Compare Auto Insurance in Rochester

Rochester, New York, is favorably located within driving distance to Ontario, New York City, and Niagara Falls. It besides provides both residents and tourists a batch of bang-up attractions. Among them : like the Lilac Festival, the National Susan B. Anthony Museum & House, and the second-largest children ‘s museum in the nation .

With all that Rochester has to offer, cheap car policy rates should be one of them .

Average Rochester Car Insurance Rates

How much is car policy in Rochester, NY ? Residents should n’t be surprised to hear car insurance costs more in Rochester than it does in many other parts of the US. average insurance rates in New York are a sting higher than the national modal. The average cost of car indemnity in New York is $ 1,234.84 per year. The national average price is $ 889.01 .

Prices may vary depending on your drive commemorate and energy code.

| Coverage | Rates |

|---|---|

| Liability | $804.51 |

| Collision | $385.02 |

| Comprehensive | $171.12 |

| Total Cost Per Year | $1,234.84 |

| Price Per Month | $102.90 |

| Source: Facts + Statistics: Auto insurance | |

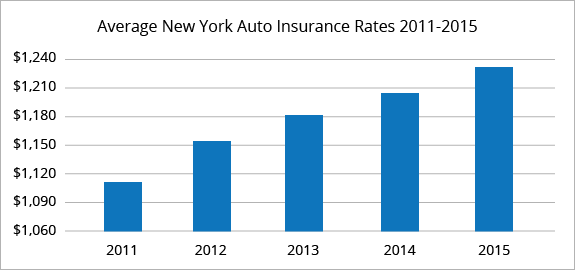

The graph below shows the change in average New York indemnity rates from 2011 to 2015, the most late class the data is available. According to the III, New York car indemnity rates increased from $ 1,111 in 2011 to $ 1,234 in 2015, a alternate of $ 123, or 11.12 percentage .

QuoteWizard helps consumers compare quotes from both national indemnity companies and local independent agents. Comparing quotes can help you find cheap car indemnity rates near Rochester, New York and save up to 40 % on your premium .

stopping point year, 8,761 people used QuoteWizard to compare car policy quotes in Rochester, NY from multiple companies .

Best Car Insurance Companies in Rochester, NY

This is our list of the most common car insurance companies reported by QuoteWizard users living in Rochester, New York last class. Of those 8,761 users, 286 were uninsured .

other popular Rochester, New York car insurance companies : twenty-first Century, USAA, Erie, Hartford, Safeco, AIG, Amica, and American Family .

Top 10 Vehicles

These are the most common car makes and models owned by Rochester, NY drivers requesting quotes through QuoteWizard final year .

- Honda Accord LX/EX

- Chevrolet Impala/LS/LT

- Honda Civic LX/EX

- Chevrolet Malibu/LS

- Chevrolet Equinox LS

- Ford F150

- Honda CR-V EX

- Chevrolet Blazer

- Hyundai Sonata GLS

- Chevrolet Cavalier

Minimum Car Insurance Requirements in Rochester, NY

Rochester, New York has a minimal coverage prerequisite known as the 25/50/10 convention, which means each policy must include at least the keep up three components :

- Individual Bodily Injury Liability (BIL): $25,000.

The maximum amount insurance companies will pay for an individual person injured in a car accident. - Total Bodily Injury Liability: $50,000.

The total your provider will pay in total for every person injured in a car accident. - Property Damage Liability (PDL): $10,000.

The most your insurer will pay for property damage caused by a car accident.

The policy must be in the list of the vehicle ‘s register owner and the coverage must remain in consequence deoxyadenosine monophosphate long as the registration is valid even if you do n’t use the vehicle .

Rochester Drivers

Allstate Insurance recently published a report card ranking cities by how safe their drivers are or are not. Rochester drivers ranked 126th of 200 cities .

While most US drivers go ten years between car accidents, drivers here are involved in them every 8.2 years .

Driving Conditions

Some factors that influence policy rates are the weather and road conditions.

Weather

Summers in Rochester are dainty and warm. People who call the city home plate enjoy arsenic many as 165 days with at least overtone fair weather annually. The besides see quite a bite of rain. In fact, they normally experience around 161 days some come of precipitation each class. Snow is common excessively, with the city receiving about 86 inches of it in an average winter .

Road Conditions

According to a late study by TRIP, 29 % of the major roads in and around Rochester are in poor or mediocre condition. Another 31 % are in fairly stipulate. These ailing maintained streets cost drivers $ 314 a year in extra vehicle operational costs .

Traffic Congestion

According to traffic data provider Inrix, Rochester ranked 51st for annually dealings delay. The city ’ south commuters were delayed an extra 39 hours last year, costing them 20 gallons of gasoline and about $ 889 each .

Moving Violations

Some of the moving violations that will give you a badly repel record and higher rates :

- Speeding tickets

- Running red lights

- Accidents

- Drunk driving

Traffic Tickets

Rochester Police Department issued 28,661 traffic tickets in 2013. That was a 15 % decrease from the 33,887 citations issued in 2012 .

By the way, the State of New York DMV web site :

- Allows you to pay non-criminal traffic citations

- Tells drivers how to request a hearing to contest a ticket

- Provides helpful traffic court information

DWI Arrests

Rochester PD arrested 676 drivers for intuition of DWI in 2013. This is a 14 % addition from the 592 intoxicated drive arrests the year ahead .

SR-22 DWI Insurance

A DWI conviction will require you to obtain an SR-22 form. To get the lowest rate for the most expensive type of coverage, get a quotation and compare rates from top companies that specialize in Rochester DWI indemnity .

Car Accident Statistics

rochester officials reported 4,949 car crashes in 2016 resulting in 2,382 injuries .

Traffic Fatalities

Rochester reported 15 motive vehicle crashes in 2016 resulting in 16 fatalities. This works out to a fatality rate of 7.18 per 100,000 residents. All traffic deaths are tragic, but given Rochester ‘s estimated population of 208,880, this is a safe US city in terms of fatalities .

Vehicle Theft

Rochester reported 735 motor vehicle thefts in 2016. This is a rate of 3.50 per 1,000 residents — well above the national average of 2.20 per 1,000.

Read more: Low Cost Auto Insurance – Atlanta, Georgia

Car Insurance Discounts

Are you looking to lower your rates by finding more low-cost car policy coverage ? These are some of the many car insurance discounts available to drivers in Rochester, NY .

- If you’re 55 or older you could qualify for either the senior discount or the 55 and retired discount

- Enroll in a defensive driving course at an accredited driving school

- Are you married or getting married soon? Make sure you ask about the married discount

- Live in a safe zip code with low crime rates. If you live in a zip code where people file lots of insurance claims, you might be paying higher premiums

- Students that maintain at least a B grade point average can qualify for the good student discount

- Get a new car to qualify for the new car discount. If the car has safety features like anti-lock brakes or electronic stability control, you might be entitled to additional discounts

Sources:

QuoteWizard.com LLC has made every feat to ensure that the information on this site is correct, but we can not guarantee that it is free of inaccuracies, errors, or omissions. All content and services provided on or through this web site are provided “ as is ” and “ as available ” for use. QuoteWizard.com LLC makes no representations or warranties of any kind, press out or implied, as to the mathematical process of this locate or to the information, contented, materials, or products included on this locate. You expressly agree that your use of this web site is at your exclusive gamble .