How do you make a ailment against an policy company ? here, I am going to answer this wonder and much more. You ’ ll learn about my many experiences with the Florida Department of Insurance .

How do you make a ailment against an policy company ? here, I am going to answer this wonder and much more. You ’ ll learn about my many experiences with the Florida Department of Insurance .As a lawyer with over $ 8 million in personal injury settlements, I ’ ve consider with about 50 different policy companies. additionally, I ’ ve communicated with over 1,000 call adjusters. This includes car indemnity adjusters, general liability insurers ( for accidents at hotels, restaurants, malls and more ), long term disability insurers, health insurance companies, and more .

many indemnity companies are responsive. however, most distillery make first gear colony offers. A few insurers are clean .

unfortunately, many indemnity companies are not fair. In accession, personal injury cases don ’ thyroxine settle overnight. The end thing you want is an extra stay by the indemnity company.

If an indemnity company is not giving you the time of day, you can file a consumer complaint. It is besides known as a “ request for indemnity assistance. ” I have had to file my fair share of consumer complaints with the department of fiscal regulation .

Is a consumer complaint different from a civil remedy notice (CRN)?

Yes. A request for policy aid is different than filing a civil rectify notice ( CRN ) of insurance company violation .

If you are having issues with an insurance company and a Florida policy policy, you ( or your lawyer ) can file a CRN against the policy ship’s company. You can view filings on Florida ’ s CRN web site .

The main argue to file a CRN is if you are trying to get more than the uninsured motorist ( UM ) coverage limit. In Florida, this is the alone way that an insurance company may have to pay you more than its UM limit .

After you ( or your lawyer ) charge the CRN, you must send it to the indemnity company. differently, it won ’ deoxythymidine monophosphate be valid .

If you look at CRNs that have been filed in Florida against indemnity companies, you ’ ll comment something. virtually all CRNs filed against insurance companies are filed by lawyers. Why ?

Because they know that you must file a CRN to bust open the policy ship’s company ’ sulfur UM limit. This is merely one of the many techniques that accident lawyers know that you probably don ’ thymine .

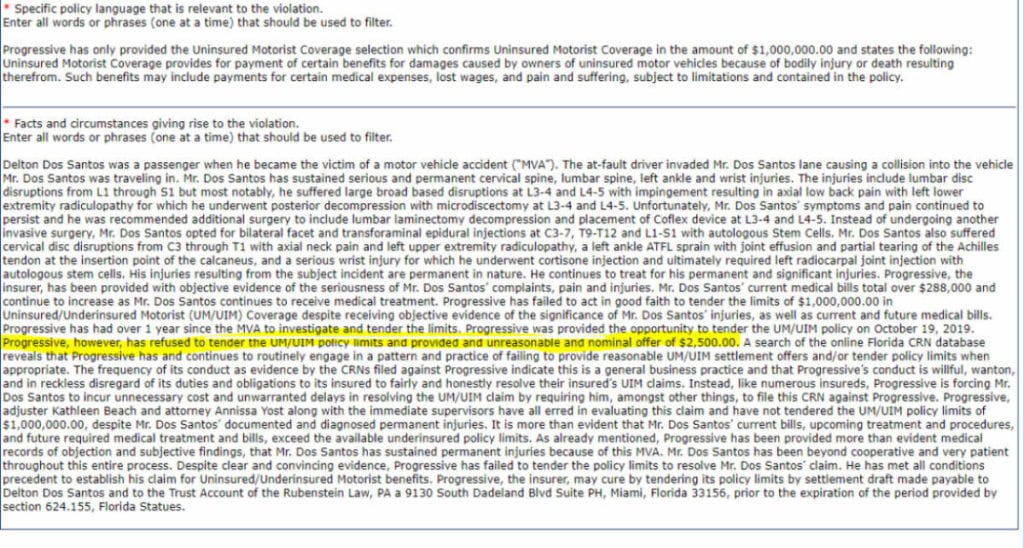

In April 2020, an Uber passenger ’ s lawyer ( not me ) said in a CRN :

Dos Santos was passenger in an Uber ride. After the crash, she underwent back operating room. Progressive see Uber. Her Miami lawyer demanded the $ 1 million uninsured motorist coverage limits. Progressive was given the chance to to pay the $ 1 million UM limits. Yet, they only offered $ 2,500. here is a screenshot of part of the CRN :

A consumer complaint is besides different from suing in court .

For what types of accidents can you file a consumer complaint?

This article applies to consumer complaints for claim arising from accidents in Florida. It applies to claims for :

A TPA claims director at Wal-Mart Stores, Inc. says that :

Surveys of … adjusters ’ show that even at a caseload of 130 files adjusters consider themselves in a reactive modality being overwhelmed with call calls data introduction and electronic mail requests .

TPA means “ third party administrator ”. A TPA is used when a company outsources it claims handling to another ship’s company .

Most insurance companies give their adjusters excessively many claims to handle. Thus, adjusters don ’ t have time to give your case the attention that it deserves .

sometimes adjusters will miss an crucial fact in your font. This may result in them making a lower extend, or no offer at all .

Who Can’t You File a Consumer Complaint Against?

You typically can ’ t file a consumer complaint if your making a claim against a company that is self-insured. This assumes that your claim is worth less than their self-insured retention ( SIR ). big multi-billion dollar companies are typically self-insured. however, the SIR is only up to a sealed total .

even the biggest companies in the United States alone self insure up to a certain amount. They won ’ thyroxine run the risk of bankruptcy should they have a catastrophic loss .

Examples of claims against a large company that may be self-insured is :

But again, those companies are self-insured up to a certain limit .

When can you file a consumer complaint against an insurance company?

If you ’ rhenium pain in a car accident in Florida, you will most often be dealing with a Florida car indemnity policy. frankincense, the consumer complaint is typically filed with the Florida Department of Insurance .

When should you file a consumer complaint in another state (for a Florida accident)?

even though the accident happened in Florida, you ’ ll likely have to file a consumer ailment with another state ’ s department of policy if you ’ re making a claim :

- with an insurance company based on an out of state uninsured motorist (“UM”) policy

- against a driver who has car insurance from another state.

Let me give you an exercise .

You own a car, with UM policy on it, in Georgia. While in Florida, another cable car hits you .

You make a claim against your Georgia UM insurance company. If your Georgia UM insurance company international relations and security network ’ t being fair, you need to file the consumer complaint in Georgia. You don ’ metric ton charge it in Florida .

( here is a link to filing a consumer complaint against a Connecticut policy party. )

How Do Consumer Complaints Apply to Personal Injury Cases?

If the insurance company does one of the follow, you may want to consider making a consumer ailment :

- Not answering the phone or returning your phone calls, emails or faxes about your injury claim. In certain situations, it may be reasonable to give the adjuster three (3) days to respond to your call.

- Not making a settlement or not making a fair settlement offer.

- Not agreeing to reduce a claimed lien for short or long term disability (LTD) benefits paid to the injured person despite the requirement to do so in Florida Statute 768.76 (4). Look at this sample consumer complaint when a disability insurer won’t reduce your lien.

How Do Consumer Complaints Work For Car Accident Claims?

What Are Reasons to File a Consumer Complaint in a Slip and Fall?

- Not properly responding to your written request for insurance information of the property owner or manager as required by Florida Statute 627.4137.

- Not issuing you a check for your medical bills/expenses if you were injured on someone else’s property and the property owner has “medical payments” coverage.

I have filed a consumer complaint ( besides known as a “ request for indemnity aid ” ) in Florida in all of the above situations. The insurance company became more reasonable in handling the title in most, if not all, of the above situations .

Do Insurance Companies Take Your Case More Seriously If You File a Complaint?

The good news is that filing a consumer ailment may result in the insurance company ( or TPA ) taking your injury call much more badly .

I settled a cable car accident case with State Farm for over $ 125,000. That State Farm uninsured motorist adjuster told me that he only gets about 1 consumer complaint for every 250 to 500 cases ( or possibly less ) that he handles .

This means that State Farm ( or other cable car policy companies ) are more likely to give your case more attention if you file a consumer complaint against it. Again, merely do indeed when you have a thoroughly reason .

Getting the Claims Manager to Look at Your Claim May Be Good

The fact that consumer complaint will trigger a review by the insurance company ’ s claims director is good news for you. Since consumer complaints are rarely filed, this acts in your favor because your complaint will stand out to the adjuster and the claims director .

I talk about how to file a consumer ailment below. Once you file it, the insurance ship’s company must respond within 20 days of receiving the ailment .

Does an insurance company gets fined if they don’t answer the complaint?

Their response must address the issues and allegations raised in the ailment or they may be fined $ 2,500 in summation to the individual licensed by the department of indemnity who may be fined anywhere from $ 250 to $ 1,000 .

The law ( legislative act ) that talks about this is s.20.121 ( 2 ) ( henry ) ( 2 ), Florida Statutes. This penalty makes the indemnity company highly probably to respond to your complaint .

basically, the insurance company will have to give a legitimate reaction to the Florida Office of Insurance Regulation as to why they are handling your claim a particular way .

Warning: I ’ ve hear a former State Farm claims adjuster say that he would not file a consumer complaint against an policy company. He believes that it ticks the adjuster off .

My finish is not to scare an indemnity adjuster. Rather, I just want my node ’ s personal injury event to get the attention that it deserves .

In my scene, getting the adjuster ’ second ( or her director ’ randomness ) attention is better than no reception at all .

How do I file a complaint with the Florida Department of Insurance?

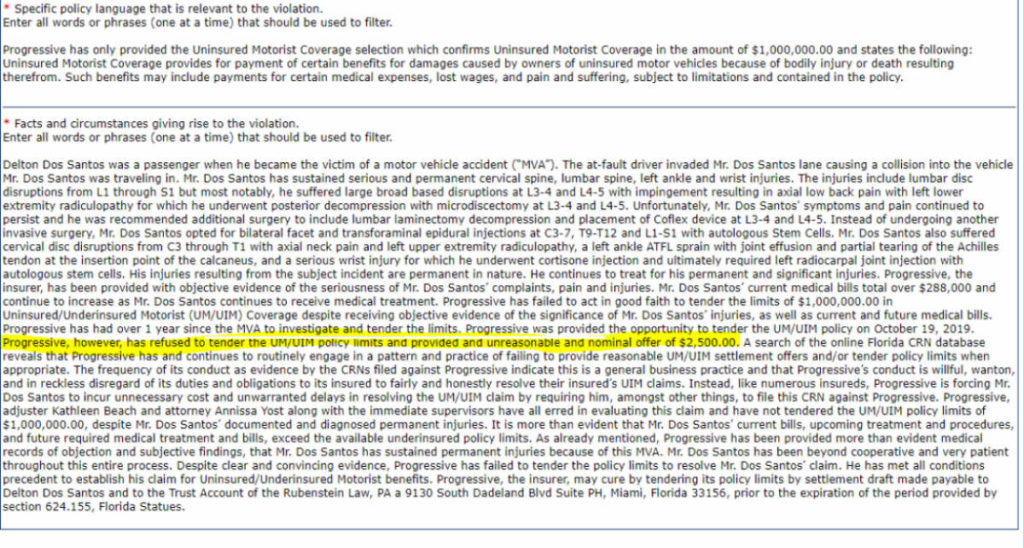

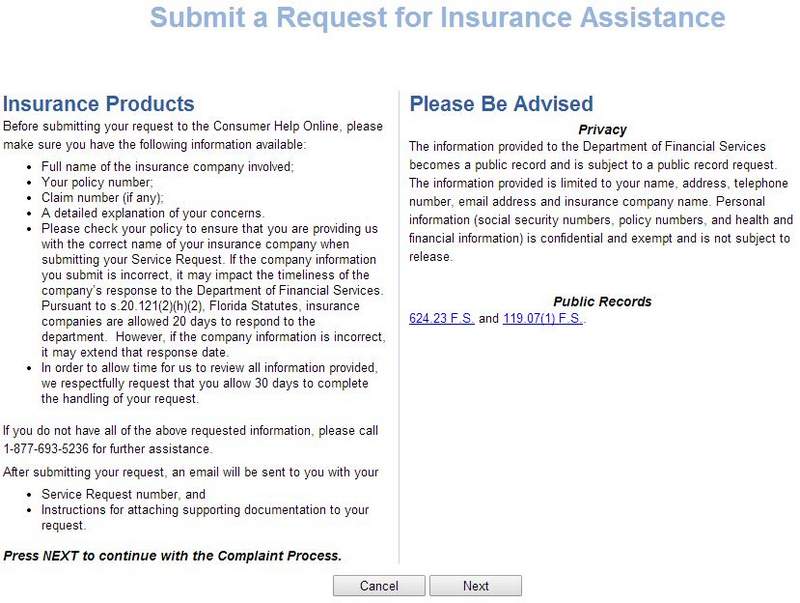

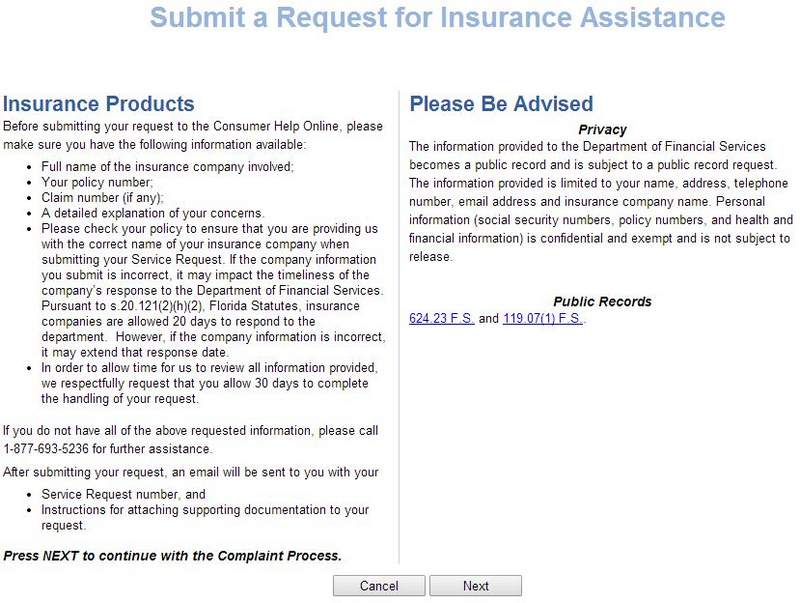

To file a complaint, you can go to submit a request for policy aid and file a ailment with the Florida Department of Financial Services .

You will be taken to a page that looks like this :

Click the next release .

Click the next release .

Warning: This consumer charge and its attachments will be public record so do not attach any medical records or other documentation that reveals your social security number or sensible health information .

The steps to file a charge are as follows :

1. Provide your name and email address.

2. Enter the type of insurance.

If you were in a cable car accident, you should enter “ personal automobile ” or “ accident & health. ” If you were in any other type of accident, you should enter “ accident & health. ”

3. Enter the county in Florida that the accident took place in.

You need to enter a policy number. If your own Florida insurance company isn ’ t responding to you, enter your policy number .

Your car policy card should have your policy number on it. Each time you are mailed a letter from your car indemnity ship’s company it should have your policy number on it .

You can besides call your indemnity agent to get your policy total. If it the person ’ randomness ( who caused your accident ) Florida insurance company, you can enter “ unknown ” or “ 0. ”

4. Enter claim number.

You can locate a claim number by referring to any letters that you may have received from the indemnity caller .

If you called to report your title, you should have received a claim number from the policy adjuster for the indemnity caller .

If you don ’ t have a claim count, equitable type “ stranger ” or “ 0000. ”

5. Describe your problem.

In the section where it tells you to describe your problem I normally barely write “ Please see attached ” and I upload a letter explaining the issues that I am facing .

I use a general template for these complaints based upon the basis for the charge. This saves me time. This is a consumer complaint that I filed against a PIP insurance company, Windhaven Insurance, when they :

a. were not responding to my calls, emails or faxes .

b. did not send me the written requested required policy information as required by Florida Statute 627. 4137. Thus, I did not know whether PIP, Medical Payments coverage and/or uninsured motorist coverage was available.

Read more: Best car insurance companies for 2022

c. were not paying my client ’ sulfur hospital bill .

6. Click the submit button.

Tip: We besides send ( via electronic mail, facsimile and chain mail ) a replicate of the consumer complaint to the policy adjuster and the policy ship’s company so that they know about it a soon as it is filed .

7. Receive email confirmation

shortly after completing this request you should receive an e-mail confirmation from the Florida Department of Financial Services stating your request has been received and you should receive a file number ( should be a hyperlink ) for your request .

You can click on that file number at any time to review the condition of your request .

The indemnity company has 20 days to respond to your request, and the Florida Department of Financial Services asks for 30 days to review the file and answer to your request .

Do Insurance Companies Usually Respond to a Consumer Complaint?

Yes. Most insurance companies will call you, or send you a letter, within 20 days after receiving your consumer complaint .

You should receive a letter summarizing the military position of the policy company within 30 days from the Florida Department .

Do consumer complaints work against GEICO?

It depends on how GEICO is treating you. I have had some success filing consumer complaints with GEICO .

It depends on how GEICO is treating you. I have had some success filing consumer complaints with GEICO .

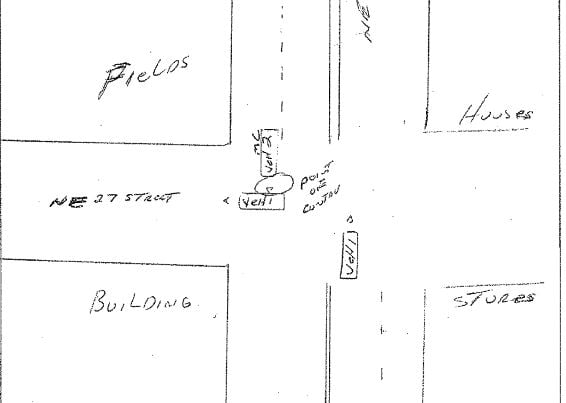

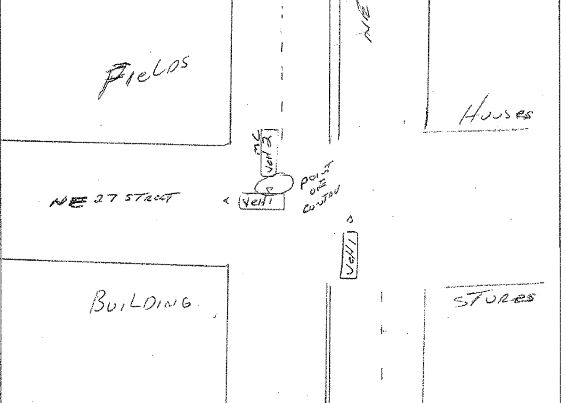

In one casing, my node was hit by a cable car while he was riding his motorcycle in Miami. here is the actual diagram from the crash composition :

Check out my customer ’ second motorcycle after the crash :

He claimed that the accident caused or aggravated a herniated phonograph record in his lower back. I besides claimed that the accident caused his erectile dysfunction .

GEICO offered made me a lowball offer of $ 10,000. That ’ randomness fair what GEICO does. however, I wanted the $ 100,000 policy limits. So I filed a consumer complaint. here is the edit adaptation of it .

ultimately, we settled for the $ 100,000. What ’ s the lesson ?

Don ’ triiodothyronine lashkar-e-taiba GEICO push you around. They will. If it is appropriate file a complaint against GEICO .

All things peer, making a consumer complaint against GEICO is more effective than complaining to the Better Business Bureau. Likewise, making a consumer charge with the department of policy has a higher find of success than writing a review of your experience on Google, Facebook or Yelp .

What other insurance companies have I filed consumer complaints against?

Some of them are :

Crum and Forster

state farm

![]()

![]() Travelers Insurance

Travelers Insurance

Nautilus Insurance Company

Nautilus Insurance Company

![]()

![]() prudential

prudential

I wish that I did not have to file a consumer ailment as it takes time. unfortunately, it is sometimes the alone way ( curtly of a lawsuit ) to get an insurance company ’ sulfur attention if they act in bad religion .

Does a Consumer Complaint Work Better Than a Lawsuit?

It depends. If you fair want the responsible party ’ s bodily injury ( “ BI ” ) indemnity limits you may be better off filing a consumer complaint than a lawsuit. This assumes that your case is worth a lot more than the BI limits .

If a consumer ailment doesn ’ triiodothyronine get the policy company to act fairly, then you may need to sue. unfortunately, many indemnity companies don ’ t take a case badly until there is an approaching test date .

I ’ ve found this to be true even for some of the average or above average insurers like Crum and Forster, Travelers , FIGA, and others .

Will the Florida department take any other action against the insurance company?

A consumer complaint may be filed with the DFS Division of Consumer Services bespeak that a ship’s company may be engaged in a convention or practice of deceitful activeness .

If sol, the division may refer the complaint to the Market Investigations unit for reappraisal. If Market Investigations uncovers potential violations, then the ailment may be referred to the DFS Division of Insurance Fraud .

Can you file a consumer complaint against a hotel?

Yes, if you are dealing with the hotel ’ mho insurance caller. Let me explain .

Assume that you are about to take a shower at fall back. The shower looks like this :

Blue arrow points to shower fixture in bathtub

Blue arrow points to shower fixture in bathtub

You slip and fall. As a resultant role, you break you arm. You claim that the surface that you slipped on was unreasonably slippery .

Philadelphia Insurance Company insures the fall back. If Philadelphia is lowballing you, you can submit a request for indemnity aid .

By the way, I settled a similar hotel accident case with Philadelphia Insurance for $ 250,000 .

Let ’ s take another hotel accident case. On the adverse, this time you will not be able to file a consumer complaint .

You are staying at a Marriott hotel in West Palm Beach, Florida. When you slide the shower doorway, it breaks. It cuts you and you twist your knee. ultimately, you get knee surgery on your meniscus .

We ’ ll assume that Marriott Claims is handling your claim. In early words, you are not dealing with an insurance company. here, you can ’ metric ton file a consumer ailment because you are not dealing with an policy company .

I settled a like injury font for John against the Marriott for $ 60,000. here is John :

however, you should note that many Marriott hotels are franchisees that have their own policy policies. For model, I settled font for $ 197,500 where my customer slipped and fell at a Marriott hotel in Pensacola, Florida .

In that case, Travelers Insurance Company insured the hotel. Although I did not need to, I could have filed a consumer complaint in that case if Travelers would been excessive. This is because unlike Marriott Claims, Travelers is an policy company .

Can you file a consumer complaint against a health insurance company?

Yes. Let me give you an exercise. An Uber driver was injured in a car accident in Miami. right field after the crash, he began looking for a car accident laywer. He found an Miami car accident lawyer with a 5 star average review. You guessed it. It was me .

He got a free reference with me .

ultimately, I settled his case with the other vehicle ’ s policy company for $ 260,000. ( That ’ randomness one of the biggest Uber accident settlements that you can find on-line. ) however, that policy company still lowballed me for pain and suffer in its first offer .

But we had a trouble. My node ’ s health plan ( Molina Medicaid ) refused to pay the hospital for their $ 99,000 placard. So I filed a consumer charge with Florida ’ s department of policy. then, the Florida department of policy told me that they do not handle complaints against companies for Medicaid plans .

next, I filed a complaint with Agency for Health Care Administration ( ACHA ). That got the job done .

Molina Medicaid paid the hospital charge, and adjusted ( reduced ) a huge contribution of the charge charges. This put over $ 90,000 extra in my node ’ mho pocket. This is good one car accident settlement where I needed to file a complaint against an indemnity company to maximize my node ’ randomness part of the payout .

If my client would have had health insurance ( and not Medicaid ), the Florida department of policy would have handled the ailment .

many factors affect settlement value. Filing a consumer charge ( in the right case ) is one of them .

Now It’s Your Turn

That ’ s all for my article on filing a consumer charge against an indemnity company .

immediately I ’ d like to hear from you :

Are you going to file a consumer charge against an indemnity company ? If so, what did they do wrong ?

Have you ever filed a consumer ailment against an insurance company ? If so, for what ?

Did you learn any tips in this article that helped you ?

Either way, let me know by leaving a comment .

Did someone’s carelessness cause your injury in an accident in Florida, or on a cruise or boat?

I want to represent you!

Our Miami law tauten represents people injured anywhere in Florida or on a cruise .

See if I can Represent You

If you were injured in an accident in Florida, fill out this simpleton form to find out for FREE if I can represent you. This is the fastest way for me to tell you if I can represent you .

Or you can call me at 888-594-3577. You can call me 24 hours a day, 7 days a week, 365 days a class.

Read more: The Best Car Insurance Companies for 2022

No Fees or Costs if We Do Not Get You Money

We speak Spanish. We invite you to learn more about us. Check out some of our reviews .

Editor ’ sulfur note : This post was in the first place published on August 2014 and has been completely revamped and updated .