bribe car policy is a must for all car owners

What are the types of car insurance plans/cover?

basically, there are two main types of insurance plans provided by the amerind car indemnity companies, which are third party liability car insurance and comprehensive examination policy .

Third-party liability car insurance

The third-party indebtedness car indemnity is the types of policy that will insure in font of damage caused by the first party ( car policyholder ) to the third party. The third-party could be the driver, owner or passenger of vehicles and passengers, who are injured by the vehicle of the first party. It is mandatary for all cable car owners to buy third base party liability for their cars .

ALSO READ

5 Popular Mistakes When Buying Car insurance

Third-party indebtedness cable car policy is compulsory for all cars

Comprehensive car insurance

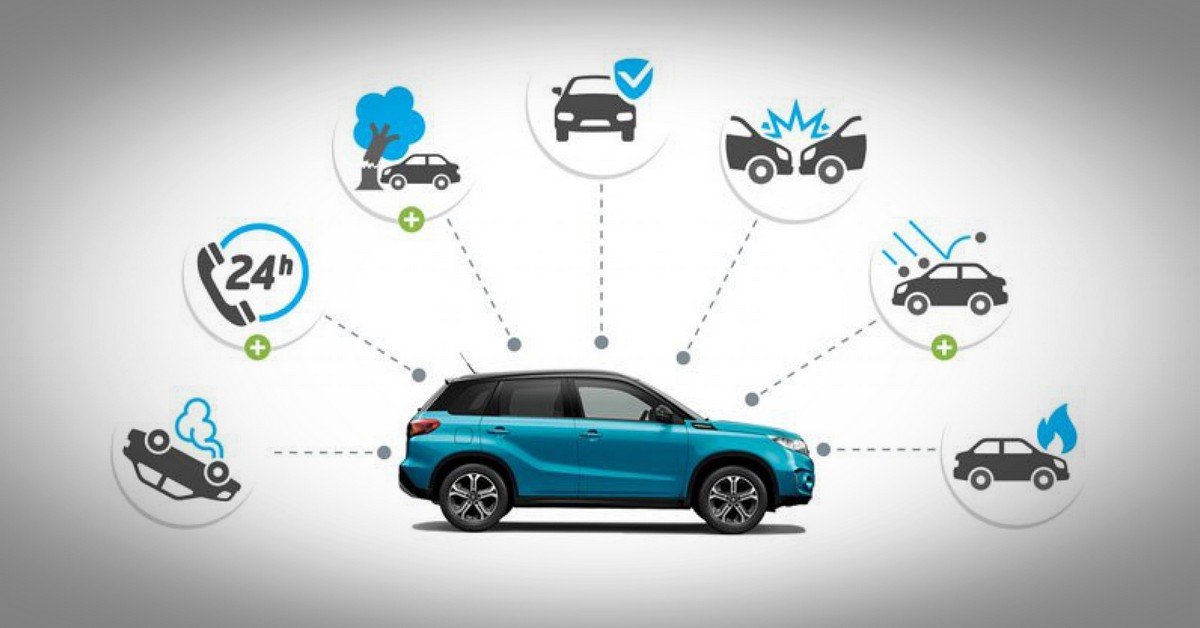

While third-party liability cable car indemnity is a compulsory insurance design, comprehensive examination car policy is an optional policy. This indemnity plan offers a higher level of protection against comprehensive types of damages caused by road accidents or other undesirable incidents. It is deserving noticing that this policy plan besides covers the one-third party liability car policy, meaning that you won ’ triiodothyronine have to buy both insurances to receive the comprehensive benefits. furthermore, unlike car policy company includes different extra features on the comprehensive policy policy .

Use a car insurance calculator

What ’ s a cable car policy calculator. It ’ s an on-line tool that can cursorily calculate the collectible premium come assisting prospective buyers to compare the quotes from multiple insurers and buy the most desirable policy as per want and budget. Simply input your car ’ s registration phone number, a bounty qoute will be generated considering the old age, stead, and other factors of the car. besides this quote can be customized with add-ons and other benefits .

Add On Covers

Add On Cover or the extra coverage is a special offer that is not included in the comprehensive car insurance plan. It besides means that if you want to have an addition cover, you will have to make an extra payment in accession to the policy premium. cable car owners can find batch of attractive addition offers and discounts provided by the car insurers in India. here are some of the most common and prefer addition covers for car policy .

Having addition covers can be a wise option in some particular occasions

- Zero Depreciation/Nil Depreciation: Each clock time a claim is settled, the insurance company will have to estimate the depreciation of your car. Over the years, your car ’ second value will decrease. It besides means that the call sum will besides reduce. however, if you buy a zero depreciation covering, you can get the full claim measure .

- No claim bonus: When you add No claim bonus to your car indemnity plan, you will be entitled to the premium discount rate provided by the car indemnity ship’s company if you made no policy title during a policy term. NCB can help policyholder save up to 50 per penny in insurance premium .

- Engine Protector: Car engine is one of the most expensive parts of a cable car. In most shell, the cover charge for car engine damages is not included in the car policy policy. Under the Engine Protector policy, expense on repairs or damages which are not caused by accidents will be covered. This addition option is highly recommended for luxury and high-end cars whose engine repairs are very expensive. however, entirely cars that are under three-year-old can be covered by this addition .

- Roadside assistance: Among these addition covers, wayside aid is the most hardheaded and authoritative. If you include this addition on your indemnity policy, the cost for road aid like towing, fuel-refilling, flat-type change, mechanic aid in event of car breakdown will be provided by the policy policy companies around the clock .

ALSO READ

All Things You Should Know About Car Insurance Renewal in India

What factors to consider when buying car insurance

Find the right policy

basically, car owners are provided with two main options, comprehensive cover and third-party liability policy. If you own an expensive lavishness car, the comprehensive cover is highly recommend. On the other hand, the liability policy is compulsory so it would be the option if you found the comprehensive examination policy are not necessary for you .

Find the right insurer

Most car insurers provide both the comprehensive policy and third-party liability policy. however, the coverage that each insurance company offers is different. Besides, each indemnity party besides has different addition screen offerings. You should find a car policy providers with a desirable policy for you. Apart from considering the policy, it is besides important to find an insurance company with a commodity repute, eminent claim liquidation ratio, services and customer support .

ALSO READ

Which Are Five Best car insurance Companies In India ?

Choosing a full insurance company is a very authoritative function of the process

Check the premium

After doing research, you credibly have a number of the insurers and policies that you are concern in. now you can estimate the premium that you will have to pay. Some insurers provide on-line calculator which allow you to check the quotation. Knowing the agio will be a crucial step before you make the buy decision .

What are the important factors when calculating insurance premium?

One of the most important step before buying a cable car indemnity policy is to estimate the car policy price. however, there is no fixate formula for calculating the insurance premium. In fact, each automotive insurance company has a different way of calculating the premium for their policyholders. Car premium calculation besides depends on versatile factors. To check the closest premium amount for your car insurance, you can visit the site of the indemnity provider. Based on the information that you give, the on-line premium calculator will give you the claim number to consider .

insurance premium calculation is based on different factors

In the follow, IndiaAuto will give you some basic factors that play crucial roles in determining the car indemnity cost in India .

1. IDV (Insured Declared Value)

Insured Declared Value could be defined as the grocery store prize of your car at the time of policy purchase. however, the IDV will drop over time due to depreciation. The newer the car, the higher the insure declare value is .

2. Make-model

The car model is one of the major factors when it comes to insurance calculation. The more premium and high-end the car exemplar is, the higher the indemnity price is. For example, the premium SUV will cost higher than a regular hatchback .

3. Car modification:

Before opting for any alteration to the car, you should check if the modification will affect your agio. For exercise, if your car was installed with an aftermarket GPS or audio system, the value of your cable car will be increased, leading to the rise in premium amount .

4. Engine capacity

Engine capability is the parameter that is used by the IRDA to decide the premium for third party liability policy. The bigger the locomotive capacitance, the higher agio you will have to pay. IRDA amends the bounty rate for third party indemnity screen per annum .

5. Location

location is besides one factor that would be taken into circumstance when the cable car policy company calculate your premium. The location of the owner or the vehicles matters as the insurers take into account the fact that some locations are safer than others. For case, vehicles from a safe vicinity are subject to lower chances of vandalism, larceny or accidents, meaning that the lower risk for the insurance company. Thereby, it will benefit the car owner with a lower premium .

6. Demographic

Besides your placement, the car indemnity will decide the premium come based on what demographic group you belongs to.

- Age: While the young drivers are more likely to drive firm and get involved in a cable car crash, the middle-aged drivers are normally more experience and thereby less prone to cause a car accident .

- Marital status: As per research, demographic of marry people are less likely to have an accident compared to the single .

- Gender: statistically speaking, compared to female peers, young male adolescents tend to be involved in car accidents more. however, at an older senesce, women are more prone to car accidents than men .

- Profession: Your profession is besides one factor that determines the car insurance premium. There are some finical professions requiring more driving which can be translated to higher risks of having accidents. For example, a sales example or marketing employee will have to do more travel than other professions like regular office workers. So their indemnity quote will besides be higher .

If you are on the demographic groups that stand less hazard of having a car accident, you will get a lower premium .

7. Add-Ons/Discounts

Having adds-on will increase the bounty. however, it will secure you better against unfavorable situations. If you can choose vigorously, it will give you a great advantage in the conclusion. On the early hand, insurance companies besides offer some discounts for policyholders that will reduce the premium amount. here are some discount benefits that car policy company normally offers .

- No Claim Bonus: As explained above, the No Claim Bonus cover will be available for a policyholder who does not raise any claim during the indemnity menstruation .

- Membership concession: Insurance companies might offer a concession for members of a registered automotive agency. For example, people with membership of Automobile Association of India you can get a concession on Own damage premium .

- Voluntary Excess: Voluntary access is the deductible that policyholder will declare to pay when a claim is raised. Opting for the higher voluntary deductible amount will benefit you with a lower premium .

- Anti-theft Discount: If your car is fitted with an ARAI anti-theft device, you will be offered with a rebate of around 2.5 per cent on the Own Damage premium .

ALSO READ

All Things You Should Know About Car Insurance Deductible

How to calculate insurance premium?

basically, the car indemnity cost in India or the indemnity agio is the union of the third party cover and own price binding. other factors like add-ons, discounts, GTS will besides be taken into explanation. own damage cover is optional and included on the comprehensive insurance policy .

Third-party car insurance price list in India

The monetary value of third party dependability is fixed by the IRDA. The rate varies on the basis of the engine capacity. Check the following table to see the price of third party insurance policy for 2019-2020 period .

| Cubic Capacity (cc) of car | Third-Party Insurance Company |

| up to 1000 CC | Rs. 2072 |

| Over 1000 CC up to 1500 CC | Rs. 3221 |

| Over 1500 CC | Rs. 7890 |

Comprehensive car insurance price list in India

Each car company will come with a different plan for comprehensive car policy policy and the cost will besides vary. The following table will list out the monetary value of a comprehensive car insurance plan provided by the major insurance company in India .

| Insurance Companies | Comprehensive Car Insurance Premium (excluding add-on and tax services) |

| TATA AIG General Insurance | Rs. 13,616 |

| Digit General Insurance | Rs. 15,226 |

| Royal Sundaram General Insurance | Rs. 17,793 |

| Bharti AXA General Insurance | Rs. 20,071 |

| Liberty General Insurance | Rs. 20,378 |