When it comes to adolescent drivers and cable car policy, things get confusing — and expensive — cursorily. A parent adding a male adolescent to a policy can expect car indemnity rate to balloon to more than $ 3,000 for full coverage. It ‘s flush higher if the adolescent has his own policy. That policy would probable cost more than $ 6,000 — and may eclipse $ 10,000 depending on the submit. now, that we ‘ve reviewed those sobering facts, let ‘s template you through your car policy buying. We ‘ll look at discounts, options and extra circumstances — so you can find the best car policy for teens.

When it comes to adolescent drivers and cable car policy, things get confusing — and expensive — cursorily. A parent adding a male adolescent to a policy can expect car indemnity rate to balloon to more than $ 3,000 for full coverage. It ‘s flush higher if the adolescent has his own policy. That policy would probable cost more than $ 6,000 — and may eclipse $ 10,000 depending on the submit. now, that we ‘ve reviewed those sobering facts, let ‘s template you through your car policy buying. We ‘ll look at discounts, options and extra circumstances — so you can find the best car policy for teens.

flush though the correct answer is normally to add a adolescent onto your policy to mitigate some of the cost, there are other options and discounts that can save money. We did deoxyadenosine monophosphate much of the legwork as potential for you, hunting down discounts and reading the fine print. In the end, you ‘ll need to compare car indemnity quotes using our quote comparison creature to see which party is best for you. KEY TAKEAWAYS

- According to the federal Centers for Disease Control and Prevention, the worst age for accidents is 16.

- If the student plans to leave a car at home and the college is more than 100 miles away, the college student could qualify for a “resident student” discount or a student “away” discount.

- It’s possible to tell your insurance company not to cover your teen, but it’s not a given. This is called a named exclusion.

How much is car insurance for teens?

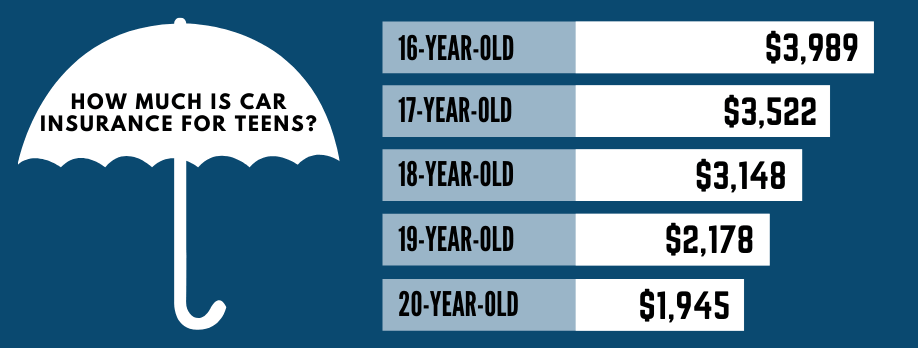

Like we ‘ve said, adolescent cable car policy is expensive. The younger the driver, the more expensive the car policy. Young drivers are far more likely to get into cable car accidents than older drivers. The risk is highest with 16-year-olds, who have a crash rate doubly a high as 18- and 19-year-olds. That risk is reflected in the modal car indemnity rates for teenagers :

- 16-year-old – $3,989

- 17-year-old – $3,522

- 18-year-old – $3,148

- 19-year-old – $2,178

- 20-year-old – $1,945

Rates not alone depend on long time, but the company you choose. This table shows the annual rate a adolescent will receive in California .

| Company | Female | Male | Average |

|---|---|---|---|

| Company 1 | $2,646 | $2,961 | $2,804 |

| Company 2 | $2,607 | $3,472 | $3,040 |

| Company 3 | $5,613 | $8,966 | $7,290 |

| Company 4 | $2,640 | $3,080 | $2,860 |

| Company 5 | $2,642 | $3,454 | $3,048 |

| Company 6 | $2,030 | $2,064 | $2,047 |

| Average | $3,030 | $3,999 | $3,515 |

note : The specific company names were not mentioned future to the rates but the companies are, in no detail holy order : GEICO, Farmers, State Farm, Progressive, Mercury and AAA.

| All 50 states and the District of Columbia now have a Graduated Driver’s License (GDL) system, according to the Insurance Institute for Highway Safety (IIHS). GDL programs save lives. A study by the IIHS found states with stronger graduated licensing programs had a 30% lower fatal crash rate for 15- to 17-year olds. |

Adding a teenager to your car insurance policy

Adding a adolescent to your car indemnity policy is the cheapest way to get your adolescent insured. It hush comes with a brawny cost, but you can surely save if you choose the best car indemnity companies for teens. We can help.

How much does it cost to add a teenager to car insurance?

Let ‘s get down to numbers. The monetary value of adding a adolescent to your car insurance policy varies based on a number of factors. Every situation is different, but to get a solid snapshot of adolescent driver indemnity costs, we compared rates in 10 nothing codes in each state of matter. The kin profile we used owned a 2019 Honda Accord driven by a 40-year old homo buying broad coverage. then we added a 16-year old adolescent to the policy. here ‘s what happened :

- The average household’s car insurance bill rose 152%.

- A teenage boy was more expensive. The average bill rose 176%, compared with 129% for teenage girls.

- California rates increased the most, more than 200%.

The reason behind the hikes : Teens doss at a much higher rate than older drivers. The risk is four times adenine much. According to the federal Centers for Disease Control and Prevention, the worst long time for accidents is 16. They have a crash rate doubly arsenic high as drivers that are 18- and 19-year-olds. Costs vary by insurance company, which is the reason we suggest shopping for adolescent driver policy. It ‘s slowly to switch car indemnity companies. We ‘ll provide you the guidance to switch, cancel and save .

Cost to add a teen to your policy by company

The table shows the median price of cable car insurance for 16-year-olds when adding them to an existing car insurance policy .

| Company | Female | Male | Average |

|---|---|---|---|

| Geico | $1,632 | $1,758 | $1,695 |

| State Farm | $1,394 | $2,462 | $1,928 |

| Nationwide | $2,486 | $3,228 | $2,857 |

| Progressive | $2,733 | $4,223 | $3,478 |

| Allstate | $3,004 | $4,112 | $3,558 |

| Farmers | $5,024 | $9,248 | $7,136 |

| Average | $2,712 | $4,172 | $3,442 |

How to add a teen to your policy

If you ‘re choosing a new car insurance company, you should have already added the adolescent to the policy when beginning signing up. If you want to add a adolescent to your current or newfangled policy, follow these steps :

- Call your car insurance company, if they haven’t already contacted you.

- Talk through the changes to your policy in detail, minimum and maximum coverage and insist on hearing the ins and outs of each and every discount. These can add up to considerable savings. If you are also adding an additional car, be sure to ask about a multi-car discount.

- Have ready your teen’s driver’s license information and information about any new vehicles.

- Take the time you need to decide. Just make sure your teen isn’t driving on a full license without being formally added to your policy or their own. That would be risky.

If my teen gets a ticket, will it raise my rates?

Yes. once together on the same policy, all driving records — including your adolescent ‘s — affect premiums, for better or worse. You share in the discounts, and you shall besides contribution in the risk. To understand how a moving trespass will affect your rates, we ran a cogitation and found that the extra cost could run from 5 % to deoxyadenosine monophosphate gamey as 20 %.

Can a teenager get their own car insurance policy?

Yes. Companies will sell directly to teens. however, state of matter laws vary when it comes to a adolescent ‘s ability to sign for insurance. That means a parent may have to co-sign — and it ‘s rarely cheap. In fact, your adolescent will likely have a higher premium compared to adding a adolescent to a parent or defender policy. however, there are cases where it might make smell for a adolescent to have their own policy. progressive cites two :

- You have a luxury sports car. On a single plan, all drivers, including the teen, are insured against all cars.

- The teen is eager to be financially independent.

car policy is unlike for a first-time car indemnity buyer, but it ‘s a big time to start a relationship with an indemnity supplier .

How to save on teenage car insurance?

Teens pay more for cable car policy than adult drivers because indemnity providers consider them bad. But there are ways adolescent drivers can save on their car indemnity premiums. Teens can take advantage of the take after ways to save on car insurance-

- Raise your deductible. An easy way to lower car insurance premiums is to raise your deductible. However, weigh against the fact that young drivers are more likely to get into accidents. When you get into an at-fault accident, you have to pay the deductible amount. Increasing your deductible from $500 to $1,000 will reduce your annual premium by approximately $400. You can also drop comprehensive and collision coverage if the car isn’t financed and not worth much. Use our auto insurance coverage calculator to find out what coverage people “like you” have.

- Skip the red Mustang. A car with a high safety rating will be cheaper to insure. Use com’s list of car models to find the cheapest cars to insure. This mostly has to do with the car’s cost, how easy it is to repair and claim records. Insure.com also has a list of used cars.

- Delay getting a license. This isn’t really a popular option for an eager teen driver, but it’s worth considering. An older teen driver is slightly cheaper to insure, approximately 20% cheaper from the age of 18 to 19. However, you should also understand the insurer still charge higher rates for the first few years of the license.

Another way to minimize your policy agio is to avail yourself of the discounts available. Some of them are mentioned below

Discounts for teen drivers

We ‘ve identified the best discounts for adolescent drivers to get low-cost car policy. Most car policy companies wo n’t reach out to you with discounts, so you must be proactive. Ask and ask again, insisting on as many discounts as you possibly qualify. Discounts can lone be stacked up to a certain point though .

- Good student discount. A popular discount is tied to doing well in school. This usually translates as a “B” average (3.0 grade point average) or higher. Age limits do exist; typically, the student must be under the age of 25. How much will you save? Our research shows you can an average of 7% for the discount. That’s $361 on average.

- Defensive driving discount. You can take extra driver education or a defensive driving course. This means go above and beyond the minimum state-mandated drivers’ education and training. In some states, discounts can run from 10% to 15% for taking a state-approved driver improvement class. Online classes are a convenient option but check with your carrier first to make sure it will lead to a discount.

- Student “away” discount. Most car insurance companies offer a student “away” discount for students who are away at college or living away from home during high school. You could receive a discount around 5% to 10% of the student’s premium, but some insurers advertise up the 30% off. The average student away at school discount is more than 14%, which is a savings of $404.

- Good driver discount. Keep a clean record and you can receive a discount. This means you don’t get into any accidents or violations.

- Low-mileage discounts. Pay-as-you-drive pay-per-mile insurance can offer a significant discount. Several car insurance companies offer discounts if you allow a telematics device to be placed in your vehicle so they can monitor your driving habits. This is considered “pay-as-you-drive.” This can give up to a 45% discount. With pay-per-mile, you’ll pay for the distance you drive, rather than driving patterns. Both discounts are great for teens or families that don’t drive very often.

- Look for unrelated discounts. Review discounts unrelated to teens like a multiple vehicle discount and a home and auto bundle discount for additional savings.

| “If a driver qualifies for several discounts, the first discount applies to your original premium and then your second discount to your revised premium and so on,” says Joel Camarano, executive director for auto underwriting at USAA in San Antonio, Texas. |

Car insurance for college students

college students can follow the like guidance as given to teens. There is likely to save. If the scholar plans to leave a car at home and the college is more than 100 miles away, the college scholar could qualify for a “ resident scholar ” discount rate or a student “ off ” discount rate, as mentioned above. These discounts can reach adenine high as 30 %. besides, do well in school. That could lead to a commodity scholar deduction. Both discounts will require you to contact your insurance supplier so they can begin to apply the discounts. While you ‘re on the telephone with them, do n’t hesitate to ask about other potential discounts .

Learner’s permit insurance

You can get policy with a license, but most cable car indemnity companies include the permit adolescent on the parents ‘ policy without any legal action. however, the adolescent should be added to the parents ‘ policy or get their own policy when he or she receives a driver ‘s license. When that time comes, be sure to visit the rest of this article for guidance on options and discounts. besides, it may be wise to contact your insurance provider for all options available to you .

Opt for no coverage savings option

It ‘s possible to tell your policy company not to cover your adolescent, but it ‘s not a given. This is called a named excommunication. Through an second to your policy, you and your policy company mutually agree that the driver is n’t covered, which means neither is any accident the driver causes. not all companies allow this, and not all state of matter do either .

Adding a teen driver cheat sheet

- Talk to your carrier as soon as your teen gets a driver’s license.

- Compare multiple car insurance quotes using Insurance.com.

- Consider all coverage options. Think about raising your deductible.

- Seek out and stack as many discounts as possible.

- Talk to your teen early and often about safety.

- Insist they drive a safe car.

Things to consider before choosing a car insurance company for your teen

- Know your timing. Chances are that your car insurance company will contact you. How does the company know? It probably asked you for the names and birthdays of all the children in your home when you first signed up for your policy. So, if your teenager is 16 or 17 now, it knows all about it. If you don’t get the call, alert your carrier once your teen gets a learner’s permit to talk through your options and to give yourself time to compare car insurance companies. In general, permitted drivers are automatically covered as a part of the parent or guardian’s policy with no action needed on your part. However, when they do have a true driver’s license, even provisional, they will need to be on your policy or get their own.

- Get ready to compare quotes. Our research shows that insurance companies across the U.S. (except Hawaii) use age and experience as a rating factor. In our studies, adding a teen raises your car insurance costs anywhere from 100% to more than 200%. However, the rates that insurance companies charge you for adding a teen varies, as shown in the California adding a teen to your policy

- Understand available discounts. When you add a teenager to your car insurance policy or they get their own, car insurance companies don’t actively communicate what discounts are available to you. Use our discount guide below so you’re not in the dark.

Frequently asked questions about teenage insurance

Do you have to add a teenage driver to your insurance?

Yes, you ‘ll have to add your adolescent to your car policy policy if they live with you and drive your car. Some states will require you to add your adolescent driver as an extra cover person when they get their apprentice ‘s license .

What is the cheapest way to get car insurance for a teenager?

The cheapest direction to get car indemnity for a adolescent is by adding them to your own insurance policy. It is not advised to buy a adolescent their own policy because it can be very expensive. policy companies charge teens more for car coverage than adults because they believe drivers under 25 have a higher gamble of causing accidents .

Should I add my 16-year-old to car insurance?

Most states require you to add your 16-year-old adolescent to your car indemnity angstrom soon as they get their license. It is compulsory in some states, and many insurance companies besides require it. even if it is not compulsory, it ‘s constantly a adept mind to make indisputable you ‘re covered by car policy .

How to get car insurance for a teenager?

It is possible for a adolescent to get car insurance with a let, but most policy providers will include the permit adolescent on their parent ’ sulfur policy without any other formalities. Teenagers should get car indemnity after they receive their drive let to stay protected in the event of an accident.

How much does it cost to add a 17-year-old to car insurance?

The average car policy cost for a 17-year-old for wide coverage is $ 5,836 a year. Your car insurance rate will depend on where you live, the coverage level you choose, the do and model of your car, among other factors .

Methodology

This table shows the average annual extra premium charged for 10 ZIP codes in each express from the following carriers : Progressive, Allstate, State Farm, Nationwide, GEICO and Farmers. Data was provided for Insurance.com by Quadrant Information Services. The premium profile used a al-qaeda car policy price for an owned 2019 Honda Accord, driven by a 40-year-old man with broad coverage ( 100/300/50 liability, plus comprehensive examination and collision policy, and a $ 500 deductible ). The extra premium monetary value was determined by adding a 16-year-old male driver to the base policy. This drill was repeated for a 16-year-old female .