Editorial Guidelines : We are a free on-line resource for anyone interested in learning more about car indemnity. Our goal is to be an objective, third-party resource for everything car insurance related. We update our web site regularly, and all message is reviewed by car indemnity experts .

Living in New York City has its advantages like entree to first museums and art galleries, cultural experiences from all over the world, a overplus of career opportunities, and great public transportation. But downsides include heavy traffic, piercingly cold winters, caparison costs, and if you own a vehicle, high cable car insurance prices .

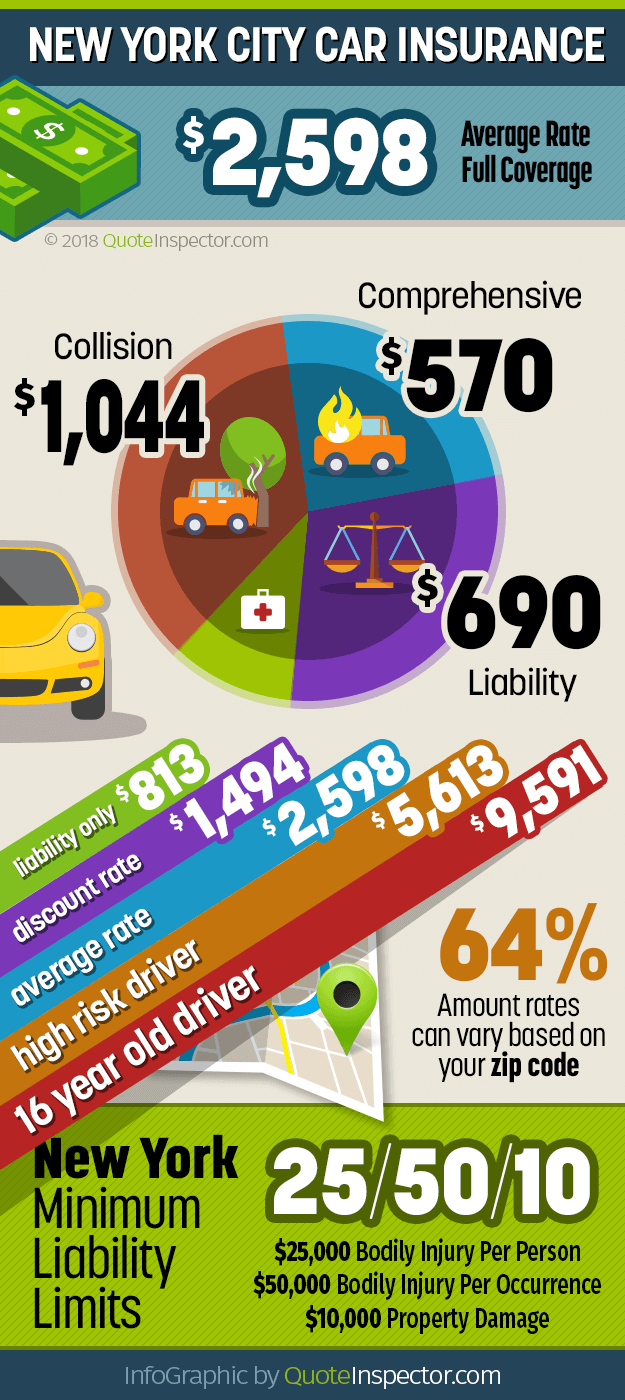

The average cost of cable car insurance in New York City is just under $ 2,600 a year, which ranks among the highest for boastfully cities in the U.S. If you live in the Bronx, Brooklyn, or the southern separate of Queens, your rates could be american samoa much as 69 % higher, with prices approaching $ 4,400 a year .

Annual premium for full coverage: $2,214 pace estimates by individual coverage type :

Comprehensive $486

Collision $888

Liability $588

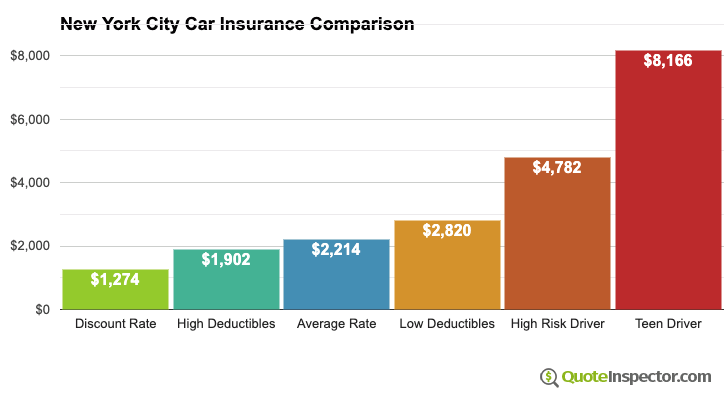

These rates assume a 40-year-old driver with a good drive record and full coverage with $ 500 deductibles. The chart below shows rates for early scenarios like if you qualify for policy discounts, low and high physical price coverage deductibles, and bad and adolescent driver indemnity rates .

View Chart as trope

Chart showing New York City car insurance rates including the cheapest discount rate, rates with both low and high deductibles, and rate for high-risk and teenage drivers

Not everyone needs full coverage, and the illustration below shows the price range from a cheaper liability-only policy up to a much more expensive bad policy. Drivers who may need bad or ‘ non-standard ’ coverage include those who have received a DUI misdemeanor, been caught driving without insurance, or have been convicted of driving on a suspend license .

Liability Only $ 690

Full Coverage $ 2,214

High Risk $ 4,782

What Determines Car Insurance Rates in New York City?

As you can credibly tell by the data above, rates can vary well based on the driver and risk being insured. The following incision discusses how your localization, the type of vehicle you drive, and early factors can impact the price of your policy .

Where You Live

Areas with lots of traffic congestion have higher policy prices equitable ascribable to the increased likelihood of collision and liability claims. New York City ranks first in population concentration in the U.S. with over 28,000 people per public square mile .

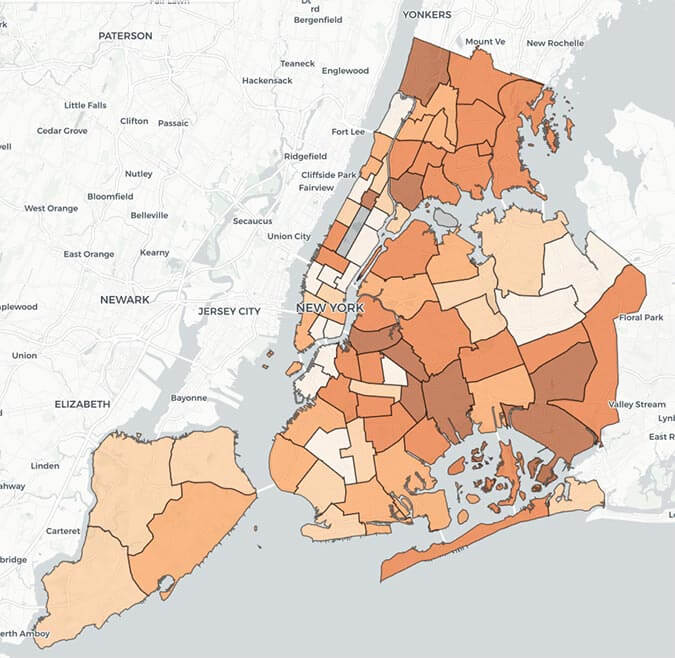

Boroughs with high incidents of vehicle larceny or vandalism tend to have the highest rates in the Big Apple. The picture below shows grand larcenies of motive vehicles by police precinct, with colored areas having the highest rates of vehicle larceny.

Map source NYC Crime Map showing Grand Larceny of Motor Vehicles by Precinct

If you live in a dark-shaded sphere in the map above, you probably pay a premium on your car insurance bill thanks to the higher likelihood that your cable car will be stolen.

Free Auto Insurance Comparison

accede your zip up code below to view companies that have bum car insurance rates .

Secured with SHA-256 Encryption

Secured with SHA-256 Encryption

The Vehicle You Drive

Another large factor that determines the price of car policy is the make and model of vehicle you drive. high performance, alien, or costly vehicles cost more to insure due to the higher animate costs and by and large higher liability indemnity rates .

The mesa below shows policy rates for some of the more popular vehicles sold in the state of New York .

The rate data shows that vehicles with dear safety ratings and less performance like the Honda CR-V and Ford Escape have cheaper policy rates. big trucks tend to have higher rates due to more frequent liability claims .

If you ’ re into performance vehicles, you ’ ll pay much higher rates than those shown in the board above. Cars like the Audi R8, Acura NSX, or Porsche 911 have rates that are about double those of the average vehicle, as shown in the chart below .

If you want sky high policy rates, try insuring one of the top-performing vehicles above in the Bronx .

Your Driving Record

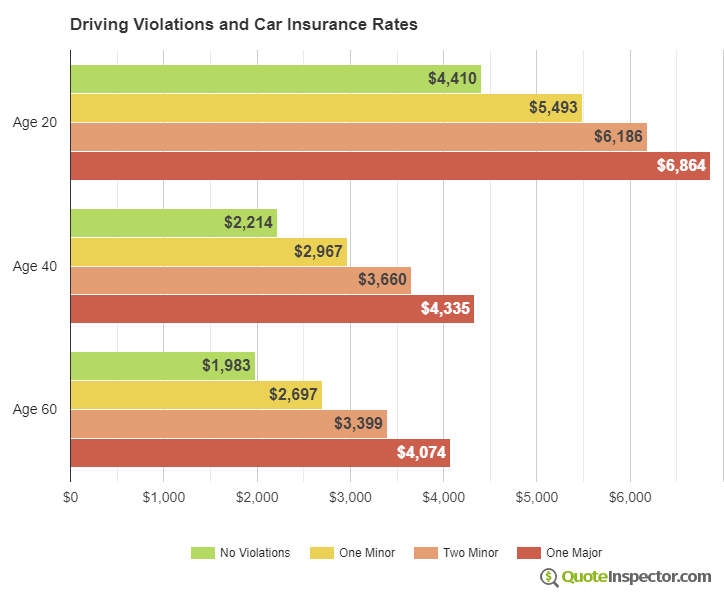

The most preventable causal agent of high cable car insurance prices is how you drive. Drivers with multiple violations pay much higher rates, as there is a direct correlation between poor driving habits and increase frequency of insurance claims .

Every ship’s company handles violations a little differently, with some allowing a minor rape without a rate increase. other companies have no tolerance for flush a minor misdemeanor, and you ’ ll see a price hike adenine soon as they discover the tag on your motor fomite report .

The graph below shows example rate hikes after one and two minor violations, and besides the large price increase after a major irreverence like a DUI, driving on a freeze license, murder and run, or heedless drive .

View Chart as image

Chart showing how minor driving violations like a speeding ticket and major violations like a DUI impact New York City car insurance rates

If your company offers discounts for being a safe driver, not lone do you get stuck paying a surcharge for having a rape, you can besides potentially lose a discount, which results in a double whammy on your car indemnity bill .

Your Car Insurance Company

Speaking of companies, that happens to be another choice that immediately impacts how much you pay. There are hundreds of indemnity companies that can write car insurance in the state of New York, and which one is the cheapest all depends on the factors we are discussing in this article .

There are good besides many variables to tell you which car insurance ship’s company is cheapest in New York City, but we can show you the largest insurers in the state of New York .

| Rank | Company | Market Share | Average Rate |

|---|---|---|---|

| 1 | Geico | 30.81% | $1,888 |

| 2 | Allstate | 14.80% | $1,572 |

| 3 | State Farm | 13.03% | $1,943 |

| 4 | Progressive | 8.01% | $1,527 |

| 5 | Liberty Mutual | 6.26% | $2,046 |

| 6 | Travelers | 4.13% | $1,544 |

| 7 | USAA | 2.79% | $1,175 |

| 8 | Nationwide | 2.67% | $3,116 |

| 9 | NYCM Insurance | 2.37% | $1,855 |

| 10 | Metropolitan | 1.63% | $1,604 |

| Get Your Rates Go | |||

reference : National Association of Insurance Commissioners ( NAIC ) 2015 Market Share Report and The Zebra

Do the largest policy companies offer the cheapest rates ? not necessarily. Is the cheapest company one of the largest companies ? credibly not. Keep in mind that the rates above are averaged for the entire state of New York, and NYC has much higher rates than early areas of the department of state .

Since cable car policy rates are so variable, and therefore many companies sell it, the only way to know which company is the bum is to compare prices based on your own site .

Additional Factors

Where you live, the car you drive, your driving record, and your choice of insurance company are four of the main factors that affect the price you pay for insurance. Some of the early things that determine your policy premium are :

- Deductible levels – High deductibles mean you pay more out-of-pocket for claims which reduces your premium. Conversely, lower deductibles save you money at claim time, but cost more in policy premium.

- Liability limits – New Yorkers are required to have minimum liability limits of 25/50/10, but increasing these limits (which is a good idea in most cases) will also increase your premium.

- Personal risk factors – These include things like your marital status, whether you own your home, your credit history, the ages of other drivers on the policy, etc.

- Policy discounts – Companies offer discounts for being claim and/or accident-free, bundling your home and auto policies, having multiple cars on one policy, paying your policy in full, getting quotes online, and more. The more discounts you qualify for, the lower your rate will be.

New York Auto Insurance Resources

The adopt resources may be helpful in researching car policy in New York .

- New York is a no-fault state which can be beneficial if you’re injured in an accident, but it can also contribute to higher insurance rates. Learn about New York’s no-fault insurance

- To learn more about New York’s minimum liability requirements or the NYAIP (assigned-risk plan), what to do if your policy was cancelled, or get general car insurance answers, visit the consumer FAQ.

- If you have a consumer complaint about an insurance agent or company, you can file a consumer complaint or call (800) 342-3736.

Tips for Reducing Car Insurance Rates in New York City

Chances are you ’ re not going to move to a different region barely to save on car indemnity, but there are other steps you can take to help lower the price of car insurance in New York City .

- Take a look at your policy and see if you’re paying for coverages that are not needed. Do you really need towing reimbursement or that auto club membership?

- If you have adequate savings, consider raising your comprehensive and collision deductibles. Higher deductibles save money in the long run, but you must have enough emergency funds on hand to pay them in the event of a claim.

- If you’re switching vehicles, consider buying a lower-performance, lower-cost vehicle that has excellent safety ratings. These types of vehicles tend to have the cheapest insurance rates.

- Ask your company or agent if there are any discounts that you might be missing. Discounts for certain occupations or professional memberships are often not well publicized so it doesn’t hurt to inquire.

- Consider taking a defensive driving class as part of New York’s Point and Insurance Reduction Program (PIRP). It can save you 10% on your liability and collision rates for three years and also help prevent a license suspension if you have 11 or more points on your record.

- Lastly, and most importantly, shop your coverage around. Price quotes are always free and you may find a company that is much cheaper than your current one. We recommend comparing rates once a year, since companies change rates frequently.