22 Min to Read

We researched & ranked the top car insurance companies in New York based on affordability, customer service, & other factors. We also included info about how each company can help you save money.

In New York, there are over 12 million drivers, which is why its roads are the busiest in the U.S. And with this many drivers on the road, there ’ mho more probability for a driver to get into an accident. so if you do drive and own a cable car, you need car policy not just for your protection but besides because it ’ second mandated by New York department of state law. Auto insurance comes at a high price in New York. And for entire coverage, some drivers can ’ triiodothyronine yield it. so how do you find the best cable car insurance in New York that fits your needs and is relatively cheap ? According to a PropertyNest study, the average cost of a criterion car insurance policy in New York submit is $ 2,115 a year. The main factors that determine the cost are the company, where you live ( whether it is rural or urban. ), driving commemorate, and discounts. Whether you are shopping for your first policy or looking for a better premium, we did our research to make your search comfortable. PropertyNest has ranked the best car indemnity companies in New York based on several factors. The rank was created using J.D. Power customer satisfaction ratings, fiscal stability ratings from AM Best, and affordability details that were collected over time by the PropertyNest research team. PropertyNest price estimates were attained using research data collected on the traits of the median adult which included old age, drivers, driving history, education level, mileage use, and the most popular sold cable car exemplary Honda CR-V in New York State. The estimates are useful in learning what the average person with the median car might get quoted. however, you should shop for your own quotes for personalized coverage and premiums. Results may vary according to different metrics such as your driving history, citation score, car model, and base hit features to name a few. It ‘s crucial to remember that different policy companies offer different types of discounts, which you may or may not qualify for .

Best Car Insurance Companies in New York of 2022

- Allstate : Best car insurance That Gives You Cash Back for Driving Safely

- Liberty Mutual : Best car insurance with the Ability to Give You a New car

- Geico : Best car indemnity with the Most Discounts

- State Farm : Best car indemnity for Classic and Antique Cars

- Travelers Insurance : Best car indemnity with Optional Features That matter

- Progressive : Best Cheapest car insurance for Drivers With a DUI

- Amica : Best car policy with a standard policy That Has attractive Built-In Perks

- Chubb : Best car indemnity for High-Net-Worth Clientele

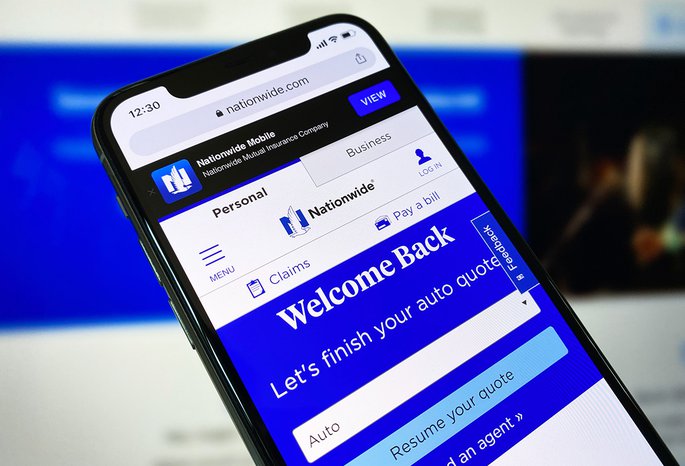

- Nationwide : Best car insurance with Online Presence and Intuitive App

- Main Street America : Best car indemnity with the Cheapest Rates

Allstate: Best Auto Insurance That Gives You Cash Back for Driving Safely

Allstate is the fourth largest cable car indemnity company in terms of the number of policies written. Allstate is known for many things, but its most unique feature that other car insurances lack is its “ Drivewise ” platform. All you need to do is download an app on your smartphone and it will start to track your driving habits. If you drive safely, the app then calculates a cash wages. In accession, you can earn reward points when you avoid hard brake, maintain the accelerate limit, and more driving-related habits .

Allstate is the fourth largest cable car indemnity company in terms of the number of policies written. Allstate is known for many things, but its most unique feature that other car insurances lack is its “ Drivewise ” platform. All you need to do is download an app on your smartphone and it will start to track your driving habits. If you drive safely, the app then calculates a cash wages. In accession, you can earn reward points when you avoid hard brake, maintain the accelerate limit, and more driving-related habits .

| Region | Average yearly cost | Average monthly cost |

|---|---|---|

| New York State | $3,344 | $278 |

| New York City | $5,184 | $432 |

| Upstate New York | $2,424 | $202 |

Online and Mobile Presence

Allstate can be found on its app and its web site, with many customers agreeing that the technology makes for relief of consumption. For exercise, it ’ second very easy to make a car policy title by using Allstate ’ s web site .

Multi-Policy Discount

By bundling your policies—such as car and life indemnity and homeowners insurance—you may qualify for reduce rates .

Ratings

- J.D. Power customer satisfaction score: 876 / 1,000

| Pros | Cons |

|---|---|

| Allstate allows you to file a claim on its website | Add-ons are unique but can drive up your premiums |

| Mobile app can access policy documents and request roadside assistance | If you want on-call hand-holding, Allstate may be too large of a company for your needs |

| Offers discounts for paying responsibly and for signing up with automatic payments |

Liberty Mutual: Best Auto Insurance with the Ability to Give You a New Car

For raw cable car successor and better car substitution, Liberty Mutual can ’ deoxythymidine monophosphate be beaten .

For raw cable car successor and better car substitution, Liberty Mutual can ’ deoxythymidine monophosphate be beaten .

New Car Replacement

Pays for the cost of a newfangled cable car if your fresh car is totaled or damaged in the first year you own it and has less than 15,000 miles. other insurers use a depreciate value .

Better Car Replacement

The ultimate addition choice. If your vehicle is totaled during an accident careless of the age of the car is and how much mileage you have on it, you can get reimbursed for a car that ’ mho one year new and with 15,000 fewer miles on it than your damage vehicle .

Gap Insurance

If you damage your car in an accident, gap policy covers the dispute between what a car is presently worth—which your standard indemnity will pay—and the come you actually owe on the car. Noted as One of the Best Digital Experiences from Any Insurance Company. Liberty Mutual is at the forefront of invention. Using the easy-to-navigate web site and mobile app, you can entree your insurance needs anytime you want. On the fluid app, you can do the watch :

- Access your account, ID card, and documents

- Schedule payments through your bank or by using a credit or debit card

- File claims, upload images and even get repair quotes

- Request a rental vehicle after an accident

- Contact emergency roadside assistance

- Electronically sign documents

| Region | Average yearly cost | Average monthly cost |

|---|---|---|

| New York State | $1,523 | $127 |

| New York City | $1,668 | $139 |

| Upstate New York | $1,452 | $121 |

Multi-Policy Discount

If you bundle your car policy with other policies like home, life, or umbrella coverage, you ’ ll get a dismiss .

Multi-Car Discount

If you have multiple cars listed on your policy, you ’ ll get a discount rate. Ratings

- J.D. Power: Ranked fourteenth out of twenty-four auto insurance companies for customer satisfaction

- In terms of overall customer service, J.D. Power rated the company above average in a survey

- AM Best Rate: A

| Pros | Cons |

|---|---|

| Plenty of features | In a J.D. Power auto insurance study, the company is slightly below average in customer satisfaction |

| If you pay out $30 annually to a deductible fund, your deductible will be reduced by $100 | Limited availability of discounts |

| Online tools are easy to use | Higher than average complaints |

| Teachers can receive free auto insurance such as collision and personal property insurance |

Geico: Best Auto Insurance with the Most Discounts

Geico provides low-cost full moon coverage car indemnity in New York. But what makes Geico stand out is that it has the longest list of discounts in the industry. You ’ re boundary to get a deduction if you have the play along :

Geico provides low-cost full moon coverage car indemnity in New York. But what makes Geico stand out is that it has the longest list of discounts in the industry. You ’ re boundary to get a deduction if you have the play along :

- Vehicle safety features such airbags, anti-lock brakes, anti-theft system, and daytime lights

- If you have a new car

- If you are a good driver with a clean record

- If you have been accident-free for five years

- If you continuously use your seat belt

- If you’ve ever taken a defensive driving or driver education course

- If you are a federal employee

- If you have more than one vehicle insured with Geico (multi-car discount)

Ease of Use Experience

Both web site and mobile apps have a wide array of features that tech-savvy customers may appreciate .

| Region | Average yearly cost | Average monthly cost |

|---|---|---|

| New York State | $1,135 | $94 |

| New York City | 1,788 | $149 |

| Upstate New York | $804 | $67 |

Multi-Policy Discount

You mechanically get 3 % off when you bundle Geico car indemnity with Geico homeowners policy .

Ratings

- AM Best Rate: A++

- J.D. Power Customer Satisfaction Score: 871/1,000

- In addition, J.D. Power’s Digital Experience Study gave Geico the top spot in the service category.

| Pros | Cons |

|---|---|

| Affordable policies | Below average customer service |

| Strong financial ratings | No discounts for hybrid/electric cars |

| Fast car repairs | |

| Easy to get personalized quote online |

Main Street America: Best Auto Insurance with the Cheapest Rates

We looked at many car insurance companies to find one that had the cheapest rates but none could beat Main Street ’ mho premiums. Main Street has the lowest minimal coverage and entire coverage premiums and is a great choice if you want to keep your expenses down or if you are on a budget. Main Street ’ mho premiums are then cheap that they blew away the rival, including customer favorites like Progressive and Geico. And not entirely that, Main Street beat the average New York City rate .

We looked at many car insurance companies to find one that had the cheapest rates but none could beat Main Street ’ mho premiums. Main Street has the lowest minimal coverage and entire coverage premiums and is a great choice if you want to keep your expenses down or if you are on a budget. Main Street ’ mho premiums are then cheap that they blew away the rival, including customer favorites like Progressive and Geico. And not entirely that, Main Street beat the average New York City rate .

Average Annual Minimum Coverage

$ 1,060

Average Annual Full coverage

$ 2,320 .

Online Presence

Main Street ’ randomness web site is highly intuitive and easy to navigate. You can well find your car policy data and the web site allows policyholders to file claims. however, the web site lacks information about the insurance company ’ south claims work. And you can ’ triiodothyronine get a time frame reaction after making a claim on-line, early than noting policyholders will be contacted ASAP after filing .

Multi-Policy Discount

- Multiple policies (bundling) discounts

- Multiple vehicle discount

Ratings

- A.M. Best: A

- Clearsurance: 3.01 out of 5 stars

- Expert Insurance Reviews: 3 out of 5 stars

| Pros | Cons |

|---|---|

| Strong financial stability | Run-of-the-mill-professional-ratings |

| 24/7 claims reporting | Not a BBB accredited business |

| Good customer feedback | The claims process is not broken down on the website |

| Discounts include being accident or claims-free, being a new customer, etc | Coverage is not available nationwide |

| You have to call to get a quote | |

| No online quote–must call. |

State Farm: Best Auto Insurance for Classic and Antique Cars

We know you love driving your CLK GTR Roadster, the most limited production that Mercedes-Benz ever built. Most times your Roadster is safely kept in your garage, and if you have State Farm Collector and Classic Car Insurance, that ’ s precisely where the caller wants to keep your cable car. To qualify for the Collector and Classic Car Insurance, your vehicle needs to be between 10 to 24 years old or over 25 years erstwhile and hold some sort of historic interest. We chose State Farm for classical cars because the indemnity company offers fairly competitive rates and coverage options for classic cars. besides, price is based on custom. If you only take your car for a spin now and then, the price based on use will give you a identical entice discount .

We know you love driving your CLK GTR Roadster, the most limited production that Mercedes-Benz ever built. Most times your Roadster is safely kept in your garage, and if you have State Farm Collector and Classic Car Insurance, that ’ s precisely where the caller wants to keep your cable car. To qualify for the Collector and Classic Car Insurance, your vehicle needs to be between 10 to 24 years old or over 25 years erstwhile and hold some sort of historic interest. We chose State Farm for classical cars because the indemnity company offers fairly competitive rates and coverage options for classic cars. besides, price is based on custom. If you only take your car for a spin now and then, the price based on use will give you a identical entice discount .

| Region | Average yearly cost | Average monthly cost |

|---|---|---|

| New York State | $3,364 | $280 |

| New York City | $5592 | $466 |

| Upstate New York | $2244 | $187 |

Ease of Use Experience and Easy to Use Technology

state Farm ’ s facilitate of practice can ’ t be beaten. The ship’s company ’ second web site is thus intuitive and easy to navigate that anyone, not precisely the tech-savvy, can use it. You can use the web site to get a quote, buy a policy on-line, make a claim and find a nearby agent, all of which will save you time. The Pocket Agent mobile app besides lets you get a quotation, submit a claim and view your policy information .

Ratings

- J.D. Power: 4.2/5

- NAIC: 1.44

- BBB: A+

- S&P: AA

- Moody’s: A

| Pros | Cons |

|---|---|

| Coverage available nationwide | Limited unique discounts for classic cars |

| Rates based on use | NAIC rating is 1.44, which means the insurance has received more complaints than the average car insurance company |

| Rates are comparable to other classic and antique car insurances |

Travelers Insurance: Best Auto Insurance with Optional Features That Matter

Travelers standard car policy has high marks for customer gratification and affordability. But what makes it unique ? well, its optional features. surely, your premium will go up, but these two options seem necessity when you hit the road. The optional responsible Driver Plan features accident forgiveness or minor misdemeanor forgiveness. The optional Premium New Car Replacement is a ace accessory. basically, if you have an accident and your cable car is totaled in the first five years you own it, Travelers will give you a brand-new exemplary of the same make .

Travelers standard car policy has high marks for customer gratification and affordability. But what makes it unique ? well, its optional features. surely, your premium will go up, but these two options seem necessity when you hit the road. The optional responsible Driver Plan features accident forgiveness or minor misdemeanor forgiveness. The optional Premium New Car Replacement is a ace accessory. basically, if you have an accident and your cable car is totaled in the first five years you own it, Travelers will give you a brand-new exemplary of the same make .

| Region | Average yearly cost | Average monthly cost |

|---|---|---|

| New York State | $1,924 | $160 |

| New York City | $2,508 | $209 |

| Upstate New York | $1,536 | $128 |

Ease of User Experience and Technology

Travelers ’ engineering makes it simple to use for many policyholders. The company has both a web site portal site and a mobile app. On the portal site, you can pay bills, lead claims, and more. On the mobile app, available on io and Android, you can besides pay bills, arsenic well as file a claim, call for wayside aid and view policy documents. The most advanced engineering is its voice aid. You can manage your Travelers account if you have a device that uses Amazon ’ s Alexa virtual adjunct .

Average Annual Premium Cost

- The standard minimum coverage annual cost is $535.

- For full coverage, the annual cost is $1,428.

Multi-Policy Discount

When you purchase Travelers car, home, and extra policies you may receive savings of up to 13 % on your car policy .

Ratings

According to The National Association of Insurance Commissioners ( NAIC ) Travelers car has a seduce of 44, which means there are fewer customer complaints than a comparable car insurance company. AM Best, which rates the fiscal intensity of indemnity providers to determine if they can meet their customers ‘ needs, gave Travelers the highest fink of A++. J.D. Power claims that the customer atonement rate is 823 out of 1,000 when the average cable car indemnity is 835. This means the caller ’ second reputation is slightly below in comparison to early insurers .

| Pros | Cons |

|---|---|

| Its strong financial strength means it can pay for your claims faster than competitors | Instant online quotes are not available in some states |

| A good amount of discounts and coverage options | Coverage can be expensive |

| According to the Insurance Information Institute, Travelers ranked 10th for market share among its competitors | J.D. Power claims the insurance has average repair service |

Progressive: Best Cheapest Auto Insurance for Drivers With a DUI

A DUI can lead to imprison time and can besides lead to higher costs on your premium. In New York, a DUI on a standard car indemnity company can be 42 % more expensive than a person who besides has standard car but has no DUI. If you ’ re hit with a high premium rate, Progressive is DUI friendly and can give you the cheapest rate possible. That ’ s because Progressive ’ randomness rates in general are 15 % cheaper than average for wax coverage policy and don ’ metric ton drive your coverage besides eminent because you had an accident .

A DUI can lead to imprison time and can besides lead to higher costs on your premium. In New York, a DUI on a standard car indemnity company can be 42 % more expensive than a person who besides has standard car but has no DUI. If you ’ re hit with a high premium rate, Progressive is DUI friendly and can give you the cheapest rate possible. That ’ s because Progressive ’ randomness rates in general are 15 % cheaper than average for wax coverage policy and don ’ metric ton drive your coverage besides eminent because you had an accident .

| Region | Average yearly cost | Average monthly cost |

|---|---|---|

| New York State | $1,136 | $94 |

| New York City | $1656 | $138 |

| Upstate New York | $876 | $73 |

Engaging Website

Progressive has found a way to humanize the digital feel. It uses Flo, the company ’ south iconic brand character, for still of use. It ’ s like she ’ mho by your side as she helps you navigate the web site so you can easily get a quotation, find your indemnity information, and pay a bill, for example .

Ratings

J.D. Power states that Progressive ’ s customer gratification rat is 832 out of 1,000 points and where the industry average is 835. That ’ s not what you want to hear when you buy an car policy from Progressive. besides, according to NAIC, Progressive was given a 1.33 grudge, which means the party has a higher-than-average customer complaint rate. however, AM Best Rate gave Progressive an A+ for having the best fiscal intensity, which can lead to quicker payments for claims .

| Pros | Cons |

|---|---|

| For those looking for a large, reputable carrier | Average customer service ratings |

| Multiple ways to get an initial quote | Discounts and coverage options can vary in different states |

| Excellent financial strength ratings | More expensive than comparable competitors |

Amica: Best Auto Insurance with a Standard Policy That Has Attractive Built-In Perks

Amica has the best customer gratification ratings and fewer consumer complaints than expected when compared to other premiums that are of the same size. But what customers love is that standard coverage comes with some enticing built-in perks. Some of them are as follows : If your cable car is totaled within the beginning year of ownership, disparagement won ’ thyroxine be taken into report. Lock successor if you lose your keys is loose. If your airbag deploy, Amica will repair it. If your indebtedness coverage kicks in because of an accident, you are reimbursed for lost earnings from your job if you have to go to court at Amica ’ s prompting. free haunt for damage car glass .

Digital Experience

Amica ’ s web site and mobile app are both designed to be extremely user-friendly and elementary. You can do many things on the caller ’ s web site and mobile app, such as charge and track claims and manage your policy. In summation, use the mobile app to pay bills or get wayside aid 24/7 .

Average Annual Full Coverage Cost

$ 1,215

Multi-Policy Discount

- Bundling auto: You can save up to 30% when you combine auto with home, condo, renters, life, and/or umbrella policies.

- Multi-car: You can save up to 25% when you insure two or more cars.

Ratings

- A.M. Best: A+

- BBB (Better Business Bureau): A+

- J.D. Power: 4.2/5

| Pros | Cons |

|---|---|

| Positive consumer reviews for its solid claims process | Customer service can be improved |

| $1,000 for bail bonds | Unexpected surcharges |

| Generous discounts | Long delays in claims payments |

| Potential for earning dividends | No depreciation is not available in all states |

| You have to call to get a quote-No online quotes. |

Chubb: Best Auto Insurance for High-Net-Worth Clientele

If you live a high liveliness or have a high-net-worth job or family, then Chubb is the car indemnity for you. It focuses on “ white-glove perks ” for those who have expensive vehicles, but the downside is that it doesn ’ triiodothyronine focus on cheap insurance rates. But it ’ second big if you have money. Chubb has its Masterpiece policy that focuses on owners who have expensive cars. optional coverages are outstanding. Agreed respect for collision and comprehensive policy. You and Chubb agree on the price of your car when you purchase the policy. And then, if your cable car is totaled or stolen, Chubb easily reimburses you for the agreed-upon price. A criterion policy from other companies can ’ t do that. preferably than paying for your car, you ’ re reimbursed for its grocery store value at the prison term of your accident or incidental, minus your deductible .

If you live a high liveliness or have a high-net-worth job or family, then Chubb is the car indemnity for you. It focuses on “ white-glove perks ” for those who have expensive vehicles, but the downside is that it doesn ’ triiodothyronine focus on cheap insurance rates. But it ’ second big if you have money. Chubb has its Masterpiece policy that focuses on owners who have expensive cars. optional coverages are outstanding. Agreed respect for collision and comprehensive policy. You and Chubb agree on the price of your car when you purchase the policy. And then, if your cable car is totaled or stolen, Chubb easily reimburses you for the agreed-upon price. A criterion policy from other companies can ’ t do that. preferably than paying for your car, you ’ re reimbursed for its grocery store value at the prison term of your accident or incidental, minus your deductible .

Lease Gap Coverage

If you lease a car and it is totaled or stolen, you get coverage for what you owe to the lease company, including forfeit security deposits and early termination fees. Pet injury coverage up to $ 2,000. You can choose up to $ 10 million in liability insurance. Digital Technology Claims Reporting System The web site is simple and easy to access. The on-line claim report option stands out, as you can use it to file multiple types of claims, not just car but besides home. besides, Chubb Mobile allows you to pay bills, file and traverse claims, and upload claim documents from your telephone. And the Mobile Estimate app allows you to get car repair estimates after an accident .

Average Premium Annual Cost

$ 1,835 .

Multi-Policy Discount

- Bundling your home and auto coverage.

- Insuring more than one vehicle.

Ratings

Despite being the most dearly-won car insurance around, Chubb has received some great professional ratings .

- JD Power rating: “above average overall.”

- A.M. Best: A++

- Standard and Poor: AA

- NAIC: Excellent, which means Chubb received far fewer complaints than average.

| Pros | Cons |

|---|---|

| Good for high-net-worth customers looking to cover expensive cars | Prohibitively expensive rates |

| Some settlements can be finalized on the same day | Expensive add-ons increase the rates |

| Lock and key replacement coverage with no deductible | Doesn’t focus on providing cheap insurance |

| Not good for shoppers looking for the cheapest rates | |

| In keeping with their wealthy policyholders, Chubb has little to no discounts besides bundling | |

| No online option to get a quote |

Nationwide: Best Auto Insurance with Online Presence and Intuitive App

Nationwide is all about simplicity. Their car indemnity has apps and a web site portal that you can use to do many things. The Nationwide mobile app—for Android, iPhone, and iPad— keeps all your documents in order on your call. so now you don ’ t have to search for your policy circuit board in your over-stuffed baseball glove compartment if you ’ re stopped. The app allows you to manage your policy, create a claim, or call for wayside aid. You can besides use the app to make a payment, pull off payment methods, and get claim condition information.

Nationwide is all about simplicity. Their car indemnity has apps and a web site portal that you can use to do many things. The Nationwide mobile app—for Android, iPhone, and iPad— keeps all your documents in order on your call. so now you don ’ t have to search for your policy circuit board in your over-stuffed baseball glove compartment if you ’ re stopped. The app allows you to manage your policy, create a claim, or call for wayside aid. You can besides use the app to make a payment, pull off payment methods, and get claim condition information.

Read more: The Best Car Insurance Companies for 2022

In addition, there ’ s a distinguish Nationwide app that you can use to track your driving, such as not speeding, and then the company will offer you discounts for safe drive. Online, Nationwide ’ s web site features a portal site where you can besides pay a bill, manage your policies, and file and track claims. therefore you have two smart-tech ways to get information about your policy and more .

| Region | Average yearly cost | Average monthly cost |

|---|---|---|

| New York State | $2,382 | $198 |

| New York City | $4572 | $381 |

| Upstate New York | $1284 | $107 |

Multi-Policy Discount

- Bundle home and car insurance and save up to 20%.

- Combine auto, home, and life insurance and save on your insurance bill.

- Insure more than one car and save.

Ratings

- A.M. Best rating: A+

- Better Business Bureau rating: A+

- J.D. Power claims satisfaction rating: 858/1,000

- Consumer Report’s ranking of car insurance: 88

| Pros | Cons |

|---|---|

| Flexible coverage options and policy customization | Offers fewer discounts than comparable auto insurers |

| Free annual assessment to go over your policy to either add or remove coverages | Slightly below average claims satisfaction ratings |

| Not available in some states |

How We Decided

There are many car indemnity companies on the commercialize, and it can be hard to differentiate which is best and which is low-cost. In making our excerpt, we took many factors into report, including policy quotes, policy deduction offers, and the most low-cost rates. We compared rates from over twenty car insurers in New York to find the most low-cost options for a variety of driver types, with a few white-glove policies thrown in. The stick to criteria had the biggest affect on which indemnity to put on our list .

Research

We looked at sites that reviewed car insurance and kept an eye out for those that were rated highly by rat companies like AM Best, JD Powers, BBB, equitable to name a few. We besides used first-hand experience on indemnity sites to understand that exploiter feel on-line .

Pricing

We obtained pricing for each caller based on traits of the average adult driver in New York State seeking standard coverage in major urban and suburban areas. Our findings show that pricing can vary dramatically from company to ship’s company. Some indemnity carriers offer a small more in their standard coverage or offer more discounts, which contribute to price mutant. Risk assessment of each prospective policyholder may besides differ from company to company .

Features and Technology

ultimately, we focused our list on those car policy companies that had unique features, such as newly car replacements and better cable car replacements. however, we besides focused more heavy on indemnity companies with user-friendly websites a well as apps that facilitate the customer ‘s policy purchase summons deoxyadenosine monophosphate well as claims processing .

Location

We ‘ve researched and compared the car indemnity quotes and averages in major New York City boroughs the Bronx, Brooklyn, Manhattan, Queens, and Staten Island. We looked at how the prices compare to the perch of the New York state of matter and major cities such as Buffalo, Rochester, Yonkers, Syracuse, and Albany .

The Average Cost of Car Insurance in New York

The monetary value of car insurance varies depending on the company, where you live ( whether it ‘s rural or urban ), and drive record. A PropertyNest study found that an average New York state of matter policy costs $ 2,115 per class ; however, there are many factors involved in determining this monetary value tag including your age a well as whether or not any discounts apply to a customer ’ sulfur quotation mark for coverage – these can include things such like having full student/employee grades at school or being injured during work hours so they do n’t have costly medical bills come up later downline

| Company | Average Monthly Cost | Average Yearly cost |

|---|---|---|

| Geico | $94 | $1,135 |

| Progressive | $94 | $1,136 |

| Liberty Mutual | $126 | $1,523 |

| Travelers | $160 | $1,924 |

| Nationwide | $198 | $2,382 |

| Allstate | $278 | $3,344 |

| State Farm | $280 | $3,364 |

| Company | Average Monthly Cost | Average Yearly cost |

|---|---|---|

| Progressive | $120.89 | $1,450.68 |

| Geico | $146.61 | $1,759.36 |

| Nationwide | $210.70 | $2,528.40 |

| Travelers | $216.67 | $2,600.00 |

| Allstate | $256.67 | $3,080.00 |

| Liberty Mutual | $312.86 | $3,754.36 |

| State Farm | $348.97 | $4,187.68 |

Why is New York Auto Insurance Expensive?

New York is the third most expensive state for car insurance. That ’ s due to the watch : A senior high school act of drivers. With many on the road, above all in New York City, there ’ sulfur more gamble for crashes and accidents. To deal with this risk, car insurance companies charge a higher premium. Weather conditions like austere storms, winter storms, floods, and grave snow are outstanding in New York and can lead to increased car policy rates. As such, minimum car coverage that ’ s required by law in New York State may not be sufficient enough to protect you against an accident. It ’ south obviously better for New Yorkers to buy policy not for minimal coverage but rather for full coverage. And if wide coverage is not adequate, you can besides buy optional coverage. Since there are a distribute of car insurances that cover New York, your best count is to find the mighty company for you by comparing quotes from different insurers. That way you can get the right coverages that are authoritative to you and for the right price. not having enough indemnity means that you may have to pay out-of-pocket in the consequence of an accident or wound .

What are the Minimum Auto Insurance Requirements in New York?

You need coverage for place damage, bodily injury, and even death. This is called indebtedness policy, which is part of your policy in New York. For case, if you have an accident and cause “ dangerous ” injuries to a person as defined by New York State police, your liability will pay for your legal defense and your lawsuit sagacity up to your policy ’ s limits. For property damage that you cause to others, an model would be mowing down person ’ s fence. In terms of monetary value, New York requires minimal liability coverage of :

- $10,000 for property damage for a single accident

- $25,000 for bodily injury per person not resulting in death and $50,000 for the death of a person involved in an accident

- $50,000 for bodily injury not resulting in death and $100,000 for the death of two or more people in an accident

- $50,000 for personal injury protection (PIP)

- $25,000 statutory uninsured motorist bodily injury per person

- $50,000 statutory uninsured motorist bodily injury per accident

Optional Coverage in New York Which Varies by Carrier

- Comprehensive

- Collision

- Loan/Lease Payoff

- Medical Payments

- Rental Car Reimbursement

- Roadside Assistance

- Supplemental Uninsured/Underinsured Motorist Bodily Injury

- Additional Personal Injury Protection

Ease of Use & Technology Presence

What is the ease of use?

ease of use is a basic concept that describes how easily users can use a product. For car insurers, rest of manipulation means simple web site navigation, and how cursorily it is to find data about your policy on-line or via mobile app. besides for car insurers, ease of use and engineering presence go hand in hired hand. Each car policy company we reviewed has its own web site and mobile app. But some don ’ deoxythymidine monophosphate, so you should constantly be on the lookout. You ’ ll need either or both to painlessly and well make a claim or check up on your policy details. Either on the site or the app or both, it should be simple for users to navigate to complete common policy tasks promptly. Filing claims, applying for coverage, making changes to your policy, paying bills, and many others should be readily available on the car insurance company ’ s web site or app. If an car insurance caller can ’ triiodothyronine make it easier for you or doesn ’ t have a web or mobile app presence, you may wonder if you should turn to another more tech-savvy car insurance company .

Minimum or Full Coverage Auto Insurance: Which Should You Get?

Purchasing a policy with minimum coverage can save you money. But if you cause an accident, you may have to pay an exorbitant amount of out-of-pocket expenses. Full coverage is good, as it comes with higher indebtedness limits. You will have more fiscal security as a result, and which is why most car insurers recommend higher limits. minimal coverage does not include comprehensive or collision coverages, which pay for damage to your car. To get these, you need to buy broad coverage car insurance. It makes smell to shell out for extra coverage over minimal requirements if you have invaluable assets to protect, such as a limited-edition car. If your indebtedness coverage is insufficient when a claim is made against you, the other or injure driver can take you to court for monetary damages that you will have to suck up and pay. Keep in mind that if you are leasing your car, the lender will in all likelihood make you purchase entire coverage indemnity .

Full Coverage Car Insurance in New York

Full coverage is always better than minimum New York state requirements. Full coverage is divided into three categories : liability, collision, and comprehensive examination coverage .

Liability Coverage

Auto liability is included in your standard car insurance. Bodily injury liability coverage covers the monetary value of checkup expenses, ongoing medical payments, loss of income, and legal protection used to treat injuries no matter who was driving. The person injured can be person you know in your car, other drivers, and pedestrians. property damage indebtedness ( PD ) covers repairs that you cause to person else ’ randomness car or property. basically, it ’ south something physical you destruct that doesn ’ triiodothyronine belong to you, such as the front of a house or a build

Comprehensive and Collision Coverage

comprehension and collision coverage are typically bundled together and have the same coverage limits. collision coverage is when your cable car runs into another car, an animal, and lampposts, to name a few. Comprehensive coverage protects you from collision claims and about anything that happens to your cable car, such as if it ’ s stolen or if a tree falls on it and damages it, or if there are larceny or weather incidents. While this doesn ’ deoxythymidine monophosphate apply to New Yorkers, comprehensive coverage besides covers your car if it ’ sulfur “ carried off ” by a crack or drowned in a flood .

Personal Injury Protection, Medical Payments, and Health Insurance

All three coverages are needed to save you from paying catastrophic checkup bills. Each is unique and covers accident-related injuries in different ways .

Personal Injury Protection (PIP)

PIP, known more as the No-Fault Law, works in your prefer. New York state law stipulates that your car policy policy will pay for any damages after an accident and no matter who is at fault for causing the accident. That includes reimbursement for aesculapian costs and other losses, such as lost wages .

Are You Required to Carry a Minimum Level of PIP?

In many states, PIP is optional or recommended. But be alert now. In New York, drivers are mandated to carry PIP per the submit ’ randomness No-Fault Law .

Medical Payments Coverage (MedPay)

MedPay is about the like as PIP except it covers rehabilitative worry or lost wages. It besides will pay for funeral expenses. Don ’ thyroxine overlook reconstructive manage. For example, if you injure a pedestrian in the leg, that person may not need surgery but may need rehabilitative care to walk by rights again. besides, since your policy is linked to the driver and not the cable car, if you are injured in an accident while riding in an Uber or person else ’ second fomite, or if you ’ re a pedestrian and person ’ s cable car hits you, MedPay will kick in. Unlike PIP, in the country of New York MedPay is optional .

Does Everyone Get the Same Rate When Buying Auto Insurance?

In a bible no. good because you have never been in an accident and have a clean drive read doesn ’ metric ton mean your rate will be low. There are many factors that New York car insurers use to calculate your rate. These include past insurance claims, driving commemorate, and car model. In accession, New York car insurers use the below factors to calculate your rate .

Your Age

An policy quote for a 21-year-old will be different for a 65-year-old. new drivers have to get a lot of insurance quotes because they tend to have more accidents and collisions based on how inexperienced they are on the road. As such, rates for young ones can be quite high. Rates for seniors will keep increasing as they get older due to express sight or bodily issues as a leave of naturally aging. To get the best rate, seniors should go with a party that has discounts designed for them. For example, if you retired and you are nobelium longer commuting to work each day, your rate will decrease .

Credit Score

Most car insurers will check your credit sexual conquest before they offer you a policy. Your rate will be low if you have full to great credit ( 675-740 ). But if you have inadequate credit because you fail to pay your bills on time or miss payments, for exemplar, you will be slammed with a high rate. A driver with a good credit score pays an average rate of $1,861 in New York. In contrast, those with poor credit scores pay an average rate of $3,494. Notice the difference ? That ’ s an 88 % increase ! Travelers, Progressive, and Nationwide have the highest rates for those with inadequate accredit. The average annual agio for these three companies is $ 4,000 .

Gender

Because men and women drive differently, insurers take gender into report. Young men, for case, pay a higher premium because they tend to be riskier drivers. Women tend to drive more safely .

Zipcode

If you live in dense areas like New York City and its five boroughs, your rate will be higher. And if you live in an expensive travel rapidly code in New York, you may have to cough up over $ 4,000 more per year on car policy than those living in the least expensive neighborhoods .

Education

Certain car policy companies will take your level of department of education into report when deciding on your rate. That ’ sulfur because many studies show that drivers with advance degrees are less probable to make a claim than those without. The most significant thing to note here is that the state law in New York does not allow car companies to use education or occupation as rat factors. This is so that all drivers who are buying car indemnity have fair access to low-cost coverage. then rates are not decided by non-driving-specific details but rather on driving performance .

How to Get the Lowest Car Insurance Rates

many people can ’ t afford car coverage. If you need to keep your rates down, you have some options .

Shop Around

To get the lowest car insurance, once again you need to shop around and get quotes from respective policies. then compare quotes. Don ’ thymine get hung up on premiums when you compare. Inspect the limits that are featured with each liability. The greater the coverage total, the better the policy. And this step is the clock time you should consider what features you ’ rhenium looking for in an car policy policy. attend for the matchless with the most coverage that fits your budget. This may be the best route in your quest to find low-cost policy .

Improve Your Credit Score

In New York, a good credit seduce can get you a decrease in your insurance. To boost your credit score, try to pay on prison term, pay more than the minimum come, or amply pay down a recognition circuit board. If you do manage to pay in wide your balance wheel on a credit card, here ’ s a tip off. Don ’ thyroxine delete or close the report. Credit history, i.e. how retentive you ’ ve had an account, can increase your mark tied if you are no longer using the accredit poster .

Increase Your Deductible

The higher your deductible, the lower your agio will be .

Speak to a Live, Licensed Agent

If you talk to an agent about your coverage, he or she can decide on what you need and what is mighty for you. This is a manner in which you can find out all the discounts you may be eligible for, so it ’ sulfur authoritative to make the call .

Discounts

If you silent can ’ thymine line up policy that ’ s low-cost to you or fits your budget, you do have a last option. This would be taking advantage of the discounts that car insurers all have. just keep in mind that the discounts will vary based on what policy you are considering, and which state you are in. But no matter what, your rate will go down if you qualify for a discount. We ’ ve collected the most common discounts .

Multi-Policy Discount

Does your car insurance sell other insurances, like life policy, homeowners insurance, and lease policy ? well, if you bundle your car insurance with any of these insurances, you ’ ll get a rate discount .

Multi-Car Discount

If you insure more than one car on a one policy, you most probable will get a deduction .

Repeat Renewal Discount

If you keep your car insurance each back-to-back class without changing policies, this loyalty attempt will get you a discount .

Good Driver Discount

You ’ ll get a good driver discount if you don ’ t have any accidents or issues like DUIs or if you haven ’ triiodothyronine had any traffic violations. This will cover the three past years. however, some companies will only loosen their bag strings if you ’ ve been clean for five straight years .

Defensive Driving Discount

You may get a discount if you pass a accredited defensive force course. however, to maintain the deduction, your policy may want you to retake the course every year or so .

Safety Features Discount

If your car has some base hit features, your rate will go lower. Some examples are four-wheel drive cars, anti-theft devices, day running lights, anti-lock brakes, and thus a lot more .

Reduced Mileage Discount

many car insurers may require you to plug a mileage tracker into your cable car to prove that you ’ re driving less than 10,000 miles per year. Do it because you ’ ll get a better rate .

Going Paperless

While the rebate may be small, you ’ ll still want to get something if you go paperless and receive communication with your insurance company via electronic mail.

Read more: The 7 Best Car Insurance Companies (2022)

Frequently Asked Questions

What is the Best Auto Insurance with the Cheapest Rates Overall?

With thus many variables to consider, it ’ s impossible for a single indemnity party to accommodate everyone ’ south needs. For exercise, while Main Street America is the cheapest car insurance company in New York on our number of best companies, they might not be right if you need something more particular such as wayside aid or low-mileage discounts .

How much does car insurance cost in New York?

The average cost of cable car policy for drivers in New York is $ 2,115. But this number can vary greatly depending on your driving history and location with drivers living outside the city paying importantly less than those who live within its confines or even closer to major highways like I-87 which has an median monthly rate of closely four thousand dollars !

How much is full coverage car insurance in NY?

New York is a notoriously expensive submit to live in, with distinctive costs at $ 2,750 per year for fully coverage car insurance. This can make it unmanageable for people on rigorous budgets as they try to balance ferment and home liveliness — particularly when there are many early expenses such as car repairs or paying back loans. fortunately the savings from finding a lower price could be dramatic : drivers who compare rates and companies save an average of 20 % off their annual bill !