Travelers : $ 244 per year |

Secura : $ 339 per class |

Wolferine Mutual : $ 489 per year |

Chubb : $ 533 per year |

Metropolitan : $ 618 per year |

Although mature drivers pay less for car insurance than teens, older drivers start to see their rates go up as they enter their senior years. Comparing car insurance rates can save older drivers hundreds of dollars a year.

Best Cities for Cheap Car Insurance in Michigan

| City | Premium | Percent Increase |

| Kalamazoo | $1,679 | 0.0% |

| Grand Rapids | $1,724 | 2.7% |

| Traverse City | $1,751 | 4.3% |

| Lansing | $1,786 | 6.3% |

| Ann Arbor | $1,798 | 7.1% |

| Holland | $1,817 | 8.2% |

| Jackson | $1,819 | 8.3% |

| Muskegon | $1,927 | 14.7% |

| Midland | $1,935 | 15.2% |

| Bay City | $1,939 | 15.5% |

| Battle Creek | $1,950 | 16.1% |

| Ypsilanti | $2,178 | 29.7% |

| Canton | $2,260 | 34.5% |

| Rochester | $2,338 | 39.2% |

| Waterford | $2,353 | 40.1% |

| Saginaw | $2,397 | 42.7% |

| Farmington | $2,446 | 45.6% |

| Livonia | $2,447 | 45.7% |

| Troy | $2,566 | 52.8% |

| West Bloomfield | $2,707 | 61.2% |

| Macomb | $2,802 | 66.8% |

| Utica | $2,887 | 71.9% |

| Clinton Township | $2,925 | 74.1% |

| Flint | $2,972 | 77.0% |

| Westland | $3,035 | 80.7% |

| Sterling Heights | $3,244 | 93.1% |

| Southfield | $3,271 | 94.8% |

| Warren | $4,114 | 145.0% |

| Dearborn | $4,941 | 194.2% |

| Detroit | $5,704 | 239.6% |

Factors That Affect Car Insurance Premiums in Michigan

Although ripen drivers pay less for car insurance than teens, older drivers start to see their rates go up as they enter their senior years. Comparing car insurance rates can save older drivers hundreds of dollars a year.

Cheapest Car Insurance in Michigan

- Travelers: $41 per month

- Secura: $45 per month

- Chubb: $60 per month

- USAA: $67 per month

- Nationwide: $70 per month

- Wolverine Mutual: $74 per month

- Westfield: $84 per month

7 Tips for How to Get Cheap Car Insurance in Michigan

1. Compare quotes from both national and regional insurers

Don’t forget to include local insurance companies in your search for cheap car insurance. In Michigan, regional insurers like Westfield, Indiana Farm Bureau and Erie Insurance might have lower rates than national companies like State Farm and Geico and have comparable customer satisfaction ratings.

2. Know the factors affecting insurance in Michigan

Everyone knows that your driving habits and

3. Maintain coverage

You’ll see higher rates if you let your insurance lapse, even

4. Choose the coverage that is right for you

You need

5. Search for discounts

Top car insurance companies in Michigan have a variety of discounts, so almost anyone can find ways to save. You may be able to get a

6. Stay in less expensive zip codes

Car insurance prices can vary a lot based on zip code in Michigan. On average, drivers in the

7. Lower your PIP coverage

Until 2020, Michigan was the only state that required unlimited personal injury protection (PIP). This meant that if someone got into a life-changing car accident that required expensive lifetime medical care, it was covered—even if that care cost millions of dollars. Effective July 1, 2020, drivers will be able to choose a level of medical coverage, so your premium and potential savings will depend on the PIP option you select.

Methodology

In the table below, you can see all of the profile characteristics that were used in WalletHub’s analysis, in addition to the specific subset of characteristics that make up our Good Driver profile.

| Category | All Profile Characteristics | Good Driver Profile |

| Gender | Male, Female | Male |

| Age | 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 35, 45, 55, 65 | 45 |

| Marital Status | Single, Married | Single |

| Teenage Driver Included on Policy | No, Yes | No |

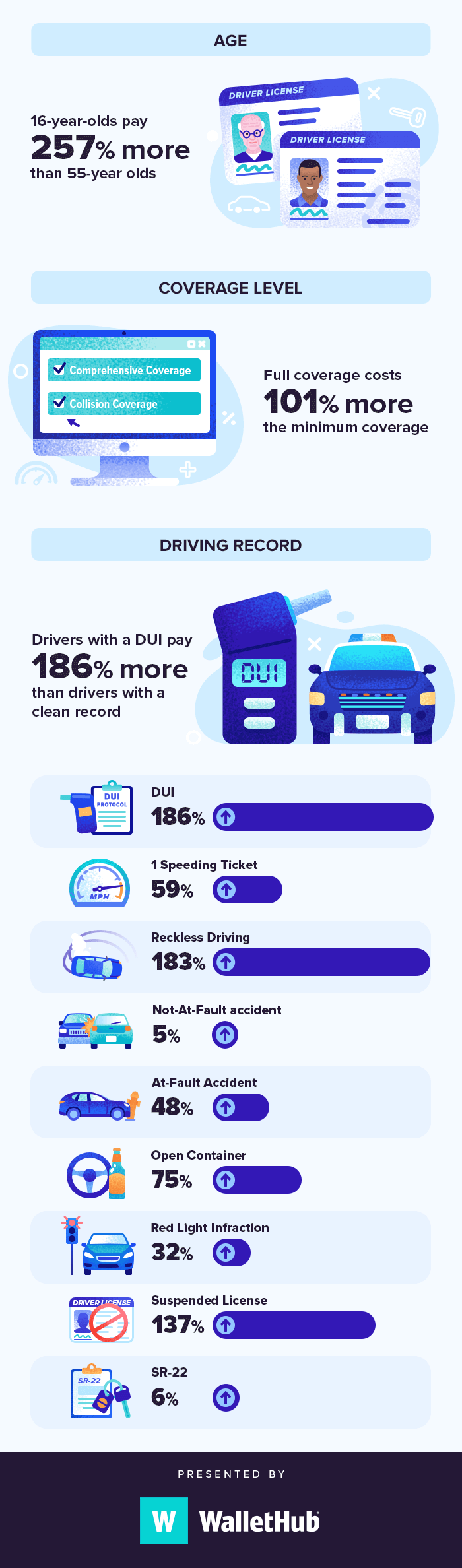

| Driving Record | Clean, One Speeding Ticket, One At-Fault Accident, One DUI, Suspended License, Open Container, Red Light Infraction, Reckless Driving, One Not At-Fault Accident | Clean |

| Miles Driven Per Year | 7,500 Miles, 15,000 Miles, 20,000 Miles | 15,000 Miles |

| Coverage Level | Minimum, Standard, Full | Minimum |

| Discounts | None, Multi-Policy, Homeowner, Student | None |

| Credit Level | Poor, Good | Good |

| Filings | None, SR22, FR44 | None |

| Car | Sedan, Minivan, SUV, Coupe, Truck | Sedan |

Below are additional details regarding the terminology and specific characteristics of the variables in the above table:

- Minimum Coverage: Coverage requirements of $20,000 in bodily injury liability per person, $40,000 in bodily injury liability per accident, and $10,000 in property damage liability per accident outside Michigan, as well as unlimited personal injury protection and $1 million in property protection within Michigan. Minimum coverage requirements are from before changes were made to Michigan’s auto insurance requirements in 2020.

- Standard Coverage: Coverage levels of 50k/100k/25k of liability coverage, 50k/100k/25k of uninsured motorist coverage, unlimited personal injury protection and $1 million in property protection within Michigan.

- Full Coverage: Coverage levels of 100k/300k/50k of liability coverage, 100k/300k/50k of uninsured motorist coverage, collision and comprehensive coverage with a $500 deductible, unlimited personal injury protection and $1 million property protection within Michigan.

- Sedan: 2018 Toyota Camry.

- Minivan: 2018 Dodge Grand Caravan.

- SUV: 2018 Toyota RAV4.

- Coupe: 2018 Ford Mustang.

- Truck: 2018 Ford F-150.

Where driver profiles are not specified, WalletHub averaged Michigan insurance quotes across 40 different driver profiles, using the above variables. Quote information is from Quadrant Information Services and is representative only. Individual rates will be different.

WalletHub ’ s analysis of cheap car policy companies in Michigan is based on data from the Michigan DMV and Quadrant Information Services. together with that data, WalletHub used the characteristics listed below to create 40 different driver profiles designed to identify the cheapest car insurance companies for Michigan drivers in a solicitation of key categories. For each profile, WalletHub compared quotes among top Michigan cable car policy companies by averaging premiums from 34 zip code codes that represent at least 20 % of Michigan ‘s population. Military-specific companies like USAA were only considered for the military-specific class, ascribable to their eligibility restrictions. In some cases, they may still be the best choice overall for eligible drivers.In the table below, you can see all of the profile characteristics that were used in WalletHub ’ mho analysis, in addition to the specific subset of characteristics that make up our good Driver profile.Below are extra details regarding the terminology and specific characteristics of the variables in the above mesa : Where driver profiles are not specified, WalletHub averaged Michigan indemnity quotes across 40 different driver profiles, using the above variables. Quote information is from Quadrant Information Services and is representative alone. individual rates will be different. Don ’ thymine forget to include local policy companies in your search for cheap car insurance. In Michigan, regional insurers like Westfield, Indiana Farm Bureau and Erie Insurance might have lower rates than home companies like State Farm and Geico and have comparable customer gratification ratings.Everyone knows that your driving habits and claims history affect how much you pay for cable car policy. But in Michigan, companies can besides consider your age, gender, recognition history, marital status, and more when setting premiums. The car you drive, your annual mileage, and evening some factors beyond your control all impact the price of insurance.You ’ ll see higher rates if you let your indemnity oversight, even if you don ’ thyroxine own a cable car. Michigan drivers who don ’ thymine maintain continuous coverage pay an average of 48 % more than those with five or more years of insurance history.You need liability policy to pay for the early driver ’ south damages if you ’ re at mistake in an accident in Michigan. Collision and comprehensive coverage, on the other hired hand, are optional and may be unnecessary if you own an older car. Usage-based insurance might be a better fit than a criterion policy for low-mileage drivers, and going with a higher deductible or lower coverage limits costs less, besides. Don ’ thyroxine scant on the coverage you need, but do make inform choices. That way, you won ’ t end up paying for more car policy than you need.Top car indemnity companies in Michigan have a assortment of discounts, sol about anyone can find ways to save. You may be able to get a deduction if you ’ re a scholar, veteran, good driver, homeowner, willing to go paperless, and more.Car insurance prices can vary a lot based on slide fastener code in Michigan. On average, drivers in the most expensive parts of Michigan spend over $ 3,800 more per year on car insurance than those living in the least expensive areas.Until 2020, Michigan was the only state that required inexhaustible personal injury protection ( PIP ). This entail that if person got into a life-changing car accident that required expensive life medical wish, it was covered—even if that caution cost millions of dollars. Effective July 1, 2020, drivers will be able to choose a level of checkup coverage, so your premium and electric potential savings will depend on the PIP choice you select .