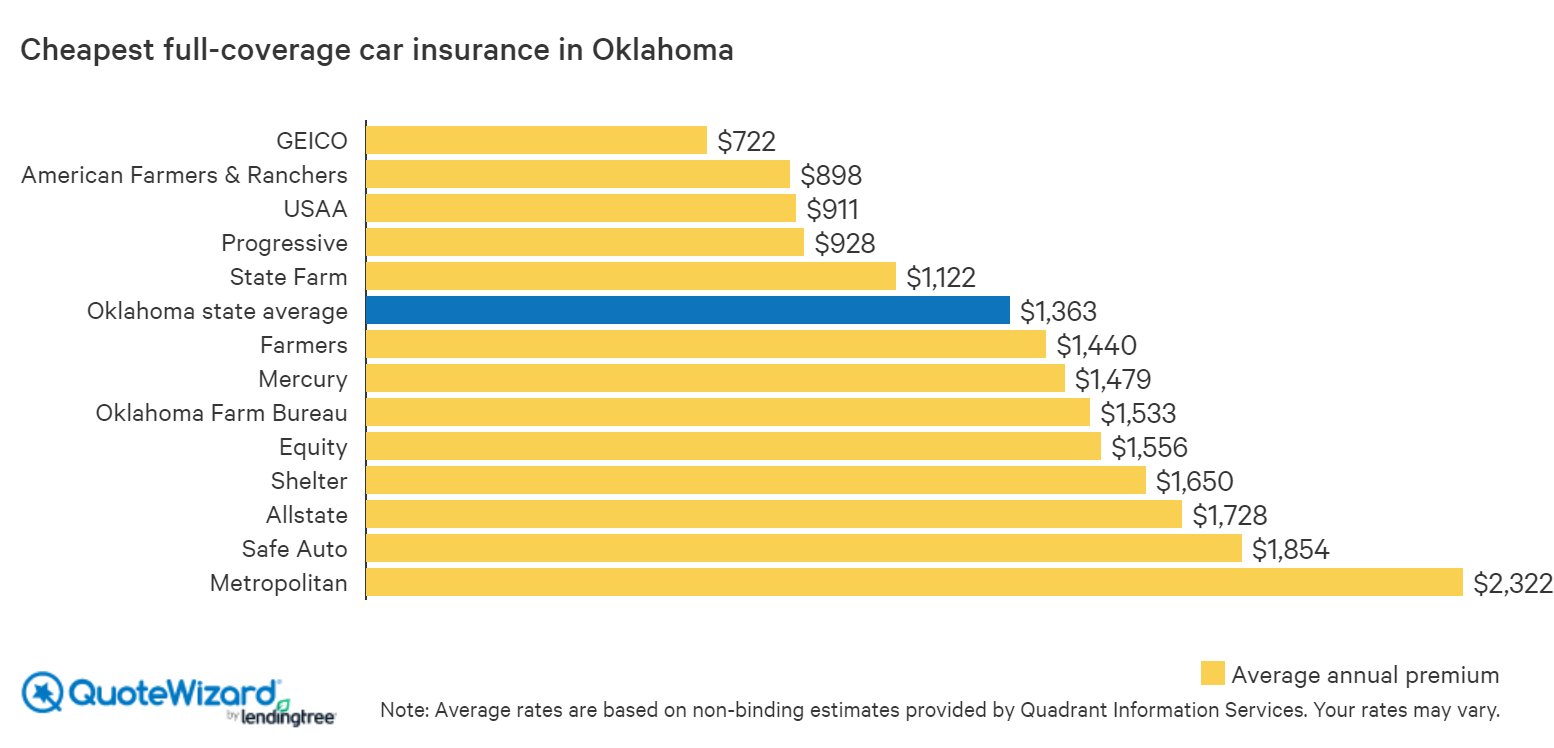

Our data shows that Oklahoma drivers pay $ 368 per class, on modal, when they buy the minimal total of car insurance the department of state requires from GEICO. And they pay an average of $ 722 per year for a full-coverage policy when they purchase it from the lapp insurance company .

Those rates are a distribute cheaper than what a typical driver in Oklahoma pays for car insurance. Based on our research, the average driver in this express spends $ 662 per year on minimum coverage and $ 1,363 per year on entire coverage .

other policy companies besides provide low-cost car insurance to Oklahomans. American Farmers & Ranchers and USAA are two noteworthy examples, as you ’ ll learn in this article.

Reading: Buy Cheap Car Insurance in Oklahoma

Keep reading for everything you need to know about :

Where can I get cheap car insurance in Oklahoma?

GEICO is the best option for cheap state-minimum car insurance in Oklahoma, with a $ 368 average annual premium. It is the best choice for bum full-coverage car indemnity in the state, besides, with a $ 722 average annual premium .

These modal annual premiums are based on rate quotes gathered from Oklahoma insurers for a typical driver .

A number of other insurers besides offer low-cost car insurance in Oklahoma, according to our data. For case, USAA ’ s average rate quote of $ 392 per year for a state-minimum policy was only $ 2 per calendar month more than what GEICO offered for the same sum of coverage .

The modal rate quotation American Farmers & Ranchers offered our sample driver for minimum coverage was fair $ 4 per month more than GEICO ’ sulfur median offer .

American Farmers & Ranchers and USAA offered our sample Oklahoma driver low-cost full-coverage car indemnity, excessively .

specifically, the modal rate quotation American Farmers & Ranchers provided for full-coverage car policy was around $ 15 per calendar month more than what GEICO provided. inactive, that figure is about $ 39 per calendar month cheaper than the express average for such a policy — which normally includes liability, collision and comprehensive examination coverage .

USAA ’ south average rate quotation mark of $ 911 per year for full coverage was about $ 16 per month more than GEICO ’ mho average rate quotation mark, but $ 38 per month lower than the state average .

What are the best car insurance companies in Oklahoma?

American Farmers & Ranchers, GEICO and USAA offer the best car insurance rates in Oklahoma, based on our research .

GEICO: best car insurance rates in Oklahoma

GEICO offered our sample driver the cheapest rates for both state-minimum and full-coverage policies. That makes it the best car policy company in Oklahoma, in our estimate .

GEICO ’ s median premium of $ 368 per year for a state-minimum policy is $ 294 per year cheaper than the median cost in Oklahoma for this sum of car indemnity coverage. That ’ s a deviation of $ 24.50 per calendar month.

Read more: 5 Best Ohio Car Insurance Providers (2022)

GEICO besides offered an modal premium of $ 722 per year for a full-coverage policy. This is $ 641 per class, or $ 53 per month, lower than the state modal .

American Farmers & Ranchers: runner-up for cheap full coverage in Oklahoma

American Farmers & Ranchers offers bum full-coverage car insurance in Oklahoma, excessively .

It offered our typical driver an average premium of $ 898 per year. That is $ 465 per class lower than the state average for this amount of coverage. The monthly remainder between the two in this case : $ 38.75 .

USAA: runner-up for cheap minimum coverage in Oklahoma

USAA is another good option for brassy state-minimum car policy in Oklahoma. The modal annual agio of $ 392 it offered our sample driver is $ 270 per year, or $ 22.50 per month, cheaper than the state average for this type of policy .

USAA besides offered our sample Oklahoma driver an low-cost rate for full-coverage car policy. Its modal agio of $ 911 per class is $ 452 per class cheaper than the country average for such coverage .

What are the most popular car insurance companies in Oklahoma?

state grow is the most democratic car indemnity party in Oklahoma, according to data from S & P Global. It writes 24 % of the state ’ second car policies .

GEICO, our pick for best car insurance rates in Oklahoma, is fourth in terms of market share. It writes 8 % of the state ’ sulfur policies .

| Insurance company | Oklahoma market share | |||

|---|---|---|---|---|

| State Farm | 24% | |||

| Progressive | 12% | |||

| Farmers | 10% | |||

| GEICO | 8% | |||

| Allstate | 8% | |||

| USAA | 7% | |||

| Liberty Mutual | 6% | |||

| Oklahoma Farm Bureau | 4% | |||

| Shelter | 4% | |||

| American Farmers & Ranchers | 3% | |||

| Source: S&P Global | ||||

Our runner-up for cheap minimum car indemnity in Oklahoma, USAA, writes 7 % of the department of state ’ s car coverage. That ’ second good enough for it to the sixth-largest insurance company hera by market share .

As for American Farmers & Ranchers, our runner-up for brassy full-coverage cable car indemnity, it is the 10th-largest car insurance company in Oklahoma by grocery store plowshare, writing 3 % of the state ’ randomness policies .

Best and worst driving cities in Oklahoma

Auto indemnity premiums differ across cities. The odds of needing to file a claim are greater in cities with eminent rates of badly drive. That includes car crashes, speeding tickets, DUIs and more. insurance companies charge more for car indemnity in areas with a high claim frequency. Our research found that these are the best and worst driving cities in Oklahoma :

| Rank | City |

|---|---|

| 1 | Tulsa |

| 2 | Muskogee |

| 3 | Lawton |

| 4 | Bartlesville |

| 5 | Enid |

| Rank | City |

|---|---|

| 1 | Norman |

| 2 | Edmond |

| 3 | Oklahoma City |

| 4 | Yukon |

| 5 | Broken Arrow |

These rankings are based on indemnity quote data from our users in Oklahoma. To evaluate driver timbre we looked at which cities had the highest rate of tickets, accidents, speeding and DUIs. Cities with the highest rate of violations and accidents were considered to be the worst drivers and cities with the lowest pace of incidents are considered to be the best drivers .

What are Oklahoma’s auto insurance requirements?

country law requires Oklahoma drivers to carry a minimum of 25/50/25 liability car policy coverage. This means all car policies must include at least :

Read more: 5 Best Ohio Car Insurance Providers (2022)

- $25,000 of bodily injury liability coverage per person.

- $50,000 of bodily injury liability coverage per accident.

- $25,000 of property damage liability coverage per accident.

Methodology

We conducted a comprehensive examination study of car indemnity rates in Oklahoma through Quadrant Information Services. The quotes we collected were for a individual, 35-year-old male who has an excellent credit grudge and a clean drive criminal record. He owns a 2012 Honda Accord and drives it an modal of 15,000 miles a class. His cable car indemnity policy has 100/300/50 coverage limits and a $ 1,000 deductible, where applicable .

QuoteWizard.com LLC has made every attempt to ensure that the information on this locate is right, but we can not guarantee that it is release of inaccuracies, errors, or omissions. All content and services provided on or through this site are provided “ as is ” and “ as available ” for use. QuoteWizard.com LLC makes no representations or warranties of any kind, express or implied, as to the process of this locate or to the information, content, materials, or products included on this web site. You expressly agree that your use of this locate is at your sole risk .