Bundle & Save

car home presently insured ? many insurers, including State Farm, Geico, Progressive, Allstate and Farmers, offer a dismiss for bundling car and renters indemnity policies .

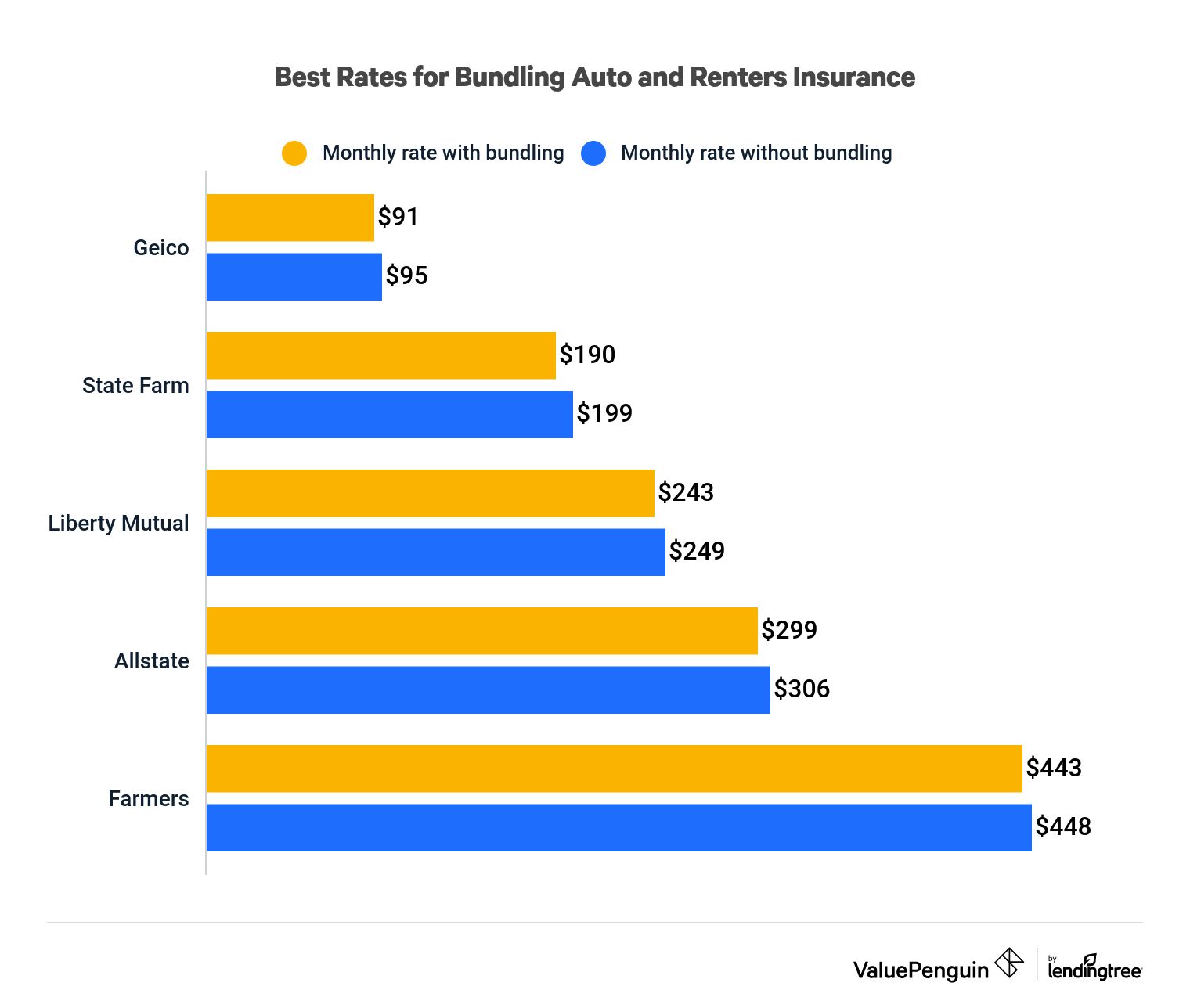

Cheapest car and renters insurance companies

Bundling your car and renters coverage can lead to modest savings, according to our analysis. State Farm offers the best auto-renters bundling discount at 4.7 %, which could save you $ 112 per year .

Bundle & Save car home presently insured ?

|

Insurer |

Discount |

Bundle total |

Auto rate per month |

Renters rate per month |

|---|---|---|---|---|

| State Farm | 4.7% | $190 | $189 | $10 |

| Geico | 4.0% | $91 | $83 | $13 |

| Liberty Mutual | 2.4% | $243 | $234 | $15 |

| Allstate | 2.1% | $299 | $290 | $16 |

| Farmers | 0.9% | $443 | $438 | $10 |

Insurers that bundle renters and car insurance

Most insurers offer the option to bundle renters and car policy, including :

- Allstate

- American Family

- Ameriprise

- Amica

- Auto-Owners

- Esurance

- Farmers

- Geico

- Kemper

- Liberty Mutual

- Mercury

- Nationwide

- Progressive

- State Auto

- State Farm

- The Hartford/AARP

- Travelers

- USAA

Best auto and renters insurance companies

While price is surely an significant divisor when buy car and renters indemnity, there are other significant elements to consider when choosing the best policy company, such as how you ‘ll be treated as a customer .

We found that USAA is the best company that offers an car and renters policy dismiss, based on our rating system that combines price, policy offerings and customer overhaul. however, USAA is only available to military members, veterans and their families .

Amica and Auto-Owners are besides big indemnity companies that offer car and renters insurance bundles .

|

Company |

Editor’s rating |

J.D. Power rating |

|---|---|---|

| Amica |

|

907 |

| Auto-Owners |

|

890 |

| USAA |

|

890 |

| Geico |

|

871 |

| State Auto |

|

N/A |

Show All Rows

How to bundle your auto and renters insurance policies

If you already have car or renters indemnity with your stream insurance company, bundling your policies is quite elementary. You should reach out to your insurance company and ask about getting a quotation mark and a deduction for bundling your policies. If your insurance company does n’t have the choice or does n’t offer a discount rate, you could save money by getting car and renters quotes from other insurers .

If you want to bundle your car policy with a renters policy policy with a modern insurance company, normally you will use one of the come two methods :

- Get a quote for both auto and renters at the same time, and sign up for both at once.

- Get a car insurance quote. After you sign up for the auto policy, the insurer will give you a discount on your car insurance if you sign up for renters insurance with the same company.

Some companies will offer you a multi-policy deduction even if you do n’t bundle with them or they do n’t offer renters insurance. For example, you can get a bundle discount with a Geico car policy policy if you bundle it with a renters indemnity policy from Assurant, Geico ‘s renters policy spouse .

You may not have the choice to bundle if you ‘re covered by a small or regional insurance company that does n’t offer renters indemnity policies .

Should you bundle your car insurance and renters insurance?

You should bundle your car and renters insurance if it helps you save money and is more convenient, but bunch is n’t always the best or cheapest choice for everyone .

Pros and cons of insurance bundles

|

Pros |

Cons |

|---|---|

| Save money by getting a bundle discount | You might pay more for a combined policy with one company than you would with two separate policies |

| Streamline paying bills and making claims | Support experience may be different for auto versus renters claims |

| Some insurers offer a combined deductible, which means you pay one deductible for a combined auto and renters claim |

Insurance bundle opportunities

You can bundle more than precisely car and renters insurance policies. For example, if you ‘re looking to increase your liability coverage beyond your renters insurance policy limits, you may have the option to bundle a personal umbrella policy with your renters or car policy — or bundle all three together — to find more discounts .

As a general rule, bundling more expensive policies together tends to provide bigger discounts. Since base policy and car insurance are typically two of the more expensive policies, home plate and car indemnity bundles tend to provide the biggest discounts of up to 10 %, according to a ValuePenguin discipline. You wo n’t get as big of a dismiss for bundling renters and car insurance, but bundling could even help you save .

Frequently asked questions

Can you bundle renters and car insurance?

Yes, most major insurers let you bundle renters and car policy, including State Farm, Geico, Progressive, Allstate and Farmers. Most insurers will ask at the goal of your quote process if you would like to add car or renters coverage if you do n’t have it already.

Which company has the best car and renters insurance bundle?

Geico offers the brassy car and renters policy bundle at an average rate of $ 91 per month. State Farm offers the best deduction for bundling car and renters policy at 4.7 %.

How much does bundling renters and auto insurance save?

On average, bundling renters and car insurance saves 2.6 % off your sum premiums. State Farm offers the biggest bundling dismiss at 4.7 % or $ 112 in savings per year .

Methodology

sample quotes were pulled from five companies for a 30-year-old male driver with minimum car indemnity coverage. All sample distribution quotes were from Brooklyn, New York, where renters make up a more meaning part of the population than in most of the United States. We used the follow coverage limits :

|

Coverage type Read more: Best car insurance companies for 2022 |

Study limits |

|---|---|

| Bodily injury liability | $50,000 per person/$100,000 per accident |

| Personal injury protection | $50,000 |

| Property damage liability | $25,000 per accident |

| Uninsured/underinsured motorist bodily injury | None |

| Comprehensive and collision | None |

| Renters personal property coverage | $20,000 |

| Renters liability coverage | $100,000 |