One of the reasons the risk is high is because of sheer volume of traffic in some areas, peculiarly the act of motorcycles on the road that cut in and out of traffic. But it ‘s besides because of poor drive standards. trial standards are better than they were some years ago, but there are still many people on the road who learned to drive in rural areas without formal education. This means lots of random lane cutting and poor signal. The high volume of cars in built up areas like Bangkok means that even when stationary there can be a senior high school hazard of being hit. And sol policy is a must. There ‘s a long ton of companies to choose from, many of which can be compared here on Mr Prakan, where you ‘ll see the most competitive quotes. In this post, I ‘ll walk you through everything there is to know about car insurance in Thailand. I ‘ll cover everything from types of insurance, must-know terms, the claims action and more.

Car Insurance Options

Thailand has two types of car policy :

- Compulsory Third-Party Liability Insurance

- Private Insurance

Compulsory Third-Party Liability Insurance (CTPL)

compulsory Third-Party Liability Insurance is known as Por Ror Bor. This type is required for all cars and motorcycles that are registered in Thailand. It is the minimal requirement under the Road Protection Act and a policy costs around 650 Baht per class for a even vehicle. Renewed on an annual basis, it provides basic coverage on death and injury caused by a road accident. CTPL insurance gives you a standard 80,000 Baht cover for injury and 300,000 Baht for death, if the accident is n’t your fault. If the accident is your demerit, the coverage decreases to 30,000 Baht for injury and 35,000 Baht for death. To claim the maximal amount, you will need a patrol report that says the accident was n’t your fault, You can claim checkup treatment at the hospital or get a reception and claim through your insurance ship’s company. The company will require a transcript of your recommendation and a transcript of the insurance policy. CTPL is renewed on an annual basis through the Department of Land Transport or your car indemnity caller. Most people purchase it at the lapp time as their annual car tax, so the two are renewed in synchronize. This character of insurance is n’t wholly sufficient and holders normally endure a fairly difficult claims serve. For this reason, those who can afford it choose Private Insurance, which comes with extra coverage on the vehicle and injury compensation .

Private Insurance

individual Insurance gives you access to professional aid after an accident and greater control over the animate of your car. It ‘s sensible to have this compensate control option because while Thailand does have a high road traffic death pace, the majority of the accidents are simple bumps. With Private Insurance, when you have an accident, a representative from the indemnity caller will come out to the scene of the accident and confer with the opposing party. They will provide you with aid on next steps, and issue the relevant claims documents. This is useful because it saves you from getting into a challenge with the person you have collided with. There are many different types of PI cover, and these are categorized into five types : 1, 2+,2, 3+ and 3. type 1 insurance is the most expensive and provides the best coverage. Type 3 indemnity is the cheapest and provides the lowest grade of cover. + Get Quotes here

Insurance Coverage Types

Let ‘s have a spirit at the different types of insurance binding in Thailand .

Type 1

This is the alone indemnity that covers you for all accidents, including accidents not involving a one-third party. So it might be that you swerve to avoid a dog and crash your cable car, or reverse into a post while parking. These accidents will be covered. Depending on the policy, you may or may not have to pay an excess of 1,000 Baht+. broadly speaking, this type of policy is available to cars that are less than seven years old. That said, it ‘s inactive potential to get this type for an older car in good repair and without any major accident history .

Type 2+

type 2+ is alike to Type 1 insurance but does not cover not one-third party accidents like Type 1. additionally, unlike Type 1 policy, which typically sends your car for repairs at official garages, Type 2+ policy normally sends cars to independent garages .

Type 2

type 2 insurance is similar to Type 2+ but does not come with collision coverage. Type 2+ is widely preferred for this reason. very few policy companies offer type 2 now .

Type 3+

type 3+ policy provides road accident protection, collision coverage, and third party property wrong, but does not cover larceny, fire, flood tide, and terrorism .

Type 3

type 3 is a popular insurance for low value cars. It ‘s identical basic, covering only checkup expenses and third-party indebtedness .

Policy Coverage

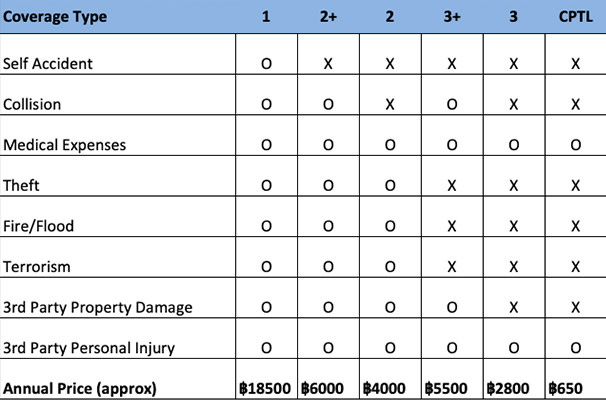

Let ‘s have a search at some of the specific aspects of a policy and which type of indemnity covers each .

Collision

type 1, 2+, and 3+ policy normally offer collision coverage. This covers the cost of repairing your car arsenic long as the damage is caused by a collision with another car. The key difference between policies is normally where the car is fixed. A more expensive design will allow you to take a car to the official principal, whereas a cheaper plan will mean going to an mugwump garage. When a car is written off ( deemed irreparable ), you will normally be offered 70-100 % of the insurance payout limit, depending on the fine details of your policy .

Medical Expenses

All the aforesaid policy types cover checkup expenses incurred by a road accident. The coverage is normally similar across all types, and normally lower if you cause the accident. The indemnity caller will require a checkup reception, unless you attend a collaborator hospital, in which case they will liaise immediately with the hospital. You besides have the choice to use your car policy, health insurance, or class insurance policy to cover your checkup expenses after a car accident .

Theft

Types 1, 2+ and 2 all cover larceny, but remember that personal duty is a factor when a claim is being processed. For case : if you forget to lock your car and get burgled, you may receive a lower payout .

Fire/Flood

Flood damage related to accidental, as in a flash flood that swamps your car. Do n’t expect to be compensated if you drive through floodwaters. You ‘ll see a lot of people make this mistake during showery temper. similarly, you ca n’t torch your car and claim it was submit to a fire. Like larceny, Types 1, 2 and 2+ breed fire and flood tide damage .

3rd Party Property Damage

3rd Party Property Damage covers the opposing party in the accident. Type 3 insurance, for case, covers the one-third party but not you. So you pay for your own damage but not the other person ‘s damage .

3rd Party Personal Injury

All the insurance types, including Compulsory Third-Party Liability Insurance, have 3rd Party Personal Injury coverage. So you can claim compensation if a car hits you when walking down the street. You may already have this coverage on early policies such as your aesculapian insurance policy .

Coverage Exclusions

equally crucial to knowing what ‘s covered is to know what ‘s excluded. These are standard exclusions you ‘ll find with indemnity companies back home, but you should be aware that these besides apply in Thailand .

- Driver’s License: You will not be insured if you don’t have a driver’s license.

- Drunk Driving: If your blood alcohol concentration (BAC) is more than 50mg, you are considered drunk (according to Thai law). This will invalidate your insurance claim.

- Unauthorized Driver: Depending on your policy, you may be authorized to have other drivers on the insurance. However, if the person isn’t listed or automatically covered, your insurance will be invalidated.

- Incorrect Purpose: a car is to be used for a specific purpose; that is transporting the allowed number of people in a safe manner. So don’t carry more passengers than the vehicle should, install an NGV or LPG gas systems without giving notification, or do something silly like strap a fridge to the top of the car when you move home.

- Leaving the Scene of an Accident: This is considered a crime in Thailand, and you won’t get your insurance payout either. Always stop in the event of an accident.

- War: If your car is damaged by an act of war, or even a street protest, it’s likely that you won’t be covered.

Policy Pricing

Of course policies differ well in price. The price is pendent on numerous factors such as whether the garage sends the car to a franchise or independent garage. Some policies offer deductibles, besides, and then there are no-claims bonuses, excesses, and driver specification choices. Below is a table that provides a ocular overview of what ‘s included in each policy type, and an estimate of what an modal policy might cost.

Insurance Policy Terms You Should Know

Excess

An excess is a pay back come you agree to pay out of your own pocket when a claim is made. The excess is normally waived if the accident was n’t your defect, but is enforced when no third party is involved. Excess in Thailand normally starts at 1,000 Baht. In general, the higher the surfeit, the lower the insurance agio .

Deductible

A deductible is often confused with excess. It ‘s a fixate come you agree to pay the insurance company whenever you would like to make a claim. Unlike surfeit, it is never waived and constantly applies. The estimable thing about a deductible is that it can considerable lower the cost of your policy. For exercise, a 20,000 Baht policy might be reduced to 13,000 Baht if you have a deductible of 3,000 Baht. A deductible normally applies to proper accidents and not claims on small damage such as scratches caused by a tree. note that the word for excess and deductibles is the same in Thai and is therefore much confused by policy holders and policy representatives. As with all aspects of a policy, read the humble print to make sure you understand your excess/deductible article .

No-Claims Bonus

The no claims bonus might be called a bonus but it heavily favors the insurance company. It rewards you for not claiming by lowering your annual premium, but this in plow barricade people claiming through fear of increasing the cost of their agio. Drivers end up paying to fix their own cable car so that they do n’t see a rise in their premium. If you have a no-claims bonus in Thailand then you will get a discount bounty. You need to have driven for a minimum of a year, claim-free, to get the bonus .

Dealership Vs. Independent Garage

If you have bought a new car in the last 5 years, you may want all animate work to be done at an official franchise. This will result in a more expensive premium. It may besides mean a longer expect time to get your cable car fixed because dealerships are fewer in number, particularly in rural areas. The cardinal benefits of a franchise are :

- Fully qualified mechanics

- Genuine parts

- Warranty guaranteed work

mugwump garages are hit and miss. Find a good one and keep it for life, but find a bad one and it could cost you. Stories of sub-quality parts being used, badly paint jobs, and temp fixes are not hard to come by on-line.

I would argue that it is worth paying a little extra on your bounty for the franchise choice. That said, the benefits of an independent garage are :

- Easier to find one in a remote area

- Faster turnaround times

- Cheaper labour, keeping your insurance premium lower

Driver Specification

This refers to specifying the names of the drivers on the policy. If you have a maximal of two list people on the policy, you can save up to 20 % ( based on age and history ), as opposed to a policy where anyone can drive the car who is legally burst to do so .

Pay Per Use

As the title suggests, this is a pay as you go cable car indemnity choice. A ship’s company called Thaivivat introduced this concept. Vehicle use is covered for a specific number of hours such as 144 hours for 30 days, or 600 hours for 108 day. This is an option that suits those who only drive for a few hours each day. The price is lower than an average insurance policy but you can merely use your car for a intend – normally 3 or 5 – count of hours per day. This sounds like a well choice but in world it can be a hassle. You have to turn on an app before driving so that the ship’s company can monitor custom. You turn the app off when you finish. If you are driving in a rural area and have no internet signal, you would have to call and notify the ship’s company of when you want to drive .

Add-Ons

As with all indemnity polices, there are extras that you can add-on for coverage outside of the regular items. These may include the trace :

- Compensation for stolen goods

- Coverage for a loan car

- Additional medical care

- Coverage for travel expenses incurred as a result of an accident

Choosing Your Insurance Company

There are over 20 car insurance companies in Thailand, each advertise unlike benefits with their policies. As with all types of indemnity, it can be a minefield wading through websites to find out which is best suited to your position, In addition, if you look on the web for review you will constantly find contrasting experiences from company to caller. The same is truthful for Internet providers and utility companies. In reality, being in a foreign state like Thailand, it is wise to go for a company that you have real confidence in, even if it means paying a fiddling piece more. here are a few things you should consider :

Reputation

In your home state you might be inclined to choose a belittled independent company that offers better rates due to smaller business overheads. In Thailand, however, it ‘s credibly a better theme to go with the brand name that you have heard of earlier and possibly seen commercially advertised. If the party has been in business for 20 years as opposed to two or three, then it ‘s probably a safer bet, even if a tad more expensive .

Customer Service

If you want to know the grade of customer service that you can expect from a company in the event of a call, then give them a call anterior to taking out the policy and ask a few questions. If the person on the other end of the earphone is patient with you and goes the extra mile to help you out, that ‘s a beneficial indication of what you can expect going forward. If your Thai is n’t very full, then you will want to find a company that has english speaking customer support. The last thing you want in the event of a claim is to have to battle through a language barrier. This is why I recommend Mr Prakan ; because they have excellent english-speaking support .

Nearby Garage

If you live in a fairly distant area, then it may be worth looking at your options for garages before taking out a policy. If you have a brand-new Toyota from a local franchise, then you will obviously be taking out insurance that would allow you to get your car fixed at that garage. conversely, if you have an old pickup truck, you may want to check which policy companies your local independent caller deals with .

Insurance Companies

The following are well-known, reputable indemnity companies :

- Viriyah

- Bangkok Insurance

- Muang Thai

- Tokio Marine

- and Asia Insurance

In addition, a phone number of long-familiar banks offer car indemnity, including Thanachart, SCB, Kasikorn, Krungsri, and TMB. little car insurances companies include :

- Dhipaya

- Deves

- Allianz

+ Get Quotes On Mr Prakan

How to Make a Claim

If the worst happens and you do have a road accident, the foremost thing you should do is call the policy party and address to a representative. The caller will send out a rep to you at the scene. Get of your cable car and take photos from a number of angles, showing your license plate from both the front and rear of the vehicle. Do n’t attempt to move the car, and stand well clear if there is oncoming traffic. If it is a child accident then there is no indigence to call the patrol, who may not show up, or even stop, unless you are blocking dealings, anyhow. however, if it is a more serious accident and there are casualties involved, the third party will likely call the patrol, or you can ask your insurance caller rep to do that for you. The indemnity rep will come out and help determine which party is responsible for the accident. This is one of the best reasons for having thoroughly car indemnity in Thailand, because it means that you do n’t need to engage with the third party and avoids the want for controversy over who is responsible. It is possible to sort out a claim without a rep being present, in what ‘s known as a knock-for-knock agreement. In this situation, adenine farseeing as both parties have Type 1 insurance coverage and there are no deaths, they can agree liability and exchange a claim phase with all the compensate information filled in. This imprint can then be submitted to the indemnity company. One of the best ways to ensure that you are not incorrectly accused of being at fault is to have a dashcam. These cameras are very democratic in Thailand and a beneficial one is easily obtained for 5-10,000 Baht .

Claiming Procedure

If a representative gives you a title form at the scene of the accident, you can then submit this to a partner garage to begin compensate of your cable car. It may be the font that the indemnity company has an on-line call system, in which case you will go on-line, fill out your details and then be issued a claim number. You will submit this total to the garage where you intend to fix your car. double check the details of the claim before you proceed, making certain that it has distinctly been identified that you are not at defect and the full price of compensate is approved. If the garage fixing your cable car necessitate for a sediment, check back with your indemnity caller as to whether you should be handing this over, as this may be an indication that you are expected to pay for some of the repair .

Documents Required

To make a claim, the trace documents are required. These are normally scanned and sent to the insurance company .

- copy of car registration

- copy of the first page of a passport

- copy of driver license

- copy of insurance policy

It is constantly easier to fix your car at a collaborator garage of the indemnity company. The processes is aboveboard because the policy company and the garage will liaise back and forth without any need for you to be involved. You can repair the cable car with a garage that is not a partner of the indemnity company, but this will require you to contact the insurance company and obtain a budget for the repair. This may require you to send over pictures of your cable car. This process could take a couple of weeks. It actually depends on how effective the insurance company is. In the case that the rectify budget the policy company gives you is lower than the cost of the animate itself, then you are going to have to fork out the remainder. Bear in mind that the garage might besides charge a fee outside of the insurance company ‘s budget, such as a process fee for having to liaise with your indemnity party .

Applying for Your Insurance

The large majority of people in Thailand bargain policy through brokers. The price is approximately the same as buying through an indemnity caller but brokers tend to offer unlike benefits due to the competitive nature of the industry. For model, this may include extra help with the purchase process or with claims. And some will even offer a loanword car while yours is under sustenance. To have your car insured, you require the following documents ;

- copy of the car’s registration

- copy of the first page of your passport

- copy of your driver’s license

- copy of your previous insurance policy (if you have one)

My Thai Car Insurance Recommendation

I recommend that any foreign national drive in Thailand take out Type 1 car indemnity. The chances of having an accident in Thailand are far higher than back home, no topic how much of a good driver you are. If you have an accident it probably wo n’t be your fault, and you will want the best possible cover – specially if you are planning on buying a newfangled car, or a car that is under seven years old. The thoroughly thing about Type 1 policy is that a example will come extinct to the view of the accident. If you do n’t speak the lyric proficiently then communicating with the third base party is n’t going to be a pleasant have. Consider this, besides : The spokesperson is constantly going to try and argue the accident in your favor, because they have a vest sake in winning the controversy on your behalf. The policy representative can besides help intercede with police, call a tow truck, or arrange a loan car. You can besides avoid overcharging on compensate costs. If the insurance company is liaising with the garage, then you do not have to negotiate the repair price and do n’t have to worry that you will be charged 20, 30, or even 50,000 Baht over what you should be paying. At the goal of the day you are paying for peace of mind. And if that means paying an extra 2,000 or 5,000 Baht a class, then I think it ‘s worth it .

In Summary

I hope you found this information utilitarian when deciding on your cable car policy. policy is a constantly evolving landscape, with changing regulations and policies. This means that the information presented here may contain one or two aspects that are out of date or no longer relevant. however, to the best of my cognition it is up-to-date and utilitarian as of the time of writing. At the very least I hope you immediately have an understanding of the unlike types of policy in Thailand and the claims summons. The best thing you can do now is to get yourself a range of quotes and decide which one best fits your expectations and budget. My recommend broke in Thailand is Mr Prakan. + Get Your Quotes here The Thai Bites Newsletter receive my monthly roundup of posts with tips on living and traveling in Thailand.