Buy/Renew Third Party Car Insurance Online

Motor Third Party policy is the entirely insurance made compulsory by indian Law. It is a statutory requirement under the Motor Vehicles Act, 1988 for any cable car owner or driver to drive their vehicle on a public road .

This policy benefits some other party rather of the two parties involved in the contract, that is the guarantee and the insurance company. That is why this type of policy is referred to as “ Third-party car insurance ” .

The main purpose of the 3rd Party Car Insurance is to provide fiscal and legal protection to the policyholder in casing of an accident causing physical injury, death, or disability to the third party or damage to third-party properties .

Third-party car indemnity is the basic insurance that is compulsory for every cable car owner to hold while driving. It gives coverage to the one-third parties for their damages caused due to an accident with the see car. besides, being a mandatary embrace, it delivers legal submission ampere well along with the coverage.

Reading: Third Party Car Insurance Online

How does this Third Party Car Insurance Policy Work?

Third Party car policy is a contract between the cable car owner and the indemnity caller, where the insurance company agrees to reimburse the insured person in case he lands into any legal complication for injuring a third party or damaging his place due to his own blame .

Benefits of an Online Third Party Insurance Policy:

With a Third party car policy policy in place, you can assure yourself peace of mind in situations of legal liabilities due to third party damages and injuries. With such policies you get :

- Cover for accidental death or injury caused to other people

- Cover for accidental damage caused to other people’s property

Third party cable car indemnity is one of the sections in the car insurance policy copy, the early being the own damage department under the cable car policy policy imitate. The one-third party car indemnity part can be taken as a standalone policy top under the third base party cable car indemnity policy. The agio for third base party is decided by the government and the regulation torso for indemnity IRDA. The third party premium rates are subject to change every year depending upon the claims settled this previous year and the gross bounty cover by all the insurance companies taken into consideration .

cable car insurance cost of third party premium is decided by the IRDA and is constant for all the indemnity companies. Third party agio changes with the cubic capacity and the age of the fomite. Third party bounty rates are decided by IRDA and are subject to change each year depending on the former year ‘s premium collected, claims settled, and many other factors. cable car indemnity rates would increase if your car is fitted with the Bi-fuel system and other electrical and nonelectrical accessories. Both the own damage and third base party premiums would be increased in this case .

1. Compulsory TP

The Motor Vehicles Act, 2019 has made it mandate for the owner of the car to have at least a third base party insurance if not the comprehensive insurance blanket. The fine for not having the compulsory third base party car insurance is up to Rs.5000/- and/or imprisonment of up to 3 months. There are three slabs for the third gear party car insurance agio depending on the cubic capacity of the car. The highest premium to be paid for a cable car would typically not be more than Rs.10k which provides coverage for a year. Having a Third party policy can save your hard-earned money from being paid as a fine and prevent you from imprisonment.

2. Death and Disability Claim

The death and disability accidental claims are covered under the third gear party car insurance policy. In general the third party claims are to be reported to the indemnity companies and will be settled by the honest courts. The sum of compensation to be paid by the insurance companies to the kin of the deceased is decided by the honorable courts after taking many factors into consideration. These factors include the gain capacity of the deceased and other factors such as the age of the die etc.

In the absence of the third party car insurance policy, the compensation awarded by the honorable courts for third party death and disability claims should be settled from your own pocket. There can be instances where the courts action your property to settle the third party claims in the absence of valid third party insurance.

3. Property damage claims

The third party property damage due to your car is covered under the third base party car policy policy. The Third party property damage is covered up to Rs.7.5Lacs under the one-third party car indemnity. The limit under this section can besides be restricted to Rs.6000 for a decrease in the overall premium to be paid under your third base party cable car policy policy .

The property price claims of the one-third parties due to accidents are settled under the third party car policy policy up to a maximum terminus ad quem of Rs.7.5Lacs and anything above the mention limit has to be borne by the insure customer. The third base party property damage claims don ’ t fall under the legal power of civil courts and are by and large handled by the Motor Accident Claims Tribunal.

4. Personal accident cover for owner/driver

personal accident cover for owner/driver is compulsory for a total insured of Rs.15 Lacs to be taken under the compulsory one-third party cable car insurance policy. The personal accident cover for the owner/driver covers the claims due to the death or disability of the owner/driver at the time of accident whilst driving the insured vehicle .

The personal accident cover sum insured is Rs.15 Lacs and the customer has an option to purchase a individual personal accident cover for all of his cars in the form of a Standalone personal accident overlay for owner/driver.

5. Need for Third party car insurance

The indigence for a valid third base party car insurance has increased these days due to the increasing road accidents resulting in the loss of lives of the passengers. A third party car indemnity death claim may result in the personnel casualty of more than one liveliness and the claim sum may run up to several Lacs in some instances where the car owner/driver might not be able to pay without the help of the policy company. The 4 wheeler car insurance cost is on the ascend each class due to the increase in Third party indemnity costs. This increase is attributed to the addition in call come settlement in the third party cases by the insurance companies .

If you opt to save yourself from running into bankruptcy it is significant to purchase a third party cable car insurance policy for your car while driving in public places. besides having valid third party fomite indemnity saves you from paying unnecessary fines and prison captivity .

Best third party car insurance quotes available on www.policybachat.com. Buy Third Party Car Insurance online from Car Insurance in three simple steps by entering your vehicle registration number, make & model of your car and your contact details. After entering the details you’ll be redirected to the portal where the quotes from the top car insurance companies will be displayed for you to select from.

Third Party Policy Exclusions:

Third party car indemnity policies do not cover any damage caused to the car of the guarantee or injuries caused to him if it is proven that the reason for the natural calamities, accident or collision is his fault. however, if it is found that the third party car driver is at fault, the cover might have some casual of claiming the damage amount .

How to Claim Third Party Car Insurance in India?

Claiming third base party cable car policy is a little complicated as it does not alone involve damages to your car or injuries to you but besides involves losses caused to another person or his place.

- Contact your insurance company as soon as possible to inform them about your claim.

This is termed as “giving notice”. The faster the notice is given, the easier it

is to recover your money. - Do not forget to take down the insurance policy details of the third part right

after the incident. - Collect all possible details about the incident, like how the accident occurred,

the injuries and damages sustained (if any), and the amount you plan to claim. Also,

gather other related information like medical bills, estimates of repair charges, and police reports. - Keep the record of the claim handy. In case the process becomes controversial or

structured into a lawsuit, you should be able to produce proper evidence supporting

your claims. - Give the insurer all possible reasons why they should payout on your claims.

Know about Third Party Car Insurance- Coverage, Exclusions, and Rates, etc.

One of the most popular words known to many people owning a vehicle is Third party indemnity cover. besides known as TP Insurance is a type of insurance that is mandate to have for each vehicle owner .

For fresh buyers, there could be some doubts regarding the coverage, benefits, and exclusions in Third party insurance. This article aims to clear most of your doubts regarding Third Party Car Insurance cover in the Motor indemnity .

1. Introduction to Third Party Insurance:

This legislation was created in the 1930s with a view that drive vehicle accident victims should not go without compensation owing to the fiscal capacity of the first party .

Before the introduction of compulsory one-third party car indemnity in India, the victims of centrifugal vehicle accidents were pendent on the mercifulness or claim to pay capability of the first parties .

A person driving a fomite may or may not be able to pay recompense to the injure third gear party and this has created a need for compulsory one-third party insurance across the World .

As per the motor vehicle act, Third Party policy is besides known as Act-only or Liability-only policy and can be given on a Standalone basis. The beginning party in Motor indemnity is the Insured ( Customer ) and the second party is the Insurer ( Insurance Company ) .

According to the Motor vehicles act, it is compulsory for every vehicle plying on public roads to have Third party insurance.

2. Coverage:

Third party insurance cover has the following benefits :

- Third Party Injuries: In case of an accident resulting in the injury of a Third party in Motor insurance, compensation is paid to the Third party by the insurance company on behalf of the insured. For example, your vehicle might accidentally hit someone walking on the road and injure them. Third party car insurance policy covers the third party car insurance cost to treat those injuries.

- Third Party Death: In an unfortunate accident resulting in the death of someone, compensation is paid to the family of the deceased. For instance, your car might hit someone on the road and injure them fatally resulting in their death. Third party car insurance policy pays the compensation to the family of the kin as awarded by the honorable courts. The maximum amount of compensation to be settled will be decided by the honorable court depending on the earning capacity, age, and other factors of the deceased.

- Third party property: When you damage the property of a third party person due to an accident, then the third party is compensated by the insurance company for the damage suffered by him. The maximum limit of Third party property damage is Rs.7.5 Lacs.

- Personal Accident Cover: A third party car insurance policy comes with a compulsory personal accident policy for the Owner/Driver of the vehicle. In case of an accident that results in the death or disability of the owner of the vehicle, compensation amount up to 15 Lacs is paid to the insured or his family.

3. Exclusions:

There are certain exclusions in the Third party car insurance policy which are listed below .

- Damage to your car: Any kind of damage to the insured’s vehicle is not covered under standalone Third party insurance. For availing of this coverage, you have to purchase a Comprehensive car insurance policy. This comprehensive insurance policy has an Own damage section which covers the damage to your vehicle.

- Violating rules while driving: Any third party insurance policy will not cover the damages or losses that occurred as a result of direct violation of traffic rules. For example, driving under the influence of alcohol, driving without a valid license, etc is not covered under the Third party insurance.

- Driving without a valid insurance policy: Your third party car insurance policy in India will not cover the losses or damage to a third party in case of driving without a valid insurance policy. It is of utmost importance to renew the Third party car insurance policy online before the expiry date so as to avoid any breaks in the insurance policy. The car insurance renewal quote should contain only the necessary coverage opted by you. For instance, if you select only Third party insurance coverage, the same should reflect in the renewal quote as well as in third party car insurance renewal tips.

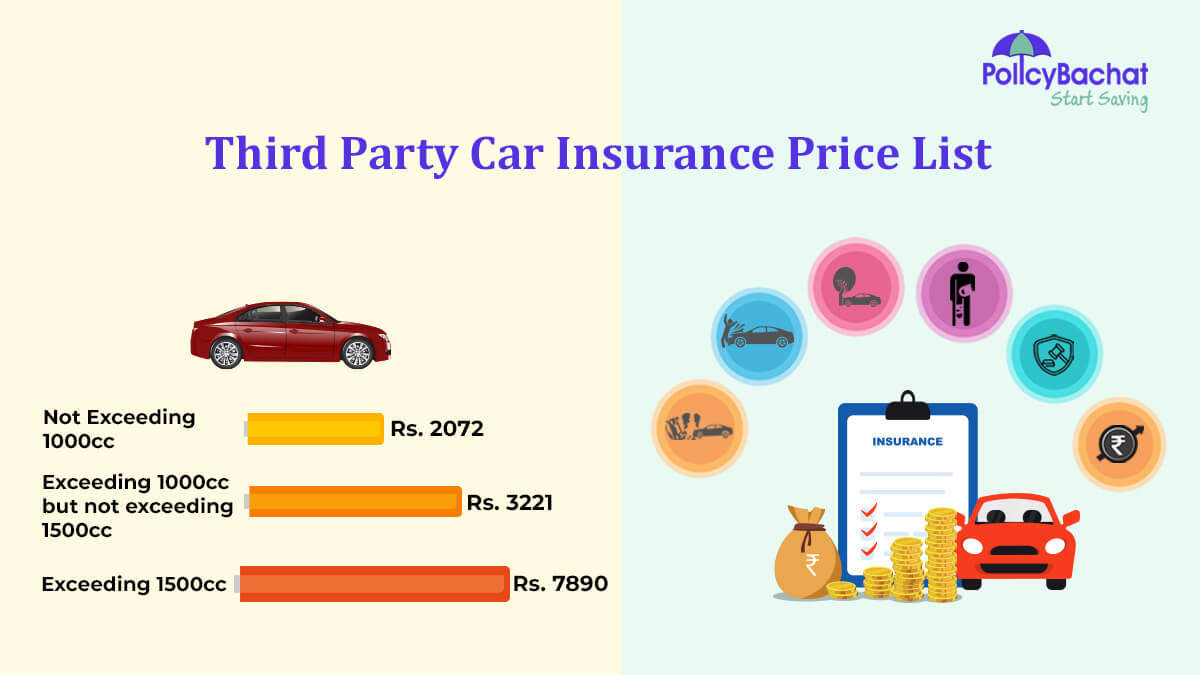

4. Third Party Car Insurance Price list:

The third party premium rates are different for different classes of vehicles. The below mesa illustrates the rates for Third party. Third party premium calculator rates can be calculated using the below board as Third party car indemnity agio calculator .

Third party car insurance rates are decided by the IRDA and are submit to change each year depending on the former year loss proportion, bounty collected and many early factors .

Third Party Insurance for Car Price List Table I

| Category | Vehicle Type | Existing Rates(Rs)FY 2019-20 | Proposed Rates(Rs)FY 2020-21 |

| Private Cars | |||

| Not exceeding 1000 cc | 2,072 | 2,182 | |

| Exceeding 1000 cc but not exceeding 1500 cc | 3,221 | 3,383 | |

| Exceeding 1500 cc | 7,890 | 7,890 | |

| Two Wheelers | |||

| Not exceeding 75 cc | 482 | 506 | |

| Exceeding 75 cc but not exceeding 150 cc | 752 | 769 | |

| Exceeding 150 cc but not exceeding 350 cc | 1,193 | 1,301 | |

| Exceeding 350 cc | 2,323 | 2,571 | |

| A1 | Goods Carrying Commercial Vehicles (other than 3 wheelers) – Public | ||

| GVW not exceeding 7500 kgs | 15,746 | 16,092 | |

| Exceeding 7500 kgs but not exceeding 12000 kgs | 26,935 | 28,288 | |

| Exceeding 12000 kgs but not exceeding 20000 kgs | 33,418 | 35,139 | |

| Exceeding 20000 kgs but not exceeding 40000 kgs | 43,037 | 44,342 | |

| Exceeding 40000 kgs | 41,561 | 44,457 | |

| A2 | Goods Carrying Commercial Vehicles (other than 3 wheelers) – Private | ||

| GVW not exceeding 7500 kgs | 8,438 | 8,607 | |

| Exceeding 7500 kgs but not exceeding 12000 kgs | 17,204 | 17,549 | |

| Exceeding 12000 kgs but not exceeding 20000 kgs | 10,876 | 11,094 | |

| Exceeding 20000 kgs but not exceeding 40000 kgs | 17,476 | 17,827 | |

| Exceeding 40000 kgs | 24,825 | 25,323 | |

| A3 | Goods Carrying Motorized Three Wheelers and Motorized Pedal Cycles – Public Carriers | ||

| except e-carts | 4,092 | 4,489 | |

| A4 | Goods Carrying Motorized Three Wheelers and Motorized Pedal Cycles – Private Carriers | ||

| except e-carts | 3,914 | 3,922 | |

| B | Trailers | ||

| Agricultural Tractors up to 6 HP | 857 | 918 | |

| Other vehicles including Miscellaneous & Special Type of Vehicles (Class-C),(For each trailer, for more please multiply by no. of trailers) | 2,341 | 2,507 | |

Table II

| Category | Vehicle Type | Existing Rates(Rs) | Proposed Rates(Rs) | ||

| FY 2019-20 | FY 2020-21 | ||||

| Basic Rate | Per Licensed Passenger | Basic Rate | Per Licensed Passenger | ||

| C1a | Four wheeled vehicles used for carrying passengers for hire or reward with carrying capacity not exceeding 6 passengers | ||||

| Not exceeding 1000 cc | 5,769 | 1,110 | 6,370 | 1,226 | |

| Exceeding 1000 cc but not exceeding 1500 cc | 7,584 | 934 | 8,375 | 1,031 | |

| Exceeding 1500 cc | 10,051 | 1,067 | 11,099 | 1,178 | |

| C1b | Three wheeled vehicles used for carrying passengers for hire or reward with carrying capacity not exceeding 6 passengers | ||||

| except e-rickshaw | 2,595 | 1,241 | 2,595 | 1,241 | |

| C2 | Four or more wheeled vehicles used for carrying passengers with carrying capacity exceeding 6 passengers for hire or reward | ||||

| School Bus* | 13,874 | 848 | 14,338 | 876 | |

| Other Bus | 14,494 | 886 | 14,978 | 916 | |

| C3 | Motorized three wheeled passenger vehicles used for carrying passengers for hire or reward with carrying capacity exceeding 6 passengers but not exceeding 17 passengers | 6,913 | 1,379 | 6,913 | 1,379 |

| C2 | Three wheeled passenger vehicles used for carrying passengers for hire or reward with carrying capacity exceeding 17 passengers | 15,845 | 969 | 15,845 | 969 |

| C4 | Motorized Two wheelers used for carrying passengers for hire or reward | ||||

| Not exceeding 75 cc | 861 | 580 | 861 | 580 | |

| Exceeding 75 cc but not exceeding 150 cc | 861 | 580 | 861 | 580 | |

| Exceeding 150 cc but not exceeding 350 cc | 861 | 580 | 861 | 580 | |

| Exceeding 350 cc | 2,254 | 580 | 2,254 | 580 | |

*School Buses are those buses which are registered in the list of the School and are used only for transporting students to or from a educate or on educate related trips

Table III

| Category | Vehicle Type | Existing Rates(Rs.)FY 2019-20 | Proposed Rates(Rs.)FY 2020-21 |

| D | Special Types of Vehicles | ||

| i) Pedestrian controlled Agricultural Tractors with Horse Power rating not exceeding 6HP, Hearses and Plane Loaders | 1,550 | 1,660 | |

| ii) Other Misc & Spl types of vehicles | 6,847 | 7,332 | |

| E | Motor Trade (Road Transit Risks) | ||

| i) Distance not exceeding 2400 kms | 1,055 | 1,141 | |

| ii) Distance exceeding 2400 kms | 1,268 | 1,371 | |

| F | Motor Trade (Road Risks) (Excluding Motorized Two Wheelers) – (Named Driver or Trade Certificate) | ||

| 1st named driver or certificate | 1,345 | 1,455 | |

| For additional drivers/ certificates up to 5 (per driver/certificate) | 651 | 704 | |

| For additional Drivers/ Certificates exceeding 5 but not exceeding 10 (per driver/ certificate) | 419 | 453 | |

| For additional Drivers/ Certificates exceeding 10 but not exceeding 15 (per driver/ certificate) | 363 | 393 | |

| F | Motor Trade (Road Risks) (Excluding Motorized Two Wheelers) – (Named Driver or Trade Certificate) | ||

| 1st named driver or certificate | 515 | 515 | |

| For each additional Driver/ Certificate | 257 | 257 | |

Table IV

| Category of Vehicle | Existing Rates(Rs.)FY 2019-20 | Proposed Rates(Rs.)FY 2020-21 |

| New Private Car – Three year single premium | ||

| Not exceeding 1000 cc | 5,286 | 6,079 |

| Exceeding 1000 cc but not exceeding 1500 cc | 9,534 | 10,149 |

| Exceeding 1500 cc | 24,305 | 24,305 |

| New Two Wheeler – Five year single premium | ||

| Not exceeding 75 cc | 1,045 | 1,223 |

| Exceeding 75 cc but not exceeding 150 cc | 3,285 | 3,845 |

| Exceeding 150 cc but not exceeding 350 cc | 5,453 | 6,505 |

| Exceeding 350 cc | 13,034 | 13,034 |

Table V

Rates for Electric vehicles – Non passenger carrying

| Category | Vehicle Type | Existing Rates(Rs) FY 2019-20 | Proposed Rates(Rs) FY 2020-21 |

| Private Cars | |||

| Not exceeding 30 KW | 1,761 | 1,855 | |

| Exceeding 30 KW but not exceeding 65 KW | 2,738 | 2,876 | |

| Exceeding 65 KW | 6,707 | 6,707 | |

| Two Wheelers | |||

| Not exceeding 3 KW | 410 | 430 | |

| Exceeding 3 KW but not exceeding 7 KW | 639 | 654 | |

| Exceeding 7 KW but not exceeding 16 KW | 1,014 | 1,106 | |

| Exceeding 16 KW | 1,975 | 2,185 | |

| A1 | Goods Carrying Commercial Vehicles (other than 3 wheelers) – Public | ||

| GVW not exceeding 7500 kgs | – | 13,678 | |

| Exceeding 7500 kgs but not exceeding 12000 kgs | – | 24,045 | |

| Exceeding 12000 kgs but not exceeding 20000 kgs | – | 29,868 | |

| Exceeding 20000 kgs but not exceeding 40000 kgs | – | 37,691 | |

| Exceeding 40000 kgs | – | 37,788 | |

| A2 | Goods Carrying Commercial Vehicles (other than 3 wheelers) – Private | ||

| GVW not exceeding 7500 kgs | – | 7,316 | |

| Exceeding 7500 kgs but not exceeding 12000 kgs | – | 14,917 | |

| Exceeding 12000 kgs but not exceeding 20000 kgs | – | 9,430 | |

| Exceeding 20000 kgs but not exceeding 40000 kgs | – | 15,153 | |

| Exceeding 40000 kgs | – | 21,525 | |

| A2 | Goods Carrying Motorized Three Wheelers and Motorized Pedal Cycles – Public Carriers | ||

| e-carts | 2,859 | 3,136 | |

| A3 | Goods Carrying Motorized Three Wheelers and Motorized Pedal Cycles – Private Carriers | ||

| e-carts | 3,204 | 3,211 | |

Table VI

Long term rates for electric vehicles – Private Cars and Two wheelers:

| Category of Vehicle | Existing Rates(Rs.) FY 2019-20 | Proposed Rates(Rs.) FY 2020-21 |

| New Private Car – Three year single premium | ||

| Not exceeding 30 KW | 4,493 | 5,167 |

| Exceeding 30 KW but not exceeding 65 KW | 8,104 | 8,627 |

| Exceeding 65 KW | 20,659 | 20,659 |

| New Two Wheeler – Five year single premium | ||

| Not exceeding 30 KW | 888 | 1,040 |

| Exceeding 3 KW but not exceeding 7 KW | 2,792 | 3,268 |

| Exceeding 7 KW but not exceeding 16 KW | 4,635 | 5,529 |

| Exceeding 16 KW | 11,079 | 11,079 |

Table VII

Rates for Electric vehicles – Passenger carrying

| Vehicle type | KW Segments | Proposed Basic TP premium (Rs.) | Proposed Premium per licensed passenger (Rs.) |

| C1a (Four wheeled vehicles used for carrying passengers for hire or reward with carrying capacity not exceeding 6 passengers) | Not exceeding 30 KW | 5,414 | 1,042 |

| Exceeding 30 KW but not exceeding 65 KW | 7,119 | 876 | |

| Exceeding 65 KW | 9,434 | 1,001 | |

| C1b (Three wheeled vehicles used for carrying passengers with carrying capacity not exceeding 6 passengers) | e-rickshaw | 1,685 | 806 |

| C2 (Four or more wheeled vehicles used for carrying passengers with carrying capacity exceeding 6 passengers for hire and reward) | School Buses | 12,187 | 745 |

| Other than School Buses | 12,731 | 779 | |

| C3 (Motorised three wheeled passenger vehicles used for carrying passengers for hire or reward with carrying capacity exceeding 6 passengers but not exceeding 17 passengers) | – | 5,841 | 1,165 |

| C2 (Three wheeled vehicles used for carrying passengers for hire and reward with carrying capacity exceeding 17 passengers) | – | 13,388 | 819 |

| C4 (Motorised Two Wheelers used for carrying passengers for hire or reward) | Not exceeding 3 KW | 732 | 493 |

| Exceeding 3 KW but not exceeding 7 KW | 732 | 493 | |

| Exceeding 7 KW but not exceeding 16 KW | 732 | 493 | |

| Exceeding 16 KW | 1,916 | 493 |

Table VIII – Quadricycle

| Category | Vehicle Type | Existing Rates (Rs.)FY 2019-20 | Proposed Rates (Rs.) | ||

| Basic Rate | Per Licensed Passenger | Basic Rate | Per Licensed Passenger | ||

| Quadricycle | Private Car | 2,072 | N/A | 2,182 | N/A |

| Electric private Car(Not exceeding 30 KW) | – | – | 1,855 | N/A | |

| Commercial Vehicles not exceeding 500 CC | 2,595 | 1,241 | 2,595 | 1,241 | |

Long term rates – Three years single premium:

| Category | Vehicle Type | Existing Rates (Rs.)FY 2019-20 | Proposed Rates (Rs.)FY 2020-21 |

| Quadricycle | New Private Car | 5,286 | 6,079 |

| New Electric private Car (Not exceeding 30 KW) | 4,493 | 5,167 |

How to Buy/Renew Third Party Car Insurance Policy in PolicyBachat?

At PolicyBachat.com buy or third party car indemnity reclamation on-line is easy and promptly sitting at home. Follow the below-mentioned steps to renew your policy within 5 minutes .

- Go to ‘Car Insurance Online’ to compare quotes above this article. Fill in the registration number of your car and required details and tap on ‘Start Save Money.

- On the quotes section, either go with your current provider or choose another one to suit your needs.

- Make the payment and you will receive the confirmation at your email address. If assistance needs Call: 1800-123-4003.

Third party Car policy cost premium can be reduced if your car policy refilling is done on-line using the connection third base party Car Insurance price comparison to the offline mode of reclamation where the premium would be slightly higher comparison prices to the on-line premium .

Best third party car insurance quotes are available on www.policybachat.com for any assistance call:1800-123-4003.