Will Adding a Teen Driver to Your Auto Insurance Policy Increase Rates?

car insurers are chiefly matter to in one thing : Are you a safe driver or a bad one ? The answer to that question is going to be the most important factor in determining what you pay each class for your policy. The dependable ( and more know ) you are behind the wheel, the cheaper your policy .

conversely, riskier ( and less experienced ) drivers are going to pay more, and that ’ s why adding a adolescent driver to an existing car policy costs quite a bit − as in 82 percentage more .

For the one-sixth consecutive class, a Quadrant Information Services cogitation – an authority on car policy cost data analysis – examined the economic affect of adding a driver between the ages of 16 and 19 to a family ’ south existing car policy policy, and the numbers were predictably unambiguous : Adding a single adolescent driver to an pornographic ’ s car policy results in an average annual premium addition of 82 percentage .

“ Besides driving history, two factors that have a large contribution in determining and comparing costs on car insurance rates are your gender and senesce, ” says personal finance adept Natasha Rachel Smith. “ Age has the biggest shock on your rate since young drivers with no experience have statistically shown to be more unfledged behind the wheel. And that leads to more indemnity claims, making them much more expensive to insure. In early words, the younger the driver the higher the rate. ”

It ’ randomness demonstrably truthful that adolescent drivers are the riskiest demographic on the road today. According to the Centers for Disease Control and Prevention ( CDC ), motive vehicle crashes are “ the leading cause of death for U.S. teens. ”

What ’ s more, the CDC points out that in 2016, 2,820 teens between the ages of 16 and 19 were killed behind the wheel, and 235,845 were treated in emergency rooms for centrifugal fomite crash injuries. “ That means that six teens ages 16-19 die every day from motive vehicle injuries, ” writes the CDC .

furthermore, the Insurance Institute for Highway Safety ( IIHS ) says teenagers “ drive less than all but the oldest people, but their numbers of crashes and crash deaths are disproportionately high. ” In the United States, teens have a crash rate per mile drive that is three times that of drivers 20 and older. The IIHS besides points out that in 2013, teens represented entirely 7 percentage of the U.S. population but accounted for 11 percentage ( $ 10 billion ) of the sum costs of centrifugal vehicle injuries .

This data, say industry analysts and experts, is why it ’ s so expensive to add a adolescent driver to an existing car indemnity policy, and a recent annual insuranceQuotes view once again supports this dissertation .

How much will a teen driver cost your insurance rates to jump?

According to the insuranceQuotes study, U.S. families who add a young driver to their existent car policy policy will see an average annual agio addition of 82 percentage ( up from 78 percentage last class ). This might shock some, but according to Mike Barry, vice president of media relations for the nonprofit Insurance Information Institute, it ’ s an equitable and ineluctable reality .

“ unfortunately, teens equitable aren ’ thymine very good drivers because they don ’ t have much experience behind the bicycle, ” Barry says. “ Teens are twice a likely to be involved in an accident and 50 percentage more probably to be involved in a fatal accident. Anytime you add a driver that is likely to be involved in more accidents ampere well as more serious accidents, the get up in indemnity costs will be steep. ”

The good news for parents is that adolescent driving datum is trending in the good management, even if the needle moves slowly toward increased condom .

For example, the IIHS reports that there were closely 10,000 adolescent driver deaths in 1975, a figure that has continued to drop substantially every class since. And while more than 2,800 teens died in centrifugal vehicle crashes in 2016, that ’ randomness 68 percentage fewer than the high water system mark 40 years prior .

even holocene trends are promising. According to the National Highway Transportation and Safety Administration ( NHTSA ), fatal crashes amongst drivers between 15 and 20 are down 43 percentage from the 7,493 involved in fatal crashes in 2006 .

According to Kathy Bernstein, senior director of the National Safety Council ’ s Teen Driver Initiative, there are several factors at toy here, including the improved guard of modern vehicles, the fact that fewer teens are on the road than always before, and the continued positive impact of graduated driver ’ s license programs ( GDL ) across the area .

According to a 2012 study from the University of Michigan, 80 percentage of Americans between the ages of 17 and 19 had a driver ’ randomness license 30 years ago. today it ’ s fewer than 60 percentage .

What ’ s more, a holocene IIHS analysis of adolescent crash deaths shows that fatality rates have plummeted since 1996, the year that states first gear began enacting GDL systems. The greatest decline occurred among 16-year-olds, with fatal crashes dropping by 68 percentage between 1996 and 2010. fatal crashes fell 59 percentage for 17-year-olds, 52 percentage for 18-year-olds, and 47 percentage for 19-year-olds .

“ When you look at the survive 15 years or so, as states have implemented these programs, there has been a distribute of success in reducing black crashes, ” says Anne McCartt, the highway safety institute ’ s senior vice president of the united states for research. “ But there are still improvements to be made. ”

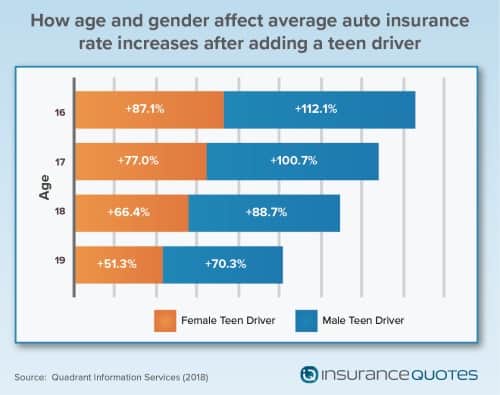

Cost varies depending on age and gender

not all adolescent drivers are created equal, and it you ’ re thinking about adding a adolescent to your existing policy you should know that the cost will differ depending on the adolescent ’ second long time and gender .

According to the insuranceQuotes study, it ’ south more dearly-won to add a young male driver than a female driver to an existing policy. According to Barry, that ’ randomness because insurers know young men are statistically riskier drivers than youthful women .

The study found that adding a male adolescent to a marry pair ’ s policy results in a national average premium increase of 93 percentage ( up from 89 percentage in 2017 ) .

however, the average increase for adding a female adolescent is 70 percentage ( up from 66 percentage in 2017 ) .

Age besides plays a meaning character in determining premium increases. For exemplify, the average agio addition is highest for a 16-year-old male driver ( 112 percentage ) and diminishes each year through age 19, when premiums increase by 70 percentage, on average .

meanwhile, the average premium increase for females is besides highest at age 16, resulting in an median spike of 87 percentage. These figures besides diminish as a female adolescent driver ages, bottoming out at 19 years old with an average annual premium addition of 51 percentage .

“ Driving well takes practice, and since all teens are modern drivers they make all sorts of mistakes that more temper drivers can avoid, ” says Eli Lehrer, president of the nonprofit R Street Institute. “ besides, teens—particularly male teenagers — are disposed towards all sorts of anserine intentional behavior that they finally outgrow. ”

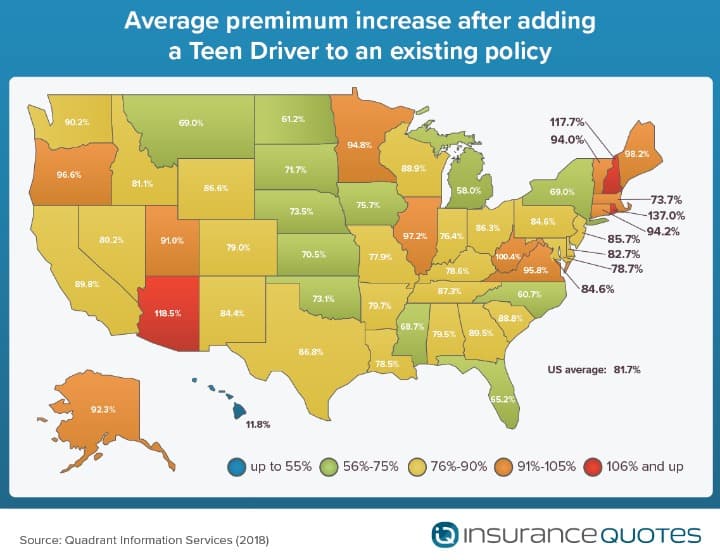

Teen insurance costs vary state by state

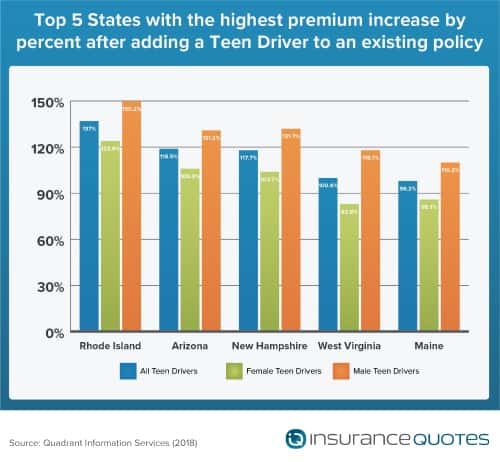

once again the insuranceQuotes study found that not all states are created equal when it comes to the monetary value of insuring a adolescent driver. For example, adding a adolescent to a married adult ’ sulfur car policy in Rhode Island will result in an average annual premium addition of 137 percentage. In Hawaii, however, the average increase is just 12 percentage .

here are the five most expensive states for car policy, on average, for adding a adolescent driver to an existing car policy :

1) Rhode Island — 137 percent increase

2) Arizona — 118.5 percent increase

3) New Hampshire — 117.7 percent increase

4) West Virginia — 100.4 percent increase

5) Maine — 98.2 percent increase

interim, here are the five least expensive states, on average, for adding a adolescent driver to an existing car policy :

1) Hawaii — 11.8 percent increase

2) Michigan — 58 percent increase

3) North Carolina — 60.7 percent increase

4) North Dakota — 61.2 percent increase

5) Florida — 65.2 percent increase

As always, the reasons behind these differences are reasonably complicated and unmanageable to pin down, but it starts with the fact that each state regulates policy differently, and those regulative differences account for some of the variations in the report ’ randomness findings .

For case, Hawaii ( which the National Association of Insurance Commissioners ranks as the 31st most expensive country for car indemnity ) is the merely department of state that doesn ’ triiodothyronine let insurance providers to consider age, sex or length of driving know when determining premiums. That means teens actually don ’ thyroxine yield a lot more than adults for car insurance .

For case, Hawaii ( which the National Association of Insurance Commissioners ranks as the 31st most expensive country for car indemnity ) is the merely department of state that doesn ’ triiodothyronine let insurance providers to consider age, sex or length of driving know when determining premiums. That means teens actually don ’ thyroxine yield a lot more than adults for car insurance .

This may besides account for lower increases in states like Michigan and North Carolina, where indemnity is regulated more strictly and rate factors are nonindulgent, which means it ’ s more difficult for individual insurers to raise and lower premiums .

“ To a large extent, the differences between states result from differences in regulative environments, ” Lehrer says. “ The states with little differences are states known for having very rigorous rate regulation. In those states, drivers who have better claims behavior and better characteristics pay more than they should in order to subsidize teens. ”

To that conclusion, Lehrer adds : “ Everyone knows that teenagers are bad drivers. If you ’ re a thoroughly driver and live in a state where teenagers aren ’ metric ton paying a lot more for car insurance, you ’ ra about surely paying more than you actually should for car insurance. ”

Teen driver safety tips

regardless of the cost incurred by insuring a adolescent driver, guard remains the primary concern for parents. here are some adept tips on how to make sure your young driver is a dependable as possible behind the roulette wheel :

- Set a good example. “The best way to ensure your teen will be a safe driver is by establishing safe habits and teaching by example,” says Smith. “Avoid speeding and breaking any minor driving laws. By putting your best foot forward, your teen can hopefully mimic your safe habits.”

- Establish firm rules and consistently reiterate them. Ken Hayes, author of Drive Me To Think, says parents should write down a list of driving commitments that their teen must read and sign. “Then, summarize them on a small card that goes inside the car and must be read before each and every time they drive,” says Hayes. “This practice helps focus the mind on their commitments and when those commitments are of a higher nature, they are much more likely to be adhered to.”

- Ask your agent about pay-as-you-drive programs. Otherwise known as usage-based insurance (UBI), pay-as-you-drive programs are now offered by some of the county’s largest insurance providers, including Progressive, Allstate, State Farm, Travelers, the Hartford, Safeco and GMAC. The concept is rather simple. UBI programs are voluntary and drivers can earn discounts based on how well, how far and how often they drive. This is accomplished through the use of telematics devices, which record data regarding driver behavior and then transmit that to insurers to help set the discount.

- Consider electronic monitoring devices. Many insurance companies now offer the installation of devices that monitor driving and flag risky behavior like speeding, aggressive driving, and the non-use of seatbelts. Some devices can even pinpoint a vehicle’s location and let parents dial directly into the car if an alert sounds. What’s more, a recent IIHS study indicates that teens in vehicles with monitoring devices take fewer risks while driving than unsupervised teens.

- Emphasize the dangers of distracted driving. According to NHTSA, research has found that dialing a phone number while driving increases a teens risk of crashing by six times, and that texting while behind the wheel increases that risk by 23 times. Smith suggests not only reiterating these dangers again and again, but also (as always) leading by example. “If you’re texting or talking while driving, they’re going to think it’s okay,” says Smith. “Your mantra should be ‘Do as I say and as a I do.’”

Final Thoughts: Teen Drivers & Car Insurance

What is the Average Cost of Car Insurance for Teen Drivers? The average cost of adding a adolescent driver to your car insurance can range from $ 1,800 to $ 2,300 annual depending on a few factors and which policy supplier you have. A adolescent driver will pay more for car indemnity coverage if they are placed on their own individual policy – up to 300 % more. It is a good idea to compare multiple policy quotes when adding your adolescent driver to your policy to get the best price.

How Much Will Your Auto Policy Rates Increase When Adding a Teenage Driver? You can expect your car policy costs to raise american samoa a lot as 82 % when adding a adolescent driver. This will be determined by your indemnity companies average rates, the sex and age of your adolescent, and what state you live in. Methodology

insuranceQuotes commissioned Quadrant Information Services to calculate the economic affect of adding a driver between the ages of 16 and 19 to a family ’ randomness existing car insurance policy. Averages are based on a marry and employed 45-year-old male and 45-year-old female who each drive 12,000 miles per year and have clean driving records and good credit. Policy limits include $ 100,000 for wound liability, $ 300,000 for all injuries, a $ 500 deductible on collision and comprehensive coverage, and uninsured motorist coverage .

Auto Insurance by State

- AL

- AK

- AZ

- AR

- CA

- CO

- CT

- DE

- FL

- GA

- HA

- ID

- IL

- IN

- IA

- KS

- KY

- LA

- ME

- MD

- MA

- MI

- MN

- MS

- MO

- MT

- NE

- NV

- NH

- NJ

- NM

- NY

- NC

- ND

- OH

- OK

- OR

- PA

- RI

- SC

- SD

- TN

- TX

- UT

- VT

- VA

- WA

- WV

- WI

- WY