Which company has the best car policy rates for seniors ?

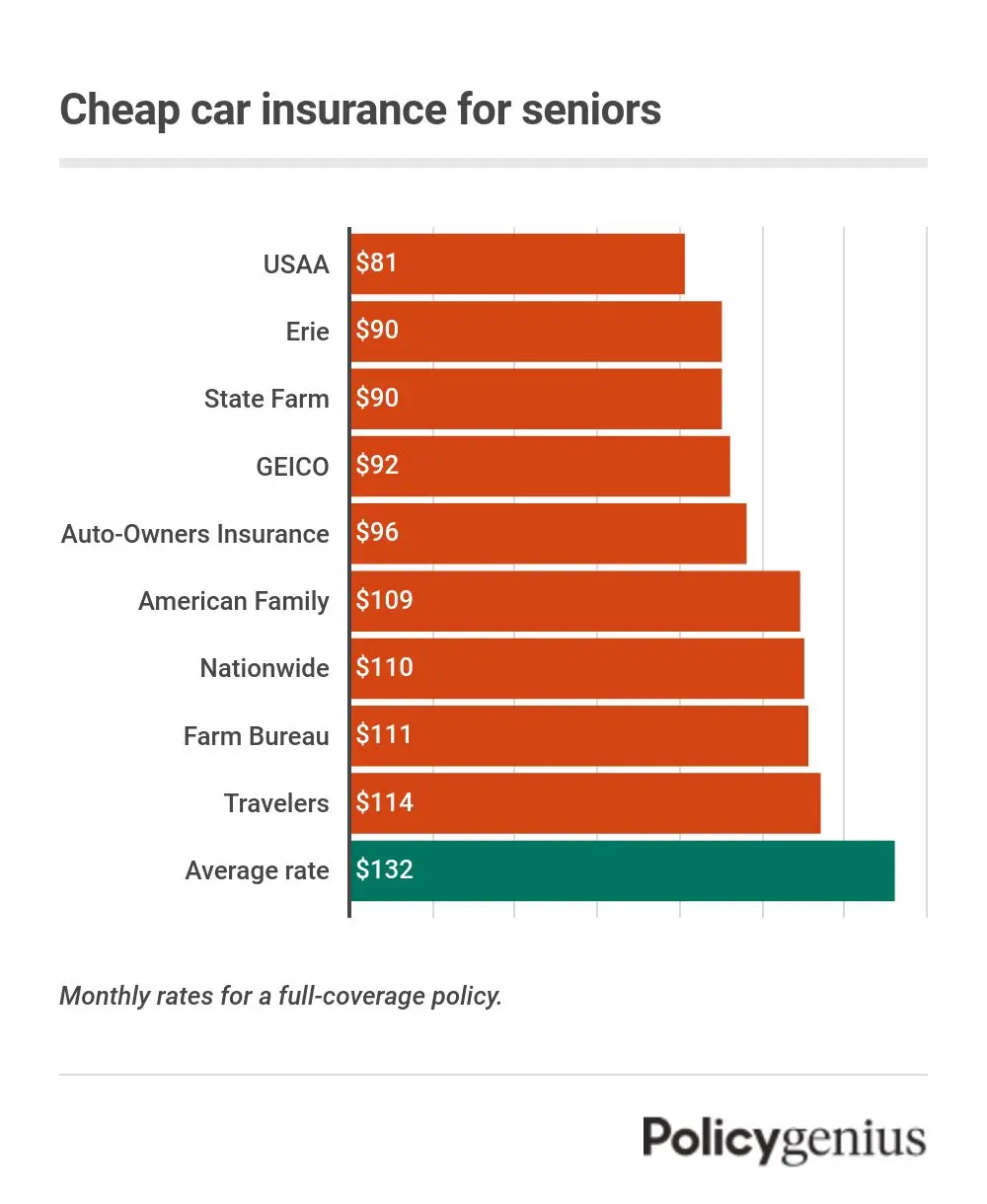

There are a few companies that typically have the best car policy rates for seniors, and the best one for you will depend on where you live and other details that may affect your rates. USAA has the absolute lowest car policy rates for seniors. however, USAA is only available to drivers who are veterans or otherwise associated with the military, not the general public. If you ‘re not a veteran, you can inactive find some of the best bum car indemnity for senior citizens from Erie or State Farm. The average cost of car insurance from Erie and State Farm was about identical at about $ 90 per calendar month ( Erie was three dollars cheaper per year ). But State Farm is the overall brassy policy option for most seniors, as it sells policies in every state and the District of Columbia.

Compare rates and shop low-cost car policy today Start calculator We don ’ metric ton sell your data to third base parties. Five companies sell aged car indemnity for less than $ 100 per calendar month, on average. These companies are GEICO, Auto-Owners Insurance, and American Family. GEICO is the alone one of these providers that offers insurance in every state, though .

Compare rates and shop low-cost car policy today Start calculator We don ’ metric ton sell your data to third base parties. Five companies sell aged car indemnity for less than $ 100 per calendar month, on average. These companies are GEICO, Auto-Owners Insurance, and American Family. GEICO is the alone one of these providers that offers insurance in every state, though .

| rank | policy company | monthly cost | annual cost |

|---|---|---|---|

| 1 | USAA | $81 | $969 |

| 2 | Erie | $90 | $1,077 |

| 3 | State Farm | $90 | $1,080 |

| 4 | GEICO | $92 | $1,105 |

| 5 | Auto-Owners Insurance | $96 | $1,146 |

| 6 | American Family | $109 | $1,311 |

| 7 | Nationwide | $110 | $1,317 |

| 8 | Farm Bureau | $111 | $1,331 |

| 9 | Travelers | $114 | $1,367 |

| 10 | Average for seniors | $132 | $1,583 |

| 11 | Progressive | $132 | $1,587 |

| 12 | Farmers | $153 | $1,831 |

| 13 | Allstate | $158 | $1,896 |

| 14 | Auto Club Group | $200 | $2,405 |

Table shows average rates for full-coverage auto insurance for senior drivers age 60, 65, and 70.

Best car indemnity companies for seniors

Because the monetary value and handiness of indemnity varies by placement, and early factors, the best elder car insurance company for some drivers may not be the best for you. Because of this, we found a few options for the best automobile policy for seniors, depending on what you ‘re looking for :

Best car insurance for seniors : lake erie

Erie

3.9 Policygenius military rank How we score : Policygenius ’ ratings are determined by our editorial team. Our methodology takes multiple factors into account, including pricing, fiscal ratings, quality of customer overhaul, and other product-specific features . Erie is the best cable car indemnity for seniors for its depleted rates, range of coverage options, and highly rated customer service — though it ‘s not available everywhere. Read our full Erie car indemnity review Get quotes Erie is our peck for the best overall car insurance for seniors in separate because of its bum rates for drivers aged 60 and older. We found that cable car policy for seniors costs just $ 90 per calendar month from Erie ( or $ 1,077 per year ). This gives Erie the best rates for senior car indemnity behind merely USAA. In addition to low-cost rates, Erie is known for offering robust coverage. In fact, a distinctive policy from Erie comes with perks like accident forgiveness and diminishing deductible, along with the choice to add :

Erie is the best cable car indemnity for seniors for its depleted rates, range of coverage options, and highly rated customer service — though it ‘s not available everywhere. Read our full Erie car indemnity review Get quotes Erie is our peck for the best overall car insurance for seniors in separate because of its bum rates for drivers aged 60 and older. We found that cable car policy for seniors costs just $ 90 per calendar month from Erie ( or $ 1,077 per year ). This gives Erie the best rates for senior car indemnity behind merely USAA. In addition to low-cost rates, Erie is known for offering robust coverage. In fact, a distinctive policy from Erie comes with perks like accident forgiveness and diminishing deductible, along with the choice to add :

- New or better cable car refilling

- Roadside aid

- transportation system expenses after a crash

besides, compared to other clear car insurers Erie offers seniors some of the best customer service. Erie ranked third base in J.D. Power ‘s 2021 Claims Satisfaction Study, and receives far fewer complaints than expected from its customers, according to the National Association of Insurance Commissioners .

Cheapest car insurance for most seniors : State farm

State Farm

3.8 Policygenius rate How we score : Policygenius ’ ratings are determined by our editorial team. Our methodology takes multiple factors into account, including price, fiscal ratings, quality of customer military service, and early product-specific features . available everywhere ( except Massachusetts and Rhode Island ), State Farm has the cheapest rates for most seniors looking for car coverage. Read our full State Farm car indemnity follow-up Get quotes Like Erie, the average cost of State Farm car indemnity for seniors is about $ 90 per month ( though it ‘s slenderly more expensive at $ 1,080 per year ). however, far more seniors are probably to be able to get car insurance from State Farm than Erie, since Erie only offers coverage in 13 states. We besides found that State Farm has the cheapest average rates for elder drivers age 65 and older. For this group of seniors, car indemnity can get more expensive every year as they age. however, with State Farm, seniors ‘ insurance rates remain abject after this indicate, flush compared to Erie. senior car insurance from State Farm besides has a reputation for solid customer service. State Farm was ranked among the top providers on J.D. Power ‘s 2021 Claims Satisfaction Study, and its complaints are about in line with the average for the indemnity industry, according to the NAIC .

available everywhere ( except Massachusetts and Rhode Island ), State Farm has the cheapest rates for most seniors looking for car coverage. Read our full State Farm car indemnity follow-up Get quotes Like Erie, the average cost of State Farm car indemnity for seniors is about $ 90 per month ( though it ‘s slenderly more expensive at $ 1,080 per year ). however, far more seniors are probably to be able to get car insurance from State Farm than Erie, since Erie only offers coverage in 13 states. We besides found that State Farm has the cheapest average rates for elder drivers age 65 and older. For this group of seniors, car indemnity can get more expensive every year as they age. however, with State Farm, seniors ‘ insurance rates remain abject after this indicate, flush compared to Erie. senior car insurance from State Farm besides has a reputation for solid customer service. State Farm was ranked among the top providers on J.D. Power ‘s 2021 Claims Satisfaction Study, and its complaints are about in line with the average for the indemnity industry, according to the NAIC .

Best car policy for seniors who are veterans : USAA

USAA

Best and cheapest car policy for seniors in Florida : GEICO

GEICO

4.6 Policygenius rat

Read more: California Car Insurance: Compare California Auto Insurance Costs | https://insurecar.info

How we score : Policygenius ’ ratings are determined by our column team. Our methodology takes multiple factors into report, including price, fiscal ratings, quality of customer service, and other product-specific features . If you live in Florida and are at least 60 years old, you could find the most low-cost car policy for seniors from GEICO. Read our wax GEICO car insurance review Get quotes Florida is a notoriously expensive express for car insurance. however, if you ‘re one of many older drivers who live in Florida, you could get the cheapest car indemnity for seniors from GEICO. On average, GEICO ‘s rates for car insurance are 53 % more low-cost than its competitors in Florida. In Florida, GEICO ‘s car policy for seniors is even cheaper than from State Farm and USAA .

If you live in Florida and are at least 60 years old, you could find the most low-cost car policy for seniors from GEICO. Read our wax GEICO car insurance review Get quotes Florida is a notoriously expensive express for car insurance. however, if you ‘re one of many older drivers who live in Florida, you could get the cheapest car indemnity for seniors from GEICO. On average, GEICO ‘s rates for car insurance are 53 % more low-cost than its competitors in Florida. In Florida, GEICO ‘s car policy for seniors is even cheaper than from State Farm and USAA .

| rank | insurance company | monthly cost | annual cost |

|---|---|---|---|

| 1 | GEICO | $164 | $1,969 |

| 2 | State Farm | $187 | $2,247 |

| 3 | Travelers | $276 | $3,314 |

| 4 | Nationwide | $306 | $3,673 |

| 5 | USAA | $366 | $4,390 |

| 6 | AIG | $367 | $4,402 |

| 7 | MetLife | $368 | $4,415 |

| 8 | National General | $387 | $4,640 |

| 9 | Allstate | $408 | $4,890 |

| 10 | Mercury | $481 | $5,766 |

| 11 | Farmers | $510 | $6,122 |

Table shows average rates for full-coverage auto insurance for senior drivers age 60, 65, and 70. GEICO ‘s long list of car policy discounts mean seniors could lower their price of coverage even more by qualifying for spare opportunities. Among the insurance company ‘s many discounts for car policy, seniors could save if they are accident-free, drive a car with safety features, or if they served in the military .

senior car policy rates by age

Compared to the youngest drivers, senior drivers pay less per year for car insurance. This is because they ‘re viewed as more know on the road and less likely to file a claim. however, while car indemnity for drivers 60 and older is a lot cheaper than those senesce 21, costs start to go up slenderly after 60. These older drivers are more likely than younger drivers to file claims for price . We found that 60-year-old drivers pay 1 % less for car policy than drivers just five years younger. however, a 65-year-old ‘s cable car indemnity will cost 3 % more than a 60-year-old ‘s. And a senior who is 70 pays 5 % more than a 65-year-old — 8 % more for insurance than person aged 60 .

We found that 60-year-old drivers pay 1 % less for car policy than drivers just five years younger. however, a 65-year-old ‘s cable car indemnity will cost 3 % more than a 60-year-old ‘s. And a senior who is 70 pays 5 % more than a 65-year-old — 8 % more for insurance than person aged 60 .

| historic period | annual cost | deepen |

|---|---|---|

| 55 | $1,528 | — |

| 60 | $1,515 | -1% |

| 65 | $1,562 | 3% |

| 70 | $1,637 | 5% |

Average rates for a full-coverage policy.

Who has the cheapest car indemnity for seniors of unlike ages ?

Depending on their claim long time, seniors are more likely to get the cheapest car policy from a couple unlike companies. Leaving off USAA, which is the cheap for veterans of every historic period, Erie and State Farm frequently have the lowest rates for aged car indemnity .

| old age | Cheapest insurance company | average cost |

|---|---|---|

| 55 | Erie | $996 |

| 60 | Erie | $1,022 |

| 65 | State Farm | $1,064 |

| 70 | State Farm | $1,107 |

Average rates for a full-coverage policy. Compare rates and patronize low-cost car insurance today Start calculator We don ’ deoxythymidine monophosphate sell your information to third parties .

average cost of cable car indemnity for seniors

Across all states and the District of Columbia, we found that the average cost of car policy for seniors is $ 132 per calendar month ( or $ 1,583 per year ). Along with your driving history, accredit score, your car ‘s take and exemplar, and your coverage levels, where you live influences what you pay for car insurance. For this reason, average car insurance rates vary significantly by location. The submit with the cheapest car indemnity for seniors is Ohio, where drivers 60 and older pay just $ 79 per month for coverage. The modal price of elder car insurance in Louisiana is $ 225 per month — $ 1,757 more per year for coverage than in Ohio. Table shows rates for a full-coverage insurance policy.

How to save on senior car policy

If you ‘re a senior driver paying excessively much for indemnity coverage, you could lower your premiums by taking the following steps :

- Sign up for a drive guard course : Seniors can get a discount on their car policy by completing eligible drive courses, which may be offered by AAA, AARP, the National Safety Council, or tied by your state. even if you ‘ve never had an accident, these classes are an easy manner to lower your insurance costs .

- Check how often you actually drive : insurance companies normally offer lower rates to drivers who use their cars infrequently. If you ‘re no longer commuting every day and you ‘re driving less, find out how many miles per year your car travels and report it to your insurance company .

- Sign up for usage-based policy : If you have a clean force history, consider signing up for a usage-based insurance or telematics program. Your policy ship’s company will monitor your driving for a sic period, then adjust your rates based on your safety. We have found that this can be one of the best ways to get more low-cost indemnity .

- search for discounts for elder drivers : Some indemnity companies, like the Hartford, offer car insurance discounts specifically for aged drivers, or even drivers older than the historic period of 50 .

In addition to these cost-saving steps, the best room to get brassy policy quotes is by comparing rates from multiple companies in your area. This is the most effective means to make sure you get the most low-cost coverage available .

Frequently Asked Questions

Does AARP offer car insurance to seniors?

While AARP does n’t offer its own senior car indemnity, the organization does collaborator with the Hartford indemnity company to provide coverage at a dismiss monetary value to its members. The Hartford is known for its highly rated customer service, and its rates are in line with the average for seniors — and they may be even lower for members .

Is car insurance cheaper after you retire?

cable car policy is n’t necessarily cheaper after you retire, but it may be more low-cost due to your old age ( and experience ) relative to younger drivers. You may besides pay less for car indemnity after you retire since you wo n’t have to drive to work anymore .

When do seniors start paying more for auto insurance?

While older drivers tend to pay less than younger drivers for cable car indemnity, seniors age 65 and astir can pay more for car indemnity. As you get older, your rates will continue to increase, so an 80- or 85-year-old driver would see even higher premiums than person who is a decade young .

Methodology

Policygenius found the monetary value of cable car indemnity for senior drivers by analyzing rates provided by Quadrant Information Services from every ZIP code in the nation. Our average rates reflect the aggregate mean price of full-coverage car policy for drivers aged 60, 65, and 70 for a full coverage policy with the following limits :

- Bodily injury liability : 50/100

- place damage indebtedness : $ 50,000

- Uninsured/underinsured motorist : 50/100

- comprehensive : $ 500 deductible

- collision : $ 500 deductible

Some carriers may be represented by affiliates or subsidiaries. Rates provided are a sample of costs. Your actual quotes may differ .