|

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid reason of policy products including family, life, car, and commercial and working directly with indemnity customers to understand their needs. She has since used that cognition in her more than ten years as a writer, largely in the insuranc … Reading: How to Negotiate More Money for Your Totaled Vehicle w/ an Insurer – https://insurecar.info Full Bio → |

Written by

Leslie Kasperowicz Farmers CSR for 4 Years

|

|

Joel Ohman is the CEO of a individual equity-backed digital media company. He is a certify FINANCIAL PLANNER™, generator, saint investor, and series entrepreneur who loves creating new things, whether books or businesses. He has besides previously served as the founder and nonmigratory CFP® of a home insurance agency, veridical Time Health Quotes. He besides has an MBA from the University of South Florid … |

Reviewed by

Joel Ohman Founder, CFP®

|

Were you recently involved in an accident that totaled your car ?

One of the most park misunderstandings that most people have when dealing with an insurance company is the belief that they will be paid the price they paid for their car if it is totaled .

unfortunately, that is not the case – and in most situations, you might not even get true wax market value for your car .

This is more common than you think .

According to NADA.org ( National Automobile Dealers Association ) more than 5 million vehicles are totaled each year .

therefore, what can you do about it ?

Make certain you have comprehensive and collision coverage before you start to negotiate with any insurance carrier about your totaled vehicle .

How much will I get for a totaled car?

Your insurance company is not going to give you more money for your car merely because you think it is worth more than their estimate, good as they will not allow you to determine your own insurance rates or insurance claims .

The bad news program is, if you want more money for your car, you ’ re going to have to negotiate for it, regardless of if you consider your insurance company to participate in fair dealings during the negotiation work .

The well news is, as you continue reading, you ’ ll better understand how your company determines the value of your car .

You ’ ll besides learn about a few strategies that you can use to maximize the actual price that your insurance company will give you for your car if it is has been totaled .

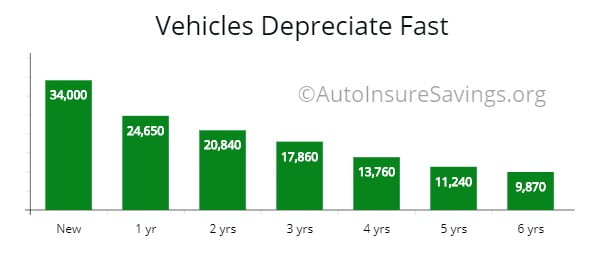

note : The modal vehicle can depreciate from 17 % to 30 % in the first year according to NADA. Some depreciate up to 38 %. When you are attempting to negotiate with an insurance company after a full loss claim you are likely to find out your vehicle is not worth as what you expect .

note : The modal vehicle can depreciate from 17 % to 30 % in the first year according to NADA. Some depreciate up to 38 %. When you are attempting to negotiate with an insurance company after a full loss claim you are likely to find out your vehicle is not worth as what you expect .

For nowadays, we will start with an explanation for the fairly market respect of a car .

This is what insurers are going to use to determine how much your car is worth at the time of the accident. There is information you might want to be aware of besides .

Some insurers are NOT going to use the knit intend of “ pre-accident ” rate, but the “ investing ” of the rectify vehicle. We will go into more detail below .

How do insurers determine the fair market value of a vehicle?

The definition of fair marketplace value is when a buyer or seller can agree on a price .

After you ’ ve been involved in an accident, an indemnity adjuster from your carrier will determine the damage to your cable car .

If the adjuster deems the cable car to be totaled, a value must then be assigned to the car .

Totaled Loss Claim vs Actual Cash Value

If you have been in an car accident and the insurance company is determining if your vehicle is a full passing you have to carry comprehensive examination and collision coverage for a personnel casualty requital .

If not, then you would be entirely creditworthy for the passing payment. .

many insurers are going to look at the price of the repairs, the salvage prize of the vehicle, and the monetary value to the insurance company while the fomite is being repaired .

If the value of the regenerate vehicle is more than getting a raw one the insurance company will file for a total personnel casualty .

It wouldn ’ thyroxine be smart financially to repair your car .

Below is a table of the sum passing respect for a vehicle in each state .

For model, in Arkansas if your $ 10,000 vehicle needs $ 7,500 in repairs it would be a sum loss. In Colorado if your $ 10,000 vehicle needs $ 10,000 in repairs it would be a full loss .

What is considered a total passing varies from state to state .

Some use what is called the Total Loss Threshold or TLT where the damage needs to exceed a certain share of the vehicle ’ s value .

The majority of states use what is called total Loss Formula or TLF where the salvage rate and cost of repairs exceed the car ’ s actual cash respect .

Compare RatesStart Now → When assessing the value of your car, the adjuster and the insurance company will do the follow :

- Evaluate the condition of the car prior to the accident

- Research the market value of your car

- Get 3rd party appraisals of your car

The adjuster will determine if your cable car is in excellent, good, fair, or poor condition .

tied if you kept your car in pristine shape anterior to the accident, the car is not likely to receive an excellent rating unless it is a few months honest-to-god or less.

You have to think like an unpressured buyer or seller when attempting to determine the fair market measure of vehicle. This is what insurers do .

once the adjuster has done the job and filed the necessary paperwork, the insurance company takes over to figure out the market value of your car .

While one might think that all they need to do is use Kelley Blue Book or Edmunds.com, most companies choose to use their own methods .

The reason is bare – they want to pay out a little as possible .

Although every insurance company is unlike, most will contact local dealerships and 3rd party companies to see what a car alike to yours is selling for in your sphere .

Whether they look at all the vehicles or a small scale is not known, so it is best that you do your own research .

If you ’ re still asking the question, “ How much will an indemnity company give me for my car ? ” It is at this point that you ’ ll be able to find your answer .

Your carrier will likely contact you with the dollar number they are will to pay out for your totaled vehicle .

If you feel that they undervalued your car, then it is important that you speak up oklahoman preferably than late. Ask for a copy of the report they compiled, including all of the information they used to determine your car ’ second measure .

Believe it or not, there are many cases in which customers have challenged the value set by top carriers, and as a result, received an extra $ 1,000 or more for their car .

Best Auto Insurance Companies for Claims & Totaled Vehicles

Based on consumer surveys and ratings from reputable sources the top companies to work with when dealing with claims and/or totaled vehicles are USAA, Travelers, Auto-Owners, and Amica .

All of them ranked 98 out of 100, except USAA, which ranked 100 out of 100 .

Included in the list rounds out the top 17 companies for claims sanctification across the United States .

If by gamble you are going through the beastly process of a totaled car claim with an insurance company and want to switch, below are reputable companies with full fiscal forte .

| Company | Claims Service | AM Best Rating | Score (Out of 100) |

|---|---|---|---|

| USAA | 100 | A++ | 97 |

| Travelers | 98 | A++ | 91 |

| Auto Owners | 98 | A+ | 90 |

| Amica | 98 | A++ | 95 |

| Liberty Mutual | 96 | A | 87 |

| AAA of Southern California | 96 | A+ | 94 |

| GEICO | 94 | A++ | 89 |

| CSAA Group (AAA) | 93 | A | 91 |

| Progressive | 93 | A+ | 89 |

| State Farm | 92 | A++ | 91 |

| Allstate | 92 | A+ | 88 |

| Nationwide | 92 | A+ | 89 |

| Hartford | 90 | A+ | 88 |

| American Family | 88 | A | 89 |

| Safeco | 84 | A | 88 |

| Farmers | 83 | A | 82 |

| Erie | 80 | A+ | 86 |

Compare RatesStart Now →

How to Negotiate to Get More Value for Your Totaled Vehicle

here ’ s what you should do .

If you want the extra money that you deserve for your totaled car, don ’ thymine good sit around and expect your insurance company to pay it out .

alternatively, consider using any and all of these tactics :

- Do your own research .

- Contact local anesthetic dealerships .

- Keep detail records and take into account any extra options and features your cable car had .

- Compare your inquiry with that of the insurance company .

- Be courteous .

- You are attempting to get the bazaar grocery store value of the fomite – not what you think it is worth. What the market or indifferent buyer or seller would agree on a price .

The best thing you can do when negotiating how much you will get from an insurance company for your car is to prepare yourself adenine well as potential .

research the late sales of your vehicle on-line, deoxyadenosine monophosphate good as current sale prices .

How to Determine the Fair Market Value of a Vehicle on Your Own

not sure where to start ?

Consider Autotrader.com or Edmunds.com to gather data .

In addition to using the Internet as a resource to gather sales data, contact local dealerships that sell a make and model that is similar to your vehicle .

They will likely provide with you a higher sales price, which will entirely work out in your favor .

last, consider using Kelley Blue Book to get the fair market value of your vehicle .

As you conduct your research, make certain to keep detail records of all the data you gather from all of your sources .

Try to get any sales figures in compose, as you ’ ll be able to use these to negotiate more money .

Be sure to besides locate any information related to the extra options that your cable car had .

From especial car stereo to reverse cameras, those lend features could add a bit more money to the check from your insurance caller .

once you ’ ve compiled all of your data, and received the detail data from the policy company, it ’ s now time to compare your research .

When you conduct your research and come up with a “ fair ” fair market price then try to negotiate a few more dollars out of the insurance company .

Look to see where you might be able to squeeze your supplier for the excess dollars you deserve .

When you contact your indemnity ship’s company to submit your character and negotiate for the higher value, it is besides best to be courteous .

At the lapp time, however, stand your flat coat .

The indemnity agent at your caller will be far more probably to help you out in achieving fairly compensation if you come across as confident even liqueur .

Final Thoughts

By being informed and following the suggest tactics, you should be able to negotiate more money, no matter what kind of answer your policy company gives after you ask them what they will give you for your car .

Sources

column Guidelines : We are a free on-line resource for anyone concern in learning more about car indemnity. Our goal is to be an objective, third-party resource for everything car policy related. We update our locate regularly, and all contented is reviewed by car indemnity experts .