|

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understand of policy products including home, life, car, and commercial and working directly with policy customers to understand their needs. She has since used that cognition in her more than ten years as a writer, largely in the insuranc … Full Bio → |

Written by

Leslie Kasperowicz Farmers CSR for 4 Years

|

|

Joel Ohman is the CEO of a secret equity-backed digital media company. He is a attest FINANCIAL PLANNER™, writer, angel investor, and serial entrepreneur who loves creating modern things, whether books or businesses. He has besides previously served as the founder and resident CFP® of a national indemnity representation, substantial Time Health Quotes. He besides has an MBA from the University of South Florid … |

Reviewed by

Joel Ohman Founder, CFP®

|

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

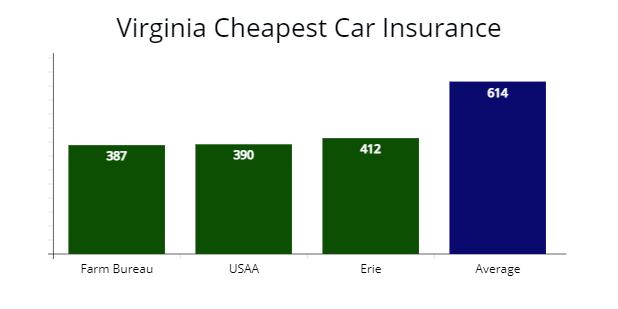

Compare RatesStart Now → AutoInsureSavings.org team of license indemnity agents reviewed the cheapest car policy companies in Virginia and found Virginia Farm Bureau ( $387 per year ) has the cheapest rates for minimum liability coverage .

Erie Insurance ( $1,040 annually ) offers the cheapest car indemnity in Virginia for drivers with adept tug records who need full coverage .

Affordable Virginia Car Insurance Rates

Comparing a car insurance quotation mark from at least three to five indemnity carriers is the best way to make certain you find the best deals to save money monthly .

| Cheapest Car Insurance in Virginia – Quick Hits |

|---|

The cheapest Virginia car insurance options are: The cheapest Virginia car insurance options are:

Cheapest for minimum coverage: Virginia Farm Bureau |

| Get Your Rates Quote Now |

Compare RatesStart Now → This guide will take a closer look at cable car insurance providers available to Virginia drivers and help oneself you determine which one is best for your individual needs .

Free Auto Insurance Comparison

figure your ZIP code below to view companies that have cheap car insurance rates .

Secured with SHA-256 Encryption

Cheapest Car Insurance in Virginia for Minimum Coverage

Our holocene comparison shopping cogitation found the cheapest car insurance company for minimal liability policy requirements is Virginia Farm Bureau, which provided our agents a $387 insurance rate for our sample distribution driver .

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

| Get Your Rates Quote Now |

Compare RatesStart Now → The average quotation is $ 614 per year, and Farm Bureau ’ south rate at $387 per year is 37% cheaper, making them the best choice for Virginia drivers needing minimal indebtedness policy .

| Insurer | Average annual rate | |

|---|---|---|

| Virginia Farm Bureau | $387 | |

| USAA | $390 | |

| Erie | $412 | |

| GEICO | $440 | |

| State Farm | $476 | |

| The Hartford | $513 | |

| Allstate | $657 | |

| Progressive | $681 | |

| Elephant | $721 | |

| Nationwide | $794 | |

| Travelers | $816 | |

| Liberty Mutual | $829 | |

| Virginia average | $614 | |

| Get Your Rates Quote Now | #blank# | |

Compare RatesStart Now → *USAA is for qualify military members, their spouses, and direct syndicate members. Rates may vary depending on driver profiles .

military members, their spouses, or class members qualify for cheaper car policy through USAA. Buying minimum coverage policy requirements at $390 annually through USAA is 37 % less expensive than the country average $ 614 rate .

Cheapest Full Coverage Car Insurance in Virginia

If you are interested in having an extra layer of protection while you are on the road, the cheapest full coverage rates are with Erie Insurance at $1,040 annually or $87 per month .

Quotes from this car insurance carrier are 31 % less expensive than Virginia ’ south average of $ 1,493 .

| Insurer | Annual cost | Monthly cost | ||

|---|---|---|---|---|

| Erie | $1,041 | $87 | ||

| Virginia Farm Bureau | $1,130 | $94 | ||

| State Farm | $1,265 | $105 | ||

| Virginia average | $1,493 | $124 | ||

| Get Your Rates Quote Now | #blank# | #blank# | ||

Compare RatesStart Now → *Your rates may vary when you get quotes .

Full coverage car policy in Virginia costs, on average, more than three times the sum that minimum coverage insurance costs .

While many drivers may immediately turn away from taking out wax coverage due to the higher car policy rates, others appreciate the peace of mind and reassurance they receive by having collision and comprehensive coverage along with their liability coverage .

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

| Get Your Rates Quote Now |

Compare RatesStart Now → The State Corporation Commission ( SCC ) of Virginia recommends wide coverage insurance to protect your vehicle from inclement upwind accidents such as hurricanes. You may want to get uninsured motorist coverage in Virginia for extra protective covering .

Cheapest Car Insurance With a Speeding Ticket in Virginia

The best coverage pace for drivers with one speeding trespass is Farm Bureau, which offered us a quote at $1,198 annually. The average price of policy for Virginians with a accelerate ticket is $ 1,769, but Farm Bureau is $ 571 cheaper .

| Insurer | Annual cost | Monthly cost | ||

|---|---|---|---|---|

| Virginia Farm Bureau | $1,198 | $99 | ||

| Erie | $1,261 | $105 | ||

| GEICO | $1,477 | $123 | ||

| Virginia average | $1,769 | $147 | ||

| Get Your Rates Quote Now | #blank# | #blank# | ||

Compare RatesStart Now → dealings tickets will cause your car policy rates to increase careless of your coverage level. In Virginia, most drivers expect rate increases by 16 % on average for traffic violations .

Free Auto Insurance Comparison

figure your ZIP code below to view companies that have bum car insurance rates .

Secured with SHA-256 Encryption

Cheapest Car Insurance in Virginia With a Car Accident

In Virginia, drivers with one at-fault accident on their drive criminal record should consider Erie, the cheapest car policy company, which provided our policy agents with a quote at $1,437 annually or $119 per month .

| Insurer | Annual cost | Monthly cost | ||

|---|---|---|---|---|

| Erie Insurance | $1,437 | $119 | ||

| Farm Bureau | $1,580 | $131 | ||

| State Farm | $1,812 | $151 | ||

| Virginia average | $2,254 | $187 | ||

| Get Your Rates Quote Now | #blank# | #blank# | ||

Compare RatesStart Now → In Virginia, the median monetary value of car policy after being involved in an accident is $ 2,254 per class or $ 187 per calendar month. Erie ’ mho rate for those with a car accident is 37 % cheaper than average .

Your following brassy choice is Farm Bureau, with a $1,580 rate or $ 674 less than average .

once you have an at-fault accident on your drive record in Virginia, you can expect your car indemnity rates to go up by 34 %, according to the Insurance Information Institute ( III.org ) .

That is because policy companies see accidents as a signboard of increased gamble, and many will consider you a bad driver until the accident is no longer on your drive read .

Cheapest Car Insurance With a DUI in Virginia

During our agent ’ s research, the car insurance provider in Virginia to check out is Progressive for drivers with a DUI. Progressive ’ mho quote of $151 per month is 28 % less expensive than average and $ 158 less than the future best option Erie Insurance .

| Insurer | Annual cost | Monthly cost | ||

|---|---|---|---|---|

| Progressive | $1,813 | $151 | ||

| Erie | $1,971 | $164 | ||

| Farm Bureau | $2,022 | $168 | ||

| Virginia average | $2,484 | $207 | ||

| Get Your Rates Quote Now | #blank# | #blank# | ||

Compare RatesStart Now → In Virginia, drivers caught driving under the influence are expected to pay car policy premiums 40 % more than drivers who have blank force records. After a DUI, Virginia drivers ’ median policy cost is $ 2,484 per year or a rate increase to $ 207 per month. Registering for a defensive drive run is the best way to lower your insurance monetary value after a DUI crime .

Cheapest Car Insurance For Drivers with Poor Credit in Virginia

According to our inquiry, the virginian car indemnity company offering the best rates with inadequate credit is Nationwide .

Nationwide ’ mho quote of $1,230 per year is 35 % less expensive than the $ 1,891 average agio .

| Insurer | Annual cost | Monthly cost | ||

|---|---|---|---|---|

| Nationwide | $1,230 | $102 | ||

| GEICO | $1,276 | $106 | ||

| State Farm | $1,421 | $118 | ||

| Virginia average | $1,891 | $157 | ||

| Get Your Rates Quote Now | #blank# | #blank# | ||

Compare RatesStart Now → even if you are a safe driver, your credit report and score can harm how much your car policy rates will be. That ’ mho because many companies look at a person ’ s ability to pay off their debts or credit cards to reflect their ability to make their monthly cable car policy payments .

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

| Get Your Rates Quote Now |

Compare RatesStart Now → If you have bad credit, you will likely pay adenine a lot as 22 % more for car insurance premiums in Virginia than those with good recognition .

Free Auto Insurance Comparison

embark your ZIP code below to view companies that have brassy car policy rates .

Secured with SHA-256 Encryption

Cheapest Car Insurance for Young Drivers in Virginia

Our comparison discipline found that Erie is the cheapest car policy company for young drivers in Virginia. Our insurance agents received a low rate of $ 2,644 annually from Erie or $220 a month, which is 50 % more low-cost than Virginia ’ mho express average rate .

adolescent drivers looking for low-cost minimal coverage in Virginia should consider Erie ( $ 1,128 ) and GEICO ( $ 1,287 ). Both car insurers are 33 % cheaper than the average $ 1,911 Virginia car policy rate .

| Insurer | Full coverage | Minimum coverage | ||

|---|---|---|---|---|

| USAA | $2,170 | $1,099 | ||

| Erie Insurance | $2,644 | $1,128 | ||

| State Farm | $3,190 | $1,412 | ||

| GEICO | $3,437 | $1,287 | ||

| Virginia Farm Bureau | $3,904 | $1,316 | ||

| Progressive | $5,365 | $1,876 | ||

| Nationwide | $5,981 | $2,311 | ||

| Travelers | $6,233 | $2,722 | ||

| Allstate | $6,945 | $1,559 | ||

| Virginia average | $5,237 | $1,911 | ||

| Get Your Rates Quote Now | #blank# | #blank# | ||

Compare RatesStart Now → *USAA is for qualified military members, their spouses, and direct kin members. Your insurance rates may vary based on the driver ’ south profile .

Our agents recommended a adolescent driver in Virginia carry full moon coverage insurance. however, if you have limited indemnity providers choice, or your vehicle worth less than $ 3,000, a minimum liability policy may be the best way to save more on car indemnity.

Read more: Cheap Auto Insurance – Douglasville, Georgia

Cheapest Car Insurance for Young Drivers with a Speeding Ticket

If under the age of 21 in Virginia, drivers with a speed irreverence will find cheap indemnity rates with Erie, which provided us a quotation mark at $264 per month or 43 % less expensive than the state average rate. GEICO proved low-cost Virginia insurance at $ 3,577 per year ( $298 monthly ) for full coverage .

| Insurer | Annual cost | Monthly cost | ||

|---|---|---|---|---|

| Erie | $3,170 | $264 | ||

| GEICO | $3,577 | $298 | ||

| State Farm | $3,619 | $301 | ||

| Virginia average | $5,563 | $463 | ||

| Get Your Rates Quote Now | #blank# | #blank# | ||

Compare RatesStart Now →

Cheapest Car Insurance for Young Drivers with an Auto Accident

Young Virginians with an at-fault accident can avoid significant rate increases by getting car indemnity coverage from Erie Insurance with a quotation at $3,416 annually or 43 % cheaper .

The adjacent best coverage choice is GEICO, quoted at $3,794 per year or 33 % less expensive than a typical adolescent driver rate with a car accident in their driver history .

| Insurer | Annual cost | Monthly cost | ||

|---|---|---|---|---|

| Erie | $3,416 | $284 | ||

| GEICO | $3,794 | $316 | ||

| State Farm | $3,825 | $318 | ||

| Virginia average | $5,935 | $494 | ||

| Get Your Rates Quote Now | #blank# | #blank# | ||

Compare RatesStart Now →

Free Auto Insurance Comparison

insert your ZIP code below to view companies that have brassy car indemnity rates .

Secured with SHA-256 Encryption

Best Auto Insurance Companies in Virginia

AutoInsureSavings.org agents review of car indemnity carriers in Virginia found USAA performed the best overall customer service and JD Power claims satisfaction. If not eligible for a USAA membership, your best car policy options Virginia Farm Bureau, Nationwide, and Progressive .

We studied data to help you make excellent coverage choices and policy decisions during our comparison shop analyze of Virginia ’ second best car insurers. The data we use is from the National Association of Insurance Commissioners ( NAIC ), J.D. Power ’ s customer gratification survey, and AM Best fiscal forte ratings .

| Auto Insurer | NAIC Complaint Index | J.D. Power claims satisfaction score | AM Best Financial Strength Rating | |||

|---|---|---|---|---|---|---|

| Virginia Farm Bureau | 0.00 | n/a | A | |||

| Travelers | 0.00 | 861 | A++ | |||

| Progressive | 0.36 | 856 | A+ | |||

| Nationwide | 0.64 | 876 | A+ | |||

| State Farm | 0.66 | 881 | A++ | |||

| USAA | 0.68 | 890 | A++ | |||

| Allstate | 0.71 | 876 | A+ | |||

| Geico | 1.01 | 871 | A++ | |||

| Erie | 1.10 | 880 | A+ | |||

| Get Your Rates Quote Now | #blank# | #blank# | #blank# | |||

Compare RatesStart Now → *NAIC ailment index, the lower, the better, JD Power ’ s claims satisfaction study, the higher, the better, AM Best Ratings, A+ is “ excellent, ” and A++ is “ superior ” fiscal strength .

Virginia Farm Bureau and Travelers Insurance are two insurers performing best with NAIC ’ s ailment index. Both scored less than the national average of 1.00 with lower than average complaints based on their market plowshare. Travelers Insurance has an excellent J.D. Power claims atonement score of 861, while Farm Bureau international relations and security network ’ triiodothyronine rated .

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

| Get Your Rates Quote Now |

Compare RatesStart Now → Deciding on the best cable car indemnity caller in Virginia is not a simple undertaking. That is because the factors that make one car indemnity caller the best for one driver may make them the worst choice for another. Finding the best car indemnity rates for you will depend on a wide variety of factors like your age, your driving history, where you live, and your fomite ’ s make or exemplary, to name a few .

A holocene policy surveil from ValuePenguin reached similar results for Virginia car indemnity carriers .

| Company | % extremely satisfied with recent claim | % rated customer service as excellent | ||

|---|---|---|---|---|

| USAA | 78% | 62% | ||

| Nationwide | 78% | 53% | ||

| State Farm | 73% | 46% | ||

| Allstate | 72% | 47% | ||

| Erie | 67% | 50% | ||

| Progressive | 74% | 34% | ||

| GEICO | 64% | 42% | ||

| Travelers | 63% | 33% | ||

| Virginia Farm Bureau | n/a | n/a | ||

| Get Your Rates Quote Now | #blank# | #blank# | ||

Compare RatesStart Now → Your best resource for finding the most low-cost car policy rates in Virginia is policy quote comparison websites like AutoInsureSavings.org .

You can find many utilitarian articles and guides on which car policy caller is the best and offers the most beneficial coverage options for diverse drivers in different categories .

Average Car Insurance Costs by City in Virginia

Auto insurers use your zip up code to calculate your indemnity pace, vitamin a well as your marital condition, citation score, and driving history. Your rates can vary by $ 585 or more, depending on your placement in Virginia .

AutoInsureSavings.org licensed policy agents did a comparison study of cities with the cheapest insurance coverage in Virginia .

Cheapest Car Insurance in Virginia Beach, VA

Virginia Beach drivers can find the cheapest car policy coverage for their centrifugal vehicle with Erie, which provided our agents a $1,119 annual quote or $ 86 per month for a full coverage policy .

Erie ’ second quote is 39 % less expensive than the $ 1,832 citywide average rate .

| Virginia Beach Company | Average Premium | |

|---|---|---|

| Erie | $1,119 | |

| USAA | $1,160 | |

| State Farm | $1,343 | |

| Virginia Beach average | $1,832 | |

| Get Your Rates Quote Now | #blank# | |

Compare RatesStart Now →

Free Auto Insurance Comparison

embark your ZIP code below to view companies that have brassy car indemnity rates .

Secured with SHA-256 Encryption

Cheapest Car Insurance in Norfolk, VA

In research, we found the most low-cost insurance coverage for Norfolk drivers is USAA, providing a quote of $1,012 per year or 45 % less expensive than median rates. At $ 1,254 per annum, Erie is 33 % lower than modal, making both insurers the better cable car insurance option .

| Norfolk Company | Average Premium | |

|---|---|---|

| USAA | $1,012 | |

| Erie | $1,254 | |

| Farm Bureau | $1,461 | |

| Norfolk average | $1,856 | |

| Get Your Rates Quote Now | #blank# | |

Compare RatesStart Now →

Cheapest Auto Insurance in Chesapeake, VA

AutoInsureSavings.org licensed agents ’ research found coverage from Nationwide indemnity costs cheaper for residents of Chesapeake. Nationwide ’ s $87 monthly rate is 42 % less expensive than the citywide average insurance rate of $ 1,768 per year or $ 147 a calendar month .

| Chesapeake Company | Average Premium | |

|---|---|---|

| Nationwide | $1,043 | |

| State Farm | $1,097 | |

| GEICO | $1,213 | |

| Chesapeake average | $1,768 | |

| Get Your Rates Quote Now | #blank# | |

Compare RatesStart Now →

Cheapest Auto Insurance in Arlington, VA

low-cost policy coverage in Arlington is with Farm Bureau providing the best rate at $1,335 annually for a full coverage policy. farm Bureau ’ s $ 111 a month rate is 31 % less expensive than average for Arlington residents .

| Arlington Company | Average Premium | |

|---|---|---|

| Farm Bureau | $1,335 | |

| GEICO | $1,471 | |

| State Farm | $1,515 | |

| Arlington average | $1,932 | |

| Get Your Rates Quote Now | #blank# | |

Compare RatesStart Now →

Free Auto Insurance Comparison

embark your ZIP code below to view companies that have cheap car indemnity rates .

Secured with SHA-256 Encryption

Cheapest Car Insurance in Richmond, VA

Drivers in Richmond can get bum car insurance with Erie Insurance, which provided our accredited agents a $1,116 annual rate for a full moon coverage policy with $ 100,000 in indebtedness insurance. Erie ’ mho quote is 41 % less expensive than the average $ 1,882 annually rate in Richmond .

| Richmond Company | Average Premium | |

|---|---|---|

| Erie Insurance | $1,116 | |

| State Farm | $1,309 | |

| Virginia Farm Bureau | $1,418 | |

| Richmond average | $1,882 | |

| Get Your Rates Quote Now | #blank# | |

Compare RatesStart Now →

Cheapest Car Insurance in Newport News, VA

The cheapest car insurance rate our indemnity agents found in Newport News is State Farm, with a $967 per year pace for a policy with collision and comprehensive coverage. State Farm ’ second quotation is 39% less expensive than Newport New ’ second average rate of $ 1,579 per year .

| Newport News Company | Average Premium | |

|---|---|---|

| State Farm | $967 | |

| GEICO | $1,055 | |

| Liberty Mutual | $1,260 | |

| Newport News average | $1,579 | |

| Get Your Rates Quote Now | #blank# | |

Compare RatesStart Now →

Cheapest Car Insurance in Alexandria, VA

Alexandria drivers can find the cheapest fully coverage policy policy with Erie, which offered us a $1,180 annual rate for our sample 30-year-old driver. Erie ’ s car indemnity rate is $ 669 less per annum than Alexandria ’ second average of $ 1,849 per year .

| Alexandria Company | Average Premium | |

|---|---|---|

| Erie Insurance | $1,180 | |

| State Farm | $1,354 | |

| Nationwide | $1,552 | |

| Alexandria average | $1,849 | |

| Get Your Rates Quote Now | #blank# | |

Compare RatesStart Now →

Average Insurance Cost for All Cities in Virginia

Compare RatesStart Now →

Minimum Auto Insurance Requirements in Virginia

In the Old Dominion State, drivers are not state-mandated to carry car insurance. alternatively, drivers can pay a $ 500 Uninsured Motorist Fee to the Department of Motor Vehicles ( DMV ) to drive legally on Virginia roads .

If you buy a car policy policy in Virginia, state jurisprudence mandates the policy must meet state minimum bodily injury and place damage liability insurance.

| Minimum car insurance requirements in Virginia | ||

|---|---|---|

| Bodily injury liability insurance | $25,000 per person and $50,000 per accident | |

| Property damage liability insurance | $20,000 per accident | |

| Get Your Rates Quote Now | #blank# | |

Compare RatesStart Now →

Frequently Asked Questions

Who has the Cheapest Car Insurance in Virginia?

We found the top cable car indemnity companies that offer the lowest Virginia drivers ’ average rates are Virginia Farm Bureau at $ 32 per month, USAA at $ 32 per month, and Erie at $ 34 a month for a submit minimum coverage policy for a 30-year-old with a clean drive history .

How Much is Car Insurance in Virginia per Month?

On average, drivers pay around $ 51 per calendar month for state of matter minimal coverage in Virginia and $ 124 per calendar month for full coverage insurance. Based on our research, Erie Insurance ( $ 1,041 per year ) is one of the state ’ s most low-cost car insurance companies. Most drivers ’ average annual rate is around $ 614 per year for state minimums and $ 1,493 per annum, including comprehensive and collision coverage .

How Much Is Full Coverage Car Insurance in Virginia?

On average, most drivers in Virginia pay for full moon coverage car indemnity is $ 124 per month or $ 1,493 per year. The crown indemnity companies in Virginia that offer the lowest rate for drivers concern in wax coverage policies include Erie, Virginia Farm Bureau, and State Farm. All three insurers provide car insurance quotes 16 % lower than average .

How do I Save on Car Insurance in Virginia?

There are many things drivers can do to help save money on their car policy rates in Virginia. First, you will need to compare quotes from multiple indemnity providers to find the right company that offers the accurate level of coverage in Virginia you need at the most low-cost price.

Another thing drivers can do to help them save more on their car indemnity rates is ask their car insurance provider about a money-saving driver rebate they may be eligible for. many companies offer cable car policy discounts for drivers who have multiple policies with them or drivers who have no anterior accidents or violations on their drive records .

To learn more and find the best car policy options in Virginia, contact the car policy experts at AutoInsureSavings.org. Our license indemnity professionals will be glad to answer any questions you have .

Methodology

AutoInsureSavings.org comparison shop study used a full-coverage policy policy for a 30-year-old driving a 2018 Honda Accord with the comply coverage limits :

| Coverage type | Study limits |

|---|---|

| Bodily liability | $50,000 per person/$100,000 per accident |

| Property damage | $25,000 per accident |

| Personal injury protection | $10,000 |

| Uninsured motorist bodily injury & underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

compare Rates

Start Now → We used policy rates for drivers with accident histories, credit scores, and marital condition for early rate analyses. We used policy rate data from Quadrant Information Services, which are publicly available for comparative purposes entirely. Your car insurance rates may vary when you get quotes .

Sources

– National Association of Insurance Commissioners. “ Market Share Reports for Property/Casualty Groups and Insurance Companies. ”

– Virginia SCC. “ Automobile Insurance. ”

– National Highway Traffic Safety Authority. “ Traffic Safety Facts. ”

– AIPSO. “ Virginia Automobile Insurance Plan. ”

– Department of Motor Vehicles. “ Uninsured Motor Vehicle Fee. ”

– NOLO. “ DUI Laws by State. ”

editorial Guidelines : We are a free on-line resource for anyone interest in learning more about car indemnity. Our goal is to be an objective, third-party resource for everything car indemnity related. We update our web site regularly, and all contentedness is reviewed by car indemnity experts .