Over 30 states plus D.C. require car insurance companies to offer fledged drivers a discount for attending a driver safety/improvement course. Requesting all the discounts you ’ re eligible for, keeping a good driving record and shop around are some of the best ways to save when you ’ re a older driver. car insurance rates increase in your aged citizens years.

Over 30 states plus D.C. require car insurance companies to offer fledged drivers a discount for attending a driver safety/improvement course. Requesting all the discounts you ’ re eligible for, keeping a good driving record and shop around are some of the best ways to save when you ’ re a older driver. car insurance rates increase in your aged citizens years.

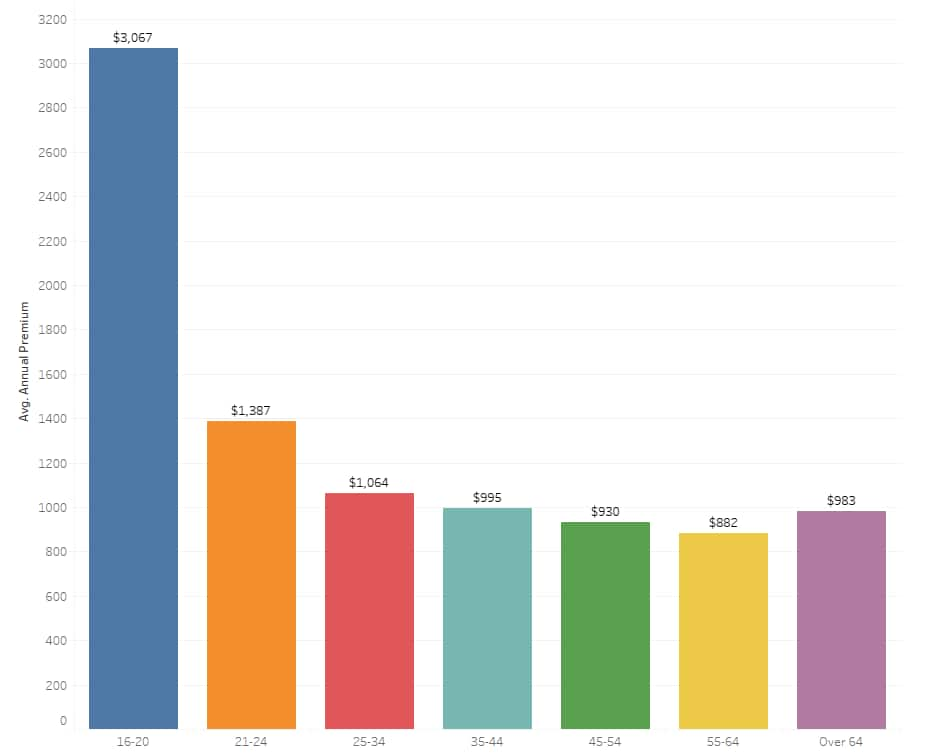

even if your driving habits remain the same and your record stays clean, the rate you pay for car insurance changes over time as you historic period. typically, car insurance rates drop as drivers move into middle long time, having acquired years of driving feel and loyalty discounts. Once you are over 65 years of old age, however, expect to pay more for senior cable car policy. here ‘s what you need to know about saving on car indemnity in your 50s, 60s, 70s and beyond. KEY TAKEAWAYS

- Car insurance rates for senior drivers are quite expensive, it tends to rise after the age of 65 but really skyrocket after age 80.

- Car insurance for drivers over 50 years of age is usually cheaper than it is for younger and older drivers.

- The full-coverage auto insurance for an 85-year-old driver costs $2,165 on average.

- AARP and other organizations offer mature driver courses that can reduce your premiums by 5-15 percent.

Car insurance rates for seniors

Auto policy for seniors frequently costs more. Older, senior, drivers as a group are more accident-prone than their middle-aged counterparts. The reasons for this include age-related changes in learn or vision, slower reflexes, health conditions and medications. In addition, careless of accident severity, older drivers suffer graver injuries and more fatalities than younger people. This makes seniors more expensive to treat following an injury. These factors can increase insurers ’ claim costs, and those costs are passed on. Will your policy premiums increase just because you join the ranks of “ older ” drivers ? What if you have no accidents or tickets ? That depends on your insurance company, but the answer is “ probably. ” indemnity rates are partially determined by the integral group to which you belong, not good your own drive record. so, if you live in Mayhem Metro, you may pay more than a driver from Safe City. In most cases, if you drive a brassy coupe, you ‘re statistically more probably to have an accident than if you ‘ve got a mundane minivan. Insurance.com data shows that older drivers do pay more than middle-aged drivers as a group — but not much more. Explore our car policy calculator to see what premium rates apply to you.  however, there ‘s a flip side — many states mandate that drivers over 55 be given discounts for good drive and/or for taking approve drive courses. car policy rates for seniors tends to rise after the age of 65 but actually spikes up after age 80. According to AARP, 34 states plus the District of Columbia require discounts for driver base hit classroom-based driver improvement courses. Of this list, 23 and D.C. require car insurance companies to besides offer a deduction to drivers who complete an on-line driver improvement naturally. Either way the course is taken, it must be state-approved, so before signing up and paying out for a course, make certain it will count for the dismiss. here are the states that mandate the discounts .

however, there ‘s a flip side — many states mandate that drivers over 55 be given discounts for good drive and/or for taking approve drive courses. car policy rates for seniors tends to rise after the age of 65 but actually spikes up after age 80. According to AARP, 34 states plus the District of Columbia require discounts for driver base hit classroom-based driver improvement courses. Of this list, 23 and D.C. require car insurance companies to besides offer a deduction to drivers who complete an on-line driver improvement naturally. Either way the course is taken, it must be state-approved, so before signing up and paying out for a course, make certain it will count for the dismiss. here are the states that mandate the discounts .

- Alabama

- Alaska

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Idaho

- Illinois

- Kansas

- Kentucky

- Louisiana

- Maine

- Minnesota

- Mississippi

- Montana

- Nevada

- New Jersey

- New Mexico

- New York

- North Dakota

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- Tennessee

- Utah

- Virginia

- Washington

- West Virginia

- Wyoming

- Washington, DC

AAA, The National Safety Council ( NSC ) and AARP are a few of the organizations that offer mature driver courses. Check with your senior car indemnity ship’s company to find out more about this rebate and who offers it in your area. A typical discount ranges from 5 to 15 % .

What is the best car insurance company for seniors?

Best company overall: State Farm

state farm managed to grab the brass section ring for best insurance company overall for seniors equally well as two other categories. State Farm is presently the largest indemnity ship’s company in the United States and is well-reviewed for both customer service and claims handling. State Farm besides offers a wide assortment of discounts for senior drivers which can help keep your bounty low-cost and are glad to lower your premium if you pass a defensive drive course. In accession to being the best overall insurance company for seniors, State Farm is besides the best indemnity company for seniors when it comes to drivers with a late ticket or who have been in an accident. The rate increase with State Farm was much lower than other insurers after a ticket or accident making State Farm the best option for seniors overall .

Best for seniors with speeding tickets: State Farm

If you have been picked up for speeding recently, State Farm is your best bet to keep your bounty low-cost. When we ran the numbers, State Farm only increased rates approximately 15 % after a speed slate, while Progressive ( which was the most expensive ) tacked on an extra 30. state Farm often finishes at the top of the heap in surveys when it comes to car insurance for seniors thanks to their reasonable premiums and excellent customer avail. They besides offer a wide kind of coverages deoxyadenosine monophosphate well as discounts for promote condom features, safe drive records and long-run customers. When shopping for coverage, seniors should absolutely get a quotation mark from State Farm .Best Car Insurance Company for Senior Citizen with Speeding Ticket

| Company | % increase |

|---|---|

| State Farm | 15% |

| Nationwide | 19% |

| Allstate | 19% |

| Farmers | 22% |

| Geico | 28% |

| Progressive | 30% |

Best for seniors with bad credit: Nationwide

If you ’ re a senior with less than leading credit, Nationwide is an excellent choice. Our data shows that Nationwide had the smallest premium increase for drivers with bad credit with a 41 % leap out. While that seems like a major increase, it ’ s a draw less than the 113 % increase you would see with State Farm. countrywide offers a wide variety show of discounts that seniors can take advantage of to help lower their premiums. A defensive drive run can help lower your rates as can signing up for Nationwide ’ sulfur SmartRide program which monitors your driving with a circuit board device and offers discounts for smart drive decisions .Best Car Insurance Company For Seniors with Bad Credit

| Company | % increase |

|---|---|

| Nationwide | 41% |

| Allstate | 56% |

| Progressive | 77% |

| Farmers | 78% |

| Geico | 85% |

| State Farm | 113% |

Best for accidents: State Farm

state grow came out on acme again when we looked at the best rates for seniors after an accident. An accident claim on your policy can result in a dramatic premium addition, but our analysis found that State Farm will only push your rates up 19 % after an accident while Nationwide ( last put closer ) will increase your rates 52 % after an accident. state grow is systematically ranked as one of the best policy companies for seniors, making it an excellent choice for aged drivers. State Farm offers a variety show of discounts for seniors including multiple vehicle and multiple wrinkle discounts. You may be able to lower your premium by taking a defensive drive course or cruising around town in a vehicle loaded with advanced condom features. careless of the insurance company you use, make sure you are getting all the discounts that you are qualified to receive. Ask your agent to conduct a discount review to make sure all discounts are being applied to your policy .Best Car Insurance Companies For older driver with accident

| Company | % increase |

|---|---|

| State Farm | 19% |

| Progressive | 19% |

| Farmers | 32% |

| Allstate | 41% |

| Geico | 43% |

| Nationwide | 52% |

Best for DUI: Progressive

A DUI is going to result in a dramatic bounty increase careless of your senesce but Progressive had the lowest increase of the insurers we surveyed. Progressive bumped rates up 33 % after a DUI while Nationwide tacked on a 125 % increase. progressive offers respective discounts that seniors can take advantage of when shopping for coverage including a loyalty discount, multi car and multiple lines discount rate if you insure your dwelling with them american samoa well. Progressive ’ mho Snapshot program lets you earn a dismiss based on your actual drive .Best Car Insurance For DUI

| Company | % increase |

|---|---|

| Progressive | 33% |

| State Farm | 38% |

| Farmers | 47% |

| Allstate | 65% |

| Nationwide | 125% |

Is there cheap car insurance for drivers with prior incidents?

If you have a speed ticket, accident, or other traffic violation on your driving commemorate, you will pay a higher rate than a driver with a cleanse phonograph record. How much your agio will jump up will depend on the type of misdemeanor a well as your other rating factors. When we ran the numbers, a accelerate ticket could push your rates up a sock 30 % while an accident on your record could result in a 55 % increase. however, the rate increase will often vary depending on your insurance company deoxyadenosine monophosphate well as what state you call home. If you have recently been in an accident or received a speeding ticket, shopping your coverage is typically the best way to keep your agio low-cost. Shop a variety show of policy companies and make sure you are comparing similar coverage limits and deductibles .

Senior auto insurance by decade

here ‘s how your historic period may affect your driving and your insurance costs in your 50s and beyond.

here ‘s how your historic period may affect your driving and your insurance costs in your 50s and beyond.

“ not all insurance companies start charging higher rates at the same age, so it pays to shop around if you get a rate raise, ” says Penny Gusner, consumer analyst for Insurance.com. “ It all depends on the home statistics within the policy company, so some will raise rates in your 60s while others will wait until your former 70s. ”

Let ’ s compare a broad coverage policy of 100/300/100 indebtedness coverage with physical damage coverages of comprehensive examination and collision as you long time .

Auto insurance in your 50s

car insurance for people over 50 is normally cheaper than it is for younger and older drivers. That ‘s because drivers in their 50s are among the safest — you have lots of experience but still have thoroughly health, agile reflexes, and authentic hear and vision.

The average rate for full-coverage car indemnity for a 55-year-old is $ 1,519 .

Auto insurance in your 60s

Barring an doomed streak or late-onset midlife giddiness, you ‘re likely to pay less for car insurance than you ever have between the ages of 50 and 65. At 65, however, some insurers raise premiums. Your current insurance company may not be among the best insurance companies for older drivers. Turning 65 might be a signal to shop for a better distribute. The median rate for full-coverage car indemnity for a 60-year old is $ 1,507.

The average rate for full-coverage car indemnity for a 65-year-old is $ 1,547 .

Auto insurance in your 70s

Does car policy go up when you turn 70 ? Sorry ; it probably does.

Data from the National Transportation and Safety Bureau ( NTSB ) and National Automotive Sampling System ( NASS ) show that drivers 70 and up experience much higher rates of intersection-related accidents and fatalities than younger drivers. More accidents mean more claims and higher rates. however, this is good the point at which accident rates begin to increase — it is n’t until drivers reach their recently 70s or early on 80s that their abilities degrade significantly. Some insurers recognize this and continue to offer reasonably-priced cable car policy for those over 70.

Read more: The 7 Best Car Insurance Companies (2022)

The average rate for full-coverage car policy for a 70-year-old is $ 1,626.

The average rate for full-coverage car policy for a 75-year-old is $ 1,808.

Auto Insurance for Seniors Over 80

Driving becomes increasingly hazardous for people 80 and up. According to American Automobile Association ( AAA ), older drivers ’ fatality rates are 17 times higher than those for 25- to 64-year-olds. It ‘s largely not ascribable to bad drive ; it ‘s because of the homo soundbox ’ s fragility in its ninth ten of life.

Driving becomes increasingly hazardous for people 80 and up. According to American Automobile Association ( AAA ), older drivers ’ fatality rates are 17 times higher than those for 25- to 64-year-olds. It ‘s largely not ascribable to bad drive ; it ‘s because of the homo soundbox ’ s fragility in its ninth ten of life.

car indemnity for older drivers gets increasingly costly with age, so it ’ mho critical to shop for car indemnity quotes and grab every discount to which you ‘re entitled.

The average pace for full-coverage car insurance for an 85-year-old is $ 2,165. This is a 20 % increase from long time 75 rates and a 44 % increase from the cost of cable car policy from when you were 60.

If you ’ re not driving angstrom much and have lowered your insurance to indebtedness limits only, dropping comprehensive examination and collision, then here are how senior car indemnity rates would compare as you are senesce :Average Rate of Auto Insurance For Senior Driver

| Age | Liability 50/100/50 |

|---|---|

| 55 | $598 |

| 60 | $598 |

| 65 | $622 |

| 70 | $665 |

| 75 | $758 |

| 85 | $958 |

Senior car insurance discounts: tips for saving

There are batch of discounts available to older drivers, and you should pursue all that apply to you. Below are eight particular actions you can take to reduce your premium costs :

- Drive less. If you’ve stopped commuting and are driving less than you have in the past, inform your insurance company. Depending on your state (some require insurers to consider mileage when setting rates), savings range from almost nothing to more than 10%. Most insurers define “low mileage” as 5,000 to 7,500 miles or fewer, but others are more generous.

- Bring in Big Brother. Gusner says some seniors can save up to 40% with usage-based or pay-as-you-drive insurance auto insurance programs. A device installed in your car records your mileage and driving habits — your speed, braking tendencies and acceleration. If your habits mirror those of most middle-aged or older drivers, you could save two ways — for driving safely and for driving less. Discounts vary by insurer by can go as high as 40%.

- Have some class. Mature driver courses offered by AARP and others, as discussed earlier, can reduce your premiums by 5-15%. Most states require the discount, but insurers in other states often offer rate reductions for driver training as well. Age eligibility varies by state.

- Drop a driver. In states that don’t require all licensed drivers in a household to have car insurance, you can exclude anyone (such as an older spouse or parent) who no longer drives in order to reduce your rates. Alternatively, you can change the primary driver to a younger member of the household, if that reflects the reality of your circumstances.

- Buy some bells and whistles. The latest vehicle safety features may get you a reduced rate on your insurance. Even without a discount, features such as rearview cameras, lane drift, collision warning systems and parking assist can prevent accidents and claims, which can minimize future premium increases.

- Keep a clean record. The bells and whistles on your car that can keep you out of an accident can really payoff if you are able to keep a driving record free of violations or accidents. Having a clean record for the last three to five years should give you a good driver discount that ranges from 15 to 40%.

- Join the club. Membership in organizations such as AARP can enable you to access promotional pricing. It’s called an “affinity discount.”

- Dial back coverage. If you have homes and vehicles that you use only part-time, look into cheaper “parked vehicle” or “snowbird” coverage during the months in which you’re not driving them.

- Bundle it up. If you haven’t yet checked on the cost of buying auto and home insurance with the same insurance company, do that now. It is a nice perk to have just one company to deal with for home and auto policies, plus you can get a discount that on average is around 11%.

- Stop driving. If your insurance rates are sky-high because of your driving record, it might be time to quit. AARP lists a number of signs that you should give up driving, including frequent close calls, finding dents or scrapes on your car or other objects, getting lost in familiar locations, trouble seeing or following traffic signs and signals, slower response time to unexpected situations, misjudging gaps in traffic, causing other drivers to honk or complain, difficulty concentrating while driving, trouble turning to check the rear view mirror when backing up or changing lanes, and receiving multiple traffic tickets or warnings. AAA gives guidance on how to evaluate your driving abilities.

For more information, review our tips on being a safe driver. Drivers of any age can raise deductibles, bundle with home or tenant ‘s insurance or reduce coverage in order to save on premiums. Insurance.com ‘s coverage calculator can help you set an allow level of coverage for the coming years.

How seniors can find cheap insurance rates

once you pass a sealed age doorsill, typically 65 years old, your car insurance rates may start climbing. Statistics show that senior drivers are involved in more accidents than middle aged drivers. According to the CDC, in 2018, roughly 7,700 drivers aged 65+ were killed in traffic crashes, and over 250,000 were treated in emergency departments for crash injuries which translates to more than 20 older adults being killed and 700 injured in crashes every individual day. While your rates are more than likely headed up after 65, there are some things you can do to keep your bounty low-cost. here are a few tips to keep your car policy rates in check :

- Shop your coverage: This is one of the best ways to lower your insurance costs. Insurers rate risk differently which can result in dramatic differences in premium quotes. There are insurers that specialize in insuring older drivers, The Hartford is an excellent example, they have partnered with the AARP to offer car insurance and discounts to drivers over the age of 50. Get at least five quotes when shopping and make sure you are comparing apples to apples when it comes to coverage levels and deductibles.

- Your driver status: Insurers use a variety of factors to set a rate and one of those is how often you drive. If you are retired and no longer commuting on a daily basis your rates should go down. Inform your insurance company you are no longer driving as many miles and ask them to rerun your rates, you should see a drop.

- Defensive driving courses: Defensive driving courses aren’t just for teenagers, older drivers can benefit from a refresher course and many insurers offer a discount to senior drivers who complete a defensive driving course. Check with your insurance company for a list of classes that meet their requirements and ask about a discount once you have passed the course.

- Look for senior discounts: Many insurers offer discounts aimed at seniors. Look for long term customer discounts as well as discounts for seniors who are driving less daily. Ask your insurer to review your policy to make sure all senior discounts are being applied to your policy.

Best car insurance companies for seniors

There is no single “ best ” cable car insurance for seniors. different insurers calculate their rates with proprietary methods and each has a unlike set of behaviors it chooses to encourage, dissuade or ignore. The cheapest car policy for seniors depends on the driver, vehicle and location. however, to get an idea of what you ‘ll pay, we provide average rates for full coverage, with a $ 500 deductible. The datum is based on rates from up to six major insurers in closely every ZIP code of the nation. The table below shows median rates for drivers age 60, 65, 70 and 75 in all states .

Top Car Insurance Companies for Seniors

Select your senesce and state below to see the average annual and monthly rates. Age

state

presently showing results for long time

60

in

California

| Company Name | Avg. Annual Premium | Avg. Monthly Premium |

|---|---|---|

Safety tips for older drivers

The National Institute of Health ( NIH ) advises that you can be safer on the road by addressing the effects of aging on your drive and being mindful that your driving ability will about surely be impacted by changes to your body. here are the most authoritative tips :

- Maintain your health. Have your hearing, vision and general health evaluated regularly, and keep any prescription equipment such as glasses and hearing aids up-to-date. If you don’t see well after dark, avoid driving at night.

- Stay physically active. Physical activity may foster quick reaction times.

- Adjust your vehicle. Elevate your seat for adequate vision and switch to power steering, brakes and mirrors to control your car.

- Review medications. Understand how your medications may affect your driving ability. Avoid driving after taking any drugs with warnings about operating machinery.

- Create a healthy buffer zone. Follow at a greater distance and avoid busy parts of town and busy times of day.

- Plan your route. Intersections are especially dangerous for drivers over age 80, and there is no reason to make a risky left turn when three right turns will get you to the same place.

- Sharpen skills. Defensive driver classes and behind the wheel refresher courses can sharpen your skills and lead to lower insurance rates.

- Maintain your vehicle. Regular inspections and tune-ups reduce the chance of roadside break-downs.

State laws specific to senior driver

Some express motor fomite departments treat you differently once you meet their definition of “ older driver. ” You may nobelium long be allowed to renew your license by call or on-line. Your renewal period may be shortened, and you may be required to pass extra screenings. hera is information from the Governors Highway Safety Association about the differences by express :State Laws For Senior Drivers

| State | Senior-related license restrictions |

|---|---|

| Alabama | None |

| Alaska | No mail renewal at 69 |

| Arizona | Five-year renewals at 69; no mail renewal at 70 |

| Arkansas | None |

| California | No mail renewal at 70 |

| Colorado | Five-year renewals at 61; no electronic renewal at 66 and mail renewal requires positive vision exam in six previous months |

| Connecticut | Two- or six-year renewal at 65; mail renewal only if a hardship |

| Colorado | Five-year renewal at 61; no electronic renewal at 66 and mail renewal requires positive vision exam in six previous months |

| Delaware | None |

| District of Columbia | Vision test, possible reaction test, and physician letter needed at 70 |

| Florida | Six-year renewal with vision test at 80 |

| Georgia | Five-year renewal at 60 and vision test at 64 |

| Hawaii | Two-year renewal at 72 |

| Idaho | Four-year renewal at 63 |

| Illinois | Two-year renewal between 81 and 86; every year at 87; and road test at 75 |

| Indiana | Three-year renewal between 75 and 84; two years at 85; no electronic or mail renewal at 70 |

| Iowa | Two-year renewal at 70 |

| Kansas | Four-year renewal at 65 |

| Kentucky | None |

| Louisiana | No mail renewal at 70 |

| Maine | Four-year renewal at 65; vision test at every renewal at 62 |

| Maryland | Vision test at 40 |

| Massachusetts | Renewal in person only at 75 |

| Michigan | None |

| Minnesota | None |

| Mississippi | None |

| Missouri | Three-year renewal at 70 |

| Montana | Four-year renewal at 75 |

| Nebraska | No electronic renewal at 75 |

| Nevada | Mail renewal needs medical report at 70 |

| New Hampshire | Road test at 75 |

| New Jersey | None |

| New Mexico | Yearly renewal at 75 |

| New York | None |

| North Carolina | Five-year renewal at 66 |

| North Dakota | Four-year renewal at 78 |

| Ohio | None |

| Oklahoma | None |

| Oregon | Vision test at 50 |

| Pennsylvania | None |

| Rhode Island | Two-year renewal at 75 |

| South Carolina | Five-year renewal with vision test at 65 |

| South Dakota | None |

| Tennessee | None |

| Texas | Two-year renewal at 85; no electronic or mail renewal at 79 |

| Utah | Vision test at 65 |

| Vermont | None |

| Virginia | Five-year renewal with vision test at 75 |

| Washington | None |

| West Virginia | None |

| Wisconsin | None |

| Wyoming | None |

If you realize that you may have passed your prime as a driver, talk to your doctor. You may come up with a design of how to addresses your limitations, decide that it is time to give up driving or getting a license with limits. Some states offer a restrict license, such as not driving at nox if that is your trouble area.

It may besides be time to look at alternative modes of fare, such as community offered senior rides, Lyft or Uber. If you sell your vehicle, you could easily offset other exile costs from the savings you receive from no longer owning and maintaining a vehicle.

FAQs

How does age affect auto insurance rates?

car policy rates will be impacted by your long time throughout your biography. A adolescent typically pays three to four times what an experience driver in their 30s or 40s might pay. This is due to their inexperience out on the road angstrom well as their old age. once a driver hits 25 and has some experience under their belt, their rates should start to drop ( around a 30 % decrease ) a long as they have kept their drive record uninfected. Rates typically stabilize in your 30s but once you hit 65 and up there is a good luck that your rates will start to climb again. Older drivers tend to have slower chemical reaction times and are involved in more accidents which makes insurance companies nervous, leading to higher rates .

Does car insurance go up as you get older?

If you are a adolescent, the answer to this motion is no, but if you are over the age of 65, the answer is absolutely. Rates tend to be high for young drivers, drop down for center aged people and then start to climb again after the age of 65. This is because teens and seniors have higher accident rates then drivers who fall into the middle of the long time stove. Once you get to aged citizen status, expect your premium to head up .

How does a defensive driver course for senior’s work?

many policy companies offer discounts to both teens and seniors who take a defensive drive course. Contact your insurance company to make sure they offer a discount for seniors and get a tilt of approve defensive drive courses. once you have found an satisfactory path, you just sign up and take the course. Present the completion certificate to your policy company and they should apply the discount to your policy.

Read more: The 7 Best Car Insurance Companies (2022)

Is car insurance for seniors worth the cost?

Yes, and it ’ mho required in about every state in the nation. legally you can not be out on the road without basic liability coverage. Each state sets its own minimum liability limits which can range from $ 15,000 to around $ 50,000. If you are not carrying the proper measure of policy when drive, you will not be legal out on the road. While collision and comprehensive are not required in any state, if you are not carrying these coverages and your fomite is damaged or destroyed in an accident you will be covering the cost to repair or replace your vehicle out of pocket .

Do seniors pay more for auto insurance?

Yes, in most situations, a elder will pay more for cable car insurance than a driver in their 30 ’ second or 40 ’ randomness. however, they frequently pay less than a adolescent. According to our data, the average full coverage rate for an 85-year old driver is $2,165 which is a 20% increase from age 75 rates and a whopping 44% increase from the cost of car insurance for a 60 year driver.