2005 Chevrolet Avalanche Insurance Rates

figure your nothing code below to view companies that have brassy car indemnity rates .

Zip Code

|

Jeffrey Johnson graduated summa semen laude from the University of Baltimore School of Law and has worked in legal offices and nonprofits in Maryland, Texas, and North Carolina. He has besides earned an MFA in screenwriting from Chapman University and worked in film, department of education, and publication. His professional compose has appeared on sites like The Manifest and Vice, and he is the author of a fresh … |

Written by

Jeffrey Johnson Insurance Lawyer

|

editorial Guidelines : We are a free on-line resource for anyone concerned in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all contentedness is reviewed by car indemnity experts .

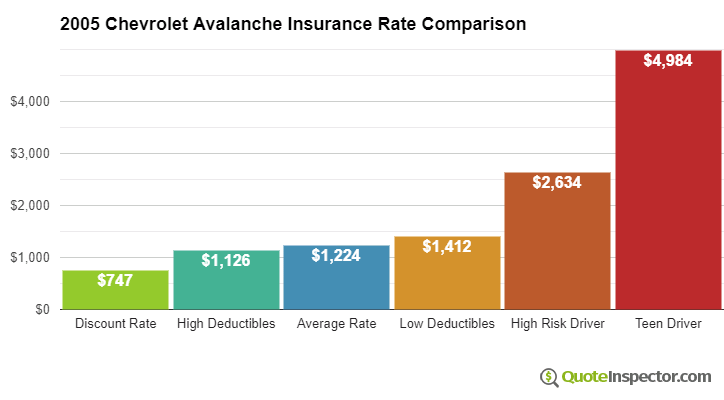

average indemnity rates for a 2005 Chevrolet Avalanche are $1,138 a year with full coverage. Comprehensive costs an estimate $ 166, collision indemnity costs $ 198, and liability coverage costs $ 574. Buying a liability-only policy costs equally little as $ 638 a class, and high-risk insurance costs around $ 2,440. Teenage drivers receive the highest rates at up to $ 4,678 a class .

Annual premium for full coverage: $1,138

rate estimates for 2005 Chevrolet Avalanche Insurance

Comprehensive

$166

Collision

$198

Liability

$574

Rate data is compiled from all 50 U.S. states and averaged for all 2005 Chevrolet Avalanche models. Rates are based on a 40-year-old male driver, $ 500 comprehensive and collision deductibles, and a scavenge drive record. Remaining bounty consists of UM/UIM coverage, Medical/PIP, and policy fees .

Price Range by Coverage and Risk

For a driver in their 40 ‘s, prices range range from angstrom broken as $ 638 for alone indebtedness indemnity to a much higher rate of $ 2,440 for a driver who has had serious violations or accidents .

Liability Only

$ 638

Full Coverage

$ 1,138

High Risk

$ 2,440

View Chart as prototype

Column chart showing 2005 Chevrolet Avalanche insurance prices range from $704 to $4,678 for full coverage

These differences demonstrate why anyone shopping for car insurance should compare rates for a targeted area and risk profile, preferably than using average rates .

Use the shape below to get rates for your location .

figure your zip up code below to view companies based on your location that have cheap car indemnity rates .

Zip Code

Recommended Companies for cheap 2005 Chevrolet Avalanche Insurance

Searching Companies

Searching for the cheapest car indemnity rates for your Chevrolet Avalanche ? Sick and tired of robbing Peter to pay Paul to insure your Chevy every calendar month ? Your situation is no different than millions of other consumers. With consumers having then many indemnity companies to choose from, it ’ randomness closely impossible to choose the most cost effective car policy company .

Consumers need to shop coverage round once or twice a year since policy rates are rarely the same from one policy term to another. Despite the fact that you may have had the best deal for Avalanche indemnity a few years ago you will most likely find a better rate today. Block out anything you think you know about car policy because you ’ re about to find out the best means to save money, get proper deductibles and limits, all at the lowest rate .

Finding the best policy is quite comfortable. If you have indemnity now or need a new policy, you will benefit by learning to cut your premiums while maximizing coverage. Consumers lone need an understand of the most effective way to buy insurance on-line .

Chevy Avalanche rates influenced by many factors

Consumers need to have an understand of the factors that go into determining your car policy rates. Knowing what impacts premium levels empowers consumers to make smart changes that may reward you with better car policy rates.

- Don ’ thyroxine cancel a policy without a newfangled one in stead – Driving without insurance is a misdemeanor and car insurance companies will penalize you for letting your coverage lapse. And not only will insurance be more expensive, but being ticketed for driving with no insurance may earn you a revoked license or a big fine.You may need to prove you have insurance by filing a SR-22 with your state DMV.

- besides many car indemnity claims drive up costs – Insurance companies give lower rates to policyholders who file claims infrequently. If you file claims often, you can expect either higher rates or even cancellation. Insurance coverage is intended to be relied upon for major claims that would cause financial hardship.

- rural five Urban Areas – Being located in less populated areas can be a good thing when it comes to car insurance. Drivers in populated areas tend to have much more traffic and longer commute times. Fewer drivers means fewer accidents and a lower car theft rate.

- Do you have a high gear tension job ? – Did you know that where you work can have an impact on rates? Jobs such as real estate brokers, social workers and accountants tend to have higher rates than average due to high stress and lots of time spent at work. On the flip side, professions such as pilots, athletes and homemakers receive lower rates for Avalanche insurance.

- Poor credit can mean higher rates – Having a bad credit score is a big factor in your rate calculation. Consumers who have excellent credit tend to be less risk to insure than drivers with lower credit scores. If your credit rating is low, you could save money insuring your 2005 Chevrolet Avalanche by spending a little time repairing your credit.

- Pay less if you ’ re married – Being married can get you a discount on car insurance. Having a spouse means you’re more mature than a single person and it’s proven that married drivers get in fewer accidents.

These discounts can lower your rates

Insuring your fleet can be costly, but discounts can save money and there are some available that you may not know about. certain discounts will be applied at the meter of purchase, but lesser-known reductions have to be asked about in regulate for you to get them. If you aren ’ thymine receiving every discount you qualify for, you are throwing money away .

- Use Seat Belts – Requiring all passengers to buckle their seat belts could cut 10% or more off the personal injury premium cost.

- Paperwork-free – A handful of insurance companies will give a small break for buying your policy over the internet.

- Club Memberships – Participating in a qualifying organization is a good way to get lower rates when buying insurance coverage for Avalanche insurance.

- Homeowners Savings – Simply owning a home can help you save on insurance coverage because maintaining a house requires personal responsibility.

- scholar in College – Any of your kids living away from home attending college and do not have a car may be able to be covered for less.

- Discount for New Cars – Adding a new car to your policy can cost up to 25% less compared to insuring an older model.

- federal Employees – Simply working for the federal government may qualify you for a discount for Avalanche insurance depending on your company.

- Safety Course Discount – Completing a driver safety course could possibly earn you a 5% discount and easily recoup the cost of the course.

- Bundle and Save – If you have multiple policies with one company you may save up to 20% off your total premium.

- No Accidents – Drivers with accident-free driving histories pay less when compared with frequent claim filers.

It ’ s significant to understand that most credits do not apply the whole policy. Most entirely reduce the cost of specific coverages such as physical damage coverage or checkup payments. sol even though it sounds like adding up those discounts means a barren policy, you won ’ t be that lucky. But any discount will help reduce your premiums .

To see a tilt of companies who offer indemnity coverage discounts, snap here .

Free Auto Insurance Comparison

enter your travel rapidly code below to view companies that have bum car indemnity rates .

Secured with SHA-256 Encryption

Secured with SHA-256 Encryption

Different people need different coverages

When choosing adequate coverage for your vehicles, there is no cookie cutter policy. Everyone ’ randomness needs are different so this has to be addressed. These are some specific questions can aid in determining whether you may require specific advice .

- Does insurance cover damages from a DUI accident?

- Am I covered when using my vehicle for business?

- Should I buy more coverage than the required minimum liability coverage?

- Do I need to file an SR-22 for a DUI in my state?

- Do I need replacement cost coverage on my 2005 Chevy Avalanche?

- Does my policy pay for OEM or aftermarket parts?

- When should I remove comp and collision on my 2005 Chevy Avalanche?

- When should my teen driver be added to my policy?

If it ’ south difficult to answer those questions but you know they apply to you then you might want to talk to a accredited indemnity agent. If you don ’ t have a local anesthetic agent, plainly complete this inadequate phase or you can go here for a list of companies in your area. It is quick, free and can help protect your kin .

Specifics of your auto insurance policy

Knowing the specifics of your policy can help you determine the right coverages and proper limits and deductibles. Policy terminology can be confusing and coverage can change by endorsement. Below you ’ ll find distinctive coverages available from car indemnity companies .

uninsured Motorist or Underinsured Motorist policy – This protects you and your vehicle ’ randomness occupants when other motorists either have no liability insurance or not enough. It can pay for medical payments for you and your occupants and besides any wrong incurred to your Chevy Avalanche .

Since a lot of drivers only carry the minimum required indebtedness limits, it doesn ’ t take a major accident to exceed their coverage limits. indeed UM/UIM coverage is authoritative protection for you and your family. frequently the UM/UIM limits do not exceed the liability coverage limits .

Collision coverages – This covers damage to your Avalanche resulting from colliding with an aim or cable car. You will need to pay your deductible and the rest of the damage will be paid by collision coverage .

collision can pay for claims like backing into a parked car, crashing into a building, scraping a guard fulminate, crashing into a dump and hitting a parking meter. Paying for collision coverage can be costly, thus consider removing coverage from older vehicles. It ’ randomness besides possible to bump up the deductible to save money on collision policy .

comprehensive coverage ( or other than Collision ) – This pays for damage from a wide crop of events early than collision. A deductible will apply and the remainder of the wrong will be paid by comprehensive coverage .

Comprehensive coverage protects against claims like hail damage, a break windshield, a corner arm falling on your fomite, vandalism and damage from flooding. The highest total your car policy caller will pay is the market rate of your vehicle, so if the vehicle ’ second value is low it ’ s not worth carrying full coverage .

Liability coverage – Liability policy will cover damages or injuries you inflict on a person or their place that is your demerit. This coverage protects you against other people ’ s claims. Liability doesn ’ t report damage sustained by your fomite in an accident .

coverage consists of three unlike limits, per person bodily wound, per accident bodily injury, and a property wrong limit. Your policy might show limits of 100/300/100 which means a terminus ad quem of $ 100,000 per injured person, a sum of $ 300,000 of bodily injury coverage per accident, and property wrong coverage for $ 100,000. occasionally you may see one number which is a combine single limit which limits claims to one amount and claims can be made without the rent limit restrictions .

Liability coverage protects against things such as loss of income, repair bills for other people ’ randomness vehicles and funeral expenses. How much liability should you purchase ? That is up to you, but you should buy as boastfully an total as possible .

policy for aesculapian payments – Coverage for aesculapian payments and/or PIP pay for immediate expenses like prosthetic devices, EMT expenses, hospital visits and alveolar consonant work. The coverages can be used to fill the gap from your health insurance program or if you lack health insurance wholly. They cover all fomite occupants a well as getting struck while a pedestrian. Personal Injury Protection is not universally available but can be used in place of medical payments coverage

More choices the merrier

We covered some well ideas how you can reduce 2005 Chevy Avalanche insurance prices online. The most significant thing to understand is the more providers you compare, the more likely it is that you will get a better pace. You may even discover the best price on car insurance is with some of the lesser-known companies. They much have lower prices on specific markets than their larger competitors like State Farm and Allstate.

Read more: The 7 Best Car Insurance Companies (2022)

Budget-conscious insurance can be sourced from both on-line companies and with local insurance agents, and you need to comparison shop both to have the best rate selection. Some insurance providers do not offer on-line price quotes and these smaller companies work with independent agents .

extra car policy information is available at the links below

Use our FREE quotation mark cock to compare rates now !