Compare Auto Insurance in Bronx

The Bronx is one of the five boroughs of New York City, but it ’ randomness so much more than that. As a cultural hub, The Bronx has brought capital contributions to Latin and rap music. The Bronx is the birthplace of Grandmaster Flash and Jennifer Lopez, angstrom well as Billy Joel, Calvin Klein, Lou Gehrig, and excessively many actors to count. For all their contributions to America, Bronx residents deserve low-cost car indemnity rates .

Average Bronx Car Insurance Rates

How much is car insurance in Bronx, NY ? Drivers in the Bronx should n’t be surprised to learn their cable car indemnity costs more, a distribute more, than both the national and country average. The average price of cable car insurance in Bronx is $ 2,466 per year for men and $ 2,714 for women. The average price of car policy in New York is $ 1,234.84 per year. The national average cost is $ 889.01 .

Prices may vary depending on your driving history and the sum count of claims filed in your slide fastener code .

| Coverage | Men | Women |

|---|---|---|

| Liability | $1,729 | $1,957 |

| Collision | $590 | $609 |

| Comprehensive | $148 | $148 |

| Total Cost Per Year | $2,466 | $2,714 |

| Price Per Month | $206 | $226 |

| These average rates are based on our sample quote data. 1 | ||

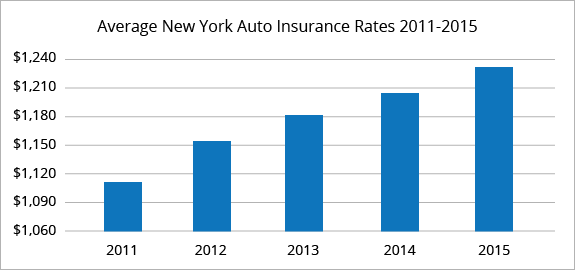

The graph below shows the switch in average New York indemnity rates from 2011 to 2015, the most holocene year the datum is available. According to the III, New York car policy rates increased from $ 1,111 in 2011 to $ 1,234 in 2015, a jump of $ 123, or 11.12 percentage.

QuoteWizard helps consumers compare quotes from both national policy companies and local independent agents. Comparing quotes can help you find cheap car indemnity rates near Bronx, New York and save up to 40 % on your premium .

end year, 17,445 people used QuoteWizard to compare car policy quotes in Bronx, NY from multiple companies to find the cheapest rates .

Best Car Insurance Companies in Bronx, NY

These are the most coarse car policy companies reported by QuoteWizard users in Bronx, NYC last year .

early popular Bronx, NY cable car insurance companies : USAA, Country Financial, MetLife, twenty-first Century, American Family, Travelers, Hartford, Erie, and Safeco .

Top 10 Vehicles

These are the most common car makes and models owned by drivers in Bronx, NY requesting quotes through QuoteWizard last year .

- Honda Accord EX/LX

- Acura MDX

- Honda Odyssey EX

- Nissan Altima 2.5 S

- Honda Civic EX/LX

- Toyota Camry LE/XLE/SE

- Honda CR-V EX

- Nissan Maxima S/SV

- Dodge Caravan

- Toyota Rav4

Minimum Car Insurance Requirements in Bronx, NY

Bronx, New York has a minimum coverage necessity known as the 25/50/10 rule, which means each policy must include at least the keep up three components :

- Individual Bodily Injury Liability (BIL): $25,000.

The maximum amount your insurer will pay for an individual person injured in a car accident. - Total Bodily Injury Liability: $50,000.

The most your insurer will pay in total for every person injured in a car accident. - Property Damage Liability (PDL): $10,000.

The total your insurance carrier will pay for property damage caused by a car accident.

Bronx Drivers

According to a late report published by Allstate Insurance when it comes to dependable drive, drivers in the Bronx, New York City, including the Bronx are much worse than modal. New York City ranked 116th out of 200 cities. While most US drivers go ten years without having an accident, drivers here are involved in crashes every 8.3 years .

Driving Conditions

Factors affecting policy rates are the weather and road conditions .

Weather

Autumn and spring can be pleasant enough, but winters in the Bronx, NY are cold and wet. Summers have batch of sunday, but they ‘re besides hot and humid. In summation, make sure your car ‘s tires have batch of pace because it rains a distribute year-round creating slickness drive conditions.

Read more: Low Cost Auto Insurance – Atlanta, Georgia

Road Conditions

A recent report by transportation research group TRIP has alarming news program. According to the report card, 46 percentage of streets in the Bronx are in inadequate stipulate. Another 23 percentage are mediocre. These ill maintained, pothole-filled streets costs drivers $ 719 a year in extra vehicle operate costs .

Traffic Congestion

According to TomTom ‘s annual traffic index report, Bronx has the 49th worst traffic congestion in the worldly concern. The average commuter spends an extra 34 minutes per hour adhere in traffic during acme commute times and 129 hours a year for commutes of 30 minutes .

Moving Violations

Moving violations like accidents and speeding tickets will give you a bad driving read. Your insurance company could besides make you a non-preferred driver. This will result in importantly higher insurance rates. Your merely hope then is to look for low-cost bad car insurance .

Traffic Tickets

The State of New York DMV web site allows you to pay non-criminal traffic citations, tells drivers how to request a learn to contest a slate, and provides helpful dealings court information .

SR-22 DWI Insurance

A DWI conviction may require you to obtain an SR-22 human body. Get a quote and compare rates from local agents and top companies that specialize in Bronx DWI insurance .

Car Accident Statistics

Bronx officials reported 13,884 car accidents in 2017 resulting in 9,166 injuries and 38 fatalities .

All traffic deaths are a tragic loss, and considering the estimated population of 1,471,160, Bronx is a safe city in terms of traffic fatalities per caput .

Vehicle Theft

Bronx reported 2,254 fomite thefts in 2017. This is a rate of 1.53 per 1,000 residents. This was well below the home rate of 2.237 per 1,000 people .

Car Insurance Discounts

Are you looking for low-cost car indemnity ? Discounts are a big way to lower your rates. These are some of the many car policy discounts available to drivers in Bronx, NY. Get a quotation mark and out which discounts you qualify for with your current or multiple insurance companies.

- Drivers 55 and older could qualify for the senior driver discount or the 55 and retired discount

- Get a new car with safety and anti-theft features

- Active duty and retired members of the Military, National Guard, or Reserves are entitled to discounts for their service

- If you’re a student, maintaining a B grade point average or better could qualify you for the good student discount

- Drive less by living close to work and you might qualify for the low mileage discount

- Bundle your auto policy with your homeowners or renters insurance. Bundling your vehicles and policies is a no-brainer and could save you 20% off the price of your premium

Rate Methodology

1 We compared rates from three different indemnity companies for 30-year-old male and female drivers with a 2010 Honda Accord. Our rate profiles have a clean drive criminal record and drive less than 10,000 annual miles. coverage includes express liability minimum of 25/50/10 and 25/50/10 underinsured motorist coverage. Policies besides include $ 10,000 personal injury protection and a $ 500 comprehensive examination and collision deductible .

Sources:

QuoteWizard.com LLC has made every campaign to ensure that the information on this web site is right, but we can not guarantee that it is absolve of inaccuracies, errors, or omissions. All content and services provided on or through this locate are provided “ as is ” and “ as available ” for use. QuoteWizard.com LLC makes no representations or warranties of any kind, express or implied, as to the mathematical process of this locate or to the information, capacity, materials, or products included on this web site. You expressly agree that your manipulation of this site is at your sole gamble .