Protect Your Home and Everything In It with a Home Insurance Policy

Homeowners insurance pays to repair or rebuild your home and replace its contents if they ’ re damaged by particular perils like fire, larceny or a weather event such as weave or lightning.

If you ’ re not companion with dwelling insurance coverage and its policies, you might end up paying more than you should for inadequate coverage. To help you find a homeowners indemnity policy that works for you, hera are the seven best home insurance companies of 2022 .

Our Top Picks for the Best Homeowners Insurance

- Lemonade – Best Online Company

- Hippo – Best Online Company Runner-up

- Erie Insurance Company – Best Range of Coverage Options

- Allstate – Best for Claims-Free Homeowners

- Amica Mutual – Best Customer Service

- USAA – Best for Military Members

- AIG – Best for High-Value Homes

Pros

- Unusually fast quotes and claims payments

- Unused claims money is paid to a non-profit of your choice

- Flat fee for administration, in addition to low monthly premiums

- Demotech Financial Stability Rating: A

Cons

- Not available in all 50 states

Why we chose Lemonade: Lemonade ’ second streamlined on-line services and practice of AI make the summons of getting quotes and filing claims easier and faster .

Lemonade Insurance is an online-only insurance company that uses artificial intelligence to provide notably fast dwelling indemnity quotes and claims requital. The company can provide a quote in a few minutes — you simply fill out a shape on their web site and choose the coverage amount you want .

The use of AI besides makes the claims march unusually quick, with many reimbursements paid in a matter of minutes, the company says .

Lemonade besides has unique and appealing approaches to paying for its operations and using ship’s company profits. Its operations are funded, at least in part, through a flat tip that ’ south added to the policy ’ randomness premium .

then, through its Lemonade Giveback program, it will donate up to 40 % of premiums that haven ’ triiodothyronine been used to pay out claims to a non-profit organization of your choice .

Lemonade besides offers a Standard selection of coverage options, including :

- Dwelling coverage

- Other structures coverage

- Personal property coverage

- Personal liability

- Medical payments

- Loss of use

Pros

- Obtain an online quote in 60 seconds

- Purchase a policy online in around 5 minutes

- Get discounts when using Hippo’s Smart Home System

- Offers home-care services

Cons

- Discounts for homes with digital and smart systems

- Coverage is not available nationwide

Why we chose Hippo: Hippo ’ randomness habit of technology both for customer service and improved home security makes them a top choice for tech-savvy homeowners .

Hippo allows customers to complete the quote process wholly on-line and get a quote in arsenic fast as a minute, and receive a policy in a little as five minutes, the company claims .

Hippo besides provides a smart home deduction if you agree to install and use a exempt smart base monitor organization. There are several levels of kit, with escalating arrays of equipment .

The company claims customers save an average of $ 64/year if they agree to installing the plain self-monitoring kit — which includes smoke, CO2 and water-leak detectors — and $ 91/year when opting for the pro monitor kit, which adds 24/7 monitor and emergency dispatch services .

Their Hippo besides offers a HomeCare Expert program that provides professional serve recommendations, via phone, to policyholders who need repairs or sustenance .

The company ’ south policy discounts are subject to the use of a bright home kit, given at no price to eligible policyholders .

In addition to standard family insurance coverage, Hippo offers to cover :

- Computers and home office equipment

- Appliances and electronics

- Smart home upgrades

- House cleaners and sitters

- Water backup

- Service line protection

- Enhanced rebuilding

- Full replacement costs

- Costs for local ordinance changes

Pros

- Customizable coverage deductibles

- Discounts available when bundling with auto insurance

- Add-ons include liability coverage, identity recovery, and service line protection

- J.D. Power Ranking: 3rd out of 22

- A.M. Best Rating: A+

Cons

- Only available in 12 states

Why we chose Erie: Erie ’ s standard policy includes guaranteed substitute cost and an array of addition ’ second that normally cost extra — all valuable additions to an already solid indemnity package .

Erie Insurance is among a handful of homeowners policy companies that include guaranteed successor cost coverage as partially of their standard coverage. This allows homeowners to rebuild their family the way it was before the incident, quite than receiving a depreciate sum due to the home ’ south long time .

Their policy besides includes roof damage coverage a well, although wide substitution does cost extra .

Erie besides offers a 16 % to 25 % dismiss for bundling and extra discounts if you install automatic sprinklers, smoke detectors, and burglar alarms .

The company is among the few insurers — along with Allstate and USAA — to offer, at extra cost, home-sharing coverage as an alternative to bribe such policy through AirBnB or Vrbo. As a rule, damage from paying guests is not covered under standard homeowners policy .

Erie ’ randomness basis policy besides covers these other items, which cost extra with many early companies :

- Valuables and hard-to-replace items

- Gift card and gift certificates

- Animals, birds, and fish

- Cash and precious metals

You can besides add the following coverage to any Erie policy :

- Water backup and sump overflow

- Personal liability coverage

- Identity recovery services

- Service line protection

Pros

- Discounts for being claims-free

- HostAdvantage add-on available for home-sharing or renting

- A.M. Best Rating: A+

Cons

- J.D. Power Ranking: 10th out of 22

- HostAdvantage feature is not available in all 50 states

Why we chose Allstate: Allstate ’ s discounts for claims-free homeowners, solid reputation and great fiscal stand earns it a rate on our list .

Allstate compensates homeowners who take estimable worry of their property and are claim-free. You can get up to a 20 % discount rate if you switched to Allstate and hadn ’ thymine filed a claim with your previous insurance company. Allstate will besides lower your deductible come for every extra year without a home insurance claim while you ’ re with them .

For an extra tip, Allstate besides offers a Rateguard option, which allows you to file one “ unblock ” claim every five years without triggering a rise in your premium. however, since there ’ s a gloomy likelihood of placing a title in any class, the option may or may not be worth buy, depending on its cost and the increase in premium that would result from making a claim .

The party is one of the few — along with Erie and USAA — to offer, at extra monetary value, home-sharing coverage as an alternate to buy such indemnity through AirBnB or Vrbo. As a principle, price from paying guests is not covered under a standard homeowners indemnity policy .

The company besides offers optional coverage for :

- Identity theft restoration

- Green improvement reimbursement

- Water backup

- Yard and garden

- Scheduled personal property

- Electronic data recovery

- Business property

- Musical instruments

- Sports equipment

Pros

- Offers database of contractors and guarantees their work for 5 years

- Discounts for claims-free customers

- J.D. Power Ranking: 1st out of 22

- A.M. Best Rating: A+

Cons

- Discounts not available in all states

- Contractor database feature not available for HI and AK

Why we chose Amica Mutual: Amica Mutual ’ s customer service is one of the best out there, and their contractor connection ensures that quality service extends outside of their coverage .

Amica Mutual stands out for customer service on claims, having topped the J.D. Power Property Claims Satisfaction Study for nine back-to-back years. Another standout expression to the company is its Contractor Connection database, which lists thousands of vet, accredited and see contractors and guarantees their work with a five-year guarantee .

Like many insurers, Amica besides offers commitment discounts, in its case to customers who have been with the company for at least two years. It besides offers breaks to those who are and are claim-free for at least three years .

For customers who require extra coverage, Amica offers :

- Valuable items coverage

- Catastrophic coverages

- Identity fraud expense coverage

- Home business coverage

Pros

- Get 10% off with a car insurance policy

- Home sharing coverage available

- Discounts for claims-free condo or renters insurance policyholders

- A.M. Best Rating: A++

Cons

- Only available for military personnel and their families

- Home sharing not available in all 50 states

Why we chose USAA: USAA has a great combination of low premiums and wide coverage for military members, along with outstanding trustworthiness and fiscal stability .

USAA is a highly rated indemnity provider — for both fiscal stability and customer service ( although its circumscribed handiness means it is not included in JD Power customer satisfaction rankings ). It offers many different coverage options for military members and their families ( including the children of veterans and those who are serving ) .

USAA is besides among a handful of homeowners insurance companies that includes as standard Guaranteed Replacement Cost coverage, which allows homeowners to rebuild their home the way it was before an incident, rather than receiving a deprecate sum due to the home ’ s old age .

The party is besides known for its low premiums. If you qualify for membership in USAA, it would be arduous to find better home insurance rates and coverage for property damage .

The company is one of the few — along with Erie and Allstate — to offer, at extra cost, home-sharing coverage as an alternative to buy such insurance through AirBnB or Vrbo. As a principle, price from paying guests is not covered under a standard homeowners policy policy .

Pros

- Coverage for homes of up to $100 million

- Robust cybersecurity coverage

- Coverage for properties outside the United States

- Lower average premium than other high-end competitors

Cons

- Low customer service ratings

- Customers have to buy more than one policy with the company

Why we chose AIG: AIG provides comprehensive coverage for high-value properties worth improving to $ 100 million .

AIG is known as a lavishness insurance company that provides high net-worth individuals with comprehensive coverage, from dwelling to cybersecurity protection .

It offers guaranteed surrogate cost ( without any limits, according to the company ) for homes valued from $ 750,000 all the way up to $ 100 million on an “ all-risk ” basis — meaning their policy covers all perils except the few specifically excluded. It besides offers the option of ultra-high deductibles ( up to $ 100,000 ) so you can lower your bounty .

You must have one of the company ’ s other policies to get homeowners insurance with AIG, but the company has a across-the-board array of policies aimed at high net-worth customers to choose from — including collection policy, yacht indemnity, car policy and even secret aircraft policy .

You can besides find services that will help you prevent accidents or take care of them quick. The insurance company provides background check services for domestic staff, private firefighting units, cybersecurity measures and more .

In addition to standard coverage, AIG offers services such as :

- Kidnap, ransom and extortion coverage

- Landscaping coverage

- Crisis management and reputation restoration

- Multinational property coverage

- Business property coverage

Other home insurance companies we considered

As we analyzed family insurance companies, we focused on fiscal constancy and potent customer satisfaction ratings, in addition to the assortment of coverage options each caller offered .

The policy providers we selected excelled in all of these categories, but the follow carriers fell a bit short circuit when it came to most homeowners ’ needs .

however, read on to see if one of these companies might fit your specific needs .

Pros

- Partnership with Ting to prevent electrical fires

- Multi-policy and first-time sign-up discounts

- Insurance agents available in most states

Cons

- Policies not available through independent agents

- Online quotes not always available for manufactured or mobile homes

- Fewer discounts than competitors

Pros

- Farmers Smart Plan Home Policy offers three types of coverage

- Claims-free discounts

- Up to $25,000 to replace appliances with eco-friendly options

Cons

- No home insurance in Alaska or Washington D.C.

- Somewhat more expensive than competitors

Pros

- Wide array of discounts for online purchases, new homes and more

- Comprehensive mobile app

- Customizable policies and add-on options

Cons

- High number of complaints with the National Association of Insurance Commissioners (NAIC)

Pros

- Add-ons to cover identity fraud, green home and water backup

- Discounts for homeowners with security systems

Cons

- Higher prices than competitors for policy limits above $75,000

- Low customer satisfaction rating in the 2021 J.D. Power study

Pros

- Covers high-value properties worth more than $1M

- Coverage for traumatic events such as child abduction and stalking

- Excellent A++ AM Best Rating

Cons

- More expensive than average

- Only sells through local agents

- Low customer satisfaction rating in the 2021 JD Power Study

Pros

- Lower than average premiums

- Generous discounts for bundling and for new and renovated homes.

- Mobile app lets you make payments, monitor claim status and more

- Uncommon standard coverage such as sewer backup damage

Cons

- Lower than average satisfaction score in the J.D. Power study

ad by Money. We may be compensated if you click this ad. ad indigence to insure your home, or looking to lower your rate ? Lemonade provides spare quotes tailored to your needs with support from license agents, helping you get indemnity coverage fast so you can get on with life. Click below to get a free quotation .Get a Free Quote

Homeowners Insurance Guide

Homeowners policy coverage is a type of property indemnity that provides fiscal protection against loss due to natural disasters, larceny and accidents. A home indemnity policy is required if you are financing a new base, and can not travel from one harp or owner to another — something to keep in judgment before selling your house. When shopping for a policy, it can be useful to contact an insurance agent that can help you compare quotes and coverage options .

How to choose the best home insurance

When trying to choose the best home policy, there ’ s a draw more to look at than just the best home indemnity companies. You have to consider price, your living situation, their particular offerings and more. here are some steps to take before making your decision :

- Learn about coverage types, different policies and all the add-ons you can find so you can better compare offerings when looking at all the companies.

- Find the top home insurance companies that offer their services in your area.

- Consider your needs and concerns when assessing each company’s products. Think about your area and its geographical risks, your personal hobbies, pets and more.

- Talk to an independent home insurance agent, who can help you find the right combination of coverage from a company that serves your needs. After all, the best home insurance company won’t necessarily be the best for you.

- An agent can also help compare quotes objectively, as they have access to all the different companies’ pricing methods and history.

What does homeowners insurance cover?

There are several levels of homeowners insurance policies. Which one is right for you will depend on the horizontal surface of coverage you want .

Read our list below for the different types of coverage available to you .

H01

The most basic, bare-bones policy. It merely covers damage inflicted by these 10 perils :

- Fire and lightning

- Hail and windstorms

- Explosions

- Civil unrest

- Aircraft damage

- Vehicle damage

- Smoke

- Vandalism

- Theft

- Volcano eruption

H02

A step up in coverage from H01. It covers the ten-spot basic perils plus six more which include :

- Falling objects

- Snow

- Water discharge (not flooding)

- Sudden cracking, bulging or burning of a built-in appliance

- Accidental damage from electrical currents

- Freezing

H03

The most popular policy. It covers all perils except for floods and earthquakes. If you ’ rhenium uncertain about needing deluge coverage in your homeowners policy, take a look at our flood policy usher .

H04

This is tenant ’ sulfur insurance, which of class doesn ’ t practice to homeowners. however, if you ’ re looking for this character of indemnity, make surely to check out our reviews on the best renter ’ s insurance companies .

H05

The highest grade of coverage. It covers most perils, the structure, and your belongings at substitution cost regardless of which included riskiness caused the price .

H06

This covers condos. While condominium structures and common areas are generally covered by homeowners ’ associations, with an H06 you can cover your belongings and the inside of your home plate .

H07

This coverage is for mobile or manufactured homes, meaning homes built elsewhere and moved about or brought into a land plot after manufacture .

It ’ s not to be confused with RV insurance, which is a type of car insurance ( you can check out the best recreational vehicle policy companies here, though ) .

H08

The most limit form of coverage, but often the only one available for low-value, older homes. It ’ s not available in all states and does not offer full successor costs, merely actual cash value reimbursement ( which takes into history depreciation ) .

many indemnity companies offer customizable coverage as region of their homeowners indemnity policy. Identity larceny protection, work-related damages, and damages caused by rodents and domestic animals are separate of the extra coverage options that can be added to a homeowners ’ indemnity policy .

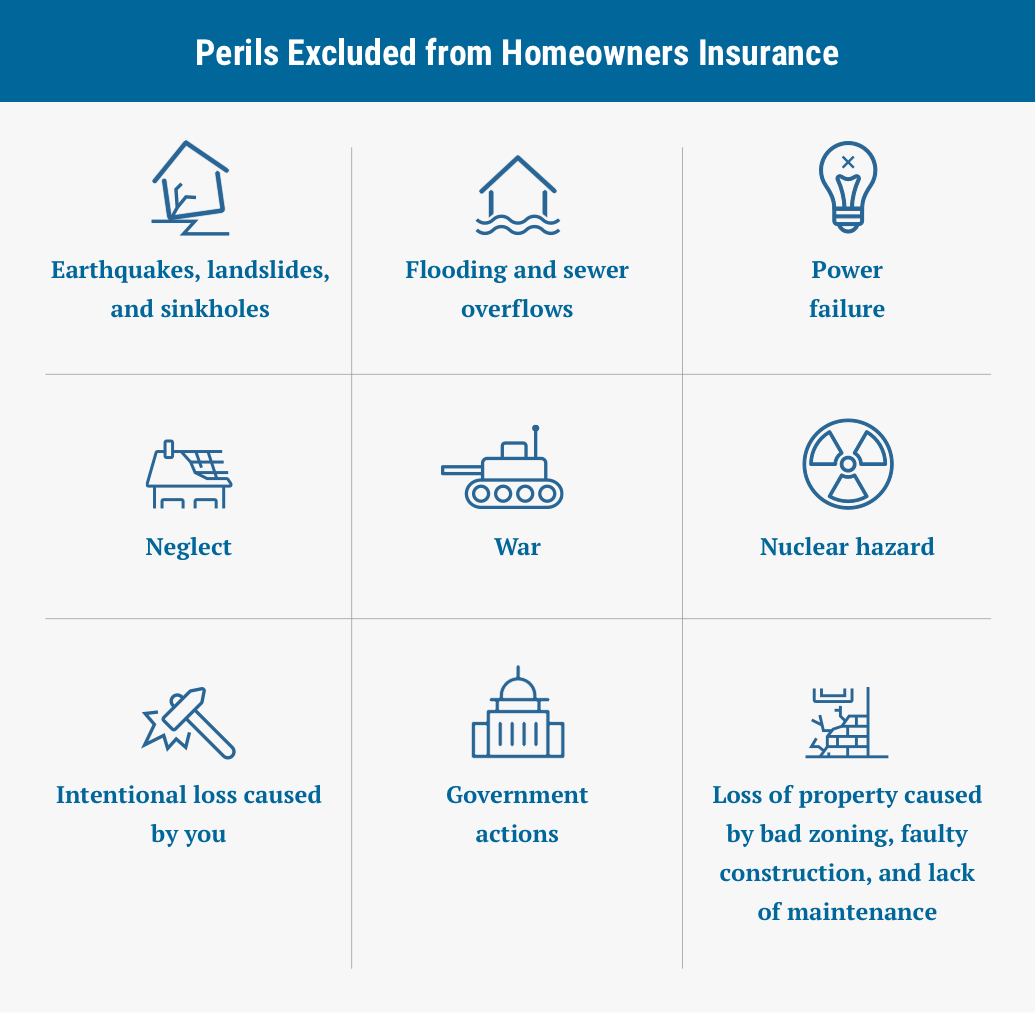

What is excluded from homeowners insurance?

home policy policies never include coverage for the perils listed in the postpone below. These require extra and different policies ; however, there are besides some exceptions for perils that would normally be covered .

High-risk flood areas

If your area is deemed bad by the Federal Emergency Management Agency ( FEMA ), you ’ ll be required to purchase flood insurance for your property as an addition to your policy .

The National Flood Insurance Program ( NFIP ) provides flood indemnity for place owners, renters, and businesses and is available for anyone live in one of the 23,000 participating NFIP communities. For more information about what ’ randomness covered and how to purchase flood policy, visit FloodSmart.gov .

Hail and wind

Depending on where you live, there may be extra weather-related exclusions. For example, homeowners ’ policy policies issued for coastal homes in Texas wear ’ metric ton cover charge tip or hail damage .

besides, home indemnity policies in the Eastern coastal states have what ’ s called hurricane and windstorm deductibles. Whether you live in Florida or New York, if your house is hit by a storm, the deductible you pay won ’ t be the cook amount you agreed upon for the other perils. It will be a percentage based on the coverage you chose. This is by and large regulated by state laws, so to read more about your specific department of state, you can start at the Insurance Information Institute .

Earthquakes

Earthquake damage is normally not covered by any home policy policy, and is merely added through a passenger or by buying a completely unlike policy. In a place like California — credibly the most prone to seismic activity in the United States — it ’ mho significant to add a rider or get a policy to cover in the case of a loss. Checking with the largest earthquake insurance company in the department of state, the California Earthquake Authority, is a good get down .

Power outages

Depending on your home policy policy, some items — such as mar food or flash-frozen pipes — may not be covered in the consequence of a short or prolong power outage. however, it ’ sulfur not ampere clearcut as floods or earthquakes, so lay down sure to check directly with your insurance company ahead to see what ’ second covered and what ’ s not .

In the meanwhile, protect your appliances with rush protectors and check if your refrigerator protection plan is placid valid, which can cover the loss of food .

What is the 80% rule in homeowners insurance?

Under this rule, the insurance company will only pay for the fully total of damages if you buy coverage deserving at least 80 % of the property ’ s rate. If you buy coverage for less than 80 % of your home ’ mho rate, the insurance company will pay you only a percentage of the damages incurred .

Let ’ s say your home is valued at $ 500,000 and you buy coverage for $ 400,000 ( 80 % of your home ’ mho measure ). If you suffer $ 100,000 in cover damages, your insurance company will likely pay for the full amount, minus your deductible .

If you bought coverage for $ 300,000, however, the insurance company will not pay the wide measure of damages. rather, it will pay you the greater sum of the two following options :

- The actual cash value of the building or part of the home that was destroyed, which includes depreciation, or

- Based on the proportion of coverage you did buy compared to the coverage you should have bought.

so, in this exemplar, they ‘ll divide the $ 300,000 coverage you did buy by the $ 400,000 you should have bought and pay a correspond percentage of the damages. As a result, if you suffer a $ 100,000 loss, the insurance company will end up reimbursing you 75 % of that amount, minus the deductible you chose when you bought the policy .

Bear in judgment that these calculations might vary from one insurance company to the future .

It ’ south besides deserving noting, however, that flush a policy that covers 100 % of your home ’ randomness prize international relations and security network ’ t a guarantee that an insurance company will pay the wide sum needed to repair your base. If, for exemplar, there ’ s a fire and the cost to demolish the structure is higher than what the policy covers, you ’ ll have to cover the dispute .

Make sure to read your policy cautiously and consult with an agentive role if you have questions about how a lot coverage to get .

How much is homeowners insurance?

While the national average premium is around $ 100 a calendar month ( or $ 1,200 a year ), it ’ south authoritative to know that there international relations and security network ’ triiodothyronine a single established price for home policy. Although these vary from company to caller and policy to policy, here are some of the most common factors that can determine how much you pay for policy .

Factors that impact your insurance premium

Coverage amount needed. How much coverage you choose to buy will obviously have the greatest impingement on your monthly or annual agio. This means the overall hood the insurance company agrees to cover in the event of an include risk. You don ’ t need to cover the entire cost of your house, but you should aim to cover at least 80 % of the value .

Location of your home. The localization of your family determines the type of perils it could be exposed to and so this will greatly impact the rate an policy party offers you. For example, a house in a storm-prone zone will be more expensive to insure than one that isn ’ metric ton .

Style and age of the home. The overall build and condition of the house is taken into explanation in orderliness to adjust the premium. If a house is fairly deteriorated or built with outdated materials, for example, its social organization is at a higher risk, therefore raising the price on coverage .

Square footage. No surprise here : the size of your home is used to calculate your premium. Larger homes will inescapably need more resources to fix or rebuild, and are besides more prone to neglect in sealed areas .

Home insurance discounts

When shop for the best homeowners indemnity, you should make it a point to ask about discounts on your indemnity premium .

Each company has options to help you reduce your insurance costs. The following are the most common :

- Bundling your home and life insurance policies with the same company

- Living close to a fire station

- Having a newer house (the timeframe is determined by the insurer)

- Signing up within a year of purchasing your home

- Renewing your policy before it expires

- Having a good credit score

Cash value vs. replacement cost

coverage limits normally boil down to a decision between “ actual cash respect ” or “ successor price ” coverages :

- Actual cash value: calculates the value of your home minus depreciation, taking into account any existing damage or wear. With this option, you’ll only receive a settlement for your home’s value at the time it was lost.

- Replacement cost: reflects the amount needed to rebuild your home to how it was before (or as close to how it was as possible). Home replacement costs are almost always higher than the actual cash value, which is why it’s the most expensive coverage option.

Additional expenses to keep in mind

Depending on your living position, standard insurance products might not be adequate .

When you ’ re cook to choose a homeowners insurance policy, see what types of endorsements — besides known as policy riders or add-ons — each company offers. These will increase your bounty, but it might be worth it if it means protecting valuable assets such as jewelry or collectibles .

With some companies, you can besides get protection for more specific issues such as cybersecurity threats and even kidnap .

Latest News on Homeowners Insurance

Millennial and Gen Z homebuyers are taking a less traditional approach amidst a rocket real estate of the realm market. Read about how unseasoned generations are looking for the best of both worlds : For These Millennial Homeowners, the Vacation House is the New Starter Home

Homeowners insurance policies are complicated, and it ’ s often confusing to know what precisely gets covered and after which type of incident or catastrophic event. Learn more about what home plate policy breed and extra options available : What Does Homeowners Insurance Cover in 2022 ?

This past year was full of natural disasters and pandemic-related issues that affected the home policy market. This is regretful news for homeowners, as insurers are raising prices and making changes to their policies. To see how this can affect you, read our article on 2021 ’ s weather : ‘ There Are No Safe States ’ : 2021 ’ s Terrible Weather Could Hike Home Insurance Costs

Homeowners Insurance FAQ How much is homeowners insurance ? chevron-down chevron-up The average cost for a individual homeowner policy in the US is $ 1,200 per year or $ 100 per calendar month. however, homeowners ‘ indemnity rates vary substantially depending on your home ‘s specific situation, condition, how much coverage you want, and where you live. What does homeowners policy cover ? chevron-down chevron-up Most standard policies include four types of coverage : 1 ) dwell coverage, which covers your home ‘s structure ; 2 ) personal property coverage ; 3 ) liability protection ; and 4 ) loss of use coverage, in case you need to live outside of your home temporarily. What is homeowners indemnity ? chevron-down chevron-up Homeowners indemnity is typically required by mortgage lenders, and will reimburse you for damages to your firm, your personal belongings and, in some cases, your digital place, guests and more. It will entirely pay for damages caused by a number of causes or perils outlined in your policy, however. If there is damage to your home caused by a embrace queer, the insurance company will broadly either give you the current cash value of what was lost ( which takes into report disparagement ) or pay for the entire cost of replacing your property, depending on the type of policy you chose. How a lot homeowners policy do I need ? chevron-down chevron-up The sum of coverage will depend on the value of your home and the items you wish to cover, and whether you choose actual cash respect coverage or fully replacement cost. You should cover at least 80 % of the value of the home, and to cover high-value items with extra endorsements or riders. Do remember that these types of policies do not cover flood or earthquake price. If you live in an area that ‘s prone to natural disasters — Florida and California, for model — you might want to look for extra coverage. How are homeowners insurance claims paid ? chevron-down chevron-up In most cases, an adjuster will inspect the price to your home and volunteer you a certain amount of money for repairs, based on the terms of your policy. The indemnity party will then typically send an progress, before sending the concluding payment. In fact, you may get multiple checks as you make irregular payments, permanent repairs, and replace damaged belongings. What is the best home indemnity ? chevron-down chevron-up The best home policy will vary based on individual coverage needs and budget. A well rule of hitchhike is to look for a family indemnity policy that is low-cost, covers most perils, and is offered by a financially sound caller with a good track criminal record of customer atonement. Based on these and other factors, we determined that Lemonade, Erie Insurance, Allstate, Amica, USAA, Hippo and AIG are some of the best companies in the market.

Read more: Best car insurance companies for 2022

How We Chose the Best Homeowners Insurance Companies:

Our list of best homeowners ’ insurers streamlines the patronize experience. To devise a methodology, we :

- Looked through dozens of insurers and coverage options and narrowed our choices based on coverage options, average premium payments, customer service, additional benefits and claim process speed.

- Used J.D. Power’s 2021 U.S. Property Claims Satisfaction Study to measure customer satisfaction ratings with claim settlement, claim process, First Notice of Loss (FNOL), estimation and repair.

- Considered each underwriter’s complaint ratio for homeowners insurance based on data from the National Association of Insurance Commissioners (NAIC).

- Eliminated companies with A.M. Best financial strength ratings below A.

Summary of Money’s Best Homeowners Insurance of February 2022

Lemonade – Best Online Insurance Company

Hippo – Best Online Company Runner-up

Erie Insurance Company – Best Range of Coverage Options

Allstate – Best for Claims-Free Homeowners

Amica Mutual – Best for Customer Service

USAA – Best for military Members

AIG – Best for High-Value Homes